Checking Account Review

T-Mobile Money Review (2023)

More than two years ago now, I ended up switching my wireless service from AT&T to T-Mobile. In doing so, I was able to save money in a few different ways — but it turns out there was another savings opportunity I had overlooked until recently: T-Mobile Money. While this digital banking account is open to non-T-Mobile customers, those who do have T-Mobile or now Sprint postpaid plans (as opposed to prepaid plans) can also enjoy bonus perks that make the account even more interesting.

So what could a banking option from a telecom really have to brag about? Let’s take a closer look at T-Mobile Money.

- T-Mobile customers can earn up to 4% APY on funds

- The account is open to all customers (you don’t need to have T-Mobile)

- ‘Got Your Back’ protection available to qualifying customers

- Earning 4% APY requires 10 debit transactions per month

- 4% APY is capped at $3,000 in funds

- Current APYs are not competitive against other online accounts

What is T-Mobile Money and What Does it Offer?

Signing up for T-Mobile Money

In order to sign-up for a T-Mobile Money account, you’ll first need to create a T-Mobile ID. If you’re a T-Mobile customer, you already have one of these. But, if you’re not, you can easily create one by entering your name and e-mail address as well as choosing a password. After that, you’ll need to provide some additional personal information such as your address and Social Security number in order to get started.

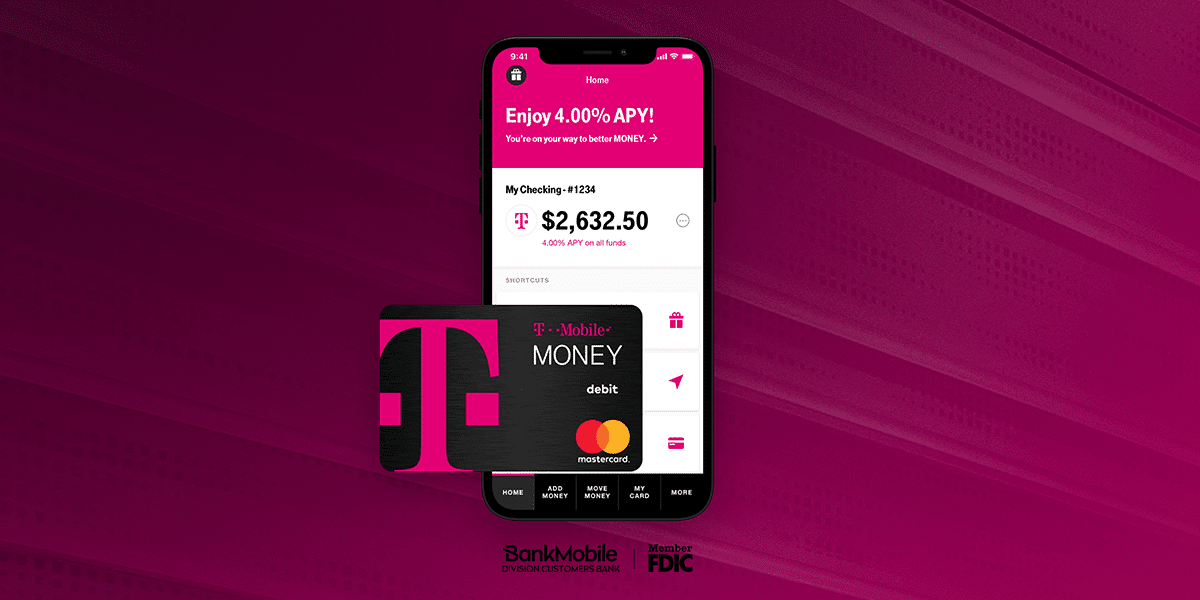

Now is also a good time to mention that T-Mobile Money doesn’t charge monthly fees, overdraft fees, or the like. Perhaps more importantly, funds are deposited with BankMobile (itself a division of Customers Bank) and are FDIC-insured up to $250,000 per depositor.

Connecting an external bank account

Normally, this is the part of the review where I’d mention that the app utilizes Plaid to seamlessly and securely link your accounts. However, that’s actually not the case this time around. Instead, T-Mobile Money relies on an older technology: micro-deposits. After you manually enter the routing and account number for the account you’d like to link, small, temporary deposits will show up in said account a few days later. Then, you can confirm these deposit amounts with T-Mobile Money in order to allow for future transfers.

In my experience, this process took a couple of business days. While this might not be quite as convenient as the Plaid route, the advantage is that my connection has yet to break as it does with some Plaid-connected accounts. Overall, it’s not that big a deal, but could be a bit of a pain if you’re looking to link a new transfer destination/origin on the fly.

