Money Management Product Reviews

Money at 30: Venmo Card Review

For several years now, Venmo has been one of the most popular options for peer to peer (P2P) payments. Despite this, I’d suspect that fewer people are aware of the app’s free debit card — and, if they are, they might not be familiar with the actual benefits that the Venmo card carries. So what is the Venmo card and what does it have to offer? Let’s take a look at a few things you should know about the card, including Venmo Rewards and much more.

What is the Venmo Card and How Does it Work?

Requesting your card and selecting a design

As a Venmo user, you can begin the process of ordering your card by tapping the three-lines button in the upper right and then selecting the Venmo card tab. However, in order to obtain your card, you’ll need to confirm some information, including the last four digits of your Social Security number and your birthdate. You’ll also need to verify your shipping address so that your card can be delivered properly.

When requesting your card, you’ll get to choose from five different design colors:

- White

- Pink

- Purple

- Blue

- Black

Within a few days of placing my order, my pretty purple debit card arrived in the mail. Like most credit and debit cards these days, the Venmo card features little on the front other than the Venmo and Mastercard logos as well as a chip. This means that your card number, your name, and other info are located exclusively on the back of the card. Also of note is that, while the card is equipped with a chip, it also supports contactless payments were available.

Adding funds

Adding money to your Venmo card works the same way as transferring money to regular Venmo account. This means that you’ll link an external bank account, select how much you’d like to transfer, and then your funds should arrive in three to five business days. While this timeframe is normal for most digital banking accounts, I will say that there are other P2P apps that credit users immediately for transferred funds — which is something I wish Venmo did as well.

Of course, another way to add money to your Venmo card is via payments sent your way from friends and family. Since your Venmo card is linked to your account balance, any payments you receive will be accessible via your debit card.

Direct deposit

For those who want to go all-in on making Venmo their main checking account, there is an option to set up direct deposit. By visiting Settings and then selecting Direct Deposit, you can view your routing and account number to provide your employer’s payroll department. As an added perk, like a growing number of digital bank accounts, Venmo allows you to get your payroll funds up to two days early. Unfortunately, this benefit will depend on your company’s payroll procedures and other factors, so don’t get too excited until you’ve tried it.

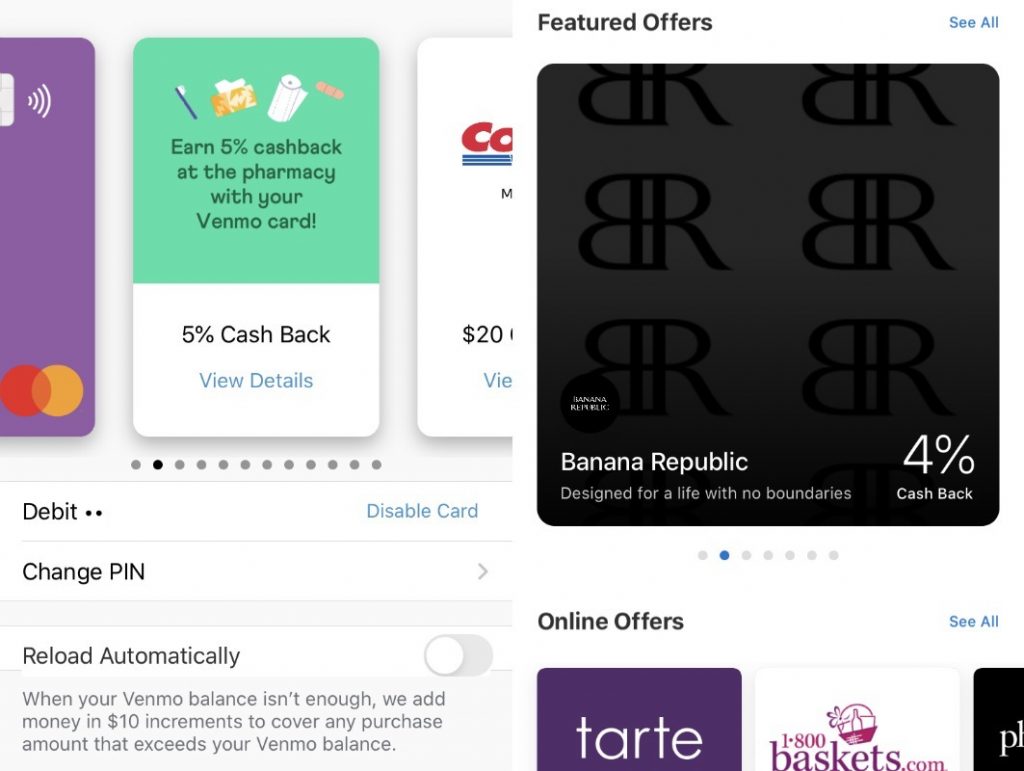

Managing your card and automatic reloads

Under the Venmo card tab, you’ll find a number of options related to managing your card. This includes the ability to freeze/unfreeze your card, change your PIN, and current Rewards offers (more on those in a minute). Another notable option here is the ability to turn on automatic reloads. By toggling this on and selecting a linked bank account to reload from, Venmo will add money to help you cover purchases that exceed your current Venmo balance. For this feature, the amount that Venmo pulls from your linked account will only be in increments of $10. So, if you make a purchase for $24 and have a current Venmo balance of $0, the app would transfer $30 from your bank, leaving you with $6 in your Venmo balance after the transaction cleared.

