Money Management Product Reviews

Money at 30: Spiral vs Bella Loves Me — Banking + Giving Comparison

One of the great things about FinTech in general and neobanks in particular is how each can put a new spin on basic financial ideas. Case in point: both Spiral and Bella Loves Me have found ways to combine digital banking with the idea of increasing giving. Yet, despite that similar focus, the execution is remarkably different — making the comparison worth a closer look.

With that in mind, let’s discuss what Spiral and Bella Loves Me have in common as well as how the two digital banking options differ.

Spiral vs. Bella Loves Me — How the Digital Banking Services Compare

Bank partnerships

Before we get into the features of Spiral and Bella Loves Me, it’s important to mention that neither option is actually a bank. Instead, each partner with a bank to offer FDIC insurance to customers. In the case of Spiral, funds in the Checking and Savings accounts are held with NBKC. Funny enough, Bella Loves Me also partners with NBKC. Also, since NBKC themselves then spreads deposits across multiple other FDIC-insured accounts, both platforms state that customers are covered up to $5 million — you know, just in case you have that much money lying around.

The giving elements

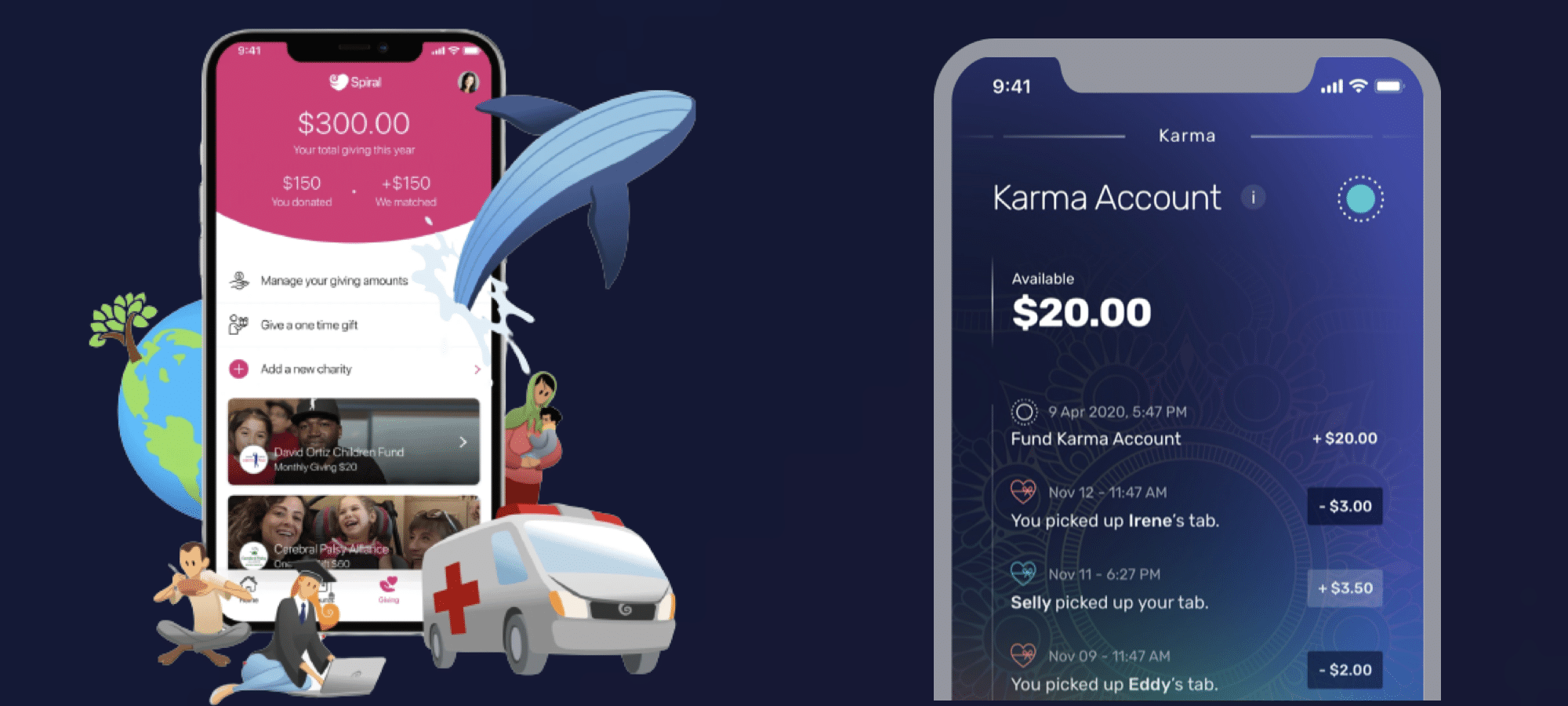

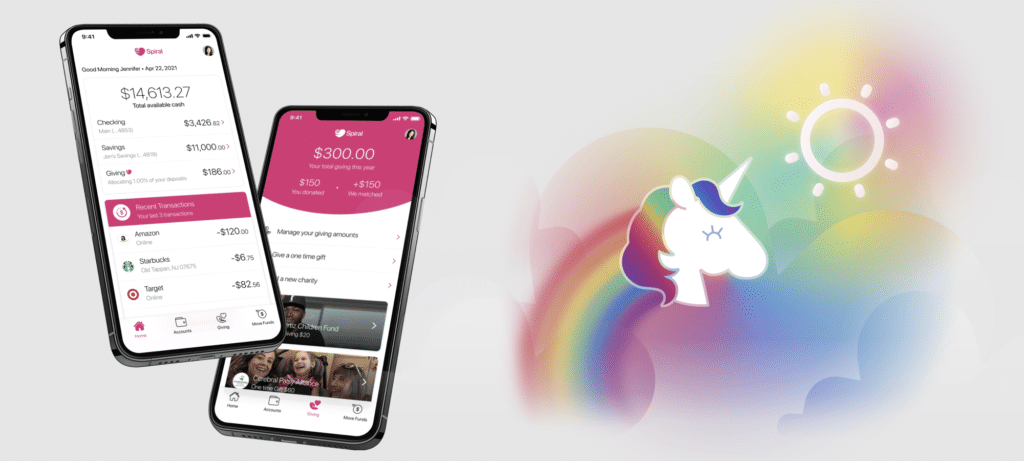

While both Spiral and Bella Loves Me put an emphasis on giving, they do so in significantly different ways. With Spiral, you can automatically set money aside for charitable giving (storing the money in your aptly named Giving account) or arrange for direct monthly donations to the non-profit of your choice. What’s more, Spiral will match user donations up to $20 per year by default, but that number can increase to as much as $150 per year based on your balance and monthly deposit amounts.

Bella Loves Me also allows you to automatically set money aside for giving but, in this case, they won’t be earmarked for a charity. Instead, the platform’s Karma account facilitates random acts of kindness between its members. Thus, when you have money in your Karma account, you may be notified that you picked up the tab for a fellow user. Of course, as you make purchases with your Bella debit card, you too could see your transaction covered by the kindness of another user or offset (either partially or up to 200%) by a Bella Surprise.

APY/Cash Bonuses

Considering that interest rates are still historically low, neither of these digital accounts offers much in the way of APY. However, they do still offer a little bit more than most brick and mortar banks. Starting with Bella Loves Me for this round, funds in Savings currently earn 0.04% APY. Spiral’s current Savings APY is also 0.04% — but the account also offers the opportunity to earn Cash Bonuses. At this time, those who set up direct deposit or set recurring deposits of $1,000 a month or more can earn between $0.75 and $11.25 per month based on their balance (starting at $1,000 and going up to $15,000).

ATM access

When it comes to accessing cash with your Spiral or Bella Loves Me debit card, things are a bit hazy — at least with one of the two. Previously, while it wasn’t heavily advertised, Bella Loves Me would reimburse ATM fees that customers incurred. However, this policy was recently updated and the app will now only reimburse up to two ATM fees per month.