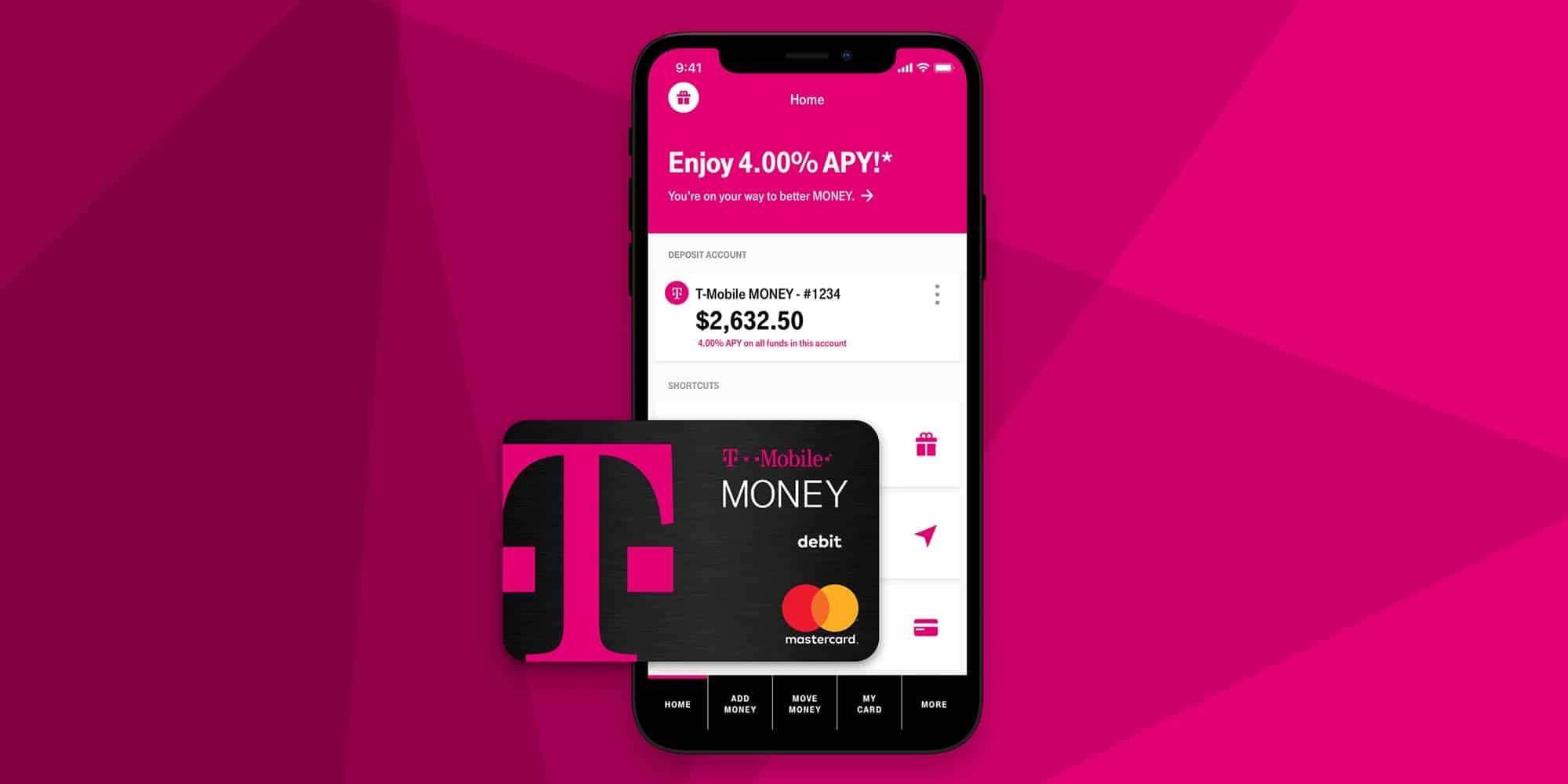

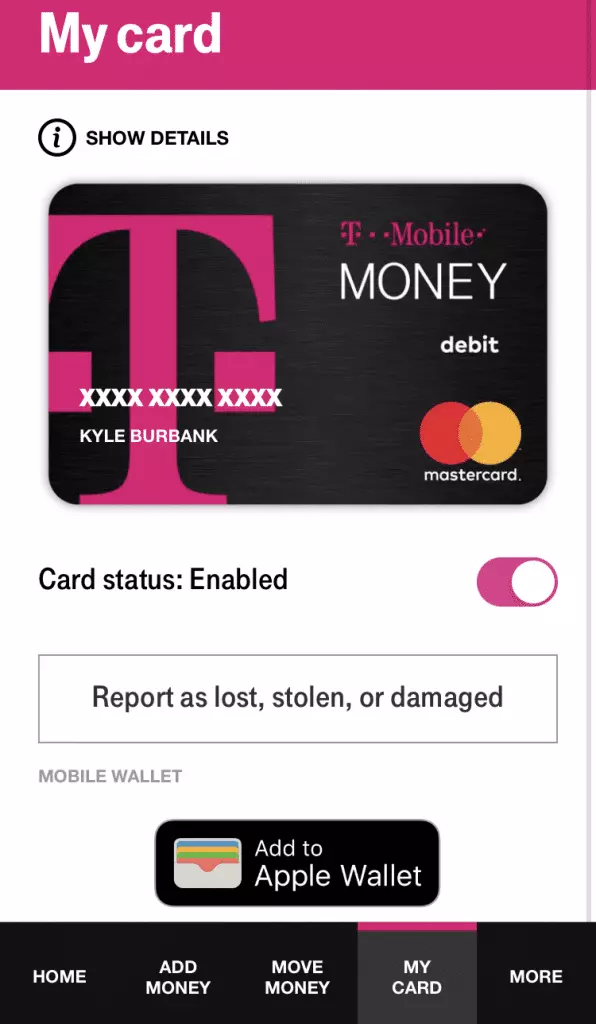

Debit card and checks

Once you open your T-Mobile Money account, a free debit card will be mailed to you. This card bears a fairly standard design, complete with the magenta ‘T’ on a black card. Sadly, it also features embossed numbers on the front (or at least it still did when I opened my account and I haven’t heard otherwise since), which is quickly going out of style. In any case, the card can also be added to digital wallets such as Apple Pay, Google Pay, and Samsung Pay.

After you activate your card, be careful not to simply discard the paper your card came attached to. That’s because, if you look on the back, you’ll notice that this is actually a sheet of three checks you can use for your account.

Meanwhile, if you’d like to order additional (and more conventional) paper checks, you can do so with CarouselChecks using the link to the T-Mobile Money app. While I have yet to do this personally, it looks as though they have boxes of checks starting at $11 or so. For the record, T-Mobile Money previously directed you to VistaPrint for checks, so this is a change. Also, T-Mobile does note, “We do not have a direct relationship with Carousel Checks or receive any financial incentive if you choose them as your check printer.”

ATM access

With your T-Mobile Money debit card, you’ll also be able to access cash at more than 55,000 fee-free ATMs that are part of the Allpoint network. As I’ve previously found with other Allpoint-enabled offerings, these machines are fairly plentiful — at least in my area. Meanwhile, if you visit out-of-network or international ATMs, T-Mobile Money won’t charge you a fee but the machine operator might, with T-Mobile not reimbursing any of those fees.

Mobile check deposit

In addition to the ability to transfer money from a linked bank account, you can also deposit checks into your T-Mobile Money account using their mobile app. Like with similar features from other banks and neobanks, you can utilize this option by entering the deposit amount, capturing the front and back of the check using your phone’s camera, and then completing the transaction. Seeing as this is a function missing from some of the other apps I’ve reviewed recently, I’m glad T-Mobile Money thought to include it.

