Money Management Product Reviews

Peak Money App Review

With a new year now upon us, you can bet that many Americans are looking to make changes to their money habits. Specifically, now more than ever, people are realizing the importance of setting money aside in savings. Luckily, there are now a variety of apps that can help them do that — including one I recently discovered called Peak Money.

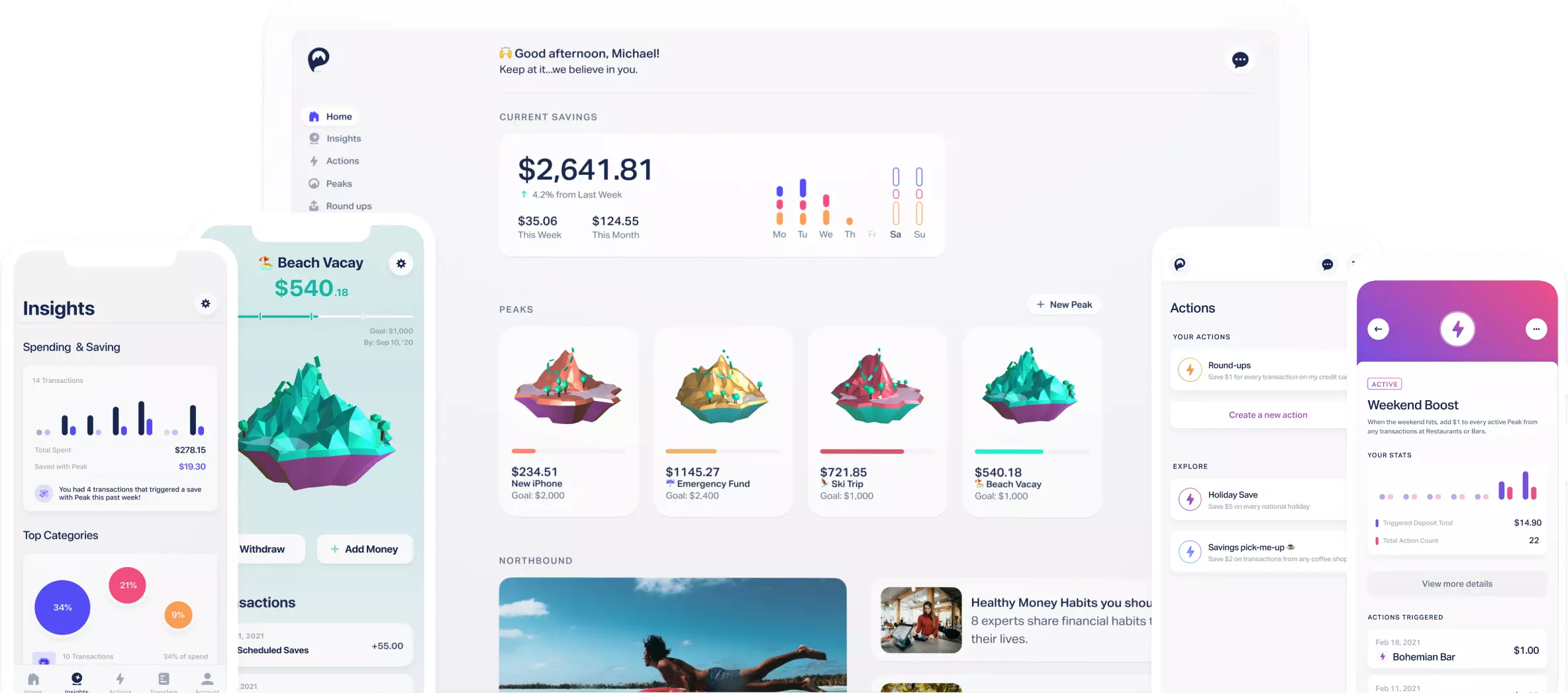

Having used Peak Money for the past couple of months, I think there’s a lot to like. So what exactly does the app offer? Let’s take a look at some of the features available in the free version of the app as well as at what comes with their Peak Premium upgrade.