For automatic reloads, Venmo does utilize a rolling weekly limit for transfers. As an example, mine is currently set at $500. This means that, if I made a $50 reload on Monday and a $40 reload on Tuesday, my remaining limit would be $410. Then, my limit would return to $460 the following Monday (one week from when the $50 purchase was made) and finally back to $500 on that Tuesday. More specifically, Venmo looks at the time the transaction was authorized so, if you triggered an automatic reload at 8:00 p.m., your rolling limit wouldn’t rise back up until 8:01 p.m. one week later.

Given the timeframe on how long transfers take to clear into your account, the automatic reload feature could be a helpful alternative. That said, users will want to ensure that their linked bank account has sufficient funds so that they don’t overdraft. In fact, if there’s any chance of that happening, I’d recommend turning this option off.

ATM access

If you’re looking to access cash from your Venmo balance, then your card has you covered. Using the Venmo card, you’ll be able to use machines in the MoneyPass ATM network without a fee. Oddly, however, the app doesn’t seem to have an ATM locator function for finding these machines (unless I’m somehow missing it). In any case, you can go to MoneyPass.com, enter your zip code, and find fee-free ATMs that way instead. Should you need to use a non-MoneyPass ATM, Venmo will charge you a $2.50 fee on top of whatever the machine’s operator charges.

Split purchases

Since Venmo is all about making money social and sending money to friends, it should come as no surprise that the app makes it easy to split purchases you make with your debit card among other users. To do this, just select your charge in question from your main feed, tap the “Split” button, and then select whom you’d like to request a split with. If need be, you can also add in a tip or other charges not reflected in the transaction itself to split as well. By default, Venmo will show each person paying an equal share, but you can adjust these figures any way you choose. After that, just complete the process to send your request — it’s that simple.

On a similar note, you can also share transactions to your feed if that’s a thing you want to do. Honestly, I don’t 100% understand why people want to do that on Venmo but, hey, you do you.

Venmo Rewards

Not that long ago, the above features were really all there was to the Venmo card. However, last year, the company introduced Venmo Rewards. Now, cardholders can take advantage of cashback offers from numerous brands by using their card. To access these offers, you can either view certain selections via the Venmo card tab or go to Rewards (right below it on the list) to see the complete current catalog.

There are actually two main types of Venmo Rewards offers: in-store and online. For the former, all you’ll need to do to claim your cashback is to use your Venmo Card at the participating merchant. As for online options, you’ll need to use the link provided in the app and then check out using your card. Among the Venmo Rewards offers available as of August 31st, 2020 are 4% back when you shop in-store at Banana Republic, 5% online from Adidas, $10 cashback at Costco, and many more.

If these types of offers sound at all familiar, it’s probably because Venmo Rewards is actually powered by the cashback app Dosh. That said, although most of the offers in Venmo Rewards mirror those found in the regular Dosh app, there do seem to be some exclusives. For example, currently, there’s an offer for 5% back on any drug store purchase. Currently, this is the only generic deal I see, with all of the others being specific to one in-store or online retailer.

Another perk Venmo Rewards has over the Dosh app is that the cashback you earn will be automatically added to your Venmo balance. This saves you the trouble of needing to accrue $25 in rewards before cashing out as you would if you were using Dosh on its own. Of course, since Venmo Rewards are powered by Dosh, you won’t be able to add your Venmo card to the app. In fact, when I tried, it kindly reminded me that Venmo already had rewards. Obviously this makes a lot of sense… but I was really hoping for a sweet double dip.

Final Thoughts on Venmo Card

Overall, there’s nothing really wrong with the Venmo card itself. That said, as a reviewer, I’m nagged by the fact that I feel there’s a better option: Square’s Cash Card. In pretty much every measure, I feel like the Venmo card is inferior to the similar Cash Card. While Venmo Rewards are nice, I think the Cash Card’s Boosts are better on the whole. While Venmo’s offer line-up is larger, I feel like the quality of Boosts is stronger — not to mention that you can get most of Venmo’s same deals through Dosh (although, to be clear, you can’t link your Cash card to Dosh either). Also, while adding money to my Cash account takes seconds, the same tasks took days on Venmo. However, one area in which the Venmo card comes out on top is in its fee-free ATM access.

With all that said, for all of the advantages I feel that Cash card has over the Venmo card, these benefits don’t mean anything if you’re not a Cash user. Therefore, if you prefer the Venmo platform, you’ll certainly want to opt for this card instead. If you do, you’ll not only be rewarded with easier access to your funds but also some potentially cash-saving rewards. All in all, that sounds pretty good to me.