Product Reviews

Lili Review (2021) — A Digital Bank Account for Freelancers

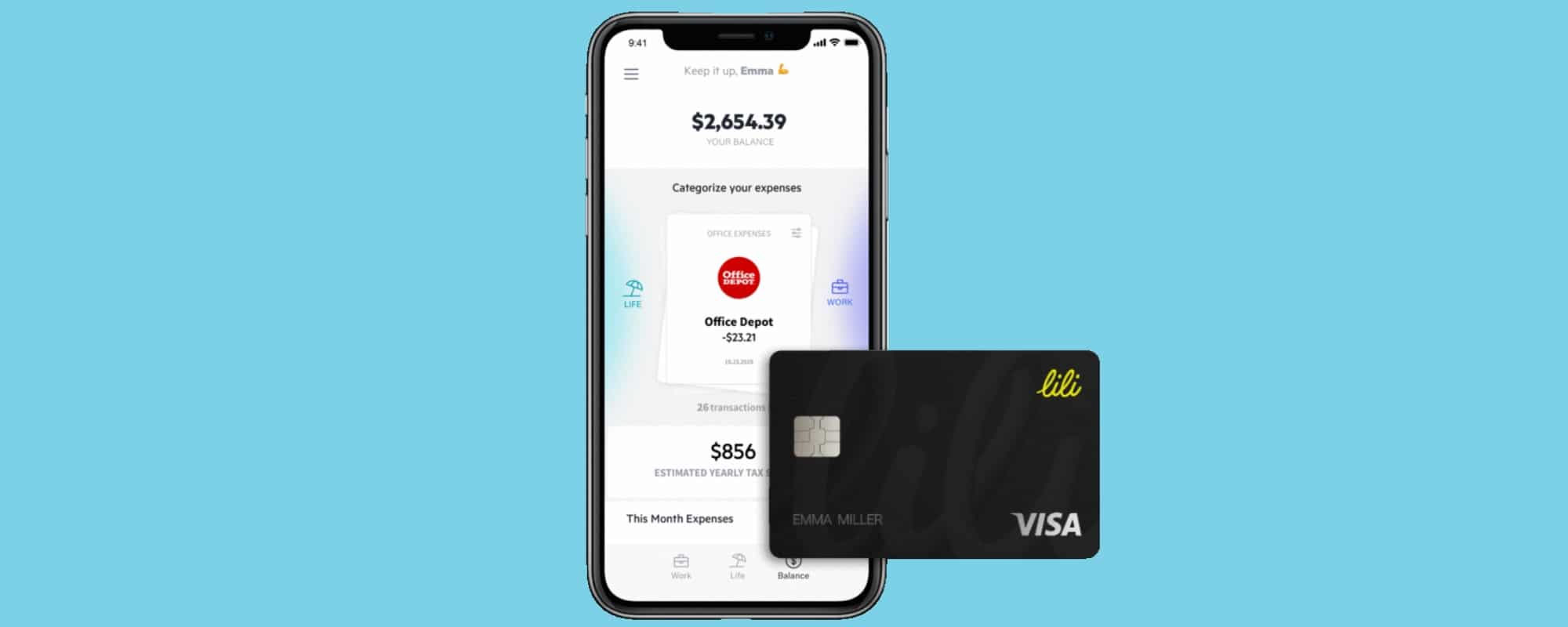

Being a freelancer often means enduring some unique personal finance situations. From irregular income and quarterly taxes to business expenses mingling with personal purchases, managing both sides of your money can be difficult. Thus, the digital banking service Lili has created a platform meant to ease these pain points while providing freelancers with a free checking and debit card.

So how does Lili work and how can it help self-employed workers? Let’s take a look at what you need to know about the platform.

What is Lili and How Does it Work?

What is Lili? Is it just for freelancers?

Lili is a free digital checking account built for freelancers and small business owners. In fact, those who don’t fit that bill are discouraged from opening accounts of their own. Therefore, if you’re not a freelancer yourself, I’d recommend checking out other options like SoFi Money instead.

It should also be noted that Lili accounts are FDIC insured up to $250,000 per depositor thanks to a partnership with Choice Financial Group.

Fees

Like many online banking offerings, Lili is free to use and comes with very few fees. For example, there is no minimum balance requirement with Lili nor do they charge monthly service fees, overdraft fees, etc. Looking at their fee schedule, it seems the only costs you may incur are a $2.50 charge for using an out-of-network ATM or a $5 fee for using a foreign ATM. Other than that, you won’t pay anything to use this service.

