Personal Finance

Money at 30: WeWoreWhat, Rewards Cards, and Creator Loyalty Potential

It was only a few weeks ago that I wrote about how one of the steps I take in crafting my various financial app reviews is to scour Instagram for new offerings. Well, earlier this week, that strategy paid off but in a different way than normal. Rather than coming across an ad for a new offering, I saw a post from one of my favorite YouTubers Amanda Golka (AKA Swell Entertainment) that said, “Can a qualified finance creator make a video about Danielle Bernstein of WeWoreWhat launching a credit card??? I’m not well versed enough in the topic to properly articulate how this is not a good idea.”

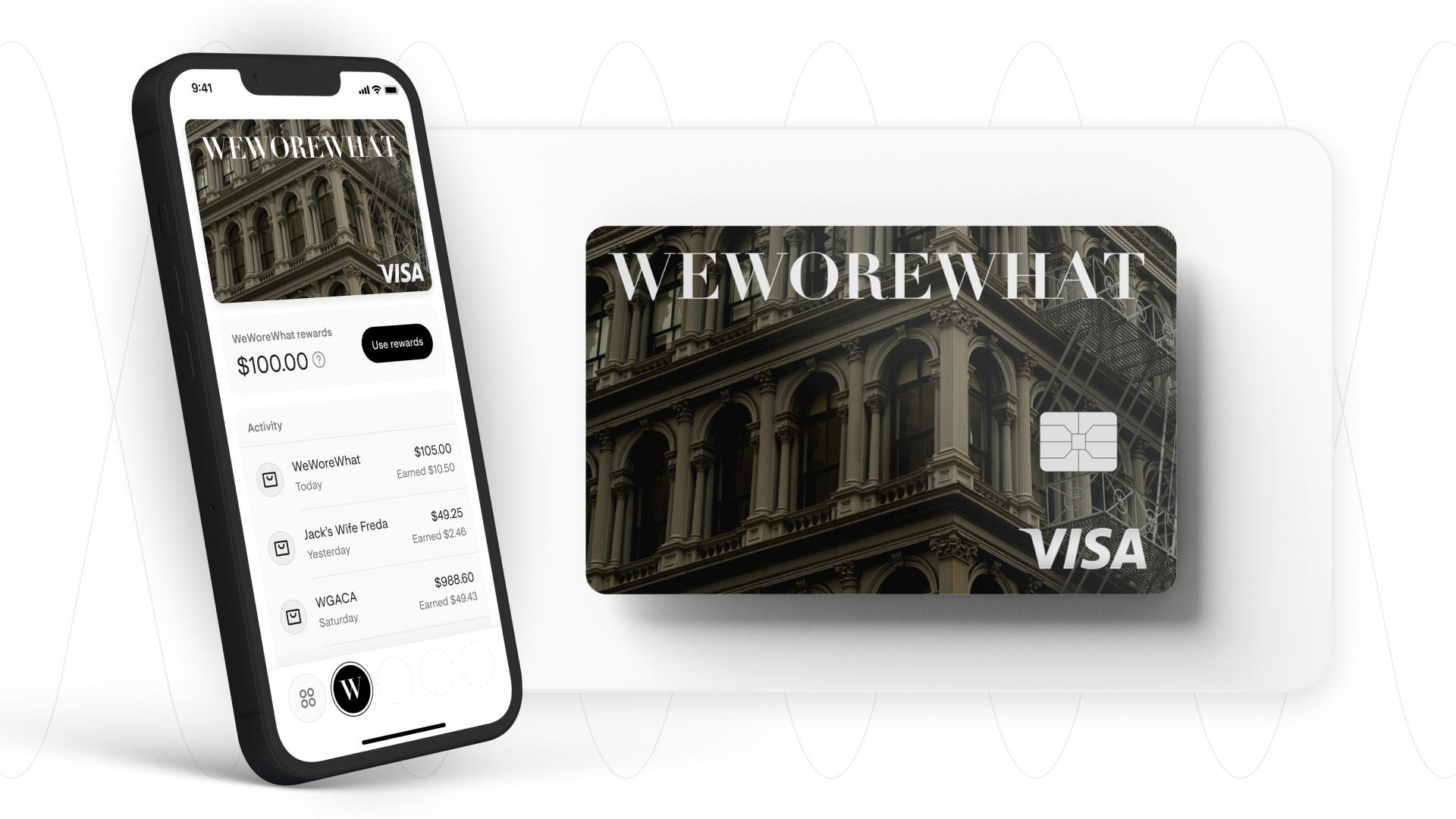

Now, I don’t know who or what a WeWoreWhat is — but I was intrigued by Amanda’s open request and decided to do some digging. What I found was actually not at all what I had expected. For one, the card in question isn’t a credit card but a “Rewards Card.” Second, it’s been released in conjunction with the startup Imprint — a company I’ve not only heard of but have actually opened a different card with in the past (it’s in my review queue). Third, while this card is one I could take or leave, I’m actually not as opposed to the idea as I initially assumed.

So, what exactly is the WeWoreWhat Rewards Visa? Let’s take a look at the card itself, how it works, and the new precedent set by this creator rewards card.

UPDATE: In April 2023, it was announced that the WeWoreWhat Rewards Visa was being discontinued. All accounts will be closed effective May 1st, 2023. Below is my review of the original offering.

Credit Card vs. Rewards Card – A New Category?

As I noted, when I looked into it, it turns out that the WeWoreWhat Rewards Visa isn’t a credit card at all — nor is it a debit card. Instead, Imprint describes the product as a Rewards Card.

