Checking Account Review

Aspiration vs. SoFi Money: Which Online Banking Option is Better?

For those who can live without depositing cash and speaking with in-person tellers, online-only banking options have a lot to offer. Moreover, as the popularity of these offerings continue to grow, competition has brought even more attractive features to consumers. Of course, as a dedicated reviewer and blogger, I’m always on the lookout for attractive accounts with interesting perks. That’s what’s led me to two accounts in recent months: Aspiration and SoFi Money.

Incidentally I previously reviewed each of these accounts on their own. However, since they share (or shared) some common features along with a few notable differences, I thought a head to head comparison was in order. With that in mind, let’s take a look at how Aspiration and SoFi Money stack up in a number of areas and which I think is ultimately the better pick.

Editor’s note: this article was updated in June 2020 with the latest APY information and changes.

Comparing Aspiration and SoFi Money

A quick note

Before we jump in, I wanted to note something about Aspiration. The institution is unique in that it puts an emphasis on charity and the environment. This includes donating a portion of their profits, allowing account holders to see what kind of impact (positive or negative) the businesses they shop at have, and more. Because of this there may be reasons beyond basic banking needs that one might want to support the company. Still, for the sake of this review, I feel it’s only fair to set this goodwill aside and focus strictly on the services they offer.

Features

FDIC Insurance

First of all, just like traditional banks, funds you deposit with Aspiration and SoFi Money are FDIC insured. However, in both cases these companies actually partner with multiple banks and sweep customer funds into accounts at one of those banks. Interestingly, since they’re utilizing multiple banks to sweep funds into, Aspiration says that customer funds are insured up to $2 million per depositor, while SoFi Money account holders are insured up to $1.5 million per depositor. I’m going to go ahead and assume that half a million dollar spread won’t make much of a difference to you but the point is that the money you keep with either of these institutions is protected.

Accounts

Aspiration and SoFi Money each offer savings and checking services, albeit in different ways. Once upon a time Aspiration offered what they called their Summit account that earned interest as well as a debit card. But earlier this year they changed their model, splitting their accounts into Aspiration Save and Aspiration Spend.

Meanwhile SoFi Money is a hybrid account akin to what Summit used to be. This has its pros and cons as some users might prefer having partitions between their savings and checking funds. Of course, for others, the single account simplifies things. Therefore this one really just comes down to preference and current needs.

Interest on savings

Both Aspiration and SoFi Money pay out interest on their accounts that amounts to much more than most traditional savings accounts offer. Nevertheless, both accounts have been heavily impacted by Fed rate cuts. Additionally, each has also installed requirements that customers must meet in order to earn higher interest rates.

Starting with Aspiration, the offering currently boasts “up to 1% APY” on savings. While this interest rate was previously offered to all users, more recently it became exclusive to those who opt into their Aspiration Plus program at a cost of $3.99 per month or $44.99 if paid for a year upfront. Moreover, by default, Aspiration Plus users will earn 0.25% APY on balances up to $10,000 in their Aspiration Save accounts. In order to get the 1%, they’ll need to also spend at least $1,000 a month on their debit card. As for those free users without Aspiration Plus, they’ll currently earn no interest on their funds.

As for SoFi, they too have not only lowered their APY but also put limits on which customers can earn interest. In order to unlock the current 0.2% APY, users will need to deposit at least $500 a month into their account. Otherwise, the interest rate is just 0.01%. Something notable here is this change only applies to those who joined SoFi Money on or after June 8th, 2020. Those who signed-up before that date will retain their 0.2% interest rate (for now) regardless of their deposits.