Signing up for Lili

When you download the Lili app, you’ll come across a landing page boasting that you can open your account in just three minutes. Like most things, this short process starts with you entering your email address. You’ll also need to enter and verify your mobile phone number, which will be used for two-factor authentication. Then, you’ll need to provide your Social Security number, birth date, and address as well as agree to the terms and conditions before you’ll be ready to roll.

Lili Business Debit Card

After opening your account, you can track the status of your Lili business debit card through the embossing, shipping, and activation process. In all, you should have the card in your hands within 10 business days. Then, once it does arrive, you can activate it in the app and set your PIN. By the way, you can also add your Lili debit card to Apple Pay or other mobile wallets for easy use.

Not only will you be able to make purchases anywhere Visa is accepted using your card but you’ll also be able to pull cash from your account using ATMs in the MoneyPass network. According to Lili, MoneyPass offers more than 32,000 ATMs across the United States — which can be located using the “Find an ATM” feature in the Lili app. As a reminder, only MoneyPass ATMs are free for Lili members to use while others may result in a fee.

Funding your account and direct deposit

If you’ve read any of my past app reviews, you surely know what’s coming next. To easily and securely allow you to link an external account and transfer funds, Lili utilizes an API called Plaid. Using Plaid, you can select from a long list of institutions, log in to an account, and arrange a transfer. In my experience, these transfers can be a bit on the slow side but aren’t outrageously long.

Another option you have with Lili is to set up direct deposit. To do this, customers can utilize a provided form that includes their Lili account and routing numbers, which can be emailed using the “Send” button. One benefit of this strategy is that paycheck funds may be available up to two days early. However, this availability is dependent on a few factors outside of Lili’s control, so there’s no guarantee. In any case, this arrangement could make sense for those who are paid through the same company or service frequently.

In the event you need to make a quick transfer to your account, Lili’s Instant Debit Transfer option can be extremely useful. You’ll just need to select a transfer amount and enter your debit card details in order to add funds to your account with zero clearance time. The only catch here is that you only do an Instant Debit Transfer once per month — and, more importantly, a maximum of three times per account. I guess that means you’ll need to choose your timing wisely for now, but I really hope that Lili makes this option more available as it’s pretty wonderful.

Mobile check deposit

So a funny thing happened when I was writing this review. While I discovered that Lili does offer a mobile check deposit feature, I was informed that I “must receive $200 or more per month in order to access check deposits.” I’m not sure if this means via direct deposit or in general but, in either case, it’s peculiar to me that this feature doesn’t come standard. Hopefully this is something that will change as I see it as a pretty important tool for freelancers.

Cash deposit

One of the newer features of Lili is the ability to deposit cash into your account. To do this, you’ll need to visit one of 90,000 participating locations, with such chains as Walmart, 7-Eleven, Walgreens, CVS, Dollar Tree, and others on the list. After locating a participant, you’ll just need to inform the cashier that you wish to add funds to your debit card. Be aware that there may be a fee for this service, although it should be less than $4.95 — also, this fee isn’t charged by Lili themselves but, instead, the retailer. Finally, there is a limit on these types of transactions, with users only being able to add up to $1,000 per 24-hour period and a maximum of $9,000 per month.

Payment request

Another interesting and potentially helpful feature in Lili is the ability to generate payment requests. These are somewhat similar to invoices but have a look all their own. Basically, you can enter the amount a client owes you as well as the reason for the payment and Lili will create a document complete with your banking info that you can then email or text.

Using the Lili App

App only

Before we get into the features of the Lili app, I should probably mention that it’s actually the only way to manage your account. While you can begin the sign-up process on their website, currently, there is no desktop-based tool you can use for access. To me, this isn’t a huge deal, although I’m always in favor of more options.

Labeling transactions

So what makes Lili specifically for freelancers and small business owners? For one, it allows customers to manage their business and personal finances from one account. This includes the ability to easily label debit card transactions as either “Work” or “Life.” Moreover, you can select from specific expense categories (Supplies Travel, Advertising, etc.) as well as add notes or even attach receipt photos to help you stay organized.

