Checking Account Review

One Finance Review (2022)

Having reviewed several digital banking account options over the past few years, it’s safe to say that most have pretty much the same few features to offer with only a couple of different twists. While the interest rate or debit card designs may differ, there usually isn’t a whole lot new under the Sun, as they say. That’s why I was intrigued when I came across One Finance, which seems to have some unique ideas for what an online banking service should be.

So what does One Finance bring to the table? Let’s take a look at both the basic and unique features that make up the account and whether or not they make it worth signing up for yourself.

What is One Finance and What Makes it Different?

Joining One Finance

The first thing you’ll need to do in order to get started with One Finance is to provide your phone number. To ensure you’ve entered the correct number, the app will send you a code that you’ll need to verify to continue. From there, you’ll need to enter other personal information, such as your legal name, your email, your Social Security number, and your shipping address. You may also need to verify your identity by uploading a photo of your license.

Also of note, funds deposited into your One account are FDIC insured up to $250,000 per depositor thanks to One’s partnership with Coastal Community Bank.

Making transfers

In order to get started with One, you’ll want to transfer funds from an external source. To make this process simple, the app utilizes Plaid. With Plaid, you can select your current bank, log into your account, and transfer funds as needed.

I should note that, currently, One is offering a $50 bonus to new users who join and make a qualifying direct deposit of at least $250.

Once you’ve connected an external account, you can continue to set up subsequent transfers by visiting the Move Money tab in the app. What’s also nice is that you can link multiple accounts at one time. That way, you can choose where you want to transfer money to or from as needed. The only nitpick I have is that these accounts display by the last four digits of the account and not by the bank name (with no apparent option to edit them).

In terms of transfer times, they are about standard for digital banking options. That is to say that they are not instant and can take a few days to clear. Still, I haven’t had issues moving funds between accounts other than the slight wait.

Obtaining and using your One debit card

Within seven to 10 business days of opening your One account, your debit card should arrive in your mailbox. It can also be added to digital wallets such as Apple Pay for even easier access.

