Personal Finance

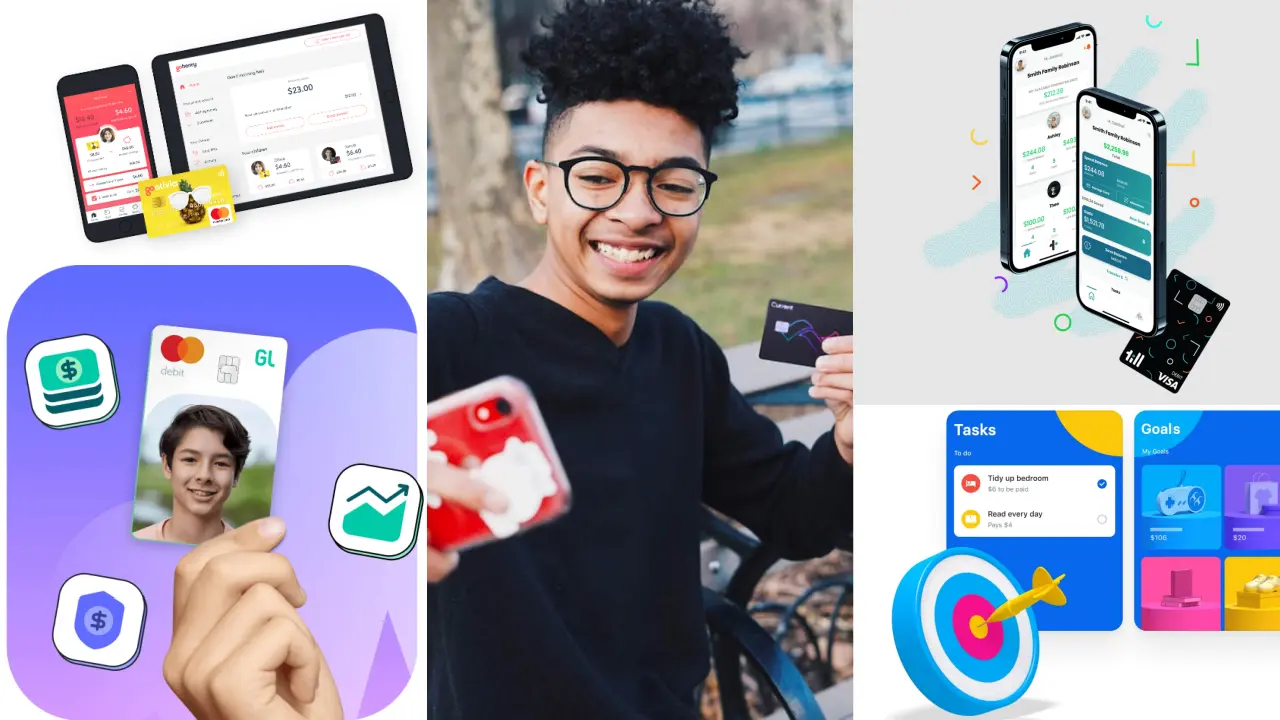

A Round-Up of FinTech Banking Options for Teens and Kids

One of the important lessons we learn in our lives is how to manage our money. Yet, financial education is often lacking from the curriculum taught to students in school. Furthermore, while learning the basics from books and lessons can be helpful, it’s the “real world” experience that can really drive these principles home. That’s why, in recent years, a number of financial technology companies (or “FinTechs”) have created platforms that not only grant kids and teens resources to learn about money but also provide parents with tools to give their children some hands-on experience.

With that in mind, let’s take a look at a few of these kid and teen-centric digital banking options, including what they have to offer, how much they cost, and more.

Child and Teen Banking Apps, Tools, and Platforms

GoHenry

One of the most popular banking platforms meant to help kids and teens (ages 6 to 18) learn about money is GoHenry. Among the many features the app offers is the ability for parents to create chore lists, with kids getting paid once they complete the tasks. Additinoally, children can earn allowance, set savings goals, donate to charity, and more. Kids also get their own debit card that not only can be customized from dozens of designs but also bears their name in place of “Henry” — like “GoAdam” or “GoJulie.” Finally, they can learn even more about personal finance with in-app videos and quizzes called Money Missions.

