Money Management Product Reviews

2024 Pay with GasBuddy Review: Yes, You Can Legitimately Save Money Every Time You Fill

I don’t remember what it was like to drive to new places before I had GPS on my phone — how did I get anywhere? Similarly, I don’t know how I survived road trips before I had GasBuddy to lead me to the best gas stations along the way. As a fan of the app, a few years back, I decided to try out their Pay with GasBuddy card to see how it works.

Put simply, the value proposition of Pay with GasBuddy is that you can use a special card that’s accepted at most gas stations in order to save a few cents off of every gallon of gas you buy. That sounds good — almost too good, if you think like me.

The offering has changed a bit since I first signed up. However, after getting a chance to test the service out, I can report that Pay with GasBuddy really does work (for the most part) and could be a great feature for some drivers.

With that background, let’s take a closer look at what Pay with GasBuddy is and how it could save you money on the road.

- Free version available

- Save up to 25 cents per gallon

- Several gas stations supported (95% of stations)

- Not all gas stations supported

- Discounts will vary by station, time, etc.

- Some gas stations may change a premium to use a card (instead of cash)

Signing Up for Pay with GasBuddy and How it Works

The first thing you should know about Pay with GasBuddy is that it is completely free to sign-up and start using the service. All you’ll need to do is either select the Pay with GasBuddy option in the app or go to their website to begin the process. On top of basic information like your name, address, and phone number, as well as less-common info such as your driver’s license number, you’ll also be asked to link a banking account.

Keep in mind that the account you select will be the one that’s charged whenever you use the service. To verify this bank account, you can either select the Instant option via Plaid (where you’ll log into your account to securely link it) or you can opt to have micro-deposits made to your account — which will take between one and six business days.

After you sign-up, a Pay with GasBuddy card will be shipped to you (again — this is all free). To the untrained eye, these look like any regular credit or debit card except that it lacks an EMV chip or Visa/Mastercard/etc. logo. Before using your new card, you’ll also be asked to create a Driver ID number, which will essentially function as a PIN.

Once your card is activated, you’re ready to go. You’ll be able to insert your card at the pump at most stations and automatically save a minimum of 2¢ per gallon. In theory, however, you could save up to 25¢ per gallon.

GasBack Offers

There is another way to save using Pay with GasBuddy and that is via their GasBack offers. Similar to how Rakuten (formerly Ebates) or Dosh offers result in cash back, taking advantage of deals offered by multiple online retailers in the “Savings” section of the app will deliver a percentage (or flat dollar amount) of your purchase in GasBack. For example, current offers include 4% GasBack from JCPenney online, 6% from Chewy, 3% on Instacart, $3 from TurboTax, as well as many others.

To earn GasBack, you’ll want to shop at the participating retailers using the links found in the GasBuddy app. Also note the “Fine Print” for each offer that will list what types of items will be eligible, how long your GasBack will take to process, and more. Once you’ve received your GasBack, you’ll be able to spend it using your Pay with GasBuddy card. Plus, these savings come in addition to the per-gallon savings you’d normally receive.

Personally I have yet to try out any GasBack offers but I will say that GasBuddy does seem to have a pretty decent line-up. Unfortunately, since you’ll need to use their link for purchases, these offers would have to take the place of those you’d get from Rakuten or others. That means GasBack is just one more thing to consider when you’re shopping for the best deals online.

Deal Alerts

When I previously checked up on Pay with GasBuddy, I was apparently a bit confused by how Deal Alerts worked. After all, this did mark a departure from the original version of the service, which was a flat discount across the board. Luckily, when I followed up last year, I was able to successfully navigate the offering and got it to work as intended.