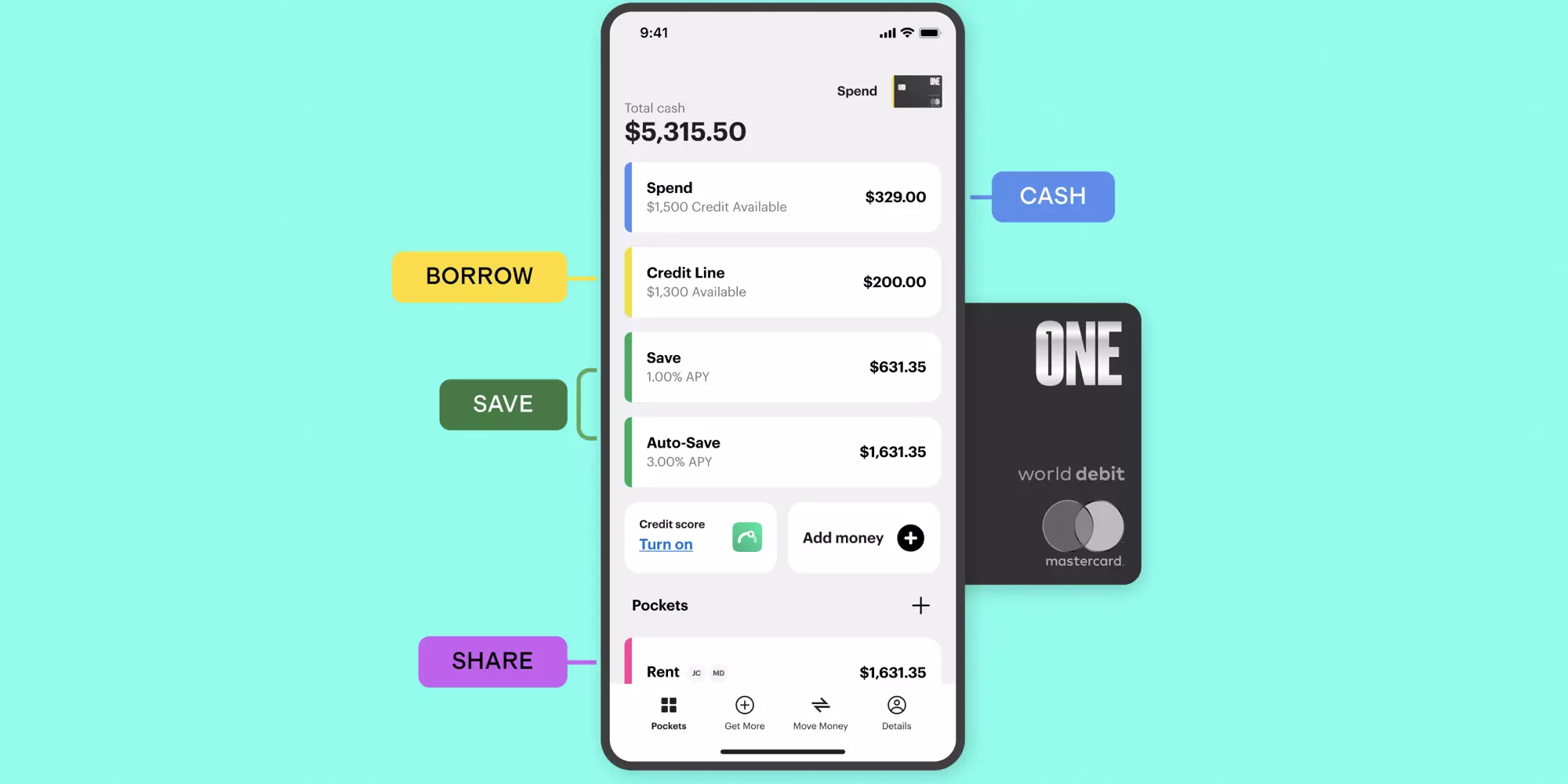

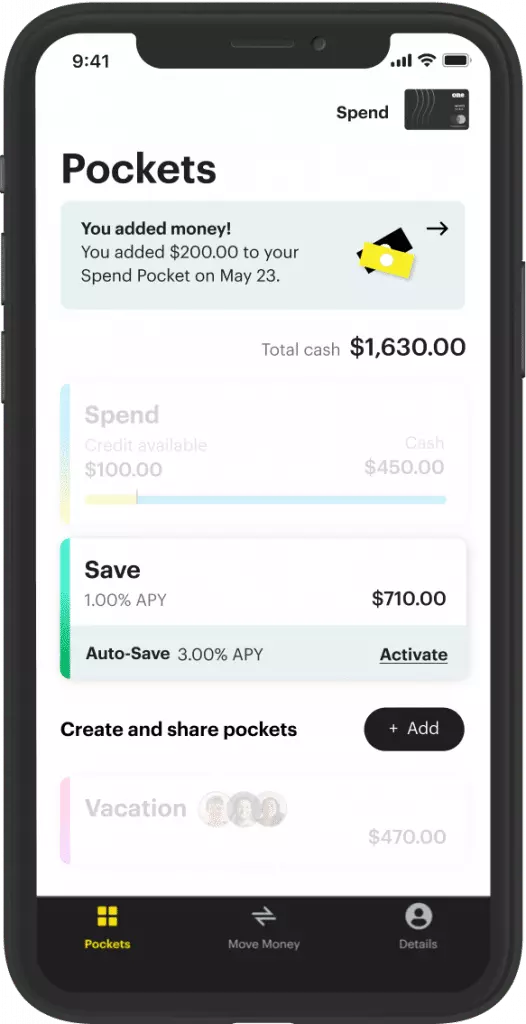

Using Pockets

Spend and credit available

At first glance, the Spend Pocket that comes standard with your One account might seem like your everyday checking feature. While it does serve as that, it has an added bonus that could come in handy in a pinch. As part of your Spend account, you can get a small credit line that will allow you to overdraft your account for a short period of time if needed. What’s more, as long as you bring your account back to positive by the end of the calendar month, you won’t have to pay any interest. Meanwhile, if you do carry that negative balance into the new month, you’ll be charged 1% interest per month (12% APR).

Before this Credit Limit will be available, you’ll need to activate it — which won’t impact your credit score as One does not perform a hard inquiry. Then, it will only kick in once your Spend balance reaches less than $0.

Your Credit Limit will depend on whether or not you’re receiving direct deposits. Without direct deposit your limit is likely to be quite small. For instance, mine is currently $20. Whatever your limit is, it will display alongside your Cash balance when viewing your Spend widget on the Pockets tab.

Personally, while I don’t intend on using this feature, I’m glad it exists. At the same time, I do wonder why the decision to tie the due date to the calendar month was made as it may make it harder for some users to avoid interest. If possible, I think it’d be better if it moved to a flat 30-days from the time of the overdraft, but at least this current system offers something.

