Money Management Product Reviews

Money at 30: BlockFi Interest Account Review

For years, I’d been hearing about cryptocurrencies and found myself increasingly intrigued. Unfortunately, at the time, I couldn’t for the life of me figure out how to purchase, trade, or spend them. Thankfully, that’s changed a lot in recent years as crypto and blockchain become more mainstream. Yet, what’s interesting to me is that cryptocurrencies are still often treated as an investment instead of, well, currency. That’s why BlockFi got my attention when I saw that they offered a crypto account that allows customers to earn interest on their Bitcoin and other assets.

So, how does BlockFi’s Interest Account work? Let’s take a look at some of the basics as well as my experience so far.

UPDATE (February 14th, 2022): As a result of an SEC settlement, the BlockFi Interest Account is not currently available to new customers. However, a new product called BlockFi Yield is expected to launch soon.

What is BlockFi and How Does it Work?

Signing up

To get started with BlockFi, you’ll first need to enter your name, email address, and referral code if applicable. Then, you’ll need to confirm your email before moving on to the next steps. In order to confirm your identity, you’ll need to provide your Social Security number, date of birth, etc. as well as answer a few questions. You may also be required to submit a photo of your ID along with a selfie for further verification.

Lack of FDIC insurance

Something extremely important to note is that BlockFi is not a bank so funds are not FDIC insured. Furthermore, it’s not protected by SIPC either. In other words, there’s definitely some risk involved with holding money in this account.

Also complicating matters are the evolving regulatory rules, which can differ by state. For those reasons, I’d definitely recommend checking out BlockFi’s disclosure pages and FAQ.

Funding your account

To purchase assets on BlockFi, you may wish to link a bank account using Plaid. For those unfamiliar, Plaid allows you to log in to an existing bank account via their secure API. Once this is done, you can transfer funds to your BlockFI account to then purchase crypto assets. Note that there is a $20 minimum when using this option and a $10,000 daily max.

Meanwhile, if you already have a crypto wallet, you can arrange to transfer your holdings to your BlockFi account. In my case, I elected to transfer Bitcoin I already had on another platform (Cash App). To do this, you’ll first need to select Transfer, then choose the asset you plan on receiving, and BlockFi will provide a wallet address to use. Soon after initiating the transfer on Cash App’s end, BlockFi alerted me that the deposit was processing but would need to have three confirmations on the blockchain network, which would take about 30 minutes. Sure enough, almost exactly half an hour later, the transfer was complete and my Bitcoin was stored in my BlockFi Interest Account.

Earning interest (and selecting payout)

