Credit Card Reviews

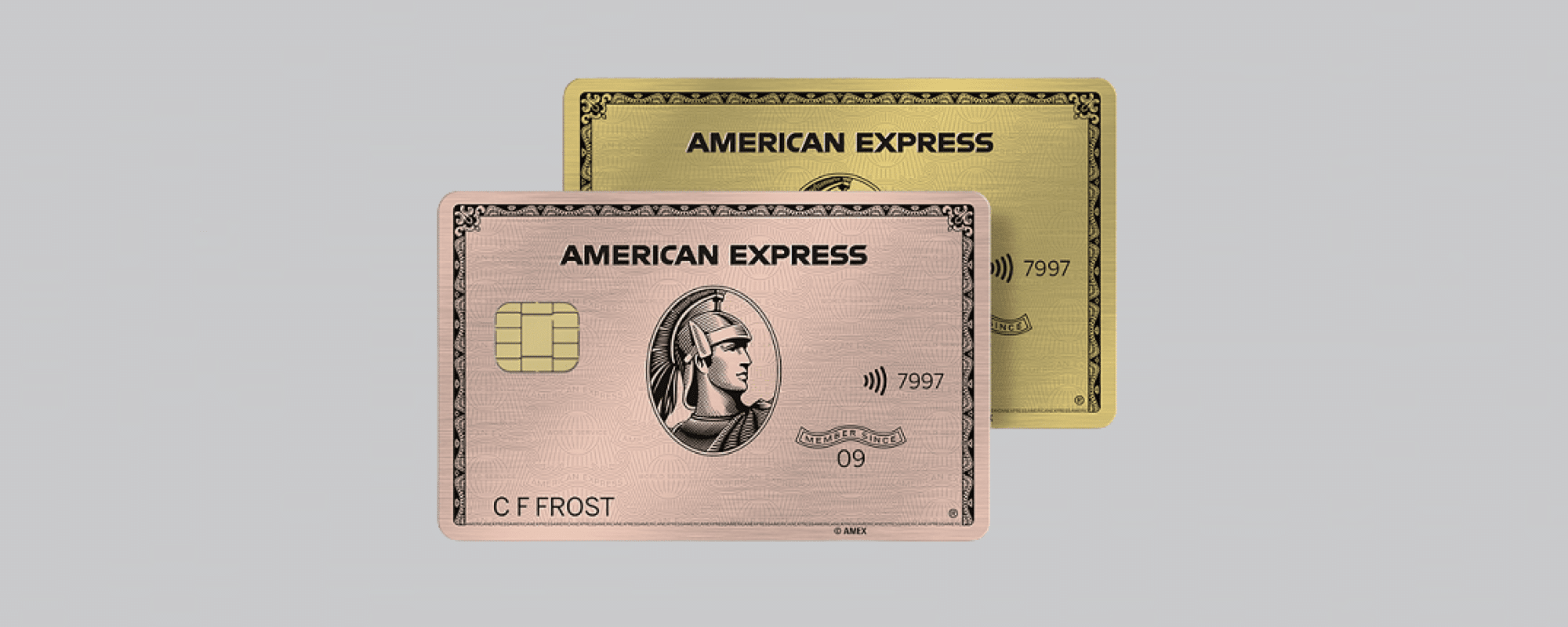

American Express Gold (and Rose Gold) Card Review

“Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

In September of 2019, I leaped into the world of premium rewards cards when I applied for the American Express Platinum card. During the following months, I continually looked at the American Express Gold card as a potential companion to my newly-acquired card, but eventually disabused myself of that idea because I wasn’t sure that I’d be able to make full use of its perks. Cut to this past fall and an enhanced welcome bonus along with new benefits on the Gold card got me to change my tune. On top of that, Amex recently reintroduced the Rose Gold card option, further bringing attention to this coveted card.

So what does the Amex Gold card have to offer and how has it benefited my wallet over these past few months? Let’s take a closer look at the American Express Gold — and Rose Gold — card:

- 4x at restaurants and at U.S. supermarkets

- Monthly Uber and dining credits offset annual fee

- Compliments Amex Platinum card or works well solo

- $250 annual fee is high if credits are utilized

- Membership Rewards points offer low cashback redemption value

What You Need to Know About the American Express Gold Card

Annual fee

Like many of Amex’s premium cards, the Gold card does carry an annual fee. In this case, the card comes at a cost of $250 per year. This fee is added to your first bill and is then paid each year on the month of your cardmember anniversary.

While $250 may seem like a lot to pay just to add a card to your wallet, as we’ll explore, there are numerous perks and rewards that help offset this cost and hopefully even allow card members to see positive value.