Turning to Spiral, while the account’s FAQ notes that cards can be used at ATMs, it’s unclear if fees are reimbursable. This could be because they don’t want such a feature to be abused, but I don’t want to speculate without knowing for sure. Thus, if you really need cash with your Spiral card, it may be worth a try… otherwise, I’d skip it until there’s more clarity.

Debit cards

Speaking of debit cards, I do want to mention the unique designs that each option offers. Spiral’s debit cards are a glossy, sparkly pink that (to me at least) call to mind the Susan G. Komen pink ribbon breast cancer awareness campaigns that have become popular over the past several years. While I like the gloss, it’s regrettably not my favorite debit design overall.

As for Bella Loves Me, their debit cards are decidedly more matte and feature a rainbow of colors. For me, this is a winning design that really sticks out in my wallet. And, although I complimented the gloss of the Spiral card, I think the matte works really well in this case. Of course, debit card designs aren’t everything, so don’t make this too big of a factor.

Other features

While most of the other features that Spiral and Bella Loves Me boast are in line with what most other digital banking accounts offer, I do want to highlight a few other aspects of each. For Spiral, I want to highlight that the app allows you to search a database of non-profits. It also highlights a number of charities in featured categories. This is a great way to discover worthwhile organizations and read a bit more about them before then being able to donate to them right through the app. To me, this simple yet effective feature is the star of Spiral.

Bella Loves Me has a few other quirky and fun features I also think are worth pointing out. As I mentioned earlier, the Bella Surprises allow cardholders to randomly see their purchases discounted or completely comped (up to 200%, actually), which is a pretty awesome perk. In fact, I want to mention that, as far as I know, Bella was doing this before others like Credit Karma Money and Yotta were. From spending to saving, Bella’s automated savings feature is also on-brand for the app, allowing users to set such interesting parameters as the weather in a chosen city for initiating a transfer. I really hope that Bella Loves Me continues to build out this functionality as I think it’s an undermentioned feature on their app — although it does make sense that the “karma” element should indeed be front and center.

Final Thoughts on Spiral and Bella Loves Me

Although Spiral and Bella Loves Me may seem as though they have similar aims on the surface, these giving-centric banking apps are actually quite different. As a result, I’ve found that they work nicely in tandem, as Spiral encourages me to give more to organizations while Bella Loves Me offers a fun way to spread happiness among individuals. In turn, I do honestly plan on continuing to use each.

With that said, if I had to pick one, I have to say that I personally find more to enjoy about Bella Loves Me. To me, the platform is incredibly unique and, as cheesy as it may sound, I really love the “karma” aspect of the app. Of course, while the instant feedback and thanks that Bella provides is great, it was also nice to get a letter from my chosen non-profit a few weeks after my donation was made on Spiral.

Ultimately, I have to say that I’m not only a big fan of Spiral and Bella Loves Me but also of what they represent. Therefore, I’d recommend checking out either or both of these “giving meets banking” apps.