UPDATE: On April 13th, 2022, Peak informed users that it was shutting down. As of that date, no new deposits will be accepted and any accrued funds are in the process of being returned to linked accounts. Below is my original review of Peak Money for posterity.

What is Peak Money and What Does it Offer?

Opening an account (and FDIC insurance)

To get started with Peak Money, you can open an account using either the iOS app or the service’s website. When creating your account, you’ll need to provide some personal info, such as your name, birthdate, phone number, email address, etc. You’ll also need to confirm your phone number via a verification code to help keep your account secure.

After your account is set up, in order to get the most from Peak, you’ll want to link an external bank account. To do this, you’ll use the secure API Plaid to log into your account to connect it. Note that Peak will then pull from this account for your scheduled transfers.

While we’re talking about the basics of Peak, I should bring up four important letters: FDIC. Unlike the app Savely that I reviewed, Peak Money does note that funds held with them are FDIC insured. And while it takes a little digging into their FAQ to find the info, they do note that deposits are held with Axos Bank.

Setting up goals (Peaks) and autosave

The main feature of Peak is what they call, well, Peaks. In short, Peaks are basically savings goals you have — whether that means building an emergency fund, saving for a trip, or whatever else. There is no limit to the number of Peaks you can create on the app.

To create a new Peak, simply head to the Peaks section of the app. First, you’ll be asked what you’re saving for. Then, if applicable, you can enter how much you need to save up and how long you have to hit your goal. Based on that info, Peak will recommend a per-week or per-month savings amount, but you’ll be able to customize if needed. If you don’t enter a specific amount, the app will show you some examples of how your weekly deposits could add up to much more in a given time period. Again, these are totally customizable as well.

Speaking of customization, after figuring out your savings plan, you can arrange for automated transfers. To do this, you can select the frequency of transfers, what day you want to start, and more. Should you need to make changes, you can edit the “Next Deposit On” date by visiting the Settings of your Peak. Additionally, Peak will email you about upcoming transfers so that you can plan accordingly.

You can also pause Scheduled Saves if necessary and can transfer funds back to your account at any time. However, regular transfers can take 1 to 3 business days to complete. Meanwhile, Peak also offers a Quick Transfer option, although this costs $1 for regular users and is only available between 6 am and noon Eastern.

Once your Peak is created, it will be represented by a digital floating island. I realize that sounds weird, but it looks pretty cool in the app. You’ll also be able to play with the look of your Peak, including editing the colors, lighting, and more. Overall, this adds an extra bit of fun to your savings adventure.

Savings bonus

One perk of Peak that’s not heavily advertised is their Savings Bonus. You can think of these monthly bonuses as interest… but Peak isn’t a bank so they don’t use that term. In any case, for free users, the current Savings Bonus rate amounts to 0.25% APY.

Earned bonuses will be added to your account after the end of the month, but will remain in your unallocated savings. From there, you can transfer your funds to your pick of Peaks or transfer to an external account.

Other features

While setting up goals and creating automated plans for achieving them are the main offerings of Peak’s standard app, there are a few other interesting features built-in. The first is their “Take a deep breath” feature. If you have an Apple Watch, this app-within-an-app will look fairly familiar. Basically, when launched, this feature will lead you through a breathing exercise, inviting you to breathe deeper as the flower petals on the screen expand. In total, you’ll breathe in and out seven times per session. Honestly, this feature isn’t terribly related to the rest of the app. However, they do accurately note that money can be stressful and that taking a moment to breathe can be very beneficial. Thus, I think this is a clever albeit simple addition to the app.

The other feature I want to quickly mention is the articles and blog posts found in the app. In addition to announcements of new features, you’ll find resources such as “The Best Place for Short-Term Savings.” These types of articles are a great idea but, unfortunately, they don’t seem to update very often. Perhaps that will change, so keep an eye on this section (found below your goals on the main screen) from time to time.