What does this mean? Namely, it means that customers will not need to undergo a credit check when opening a card and their credit will not be affected by them having the card. Instead, customers will link an external bank account from which funds will be pulled (that said, users will see a “Spending Power” limit that’s influenced by but not a direct reflection of their bank balance). Although that might sound like a debit card, the fact that the card itself doesn’t store any funds makes it unique.

To me, this is a pretty interesting concept. Yet, as I think about it, it’s somewhat similar to what Pay with GasBuddy offers, which is a card that can be used for payments and offers benefits but pulls directly from a bank account. Of course, that product can only be used at select gas pumps whereas Imprint’s cards are Visas and can be accepted anywhere that utilizes that network.

Overall, while I’m sure there are some pros and cons that could come into play in regards to purchase protection and such, I think that the Rewards Card category shows promise. In fact, I find this concept to be far more attractive than a store credit card. So, with that out of the way, let’s talk about the specific rewards card at hand: the WeWoreWhat Rewards Visa.

What is the WeWoreWhat Rewards Visa and How Does it Work?

Signing up for the card and welcome bonus

To get started with the WeWoreWhat Rewards Visa, those interested can start by scanning the QR code found on the Imprint WeWoreWhat site. If you don’t already have the Imprint app, scanning the QR code will bring you to the App Store. After downloading, opening the app will take you to the application, which starts off with your phone number. You’ll then need to confirm that number by entering a code that Imprint will SMS to you.

With that out of the way, you’ll then see an overview of the WeWoreWhat card and can tap “Let’s Go” to continue the process. This will then require you to enter your name, birthdate, address, and Social Security number. Note that your Social is only used to verify your identity and that Imprint is not pulling your credit.

Last but not least, with all of your info in, the last step before opening your card is to link a bank account. Like many other apps, this is done using Plaid, allowing you to log into your account in order to link it. Once this is complete, your WeWoreWhat Reward Visa will be ready to use. Even better, at this time, new users will earn a $10 welcome bonus just for opening the card. Unlike credit card bonuses, this $10 in rewards will show as soon as you open the card with no spending required.

Lastly, for the record, the card is actually issued not by Imprint themselves (since they are not a bank) and is instead issued by First Electronic Bank, Member FDIC.

What the WeWoreWhat Rewards Visa offers

Currently, the card earns:

- 10% back at WeWoreWhat

- 5% at partner brands

- 1% everywhere else

As for those partner brands, the list as of April 2022 includes 18 different options such as Jack’s Stir Brew Coffee, Lello The Label, Kissaki Sushi, Stephanie Gottlieb Jewelry, and several more.

Rewards earned from purchases will accrue in your Imprint app and can then be redeemed at WeWoreWhat and participating partner brands. What’s more, there’s no minimum redemption requirement. In the Imprint app, users can also toggle on the “auto-apply rewards” option to use their available rewards balance toward their next eligible purchase.

Digital only

One downside of the WeWoreWhat Rewards Visa (and seemingly other Imprint offerings) is that they are currently only available for use digitally. While the cards can be used for online purchases and can be added to mobile wallets like Apple Pay, there are no physical cards. So, although the card is technically accepted everywhere Visa is, in-store purchases can only be made if the retailer supports mobile wallets.

Is it worth it?

For me, at this time, this card pretty much has no use. However, that’s clearly not the case for everyone, as those who frequent these locations will obviously be much better served by the product. Also, since the card costs nothing to get, doesn’t impact your credit, comes with a bonus, and earns rewards that you can use easily enough, from what I can see there’s little harm in trying out the WeWoreWhat Rewards Visa. What’s more, though, is how this card really opens the door to new possibilities I think are worth considering.

Final Thoughts on the Creator Rewards Cards Concept

While I fully understand why Amanda was concerned about a content creator credit card (and I think I would be too), looking more into it, I don’t think that’s what the WeWoreWhat Rewards Visa is. In fact, although this particular card might not appeal to me, I’m very intrigued by the premise and precedent. Not only do I think that the “rewards card” format could have merit but I also kind of appreciate the idea of creators, brands, and others making this style of card the new go-to loyalty program play.

At the same time, I do have some ideas that could potentially improve this idea along with some downsides to dismiss. First up, although I appreciate that the current Imprint cards don’t impact users’ credit, it occurs to me that the arrangement is ripe to allow customers to opt-into a credit-building feature in the future. This could be akin to what Credit Sesame and One Finance already offer, enabling users to make debit card purchases, set funds aside, and automatically pay off their balance in order for the platforms to report positive payment history to bureaus. To be clear, I wouldn’t want this to be the default, but I think that making it an option could be beneficial to some consumers and make sense for certain creators.

As for downsides, there is of course a potential opportunity cost to such cards and I’m not crazy about the idea of consumers being stuck using their rewards at such a limited list of places. Additionally, as I mentioned earlier, I would need to do more research on how purchase protections on these cards work compared to credit cards before giving this form of payment my full endorsement.

With all of that said, I will definitely be keeping a closer eye on Imprint and its Rewards Card concept. Funny enough, as I was writing this, I saw that they’re currently rolling out a card with another brand I’ve never heard of: Selina. Considering the company also raised a $38 million Series A that saw the likes of Stripe investing in them, it’s clear that I’m not the only one taking an interest in them. With that, if they’d like to contact me about building a Money@30 Rewards Card… I’d at least hear them out. 😉