Credit Card Guides

Best Dining Rewards Credit Cards

“Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.”

When it comes to credit card rewards, there are plenty of cards each covering its own purpose. However, among the most common categories featured is dining — and why not? Who doesn’t love a family dinner out, date night delight, or a foodie tour of a new town? In turn, there’s no shortage of cards that can reward diners in different ways.

For those looking to earn more rewards while indulging in culinary bliss, let’s take a look at a few delicious options.

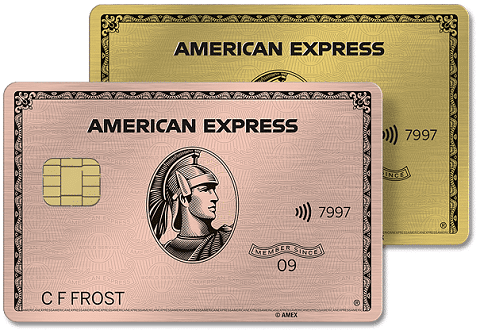

American Express Gold Card

- Dining Rewards: 4x Membership Rewards at restaurants worldwide (plus a $10 a month Dining Credit good for select locations and services)

- Annual fee: $250

- Current welcome bonus: 60,000 Membership Rewards points after spending $4,000 in purchases during your first six months

We’ll start off with a rewarding albeit more premium dining card option: The American Express Gold Card. With this card, you’ll earn 4 Amex Membership Rewards Points per dollar spent at restaurants worldwide. Additionally, if you’re dining in instead, you can earn 4x points at most U.S. supermarkets. Rounding out its rewards lineup, the card also earns 3x on flights booked directly with airlines or via AmexTravel.com.

While the $250 annual fee may be intimidating, the Gold Card packs other dining benefits that can help offset that. For one, the card includes a $10 monthly Dining Credit, triggered by purchases at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations. Then, there’s also a $10 a month Uber credit, which can also be used for Uber Eats orders.

If you are considering the Amex Gold Card, the welcome bonus might help sweeten the deal. Currently, new cardholders can earn 60,000 points when they spend $4,000 on purchases within their first six months of card membership. So, while the annual fee may give you pause, the rewards and perks certainly are tasty.

Capital One Savor

- Dining Rewards: 4% cashback on dining

- Annual fee: $95

- Current welcome bonus: Earn $300 back after spending $3,000 on purchases within your first 3 months

If you’re looking for a dining card with big rewards potential but a small annual fee, then the Capital One Savor might be the right selection for you. To start, the Savor earns 4% cashback on dining purchases. Plus, you’ll also earn 4% back on entertainment, 4% on select streaming service purchases, and 3% at grocery stores. All this for just a $95 annual fee.

As for a welcome bonus, currently, new cardholders can earn $300 cashback after spending $3,000 in their first three months. Elsewhere, if you want to avoid an annual fee altogether, the SavorOne lowers the top rewards rate to 3% but comes without an annual fee. That card also has a welcome bonus of $200 after spending $500 in purchases during your first three months. Either way, you’ll Savor the rewards these cards have to offer.

Chase Sapphire Preferred

- Dining Rewards: 3x Ultimate Rewards points on dining purchases

- Annual fee: $95

- Current welcome bonus: Earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months

Another well-rounded card with a dining emphasis is the Chase Sapphire Preferred. With this card, you’ll earn 3x Ultimate Rewards points on dining, including eligible delivery services and takeout orders. In addition to that, the Preferred also earns 5x points on travel purchased through the Chase Ultimate Rewards portal, 3x points on online grocery orders (excluding Target, Walmart and wholesale clubs), and 2x on travel purchases. It’s also worth noting that, as a Sapphire Preferred customer, your Chase Ultimate Rewards points are worth 25% more when redeemed for travel booked via the Ultimate Rewards portal. As for downsides, the card does have a $95 annual fee.

Moving on to the welcome bonus, right now new Chase Sapphire Preferred cardholders can earn 60,000 bonus points after spending $4,000 on the card within your first three months. That amounts to $750 in free travel if you redeem your points via the Ultimate Rewards portal. In other words, your appetite for rewards could take you pretty far with the card pick.

U.S. Bank Altitude Go

- Dining Rewards: 4x points on dining

- Annual fee: None

- Current welcome bonus: Earn 20,000 bonus points after spending $1,000 on eligible purchases within the first 90 days.

For our next course, we’ll take a look at the U.S. Bank Altitude Go card. Marking our first no-annual-fee option, this card earns 4x points on dining purchases, including takeout and delivery. It also earns 2x points on grocery purchases (including grocery delivery), streaming service purchases, gas station purchases, and EV charging station purchases.

The U.S. Bank Altitude Go card also comes with a good portion of points for a welcome bonus. Now, cardholders can earn 20,000 bonus points when they spend $1,000 on the card in their first 90 days. So, when it comes it dining rewards, the sky’s the limit with the Altitude Go card.

Citi Custom Cash

- Dining Rewards: 5% cash back on dining (up to $500 spent each billing cycle) if dining is your top spending category

- Annual fee: None

- Current welcome bonus: Earn $200 cashback after spending $750 on purchases in your first 3 months

Continuing with this sampler platter of picks, let’s get a taste of the Citi Custom Cash card. What makes this card a bit different is that you’ll earn 5% cashback on purchases in your top eligible spending category each month (up to $500 in purchases per cycle). As you can probably guess, one of these eligible categories is restaurants. Meanwhile, if you want to mix it up, other options include gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment. Also notable is that the card has no annual fee.

When it comes to a welcome bonus, new Citi Custom Cash cardholders can earn $200 cashback when they spend $750 on your card within your first three months. All in all, this card could be a good choice for those who love having options and earning rewards.

Bilt Mastercard

- Dining Rewards: 3x point on dining (when you make at least 5 posted transactions in a statement period)

- Annual fee: None

- Current welcome bonus: N/A

Finally, we’ll close out with an interesting card option that also boasts dining rewards. The Bilt Mastercard (which is issued by Wells Fargo) is a unique rewards card that earns 1x points on an otherwise unheard of category: rent. But we’re here to talk about dining and, for that, the Bilt card earns 3x points. That card also earns 2x points on travel. However, there’s a small catch in that you’ll need to make at least five transactions a month with the card in order to earn points for that month. Your points can then be used for travel, future rent payments, and more.

If there’s a downside to the Bilt Mastercard, it’s that there’s not a welcome bonus offer at this time. Hopefully this is something that changes in the future but, for now, it’s a bit of a bummer. Outside of that, though, the Bilt Mastercard could be a good pick for renters who also want to earn rewards on dining and much more.

As you can see, with dining being such a popular rewards category, there’s no shortage of cards to choose from. Ultimately, when it comes to making your pick, you’ll not only want to consider the dining rewards themselves but also the other reward multiplies, additional perks, and any annual fee. So, which dining rewards cards will you be eating up first?

“Fioney has partnered with CardRatings for our coverage of credit card products. Fioney.com and CardRatings may receive a commission from card issuers.” (Note: advertising relationships do not have any influence on editorial content. Advertising compensation allows Fioney.com to provide quality content for free. All editorial opinions are those of the individual author and/or Fioney staff.)