Welcome bonus

Speaking of positive value, new cardmembers can get off to a good start thanks to the lucrative welcome bonus associated with the Gold card. As luck would have it, the card is currently offering one of its highest welcome bonuses ever. At this time, new cardholders can earn 60,000 Membership Rewards points after they spend $4,000 on the card in their first six months. Anecdotally, that 60k figure puts it on par with what I earned when I first applied for my Platinum card back in 2019 (although that card also currently features an enhanced offer). As you’ll see, this outstanding offer is part of the reason I was convinced to finally get the Gold card myself.

Two color options

Once upon a time (a few years back), when Amex refreshed the Gold card, it marked the occasion by offering a “limited edition” Rose Gold version of the card. Since then, this trendy hue has been sought after by those who missed out. Well, in February 2021, American Express brought back the Rose Gold card — and it seems that it will remain an option for the foreseeable future.

To be clear, the Gold card and Rose Gold card have identical perks, annual fees, etc. and are considered the exact same product. But, when you apply for the card, you now have the option to choose which of the two colors you prefer. So, while those who thought they were getting something limited edition may now be upset, the addition of Rose Gold is a win in my book.

Charge card? Credit card?

Something else that needs to be addressed in regards to the Gold card is how it compares to a traditional credit card. While the product had long been considered a charge card (meaning you’d need to pay off the full balance each month), now, the Pay Over Time feature adds more flexibility. As a result, it’s no longer a charge card… but also isn’t a normal credit card either.

With Pay Over Time, cardholders can choose to pay off purchases of $100 or more across multiple months. Choosing this option will result in customers paying interest for those purchases. Meanwhile, if a transaction is under $100, card members will need to pay it off at the end of the billing cycle.

Despite this move, the Amex Gold card still does not have a set credit limit (except for a Pay Over Time limit). Yet, this doesn’t mean that users have unlimited credit. To see if your planned purchase will be accepted, card members can try the Check Spending Power tool found on the Amex app or site.

Membership Reward Points multipliers on the Gold card

Now we get to the fun part: the rewards. To me, the biggest points-earning draw of the Gold card are the multipliers it puts on eligible dining and supermarket purchases. With the card, you can earn 4x points at restaurants including takeout and delivery as well as 4x points at U.S. supermarkets (up to $25,000 in category spending per calendar year). Additionally, cardmembers can earn 3x points on flights booked either directly through the airline or via Amex Travel. All other purchases with the Gold card will earn one point per dollar spent.

Credits and other perks

Beyond those key point multipliers, the American Express Gold card also includes a number of credits and perks that add to its value. Starting with the newest benefit, Gold cardholders can now earn $10 a month in Uber Cash, which can be used for rides or Uber Eats orders. To activate this perk, you’ll just need to add your Gold card to your Uber account. Then, the $10 should show up on the first of each month. Be aware that, like with many of the credits we’ll discuss, this one is “use it or lose it,” meaning that your Uber Cash will not roll over to the next month.

Contrary to what some cardholders mistakenly believed when the Uber Cash perk was unveiled, the Gold card also still offers a $10 a month Dining Credit. These monthly statement credits (which are also “use it or lose it) can be earned by making purchases at:

- Grubhub

- Seamless

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Milk Bar

- Participating Shake Shack locations

With both of these credits valued at $120 a year, the effective annual fee falls to just $10. Of course, this math assumes that you’re not only able to use the available credits but also use them to their full potential. Still, it’s easy to imagine that these benefits alone could help card members cover the card’s $250 annual fee.

Amex Travel and Hotel Collection

Lastly, another benefit of the Gold card that I want to point out is the Hotel Collection. Similar to the Fine Hotels & Resorts program that’s exclusive to American Express Platinum and Centurion cardholders, the Hotel Collection allows customers to enjoy notable perks when booking stays of two consecutive nights or more at select properties. These amenities include $100 onsite property credit, room upgrades when available, and more. Plus, when prepaying for these stays, Gold cardholders will earn 2x points.

Even though I wasn’t a Gold gold member at the time, I previously booked a stay at a Hotel Collection property in Chicago. Having the $100 property credit proved to be a great perk as it allowed us to dine at the hotel’s restaurant, charge the meal to the room, and have it comped when we checked out. Also, having used both the Fine Hotels & Resorts program as well as the Hotel Collection, I’ll note that those in the latter program tend to be a bit more affordable on the whole. Because of this, I’m a big fan of the Hotel Collection and see it as an underrated Gold card perk — especially if you don’t also have a Platinum card already.

My Experience with the Gold Card So Far

That welcome offer

When I first saw Amex’s recent 60,000 welcome bonus offer for the Gold Card, I was definitely intrigued. Not only was this a big step up from the typical 35,000 point offer but also extended the amount of time you have to meet the minimum spend from three months to six months. While I may have been able to spend $4,000 on the card in 90 days, it’d honestly be a bit of a stretch without any major expenses or travel to book. Therefore, I definitely appreciated the extra time.

