Money Management Product Reviews

Spiral Review — Charity Giving and Digital Banking Meet

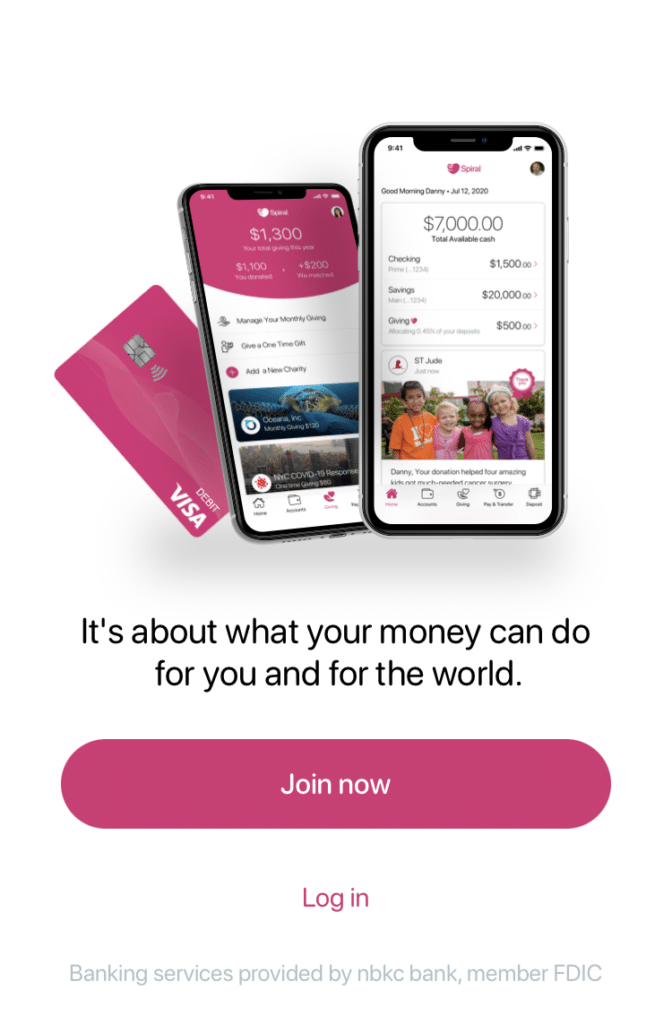

One of my favorite things about covering the state of FinTech is that there are so many fresh takes on what a digital banking account can be. That was definitely the case with Bella Loves Me, which focuses on random acts of kindness between users. The same can also be said of the app Spiral, which combines neobank features with a charity giving platform.

So, how does Spiral execute on this vision? Let’s take a closer look at this app and my experience with it.

UPDATE (October 3rd, 2022): Spiral has announced that it will be shutting down its banking services on December 31st, 2022. Ahead of that, the account has also “downgraded” many of its offerings. Below is my review prior to these changes:

What is Spiral and What Does it Offer?

Signing up

In order to join Spiral, you’ll need to provide the standard amount of personal information in order to submit your application. This includes your name, mailing address (which, as I’ll explain more later, needs to match what’s on your ID), birthdate, Social Security number, and more. Also, in this case, I was asked for my employment status, occupation, and “source of funds.” There’s a chance that you’ll need to further confirm your identity by taking a selfie and submitting a photo of your ID as well.

Now’s also a good time to mention that Spiral is not a bank. Instead, like many other FinTechs, they partner with a bank — in this case, NBKC. As a result, deposits are held with NBKC and are FDIC insured. However, according to the site, Spiral and NBKC also spread deposits across multiple other FDIC-insured accounts, apparently making it so users are FDIC-insured up to $5,000,000.

Accounts

When you sign-up for Spiral, you’ll actually have three different accounts: Checking, Savings, and Giving. As luck would have it, all of these are pretty self-explanatory. Your checking account will be linked to your Spiral debit card. Meanwhile your Savings account will earn interest. Finally, we’ll cover the Giving account in a bit, but it’s where you’ll be able to easily make donations to various charities and non-profits.

Savings APY

First the good news: as a Spiral customer, you’ll earn interest on funds in your Savings account. The bad news is that, currently, the base rate is only 0.04% APY. This is still better than what some big banks offer but is actually below the national average. That said, as you’ll see in a moment, there are other ways for your money to earn money on Spiral outside of traditional interest.

Cash Bonuses

In addition to the standard APY you’ll earn on your Savings, Spiral also offers the chance to earn monthly Cash Bonuses. These bonuses — which currently range from $0.75 to $11.25 — are determined by your balance and require recurring monthly deposits of at least $1,000 a month. Note that direct deposits also count toward this threshold. In total, you could score as much as $135 per year in bonuses.