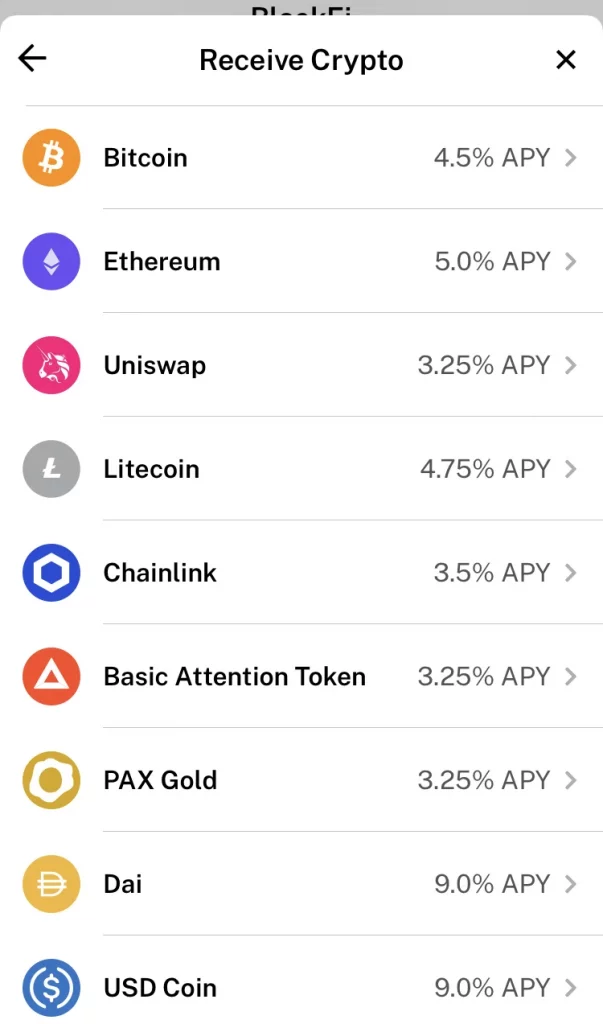

What attracted me to BlockFi wasn’t necessarily the ability to buy and sell crypto. What really caught my attention was the ability to earn interest on my crypto holdings. With the BlockFi Interest Account, you’ll receive monthly payments equal to a set percentage of your crypto balance. Note that these interest rates fluctuate quite frequently (usually changing monthly) and also vary by asset type. For example, as of this writing in November 2021, I’m earning 4.5% APY on Bitcoin and 5% APY on Ether. Meanwhile, stablecoin interest rates tend to be even higher, currently sitting at 9% for GUSD.

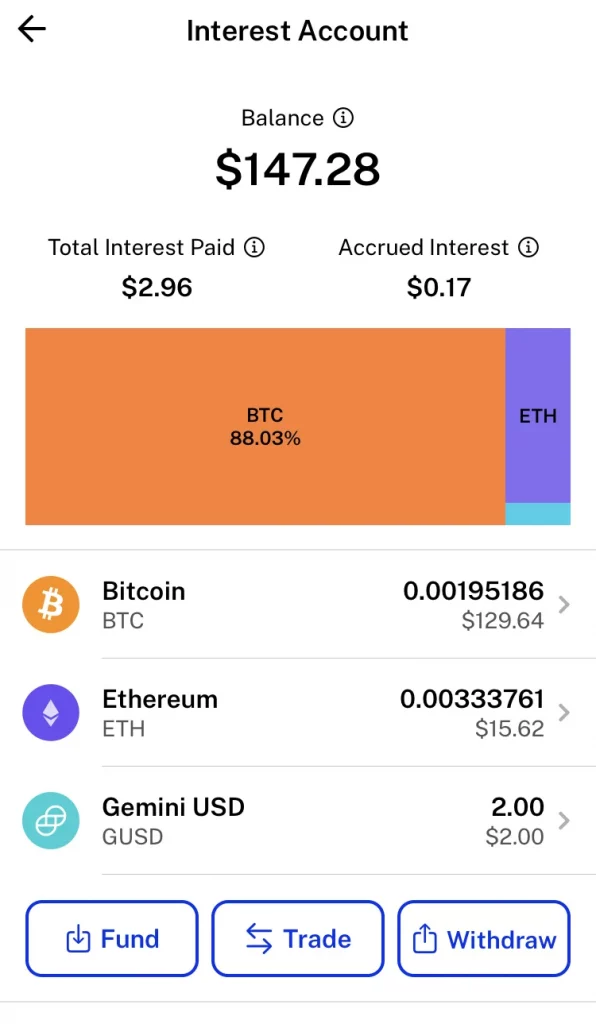

What’s also nice is that you can select how you’d like your interest paid out. Specifically, you can either choose to receive your interest in the form of the asset that earned it or choose a default crypto that all of your interest will be paid in. Whichever option you choose, your payments should arrive in your account on the last day of the month. In the meantime, you can keep track of your monthly accrued interest on your BlockFi dashboard along with the total amount of interest you’ve racked up since your account opening.