Debit cards

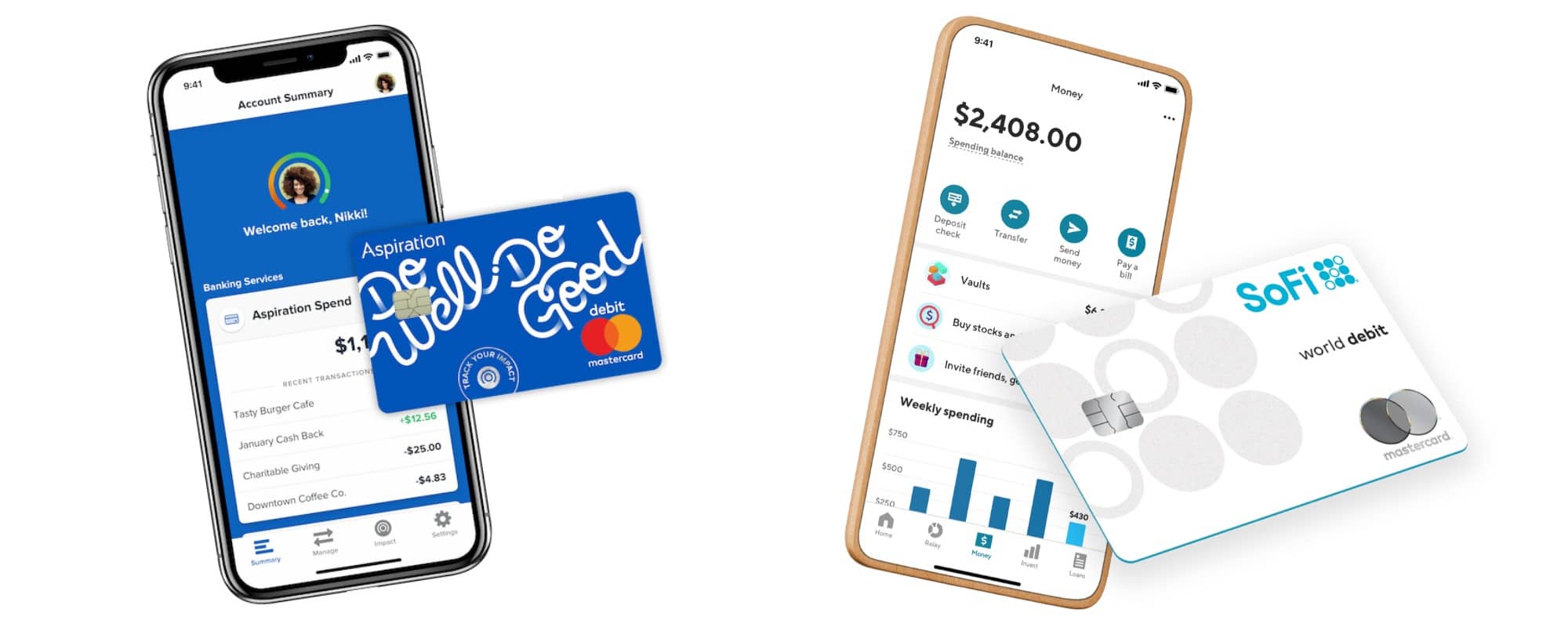

It should be no surprise that a debit card is included with both the Aspiration and SoFi Money accounts. Aspiration’s debit cards are issued by Mastercard while SoFi Money’s recently moved from Visa to Mastercard. In terms of looks, the Aspiration main debit is mostly blue but features the bank’s “Do well, do good” tagline while those issued to Aspiration Plus members feature an “upgraded” design and a card made from recycled ocean plastic. Incidentally, the blue and greens featured on the Aspiration Plus card call to mind the old SoFi Money Visa debit cards. However, since moving to Mastercard, SoFi’s cards are less exciting and simply feature a grey SoFi logo against a white background, with card info located on the back.

Turning to functionality, one advantage Aspiration’s debit offering has is that users can earn cashback on purchases they make with the card. Speaking to the bank’s mission, the amount of cashback varies based on the retailer’s AIM (Aspiration Impact Measurement) score. Currently this limited list includes Apple, Target, Verizon, Wal-Mart, and others — all of which Aspiration says have among the “highest AIM scores.” Purchases from these locations will earn users 0.5% back.

On top of that, Aspiration customers can earn much greater cashback when shopping at Conscience Coalition retailers like Toms, Warby Parker, Blue Apron, and others. For non-Aspiration Plus users, these cashback amounts can vary, ranging from 3% to 5% while those with Aspiration Plus memberships can earn 10% back from each.

Meanwhile, SoFi Money has also been getting into the cashback game, albeit in a different way. As of this writing, a current SoFi offer allows users to earn 20% back on purchases from DoorDash as well as several streaming services (up to a total cashback amount of $40). Previously, the card has also featured cashback promotions from Lyft, OldNavy.com, and others. Plus, the service is beta testing an Offers section where users can earn 4-5% back from local eateries. That said, it seems that these cashback deals are limited to those customers who unlock the higher APY rate, including those grandfathered into that rate.

ATM access

Something that attracted me to both Aspiration and SoFi Money was their promise of no ATM fees. This not only meant that they’d reimburse fees you may encounter while using domestic teller machines but will even cover international cash withdrawals. As someone who likes to have at least some local currency on hand when I travel, this was a big win for me. Sadly, this model is also something that both companies are moving away from.

Earlier this year, Aspiration announced that it had joined the Allpoint ATM network, giving users access to more than 55,000 free machines. In turn, they discontinued the practice of reimbursing ATM fees — although Aspiration Plus does retain the perk of getting one non-Allpoint ATM free reimbursed per month. Funny enough, in June 2020, SoFi Money also joined Allpoint and similarly ended fee reimbursement. However, once again, there is an exception to this policy for those who have been with SoFi longer. For the time being, those who joined SoFi Money before June 8th, 2020 will still have their domestic and foreign ATM fees reimbursed.