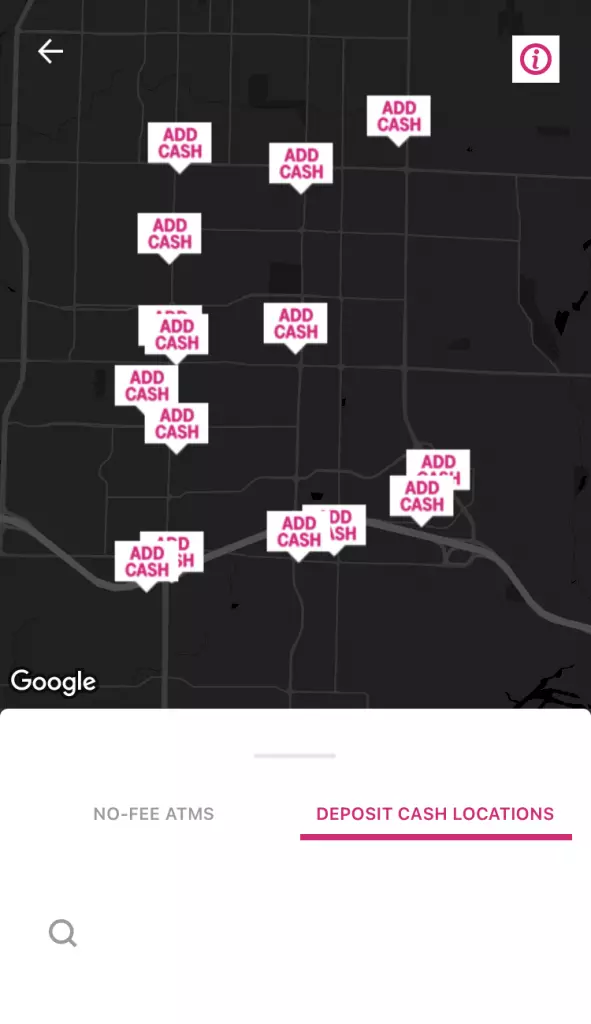

Depositing cash

One of the trade-offs with most digital bank accounts is that, since there are no physical branches, there’s no way to deposit cash into your account. That’s why it’s somewhat surprising to say that T-Mobile Money actually does have a cash deposit option.

In the app, you can locate nearby locations such as 7-Eleven, CVS, and Walmart stores where you can use your T-Mobile Money debit card to deposit cash into your account. While this may be convenient, the downside is that some merchants may charge a fee for this service — $5 or more in some cases. Therefore, be sure to check the specifics before utilizing this option and perhaps consider alternative routes.

Direct deposit

Rounding out the deposit options, you can also arrange to have your paychecks directly deposited into your T-Mobile Money account. In fact, when you do so, you may be able to access your funds up to two days early. However, like with similar offerings from other outlets, this perk is dependent on the way your employer’s payroll works. For more information on setting up direct deposit, I’d recommend checking with your employer’s HR, payroll department, or other resources.

APY

By default, T-Mobile Money pays out a healthy-enough 2.5% APY on funds. That’s not only high for a checking account but also bests most big-bank saving account options on the market — although you can currently (as of January 2023) find online savings accounts that are higher. Interest accrued is paid to your account on the last day of the month.

While 2.5% APY on its own is decent, there’s a way to do even better — but we’ll discuss that in the next section.

Savings account

While the main T-Mobile Money account includes some perks typically reserved for savings accounts (namely paying interest), it’s actually a checking account. In that way, it could be considered a hybrid account. However, not too long ago, T-Mobile Money rolled out a dedicated Savings account as well.

Now, customers have the option to open a Savings account. Once opened, users will be able to transfer money from their T-Mobile Money main account to Savings instantly or can arrange one-time or recurring transfers from external accounts. Additionally, all funds in your Savings account will earn 2.5% APY.

Overall, Savings is currently a pretty barebones offering. Furthermore, it feels a bit redundant since funds in checking already earn 2.5% APY, giving Savings no real advantage. That said, those looking to rely more on the T-Mobile Money platform could definitely benefit from having a separate account for savings. Therefore, while it’s not a huge bonus, the introduction is definitely not a negative.