Trading assets

In addition to purchasing crypto with fiat currency via ACH transfers, BlockFi also makes it easy to trade cryptocurrencies. This is as simple as selecting the asset you want to sell, which you’d like to buy, and how much you’d like to exchange. When setting this up, you can choose to express the amount you want to trade in either of the two currencies involved or in USD (even if fiat isn’t part of the trade itself). After submitting your transaction, your new balance should update instantly in your BlockFi Interest Account.

BlockFi credit card

Finally, before we get into my experience with BlockFi, I wanted to mention the Bitcoin rewards credit card the company recently launched. The main perk of this Visa card is that customers can earn 1.5% Bitcoin back on their purchases. Cardholders can also earn 0.25% back in Bitcoin on all eligible trades. Therefore, if you do decide to go all-in on crypto, this might be a nice companion to your BlockFi Interest Account.

My Experience with BlockFi So Far

Storing my crypto

Thanks to my time spent using apps such as Fold and Long Game that offer crypto rewards, I’d accumulated a few dollars worth of assets prior to opening my BlockFi account. On top of that, I’d also purchased some Bitcoin on Cash App as well as received some “Bitcoin back” from my Cash Card purchases, Thus, I was excited to find a place to store these various assets and put them to use, as it were.

Luckily, the process of transferring my crypto from Cash App as well as Uphold was fairly simple in my experience. Plus, while I haven’t earned a ton of interest (about $3 to date), it’s pretty cool knowing that I can not only enjoy the upside when crypto prices rise but also get a little something extra on top of that. In turn, if I do decide to increase my cryptocurrency investments, I think I’d be inclined to keep my assets with BlockFi.

Things I don’t understand

While I’m starting to get the hang of crypto wallets and understanding crypto assets, there are some elements I’m still a little lost on. For one, I’m not very well versed in how the fees associated with crypto transactions work. As a result, when I decided to move some Ethereum from Uphold to BlockFi, the fees on Uphold’s end ate into my transfer amount. Because of this, I’d recommend taking a closer look at your transaction before submitting and deciding if it makes sense.

The other thing I’m trying to comprehend as far as my BlockFi strategy is whether or not it makes sense to buy stablecoins. On the one hand, they offer a higher APY and less volatility. Yet, at the same time, you may be missing out if other asset prices climb. Perhaps if I do build up my account, I’ll take a “stock and bonds”-esque approach, balancing the riskier assets with stablecoins.

My thoughts on the credit card

As far as BlockFi’s credit card goes, I’m holding out on it for now. Part of the reason for that is because there are other crypto cards hitting the market that could be more interesting but also because I’m waiting to see if BlockFi’s card will evolve. Originally, when it was announced, the product was to offer more bonuses for account holders. Alas, that initial version also carried an annual fee. Later, BlockFi dropped the annual fee and revamped the card before it was even launched.

The version of the BlockFi credit card that is now available is okay but not great in my eyes. While 1.5% isn’t bad, there are other credit cards that offer 2% on everything — and you could potentially just earmark that cashback to buy Bitcoin. Nevertheless, if you want to grow your crypto account and don’t want to directly pour money into it, then perhaps this could be a good way to cash in on the crypto craze while playing with found money, if you will.

Final Thoughts on BlockFi Crypto Interest Account

As my interest (no pun intended) and investment in crypto have grown, I’ve now dabbled with a few different platforms — many of which have their own pros and cons. In the case of BlockFi, I do love that I can earn interest on my crypto assets while still having them easily accessible for trading or sale. And while I may not be too well-versed in some of what the platform has to offer, that simple part of the pitch is pretty effective in my eyes. Of course, those interested in BlockFi should definitely take note of the risks associated with crypto investing and proceed with caution.

All in all, while BlockFi may be a slight step up from the likes of Robinhood or Cash App in terms of use, I still think it falls on the “beginner” side of the spectrum. Plus, if you’re interested in earning more crypto easily and effectively, then I do think that the BlockFi Credit Card has some appealing potential. So, whether you’re looking to expand your crypto holdings or just want a place to hold them that will earn you interest, then I think it’s worth taking a closer look at BlockFi.