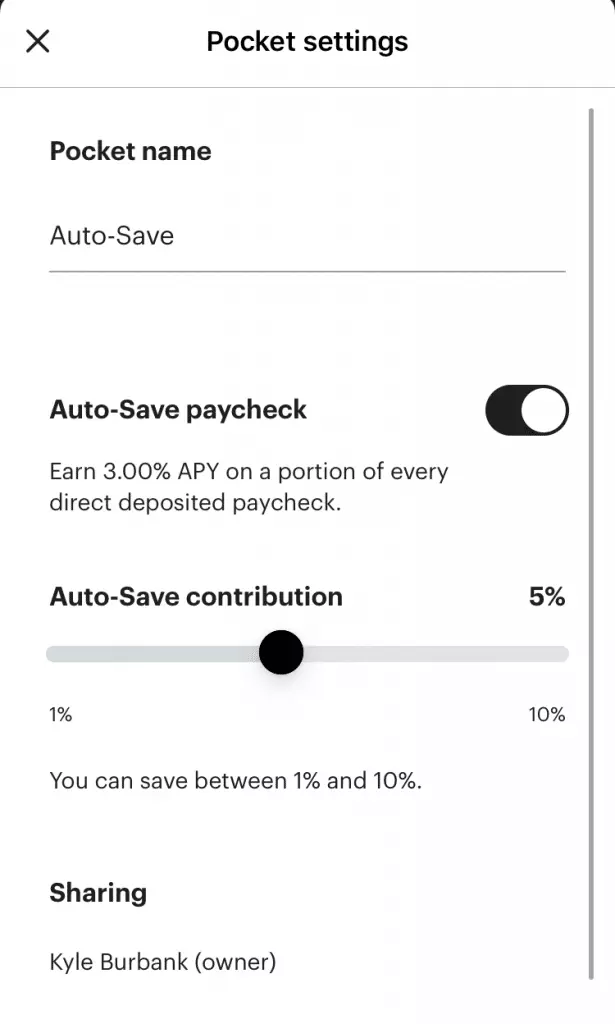

Save, Auto-Save, and earning interest

The other main Pocket is the aptly named Save. What makes this Pocket powerful is that funds you keep in it will earn 1% APY (on balances up to $5,000). This interest is accrued throughout the month and paid on the first of the new month.

While 1% APY is already pretty strong in today’s market, One also offers the opportunity to earn an even more impressive 3% APY. This is achieved with the Auto-Save sub-Pocket. Previously, this required you to directly deposit your paychecks in One and auto-save a percentage of said paycheck (currently you can auto-save between 1% and 10% of each check and can deposit up to $1,000 a month into your Auto-Save Pocket) in order to earn 3% APY on these set-aside funds. However, One has since expanded the Auto-Save pocket to also include Card Auto-Save funds.

What does “Card Auto-Save” mean? It’s One’s version of the round-ups feature popularized by apps like Acorns. When you opt into this feature and make a purchase with your debit card, One will round up the transaction amount to the nearest dollar and deposit the difference in your Auto-Save pocket. Then, this accrued loose change will earn 3% APY.

Personally, I think this expansion of the Auto-Save pocket and the opportunity to earn 3% APY has been a great addition to the app. While you’d need to use your debit card pretty frequently to make those round-ups earn much interest at first, it could still add up over time. Plus, if you do use direct deposit, then this Auto-Save option with enhanced APY could provide a great incentive to set a portion of your paychecks aside.

Credit Builder

Another interesting feature of One is their Credit Builder pocket. Using this tool, you can create what is essentially a secured line of credit and establish positive payment history. Plus, when you spend from this Pocket, One will set the money aside from your deposited amount to ensure that you make an on-time payment. To view your next payment date, tap into the Credit Builder pocket (although it should be the 25th of each month).

To get started with this option, you will need to opt-in as this will show up on your credit reports (also note that not all customers may be eligible for Credit Builder). Then, once opened, you can add money to your Credit Builder pocket that will serve as your limit. On that note, what’s nice about Credit Builder is that your utilization is not reported, so you don’t need to worry about hitting your limit.

Creating new Pockets

Beyond the standard Spend and Save Pockets, One also allows you to create additional Pockets. These will essentially function as mini sub-accounts, allowing you to earmark funds for certain purposes. Unfortunately, these Pockets will not earn APY — although I do hope One will introduce a way to add custom Save Pockets in the future.

To create a new Pocket, just tap “Add” next to the “Create and share Pockets” option. You can choose from a number of suggested Pocket names or enter your own. Once added, you’ll see your Pocket listed along with any others below your Spend and Save ones. You’ll also see the current balance of each, with the overall balance across all of your Pockets displaying as “Total Cash” at the top of the app.