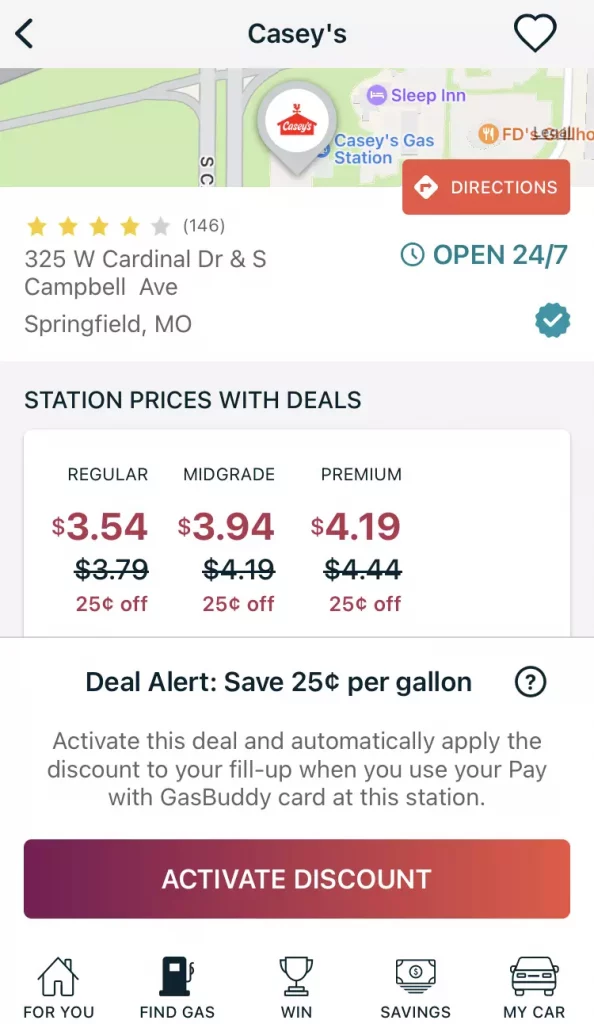

As you browse the GasBuddy app, you’ll not only see gas prices for nearby stations but might also see some banners promoting Deal Alerts. In short, these Alerts will bring your attention to stations currently offering enhanced savings. To take advantage of these deals, you will need to activate the offer, at which point you’ll have four hours to redeem it. Should you forget to activate it, GasBuddy notes that you’ll still see a minimum discount of 2¢ per gallon just for using your Pay with GasBuddy card.

I’ll detail my mostly-positive experience in the “Using Pay with GasBuddy” section below, but I will say that you’ll likely want to activate your deal when you’re nearing the station for the most accurate info. Also, just like before, be aware that the updated price won’t display on the pump itself or on your physical receipt. Instead, you’ll need to wait for an email from GasBuddy to arrive or for your app to update so you can see just how much you saved and how much you spent.

Pay with GasBuddy Premium

While the regular Pay with GasBuddy product is free, there’s also a paid Pay with GasBuddy Premium product — sometimes referred to as GasBuddy Membership. The most notable perk here is that you’ll get 20¢ off of your first 50 gallons each month (and then 5¢ per gallon after that) with the chance to apparently save up to 40¢ off per gallon with Deal Alerts. However, the other perks that come with Membership are more akin to what AAA or others might offer.

According to the site, Pay with GasBuddy Premium also includes Roadside Assistance (powered by Allstate), which offers:

- Free towing up to 10 miles

- Flat tire replacement

- Jump starts

- Fuel delivery of up to three gallons (you’ll need to pay for the fuel itself)

- Lockout service (at a fee of $60)

- And more

Currently, Pay with GasBuddy Premium comes at a cost of $9.99 per month or $99 a year if you pay upfront. Also notable is that the Roadside Assistance features are available for up to three events per year and won’t be available until 72 hours after you join (so no signing up while you’re stranded on the side of the road).

In our Guide to Gasoline Rewards Credit Cards we take a look at some of the best credit cards for earning at the pump.

Personally, I haven’t signed up for GasBuddy Membership, so I can’t speak to the quality of their services. However, just looking at the list, I can see some pros and cons compared to AAA. First, depending on where you live, AAA membership may actually cost less. For example, my annual bill in Missouri is $61 — although some of the benefits do differ from GasBuddy’s.

On the other hand, the 20¢ off per gallon (up to 50 gallons) could change the math if you’re driving a lot. Not only would this rate best anything from my credit cards but might also help make up for that price difference with AAA. Therefore, if you’re not already a AAA member or are willing to try something else, this route might make sense.