What’s cool is that, somewhat similar to Quickbooks Self-Employed’s app, you can assign your transactions to either the Work or Life tab with just the swipe of your finger — literally. If a purchase was for business, swipe left. If it’s a personal expense, swipe right. Of course, in the event that you accidentally miscategorize something, you can always click the menu button in the upper left of the screen, navigate to All Transactions, tap the item in question, and adjust from there.

Buckets

One of the main tools that makes Lili an interesting option for freelancers is their Buckets feature — namely Tax Buckets. With this, you can have the app automatically set a percentage of your deposits aside to ensure that you have cash on hand when it comes time to pay the taxman. To be clear, Lili is not calculating your estimated quarterly taxes for you based on your income and expenses (although you can run a quick estimate to help you land on a percentage to save). Instead, you’re merely earmarking a flat percentage. On that note, however, the app suggests that those making $60,000 or less per year are likely well-off setting 20% of their income aside for taxes — although various factors will of course impact this assertion. In any case, Lili now allows you to set your Tax Bucket at any percentage between 0% and 40%.

On top of the Tax Bucket option, Lili now also allows you to set-up an Emergency Bucket. By activating this, you can select how much you’d like to set aside per day to help you build up an emergency fund. Personally, while I definitely appreciate this approach, I do wish there were other savings plan options available.

When funds are in your Buckets, they won’t show as part of your main balance. Instead, your “accessible” balance will show in big, bold, black letters while the contents of your Buckets will show in a smaller, grey bubble below that. Despite this, if needed, you can easily access your Bucket funds by tapping that grey bubble. Then, you can hit “Withdraw” to transfer money from your bucket to your debit card balance. Alternatively, you can always add extra funds to your Tax Bucket using this same interface.

Work tab

As the name implies, the Work tab is where you can manage your business finance-related matters. To unlock this tab, you’ll first need to make a business purchase.

Once unlocked, this tab will feature a look at your total yearly income so far, a breakdown of your income over the past few months, your current Tax Bucket funds, and a bar graph noting your business expenses per month. In the corner of that lattermost feature is a button you can hit to take a closer look at each month. Under this view, you can tap any month’s bar to view transactions that were included and, if need be, recategorize them.

Life tab

Just like with the Work tab, the Life tab will also need to be unlocked by categorizing transactions as personal. However, the Life tab has a bit less to offer than its Work counterpart. In this case, Life features a similar chart showing expenses by month as well as a Life Insights section.

Reports and Statements

Finally, the last feature I want to highlight on Lili is their Statement and Reports. Specifically, I want to take a look at the latter. By tapping Expense Reports, you can generate a look at your business purchases by quarter. The resulting spreadsheet will then feature your spending (organized by category) for each of the three months as well as the total for the quarter. Better yet, you can then turn this report into an Excel sheet or PDF and share it via MMS, email, Airdrop, or other such options.

Granted, I haven’t been using Lili long enough to know if it also offers a yearly report of a similar nature, but I’d have to imagine it does. In that case, this report could be extremely helpful when completing your annual tax return. Because of this, I’m definitely glad Lili included this feature.

Final Thoughts on Lili

On the whole, there’s definitely a lot to like about Lili. For one, it’s free — which is always welcome. Secondly, for those who don’t need or have a dedicated expense-tracking tool like Quickbooks or Hurdlr, Lili could be a smart way to separate your business and personal expenses without needing to juggle multiple accounts. Plus, the Buckets idea could definitely come in handy and bring attention to one of the least fun aspects of being self-employed: taxes. With all things considered, I think what Lili offers is pretty smart and clever. Plus, currently, new customers using a referral link can earn a $25 bonus when they open an account and spend $250 on their debit card within their first 45 days.

Of course, I do see some room for improvement with Lili as well. Perhaps most notably, I’m still very curious why the mobile check deposit feature needs to be unlocked. Perhaps I’m crazy but, to me, it would seem as though such a feature would be more important for freelancers than direct deposit would be, considering that they may very well be working for multiple companies over the course of a year. Aside from that, I also wish that the account offered some level of interest. Also, while debit cards may work well for some people, I personally think credit cards are better for most purchases considering their extra protections and potential rewards (although those who can’t trust themselves with credit should certainly stay away).

Despite these few quibbles, I do have to say that I like where Lili’s head is at. As a free digital banking account geared toward freelancers, I think it succeeds — even if I think there are some improvements that could be made. So, if you’re self-employed and looking for a business bank account option to manage your money, Lili could at least be a good place to start.