What’s really interesting is that each Pocket you create will actually have its own account number. That way, if you want to auto-pay bills or set up recurring deposits via other apps, you can ensure that you’re using the desired Pocket. Similarly, you can assign your debit card to different Pockets on the fly… which we’ll look at more in just a moment.

Sharing Pockets

Not only can you use custom Pockets to divvy up your own bills but can also grant friends and family access to Pockets you’ve created. By tapping into a Pocket and then hitting the + button, you can invite others to join your shared Pocket. This is accomplished by sending them a link either by text, email, or other such options. If the person you’ve invited does not yet have a One account, they’ll have access to the shared Pocket as soon as they join.

It probably goes without saying but, by adding someone to a Pocket, they’ll be able to contribute money to as well as spend money from that shared Pocket. Therefore, I’d advise that you only select people you trust to join. Of course, should you wish to remove someone from a shared Pocket, you can do so in the Pocket’s settings.

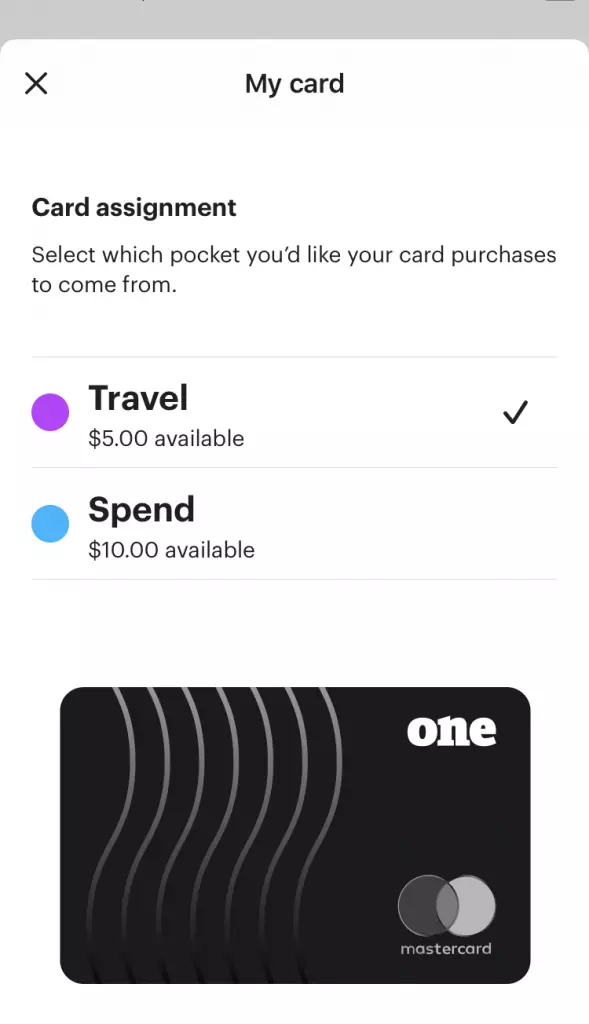

Assigning Pockets to your debit card

Another interesting aspect of Pockets is that you use the app to select what pot you want your purchases to come out of. For example, if you’re booking a flight or hotel stay, you might temporarily assign your One debit card to the Pocket you created as a travel fund. To me, this concept is actually akin to what Qube Money is doing — albeit with less of a direct emphasis on budgeting.

To reassign your debit card to a certain Pocket, just tab the card icon in the top right corner of the app (or under the My Card section in the Details tab). Then, you can select the proper Pocket. Once you’ve made your choice, the name of the assigned Pocket will display next to this icon so that you can quickly tell which is linked.

I should mention that, in keeping with the intention of the Save feature, it is the only Pocket that cannot be assigned to your debit card. Instead, you’ll need to transfer funds to a different Pocket first and then assign that.

Virtual cards

One of the more recent additions to One Finance is the ability to create virtual cards for any Pocket. By selecting a Pocket, tapping the three-dot icon in the upper right, and scrolling down to the Virtual Card section, you can generate a custom card number specific to that pocket. That way, you can use these virtual cards for certain purchases and ensure that you’re pulling funds from the proper Pocket each time. To me, this a smart alternative to needing to change which Pocket your main debit card is linked to and could definitely be useful for those using One to better budget their money.

Other One Finance Features

Recent transactions

Further down on the Pockets tab, you’ll find a list of your recent transactions. One nice touch I noticed is that some transactions will display the logos from the businesses you shopped at (such as Starbucks in my case). While there is no other dedicated Transactions tab in One currently, you can also view purchases by tapping on the appropriate Pocket.