GasBuddy Mastercard Credit Card

Before we get to my Pay with GasBuddy experience, I do need to point out that this product is different from the GasBuddy Mastercard Credit Card. That offering allows cardholders to earn 3¢ back per gallon by default and up to 25¢ back per gallon with offers, with those earnings being redeemed as a statement credit. The credit card also features 3% GasBack on convenience store purchases, 3% GasBack on restaurant purchases, and 1% GasBack on all other non-gas purchases (wherever Mastercard is accepted).

Plus, currently, new cardholders can earn $10 GasBack when they make their first gas purchase at the pump within 60 days of account opening and another $25 GasBack after they spend $500 in non-gas purchases within 120 days of account opening.

While this credit card option may make sense for some customers, it’s not what we’ll be focusing on for the rest of this article. Furthermore, to be clear, Pay with GasBuddy is not a credit card product. With that out of the way, let’s get to the matter at hand.

Using Pay with GasBuddy

On their website, GasBuddy says that their service works at approximately 95% of gas stations — calling out a few where it doesn’t work while showcasing logos of a few that do. Since my local station was not explicitly listed, I was very skeptical when I went to insert my Pay with GasBuddy card for the very first time.

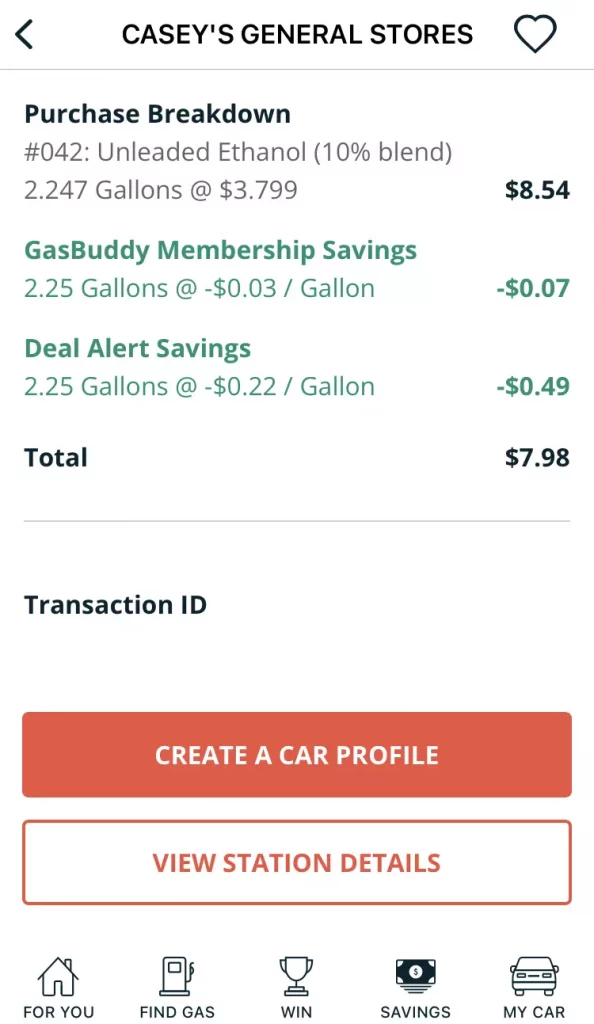

To my surprise, after swiping my card, the pump prompted me to enter my Driver ID (your PIN). Once that was done, I was good to select my fuel grade and start pumping. Admittedly, at this point, I still wasn’t 100% clear on how Pay with GasBuddy actually worked, so I printed my receipt to keep tabs on the whole process.

What I soon discovered was that the price listed on that receipt is not what would end up being debited from my account. Instead, the savings were shown and the net balance was deducted from my checking account. It was like magic!

Since that time, I have noticed that stations that don’t support Pay with GasBuddy are actually noted in the app. For example, next to Sam’s Club, there’s a small icon of a card with a circle and slash through it next to the station’s address. For what it’s worth, Sam’s is one of only a handful of stations in my area that don’t accept the card.

As I alluded to in the Deal Alerts section, Pay with GasBuddy has changed a bit since I first started using it, so I decided to try out the service again this week — and I had a pretty successful experience. Looking in the app, I saw that a Casey’s nearby had Deal Alert for 25¢ off. So, I activated it and headed there. Sure enough, while the standard price was $3.79 per gallon, looking at my receipt in GasBuddy, I “only” paid $3.54 per gallon. This includes a 3¢ per gallon standard discount plus the 22¢ per gallon Deal Alert savings.