Peak Premium

Cost

Before we get into the perks of Peak Premium, I should note the price. Currently, the upgrade comes at a cost of $5 a month. Before this fee is charged, you can try out Peak Premium for 7-days. However, if you fail to cancel before your trial is up, you will be automatically charged. Luckily, before that happens, Peak will send you an email to remind you of the upcoming fee. On that note, to cancel your Premium subscription and go back to Peak Free, go to Account > Edit Settings > Manage My Account and select the downgrade option.

Actions

So what does Peak Premium offer? To me, easily the biggest feature the upgrade adds is the Actions tab. These useful automation “recipes” help users set even more money aside. Peak Premium customers can choose from a number of Featured Actions, customize them, or start from scratch creating their own Actions. For example, I decided to employ an action called Dine-Out Dollars. To ensure it worked well, I first linked my Amex Gold card to Peak so that it could monitor my transactions. Then, when it saw purchases at restaurants, it would earmark 10% of the transaction total to be sent to savings.

As I mentioned, there are several options for customizing your actions. Looking back to the Dine-Out Dollars Action specifically, I could adjust the percentage to set aside, opt to make it a fixed amount instead, or use a round-up method (including the ability to use a round-up with a multiplier). Then, you can decide whether to have Peak wait until you have at least $5 in accrued savings before initiating a transfer or elect to have funds transferred from your funding source to a Peak of your choice immediately after an eligible transaction is completed.

Beyond that, you can also create Actions with even more options. Instead of tying them to your spending, you could create Actions tied to when you get paid. You can also utilize a number of filters to further drill down on exactly what types of transactions you want to trigger transfers.

Honestly, I found the thought and attention to detail that went into this feature to be impressive. While other apps like Astra may allow for similar results, I really like the interface and options that Peak offers. In fact, this was key a reason why I wanted to explore their Premium platform.

Insights

The other main feature that comes with Peak Premium is Insights. Unfortunately, there’s not quite as much to say about this one. Basically, when you link your other spending accounts, you can see a summary of your expenses broken down by category, merchant, and more, while also exploring trends that could help you budget. In other words, this is essentially the experience you’d get from Mint or other account aggregators. Still, I do give Peak credit for building a sleek version of this concept. Also, I do really like their Weekly Review that not only shows your total spent and total saved but also notes your total scheduled transfers, how much your set aside from Actions, and more.

Free Quick Transfers

A Premium perk I didn’t learn about until writing this post is that you can utilize the Quick Transfers feature without paying the $1 fee. That’s pretty cool… although the limited hours that this option is available might still make it hard to use.

Improved savings bonus rate

Lastly, as a Premium user, you’ll enjoy a higher Savings Bonus rate. At this time, Peak Premium users with balances of less than $5,000 will earn what amounts to 1% APY. Those with balances over $5,001 but under $100,000 will earn 0.50%. However, I should note that the 1% rate is apparently a promotion that’s currently set to run through June 30th, 2022.

For what it’s worth, 1% APY is pretty strong these days. Of course, since it remains to be seen whether this rate will last, I wouldn’t bank on this when deciding whether Premium makes sense for you (although, if you do hold just below $5,000, your monthly bonus should cover $4 of your $5 fee for now). By the way, if you are hoping to get at least 1% APY, I’d consider looking at T-Mobile Money, One, or others.

Final Thoughts on Peak Money and Peak Premium

Overall, I’ve really enjoyed using Peak Money over the past few months. While it’s a simple concept, the execution, art, and design of the app definitely make for a worthy product. I’ve also been impressed with the Actions feature that comes with Peak Premium, especially in terms of the customization and user interface.

On that note, though, the $5 a month fee for Premium is a bit steep (no pun intended). That said, I could see how these added features could really help users set more money aside, thus improving their finances overall. If that’s the case for you, then the $5 fee could well be worth it. Plus, if you do hold a significant amount of money on the platform, then the current 1% APY Savings Bonus could help offset that subscription fee.

Even if you don’t end up going Premium, I do think that Peak Money is definitely an app to check out (which is why it made my list of top money apps for 2022). If it sounds interesting to you, you can find it now on the App Store or you can create an account on their website.