Schedule transfers

Whether you want to regularly deposit money from an external account or perhaps divvy up funds to different Pockets come payday, One’s Scheduled Transfers feature could prove useful. These recurring transfers can be scheduled to take place:

- Daily

- Weekly

- Every other week

- Monthly

- On the last day of the month

You can also select a start date for these transfers as well as an end date if needed. Although this isn’t the most unique feature One offers, given the emphasis on Pockets, it’s definitely a welcomed addition.

Depositing checks

In the Move Money tab, one of the other options you’ll find is Deposit checks. Once upon a time, tapping this option would only give you a pop-up informing you that the feature was coming soon. Luckily, this capability seems to now be fully launched.

Like other mobile deposit apps, to deposit your check, you’ll need to take a photo of the front and back. Meanwhile, One does let you select which Pocket you’d like your check to be deposited in. However, one slight downside is that deposit limits for this feature are relatively low. At least in my case, my daily limit is $2,000, which is less than half of my Wells Fargo limit. Luckily, I don’t really need to be depositing checks larger than $2k in my account with any frequency, so it’s not a big deal — but it’s still worth noting.

“Pay anyone”

Yet another option listed on the Move Money tab is “Pay anyone.” Although I was expecting this feature to be a proprietary peer to peer payment service, it’s actually for more traditional bank transfers. This means that you’ll need to provide the recipient’s routing and account numbers in addition to their name and phone number. While I’m sure there’s a use for this, I suspect most users will find it easier to simply link their One account to a third party service such as Venmo or Square Cash. Alternatively, in theory, you could also create a shared Pocket (assuming the recipient was a One user), allowing the payee to move the money from there.

Fetch points

Not too long ago, One announced a partnership with the app Fetch. As a result, customers can now link their Fetch Rewards account to One and earn Fetch points on debit card purchases. To get started, simply connect your Fetch account in One and a Rewards section will show up on your dashboard, displaying your current point balance.

While this is a pretty cool and unique feature, don’t expect your debit-earned rewards to add up to much. Currently, you’ll earn 1 Fetch point per dollar spent. That might sound good enough but, considering that $10 gift card redemption on Fetch costs 10,000 points, the per-point value is pretty low. Still, it’s an added bonus and could help you push your Fetch point balance over a certain threshold as needed.

Referral bonuses

Lastly, right now One is offering a sizable referral bonus to new and existing customers. Those who join One using a referral link can earn $50 when they make a qualifying direct deposit of $250 or more. Meanwhile, the person who referred them will also score $50 (up to a max of $500). You can find your referral link by tapping the “Invited friend” button in the Details tab of the app and track your invitations from there — and if you’re looking to get started with One, you can always use this link to sign-up in order to earn your $50 bonus.

Final Thoughts on One Financial

Looking at One Finance’s main tab makes it seem deceptively simple. In reality, there are several features that make this more than another FinTech savings and checking account. Between the unique implementation of the Pockets feature, the impressive APY (with the opportunity to take it even higher), the credit cushion and Credit Builder options, and even the generous bonuses currently offered, there’s a lot to like about One.

In fact, my only real concern is that it’s too good to last. As I’ve experienced in the past, sometimes new offerings of this nature start off really strong but then need to cut back perks or start charging in order to properly monetize.

That said, it’s really unfair to judge One on what the future may hold — especially since the account has stayed solid for more than 18 months since I joined. Thus, looking at the current product, I only have a few small suggestions. For one, I do wish there was a way to create additional Pockets that earned interest. This would be great as it would allow users to save for specific goals instead of having all of their savings in one main account.

On a somewhat similar note, considering that One has already built out the Pockets infrastructure, it seems only logical to me that they’d add more budgeting features. Personally, I think it would be cool if you could assign spending limits to different Pockets or at least have a tab where you can view your transactions by spending category (and have a way to override categories, which does not currently seem possible). With the addition of Virtual Cards for Pockets, I feel like this is the way One is going and look forward to seeing what else they roll out on that front.Aside from those suggestions, I have to say I was really impressed by One Finance and hope that this digital banking option continues to only get better from here.

Yes, One Finance partners with Coastal Community Bank, so deposits are FDIC insured.

Deposits to your One Finance account are held with Coastal Community Bank and are FDIC insured up to $250,000 per depositor.

When you open a One Finance account, you’ll be mailed a free debit card you can activate and use for purchases or at ATMs.

By opting into One Finance’s Credit Limit feature, the app will allow you to overdraft your account by that limit, charging you no fees as long as you bring your balance back to positive by the end of the calendar month. The size of your Credit Limit will depend on multiple factors, including your direct deposit history.