With that said, prior to arriving at Casey’s, I did attempt a different offer, which left me with some questions. Before leaving home, I activated a Deal Alert for 12¢ off. Yet, when I got closer to the station and checked again, the discount had fallen to 6¢ off (even though I was still well within my four hour activation time limit). In this case, I bypassed the station after discovering Casey’s deal instead — but I do wonder which offer would have been honored. Either way, I guess this is a lesson to temper your expectations and activate offers as close to arrival as possible to prevent disappointment.

The Pros and Cons of Pay with GasBuddy (free version)

First, the biggest compliment I can give Pay with GasBuddy is that, to my surprise, it was accepted at every station I tried it at. That said I should note that the service is only intended to work at the pump itself and cannot be used inside (even if it is just to pre-pay for gas). As a result, if you only want to pump a certain dollar amount, you’ll have to do it manually.

In terms of cons, I have seen some users question whether it makes sense to use Pay with GasBuddy at stations that charge extra for credit or debit cards. Put simply, the answer is “probably not” — after all, these stations typically tack on 10¢ per gallon whereas GasBuddy will only save you between 3¢ and, if you’re a Premium customer, 20¢. However, while these heightened prices for credit/debit may be popular in some parts of the country, it’s not a nationwide standard. In my case, even though I saw stations all over California charging more for card transactions, I have yet to encounter one in my area of Missouri. Additionally, if you are able to find a max Deal Alert of 25¢, this should more than offset the card fee… hopefully.

Also, this dilemma is only a factor if you actually have cash on you. If you do, it is probably a better idea to pay cash and get that discount. However, if you don’t, then I don’t see any harm in using your GasBuddy card instead.

Final Thoughts on Pay with GasBuddy

Overall, I was really surprised and impressed with the Pay with GasBuddy product when I first tried it. After all, it’s essentially giving users free money. That remains true as, after a mixed experience with my previous Deal Alert trials, my latest endeavor went swimmingly, saving me 25¢ per gallon!

Of course, one potential disadvantage for people like me is that I’d be missing out on credit card rewards by using this service instead. With one of my cards granting me 4% back on gas, that might best the amount GasBuddy would offer for more fill-ups — unless of course I’m regularly finding Deal Alerts of 10¢ off or more. Additionally, as I mentioned, those in certain areas may need to weigh the benefits of using Pay with GasBuddy against potential card fees. Meanwhile, the Premium option offers yet another set of factors to consider, making it difficult to recommend generally.

I will also point out that GasBuddy does seem to be muddying the waters a bit as its GasBuddy Mastercard Credit Card is a separate product that, despite sharing some features, is very different from the Pay with GasBuddy product. While I understand the company wanting to expand its offerings, I could see this being confusing for those looking for the debit product — so hopefully this post helps clear that up a bit.

With all that said, if you don’t have a credit card that puts a premium on gas and don’t live in an area that charges more to use cards, Pay with GasBuddy could be a good option for saving at the pump given its wide acceptance, ease of use, and GasBack offers. Therefore, I’ll still be taking my Pay with GasBuddy card along with me for future road trips.

Pay with Gasbuddy securely connects to your bank account using the API Plaid. Moreover, the card can only be used at gas pumps, limiting the potential impact should your card number become compromised.

No. Pay with Gasbuddy acts like a debit card, with gas purchases (minues any savings) being deducted directly from a linked bank account. However, GasBuddy does also offer a GasBuddy Mastercard, which is a completely separate product.

Pay with GasBuddy cardholders can use their card at 95% of gas stations in the U.S. to save on each gallon they buy. These savings — which can be increased through GasBack offers and Deal Alerts — are subjected from the total and funds are directly debited from a linked bank account.

Pay with GasBuddy is accepted at approximately 95% of gas stations in the United States. However, some notable exceptions include Costco, Sam’s Club, Texaco, Exxon Mobil, HEB, select Walmart stations, select Arco stations, BJ’s, and some others.