Benefits for T-Mobile and Sprint Customers

Up to 4% APY

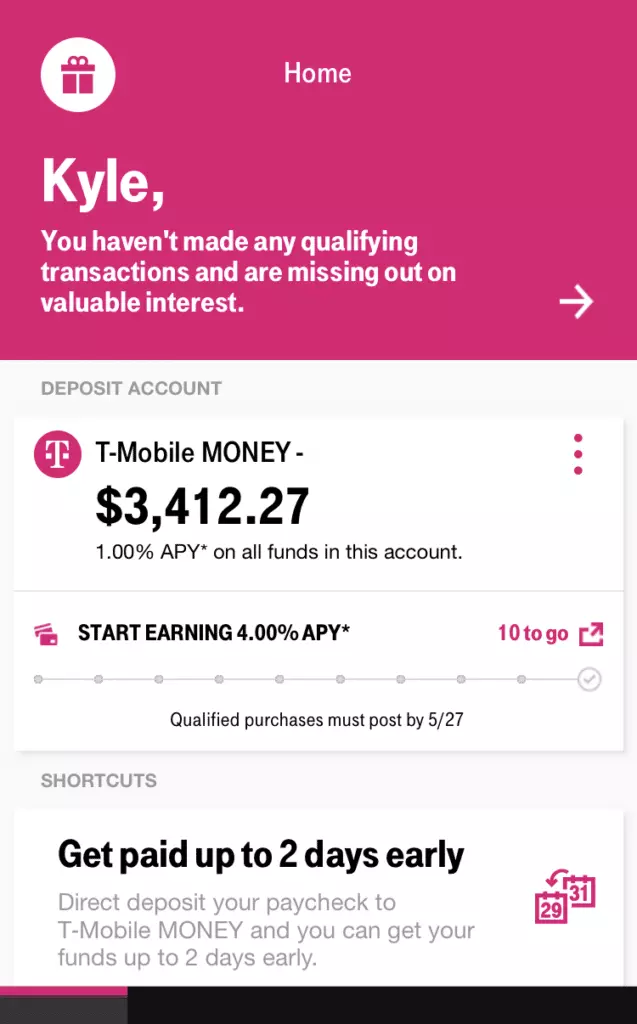

Now we get to the star of the show: T-Mobile Money’s sky-high interest rates. With your account and as a T-Mobile or Sprint post-paid customer, you can earn up to 4% APY on your funds. However, in order to unlock this, you’ll need to make 10 qualifying debit card purchases per month. Additionally, the 4% APY is only good on balances of up to $3,000, with anything above that earning the regular 2.5% APY. To be clear, this means that the first $3,000 will continue to yield that 4% APY (about $9.82 per month) while funds above that will earn the 2.5% APY. So, if you have a balance of $5,000, T-Mobile Money estimates that your effective APY would be 3.4%.

Luckily, you won’t need to keep track of these purchases yourself as the app includes a helpful tracker. Additionally, this tracker will note the day by which your purchase will need to post in order for your APY to apply to that month.

For example, for January 2023, transactions will need to post before January 30th — the day before the last business day of the month — to qualify. If you miss that deadline, purchases will count toward the following month. Either way, I’d be sure to pay attention to this notation if you’re pursuing that 4% APY.

Previously, instead of the debit card purchase requirement, users needed to deposit at least $200 a month in order to unlock the higher APY rate. However, this policy changed in April 2021. Personally, I’m disappointed with the change, but it could definitely be worse.

“Got Your Back” Protection

Most people who’ve had a traditional bank account know the severe pain of overdraft fees. You could dip just a few cents below your balance and be hit up with a fee of $35 or more. Ouch! That’s where the “Got Your Back” protection program comes in.

Available to T-Mobile and Sprint postpaid customers who make at least 10 qualifying debit card purchases per month, this feature allows you to overdraft your checking account by up to $50. You will not incur a fee for this error as long as you bring your account back to positive territory within 30 days of when it went negative. Should you fail to meet this deadline, you’ll lose your Got Your Back privileges permanently.

This feature is similar to those offered by other online accounts now, but I have to give T-Mobile Money credit as I believe they beat many others to market. In any case, Got Your Back is the type of perk you hope you don’t have to use but is certainly nice to have.

AutoPay discount (sort of)

When you flip through T-Mobile Money’s stated benefits, you might notice that it mentions an AutoPay discount. While this may be exciting, you may want to temper your expectations. That’s because this offer is only available if you don’t already have AutoPay set up. In other words, it’s merely floating the suggestion that you use your new T-Mobile Money debit card as a means of earning that $5 a month AutoPay discount. For the record, if you don’t already take advantage of that discount, you should — but, if you’ve already done so, you can ignore this “perk.”

Final Thoughts on T-Mobile Money

When I first signed up for T-Mobile Money, the 1% base APY was strong compared to other options, making the 4% APY opportunity absolutely stellar. Since then, however, the market has greatly changed. On top of that, T-Mobile Money has adjusted the way users earn that 4% APY. Between these two factors, the account is no longer the slam dunk it once was. Even though the company has tried to keep up by changing the base rate to 2.5%, they still haven’t upped the most valuable perk of the account, which seems a bit odd to me.

With that said, if you are a T-Mobile customer, it may be worth opening a T-Mobile Money account in the event that interest rates tank once again. After all, the company did hold that 1% APY firm even when many online accounts were less than half that. During those times, making 10 small debit purchases in order to unlock the 4% APY was definitely worth it. Yet, when you can now get close to that without any purchase requirement, I’m not sure the juice is worth the squeeze.

Ultimately, while I still think T-Mobile Money is an interesting product and continue to hold money with them, I do think it’s time for an update. I suspect the hesitation on their part is that they don’t want to oversweeten the deal only to have to revoke it later should the market shift — but, in this meantime, the account isn’t the standout it once was. Still, while the T-Mobile Money may not be that exciting in January 2023, perhaps things will look different for the account in the future.

T-Mobile Money is a hybrid savings and checking account created in partnership with BMT. While these accounts are not limited to T-Mobile customers, those with T-Mobile postpaid plans may be able to enjoy additional benefits.

Yes, T-Mobile Money deposits are held with BMT (itself a division of Customers Bank) and funds are FDIC insured.

T-Mobile Money partners with BMT, which is a division of Customers Bank.

Yes, T-Mobile Money deposits are FDIC insured up to $250,000 per depositor.