For the record, at the time that I’m writing this, I just hit the $4,000 minimum spend after about four months and am awaiting my points.

Stacking Uber credits

As enticing as that 60k offer was, I was still a bit hesitant to sign up for the Gold card until I learned about the added Uber Cash benefit. Seeing as I already earn $15 a month in Uber Cash from my Platinum card and have mostly been using these credits for Uber Eats orders, I was confident that I’d be able to make use of an additional $10. Well, I’m happy to report that these two benefits stack beautifully as I had $25 in Uber Cash this month between the two cards. Just as I had hoped, this sum was easy to use in one fell swoop with no issue.

On top of that, the complimentary year of Uber Eat Pass has come in handy as it saves me money on delivery and service fees. That said, if I may offer a pro tip, I’ve found that you can make these credits go much further if you select the pickup option instead. Granted, not all of the restaurants on the app offer pickup and prices may still vary from in-store, but it’s typically much more affordable than ordering delivery.

Quickly earning rewards

In the short amount of time since I added the Gold card to my rewards card strategy, I’ve definitely seen my point-earning accelerate. Between the two 4x categories, I’ve found it easy to rack up Membership Rewards — much more so than with just the Platinum. Of course, this makes perfect sense since both of the Plat’s 5x categories are travel oriented and, well, that hasn’t been happening. In that aspect, while I think the Platinum’s perks make it a great pick, the Gold card is really a points workhorse. Thus, when put together, there’s a lot of power and value there.

Switching from Gold to Rose Gold

Since I applied for my Gold card in November, I was a little miffed to see the Rose Gold option pop up in February. That’s because I feared that I had missed my chance to get this alternate hue and that it would only be available to new applicants. Thankfully, I was wrong.

Upon seeing the Rose Gold had returned, I sent a message to Amex using their online chat feature. Although I initially got an auto response saying that Rose Gold had been discontinued, I soon got a real agent who took care of everything in seconds. According to them, my account number will remain the same and I’ll have the option to switch back to regular Gold in the future should I so choose.

Seeing as Rose Gold will apparently be sticking around, I do feel a bit silly about the immediacy with which I ordered my new card — but I’m excited to have it nonetheless. Even if it doesn’t change the way I’ll actually use the card, it will look just a little bit nicer in my wallet.

Adding an authorized user

Finally, when I opened my Gold card account, I decided to make my wife an authorized user off the bat. This experience was a bit different from when I added her to my Platinum account. If you’ll recall, while Platinum customers can add free authorized users, these users are given plastic “gold cards” that don’t really do a whole heck of a lot. Meanwhile, to get them a metal Platinum card of their own, you’ll need to pay $175 for the first three authorized users (and even then, they won’t receive all of the same benefits as the main account holder). In any case, with the Gold card, you can add authorized users for free and they’ll receive a metal card that looks just like yours.

At first, I was a bit surprised by this. Yet, upon further reflection, it actually does make sense to me. Since your authorized users won’t earn any credits, their card will basically just allow them to make purchases and earn points for you — much like the “gold card” does for Platinum cardholders. Despite this, it’s a nice option to have and I think it’s fairly generous of Amex to also give AUs metal cards instead of downgrading them to plastic.

Incidentally, when I did make the switch to Rose Gold, I was informed that any of my authorized users would also be issued a Rose Gold card. Therefore, if your loved one has a color preference, be aware that you’ll end up with that choice as well.

Final Thoughts on the American Express Gold Card

Even though it took me a while to team my American Express Platinum card with the American Express Gold card, recent developments led me to take a closer look. What I found is that the Gold card has a lot to offer those who not only want to rake in Membership Rewards points but also offset the $250 annual fee with practical dining perks — including the newly-added Uber Cash credits. And while I don’t have anything against the classic design, I’m very excited that I can now hold the Rose Gold version of the card instead.

On its own, there’s already a lot to like about the Gold Card, but, to me, its real strength comes out when it’s joined by the Platinum card. Sure, the (now) $945 in annual fees isn’t easy to swallow, but it can pay off if you’re spending is in the right place. To that point, before you apply for either card, I’d definitely be sure to crunch the number, ensure that you’d be able to use the available credits and perks, and that the cards make sense for you overall.

Ultimately, while it’s only been a few months since I’ve been an Amex Gold card member, I think I made a good move adding it to my wallet. Now I just need to figure out what to do with all of these points I’ve been accruing…

“Fioney has partnered with CardRatings for our coverage of credit card products. Fioney.com and CardRatings may receive a commission from card issuers.” (Note: advertising relationships do not have any influence on editorial content. Advertising compensation allows Fioney.com to provide quality content for free. All editorial opinions are those of the individual author and/or Fioney staff.)