Here’s how much you can earn in Cash Bonuses based on your balance (as of February 2022):

| Minimum Balance During the Month | Earned Cash Bonus for the Month |

| $1,000 | $0.75 cash bonus |

| $2,000 | $1.50 cash bonus |

| $3,000 | $2.25 cash bonus |

| $4,000 | $3.00 cash bonus |

| $5,000 | $3.75 cash bonus |

| $6,000 | $4.50 cash bonus |

| $7,000 | $5.25 cash bonus |

| $8,000 | $6.00 cash bonus |

| $9,000 | $6.75 cash bonus |

| $10,000 | $7.50 cash bonus |

| $11,000 | $8.25 cash bonus |

| $12,000 | $9.00 cash bonus |

| $13,000 | $9.75 cash bonus |

| $14,000 | $10.50 cash bonus |

| $15,000 | $11.25 cash bonus |

Note that you’ll earn the Cash Bonus “if the balance in your savings account during the month remains at or above the corresponding minimum balance.” In other words, if you had $9,000 in your account but dropped to $8,500 during the month, you’d earn the $8,000-tier bonus of $6.00 for the month. Is this confusing? A bit. But, if you’re willing to build up your Spiral balance in order to maximize these bonuses, they could prove fairly rewarding.

Savings goals

Speaking of savings, you can now create savings goals within Spiral and set up auto transfers to help you reach them. To start, you can state how much you want to save. Then, you can toggle on “Enable auto transfers,” enter how much you want to transfer each time, and select a transfer frequency (monthly, bi-weekly, weekly, etc.). Once a goal is set, you’ll see a graph displaying your progress in your Savings account.

One minor downside to this feature is that it seems you can only arrange auto transfers to pull from your Spiral Checking at this time. Personally, I think it’d be more useful if you could transfer from an external account instead. Otherwise, you may need to arrange for recurring transfers to your checking, just to have the funds then transferred to your Savings. Perhaps this is something that will be fixed in the future but, for now, it’s a bit of a head-scratcher.

Giving

One of the biggest aspects of Spiral that makes it stand out is the emphasis on charity donations. This is most present in the Giving account. Here, you can transfer funds you then want to allocate to non-profit organizations. What’s more, you can have Spiral automatically move money to your Giving account when you make a deposit. For example, I currently have mine set to 10%, meaning that, when I deposit $100 to my Checking, $90 arrives in Checking and $10 goes to Giving. Once there, I can choose which non-profit I’d like to donate to.

Using the app, you can browse charities that help with specific problems. For example, current categories featured include:

- Poverty

- Youth

- Health and Wellness

- Education

- Environment

- Veterans

- Animal wellfare

By tapping these banners, you’ll be able to view a list of recommended charities. Furthermore, selecting a charity will show you a bit more about them and their mission as well as give you a link to donate through the app. Alternatively, you can search for any non-profit using Spiral. Just like with the featured charities, you’ll be able to view a short profile of each non-profit and can arrange for a one-time or recurring donation.

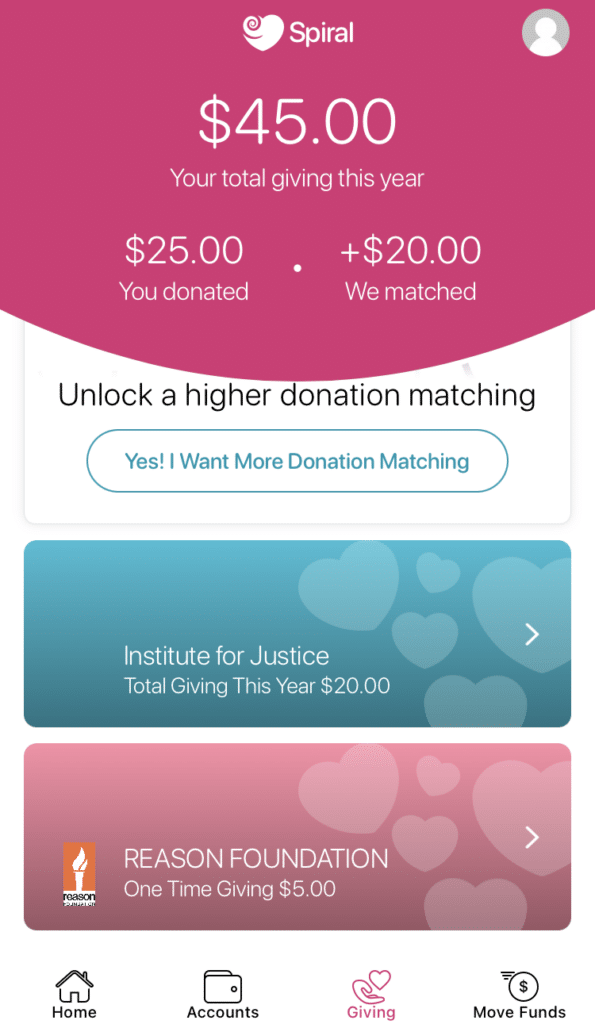

Donation matching

In addition to customers being able to donate to non-profit organizations through the app, Spiral will match accountholder donations up to a certain threshold. While the company will match up to $20 a year in donations to the charities of your choice by default, you can also unlock larger donation matching by increasing your recurring deposit or direct deposit amounts. This table shows how these annual match limits work:

| Direct/Recurring Deposit Amount | Spiral Annual Match |

| No Direct Deposit | $20 |

| $1,000 or more a month | $30 |

| $2000 or more a month | $50 |

| $3,000 or more a month | $70 |

| $4,000 or more a month | $90 |

| $5,000 or more a month | $110 |

| $6,000 or more a month | $130 |

| $7,000 or more a month | $140 |

| $8,000 or more a month | $150 |

According to Spiral’s disclosures, “If at any time during the year you increase your direct deposit of payroll (or recurring incoming transfer) so that Spiral’s annual match would be higher, Spiral will match at the higher amount. For example, if your direct deposit for July was $4,000 and you increased it to $5,000 in September, the annual Spiral match would be $110.” Meanwhile, although it’s not explicitly written anywhere that I’ve seen, I’d presume that this annual match limit is based on a calendar year.

ATM, check deposit, and more

Finally, as I was writing this review, I noticed a few things that were either missing from Spiral’s site or that are reportedly coming soon. First, while Spiral notes that their debit cards can be used at ATMs, I can’t find any word about whether they are part of an ATM network nor is there a fee-free ATM locator in the app to my knowledge. It’s possible that they actually reimburse ATM fees — but I certainly don’t know that for sure.

Elsewhere on their site, Spiral notes some upcoming features, including mobile check deposit and bill payment. They also tease some features related to the charity aspect of the app, such as getting updates from your chosen non-profits, being able to round-up debit card transactions and have the funds placed in your Giving account, and earning Spiral points. Therefore, I’ll be keeping an eye out for any updates and will revise this post accordingly.

Update: it’s now been six months since my initial review and none of the features I mentioned above have been rolled out yet. Hopefully they are still in the works!

My Experience with Spiral

Joining

Before I share my story, I should point out that I was actually a participant in Sprial’s beta program. Therefore, they may have made some fixes to the process since I first signed up. Nevertheless, I did want to share my experience — which was mostly my fault.

At the time that I signed up for Sprial, I had just moved. Additionally, I didn’t pay close enough attention when the screen noted that I needed to enter my address as it appeared on my ID. Thus, when I completed my application, I got stuck in a loop where it kept having me scan my ID and take a selfie for proof.

After contacting Spiral, they were able to reset my application and I tried again. That’s when I realized that my mailing address wouldn’t match what was on my ID. Luckily though, I was at least able to fully submit my application this time and was later contacted by Sprial for follow-up.

Eventually, what I had to do was submit proof of my new address. Complicating this easy ask was the fact that I was traveling at the time. But, after doing some quick thinking, I was able to use an image of an incoming banking statement as scanned for my USPS Daily Digest and forward that to Spiral. Thankfully, this did the trick and my debit card was on the way.

Debit card

While we’re on the topic of debit cards and since I’ve occasionally mentioned specific card designs in the past, I do want to give Spiral credit for having one of the more eye-catching cards I’ve obtained. Although the whispery artwork itself feels standard, it’s the card’s shiny and sparkly pink material that makes it unique (the back is more of a matte pink). Granted, this isn’t exactly my favorite design for a card in my wallet, but I do give it props for being different.

My donations

If you’ve been reading this review and thinking to yourself, “Yeah, but how do you actually know that the money is going to the charity?” Well, I wondered the same thing for a bit. But that was until I received a letter from my chosen non-profit, thanking me for my donation (with the amount listed). I suppose that’s pretty good proof that my money made it to them! Meanwhile, I’m not exactly sure how to confirm that Spiral matched my donation, but I’ll take them at their word.

Final Thoughts on Spiral

Compared to other digital banking services, Spiral has some pros and cons. In terms of the latter, the base APY leaves something to be desired, it lacks some of the features (such as early payroll, overdraft protection, etc.) that some neobank fans look for, and I don’t see mention of an ATM network. However, Spiral doesn’t necessarily aspire to be like all of those other platforms and, instead, wisely puts the focus on the charity aspect of the app. Sure enough, this is exactly where I think Spiral succeeds the most.

Personally, as someone who’s wanted to start donating more of my money, I truly appreciate how easy Spiral makes it to earmark funds, discover new charities, and/or give to your favorite non-profits. In that aspect, you could think of this as a “one-stop-shop” for your financial philanthropy. In turn, I’m much more willing to forgive other possible shortcomings as the other features seem secondary to this noble goal. Plus, I’m looking forward to seeing how Spiral expands both its Giving and banking features in the future.For those reasons, if you’re looking for a secondary account and want to increase your charitable giving, I think Spiral could prove to be a great tool for that. In fact, I actually think it might be fun to use this app in tandem with Bella Loves Me so that you can give to both organizations and individuals in a fun way. On that note, I really love how many different and creative FinTech banking experiences are now coming to market and look forward to seeing what Spiral and many others can blossom into.