Before these changes took place, I actually got to do a side by side comparison of Aspiration and SoFi Money on a trip to Paris, and what I found was pretty interesting. While at Charles DeGaulle Airport, I decided to use my Aspiration and SoFi cards moments apart, withdrawing €20 each time. Oddly, when these charges reached my accounts, the converted amounts differed. For Aspiration the charge in USD came out to $22.39 while SoFi’s was $22.35. Yes that’s only a 4¢ discrepancy but I suppose it could add up if you’re withdrawing enough.

Fees

One of the main reasons why people flock to online banking options is that they tend to offer far fewer (or lower) fees than mainstream brick-and-mortar accounts. SoFi Money and Aspiration are no different as both waive things like overdraft fees and maintenance fees while also carrying no minimum balance requirements. However there is a slight difference in the fee policies of these two accounts.

Aspiration operates under what it calls a Pay What is Fair model that allows account holders to select their own monthly fee. While a recommended amount will display when you first apply, you can select any amount you want — even if it’s zero. That said, the company writes that, although you can elect to pay nothing, “We really hope you won’t. And our business is built on trusting that you won’t.” This plus the fact that 10% of these fees go to charity, you may feel guilted into at least throwing a dollar their way each month. Also, as I mentioned, they also now offer the Aspiration Plus account option, which is a paid upgrade.

Meanwhile SoFi Money asks for nothing in return. As a result, most customers will be able to use their services without spending a dime — and won’t need to feel any shame about it.

Transfers

Something I complained about in my review of Aspiration is that it seemed transfers took a while and just hung in pending without updates. That’s why I was pleased to see that, when I first set up a transfer to SoFi Money, it told me exactly when my funds would be available. For larger transfers, this may actually happen in a couple of stages but it will tell you both dates before you even initiate the transfer. This is a small touch but one that I truly appreciate.

Apps

With this being the 21st century, it should be no surprise that both Aspiration and SoFi Money allow you to manage your accounts via mobile apps as well. These will allow you to transfer money, view transactions, and more. Unfortunately these applications also have their shortcomings.

There are four main tabs in Aspiration’s app: Summary, Manage, Impact, and Setting. The most useful tab for me is Manage where you’re able to deposit checks, set up transfers, and more. One quirk here is that, while you can transfer money from accounts you’ve already linked, you’ll need to set up any additional accounts via their desktop site for some reason. Nevertheless it’s a serviceable app that fits most of my needs.

SoFi Money, on the other hand, doesn’t actually have an app of its own. Instead it shares space with the company’s other offerings, such as investing, loans, etc. In fact Money only gets one tab in the app. Despite this, it packs a lot into that tab, including check deposit, bill pay, P2P payments, and transfers. Speaking of transfers, unlike Aspiration, you can either set up transfers to/from accounts you’ve already linked or add another account on the fly. Ultimately I do wish SoFi Money was its own app but it could definitely be worse.

Websites

Last but not least, you can of course also access your Aspiration or SoFi Money accounts via their respective websites. For the most part the experiences are similar to the app (with SoFi Money again being relegated to a single tab). That said, this is where one pet peeve I have comes in.

When I initially reviewed Aspiration, I noticed that their site didn’t display a running tally of how purchases and deposits affected your balance. Thankfully, this has since been corrected, making for a much better experience. On the other hand, the PDF statements you can download are still kind of confusing and not very helpful.

The Verdict: Aspiration vs. SoFi Money

When I initially wrote this comparison, Aspiration and SoFi Money were in close contention in my book (although I ultimately gave the edge to SoFi). Unfortunately, in just a few short months, Aspiration has made a series of changes that have been for the worse in my opinion. From quietly lowering their cashback debit rewards to raising the requirements for earning interest and ending ATM reimbursements, I’ve honestly been quite disappointed with how things have developed. This made for an easy SoFi victory, except they too have now started tinkering with their model. Still, in my eyes, the choice is quite easy: SoFi Money is the better product.

Not only do the recent SoFi Money changes reward loyal customers by continuing their previous benefits but the requirements for unlocking the higher APY are far more reasonable with SoFi. Similarly, while Aspiration has gutted their main product, SoFi Money remains truly free with no need to upgrade. Also of note is that, to my knowledge, this has been the first big adjustment SoFi Money has made, whereas Aspiration has gone through multiple major makeovers in just the past year or two.

Therefore, the clear winner for me is SoFi Money. Even with the lowered APY due to Fed rates, the overall enjoyable online banking experience and the opportunity to earn cash back on things I might actually buy make this a worthwhile account. So, if you haven’t already, I’d definitely recommend giving them a look.