Currently, GoHenry comes at a cost of $3.99 per child per month. However, they do offer a 30 day free trial. Also notable, since GoHenry isn’t a bank, they partner with Community Federal Savings Bank to hold deposits, making all funds FDIC insured.

Greenlight

Another growing option is Greenlight. While this platform also offers kids their own debit card, the service includes a number of other features and perks. For example, Greenlight offers a number of flexible allowance options, enabling parents to choose how often payments occur, whether kids receive a flat-rate or chore-dependent payment, and more. Elsewhere, the service includes financial literacy lessons for users of various ages. Plus, depending on which plans parents choose, kids can earn up to 2% on their savings and up to 1% back on their spending, with cash back automatically deposited into their savings account.

At this time, Greenlight offers three subscription plans: Greenlight, Greenlight + Invest, and Greenlight Max. These plans cost $4.99 a month, $7.98 a month, and $9.98 a month respectively. However, these fees include debit cards for up to five children. Meanwhile, in addition to savings features, upper tiers of Greenlight’s service also include investing options, allowing users to purchase fractional shares of individual company stocks or ETFs with as little as $1. Incidentally, Greenlight also partners with Community Federal Savings Bank to provide FDIC insurance.

Till

For parents seeking a fee-free option, Till may be the answer. With a Till debit card, kids will be able to spend their own money while also getting insights into their spending (along with their parents). On that note, parents can manage their own wallet, and similar to other platforms, they can choose to give money to their kids when they complete what Till calls Tasks.

As mentioned, Till is currently free for both adults and kids to use. In turn, it may not have quite as many features as some of the others we’ve discussed so far — but could be perfect for those kids and teens who want some financial freedom and are hands-on learners. By the way, Till partners with Coastal Community Bank for its banking services.

Current Teen Banking

Moving from dedicated kid and teen banking platforms to FinTech with a specialty wing, the popular app Current happens to offer its Current Teen Banking service as well. With a Teen account, kids will be able to try out such features as round-ups — meaning that their purchases will be rounded up to the nearest dollar and the spare change is placed into a Savings Pod. Current Teen debit cards also allow for fee-free access to more than 40,000 Allpoint ATMs. As for parents, they’ll be able to block purchases from certain merchants, assign chores to complete, set up automatic allowance payments, and more.

While Current Teen Banking was previously offered as part of Current’s Premium account, recently, the FinTech dropped the subscription fee for this service. Now, parents and teens can use Current with no monthly fee. Also, just like Current itself, Current Teen Banking accounts partner with Choice Financial Group, Member FDIC.

Revolut Junior

Lastly, let’s talk about Revolut Junior. This is a kid-centric offshoot of the app Revolut, which itself offers a number of unique features including the ability to hold and spend foreign currencies. In any case, Revolut Junior offers kids colorful debit cards, gives them access to budgeting tools, and also includes support for Tasks and Goals. In fact, with Group Vaults, kids and parents can save up for certain goals together.

With a standard Revolut account, parents can create Revolut Junior accounts for up to five children. That said, Reovlut does also offer Premium and Metal plans for $9.99 a month and $16.99 a month respectively. While these upgrades may be beneficial for some parents, it doesn’t seem as though they’ll have much impact on the Junior offerings. Regardless, Revolut partners with Metropolitan Commercial Bank for its card issuance, while Vaults deposits are held with Sutton Bank.

There’s no doubt that kids and teens can learn a lot about money by being able to manage their own spending and savings — with a little supervision and help from their parents. Thus, any of these five FinTech banking options could go a long way in getting your children to become both more financially literate and independent. Of course, parents will need to make some decisions as there are pros and cons to these various options, including some fees to consider. Still, with free trials available for many, it’s definitely worth taking a closer look at these platforms for yourself and seeing what might work best for your family.