Money Management Product Reviews

SoFi Active Investing Review (2023)

Has there ever been a better time to be a newbie investor? It wasn’t long ago that trading stocks and purchasing ETFs required “a guy” who you could give orders to and they’d make it happen. Oh, but they would charge you a significant commission for the service.

Cut to 2023 and things are much different. Not only has stock market trading moved online, allowing investors to make trades for themselves but the fees associated with trading have also come way down — like down to zero. While that’s thanks to FinTech players such as Robinhood (which gets both credit and blame for the state of stock trading), that app isn’t the only free trading option. Enter SoFi Invest.

Hailing from the online lender and now full-fledged bank SoFi, SoFi Invest makes it easy to start investing by offering low minimums, no fee trades, and now even the ability to purchase fractional shares. So how does this platform stack up against other options? Let’s take a closer look at SoFi Invest’s active investing platform.

- Offers a number of trading features, including fractional shares, options trading, and more

- No trade commissions

- Easy-to-use interface

- Fractional shares require at least $5

- SoFi app can feel cluttered

What is SoFi Invest and How Does it Work?

Active vs. Automated

Notably SoFi Invest offers two main options: Active investing and Automated investing. While the former allows you to buy and sell individual stock and ETFs, the latter serves as a roboadvisor. What’s great is that both options allow users to start with as little as $1 and don’t charge any fees.

Despite my interest in SoFi’s Automated option, I decided to start with Active instead. Therefore, for the purposes of this review, we’ll focus exclusively on this aspect of SoFi’s offerings.

Taxable account vs. Retirement account

Another decision you’ll want to make before opening a SoFi Invest account is whether you’d like to open a regular investment account (also known as a taxable account) or a retirement account. Currently, in addition to taxable accounts, SoFi also allows customers to open IRAs, Roth IRAs, or SEP IRAs with either Automated or Active investments — and now offers a 1% contribution match for these accounts. If you’re considering one of these options, be aware that there may be contribution limits and eligibility requirements associated with these products.

Additionally, should you need to remove money from one of these retirement accounts, you may be subject to an early withdrawal fee. Therefore, if you are considering a retirement option, be sure to do your research and choose the option that’s best for you.

Signing up for SoFi Invest

Getting started with SoFi Invest is fairly simple. First you’ll need to create a SoFi account using the basic info, such as your name and email address, followed by setting up a password. Then, when you select whether to open an Active or Automated investment account, you’ll need to provide a bit more info, such as your address, employment status, occupation, citizenship status, birthdate, and Social Security number.

Moreover, after I finished the sign-up process, SoFi requested a photo of my I.D. or passport to verify my identity. From my experience, this is all pretty standard for opening a brokerage account, although I can see why some might be hesitant. While I personally trust SoFi (a company large enough to purchase naming rights for a stadium has to be pretty legit, right?), you’ll need to decide if you feel comfortable providing the required information.

Using SoFi Invest

Buying and selling stocks with SoFi Invest is quite simple. Whether you’re on the desktop site or mobile app (more on that in a minute), all you’ll need to do is select the stock or ETF you want to buy, enter how many shares you want, and confirm your order. Then your purchases will display in your account, allowing you to easily view your portfolio’s performance.

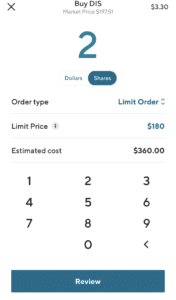

When I first started using SoFi Invest, my biggest issue was that they only allowed for Market Orders. This meant that you could purchase a share at the current price but were unable to set orders to execute when a stock hit a certain price — something that apps like Robinhood enable you to do. Thankfully SoFi has remedied this and you can now set Limit Orders.

However these orders do expire at the end of each trading day if they’re not filled. Again, this is a departure from the likes of Robinhood that allows you to set limit orders that are good until canceled. Nevertheless it’s nice to have this option added and I hope more choices are available in the future.

SoFi mobile app

As I mentioned in my SoFi Checking & Savings review, one slight downside to SoFi’s growing roster of features is that they all share a single app. On the one hand, I do enjoy being able to quickly switch between my Checking & Savings and Invest accounts. At the same time, making Invest a mere tab instead of giving it its own application does feel limiting and can make it difficult to find all of the features you’re looking for. Perhaps as the platform expands, a dedicated app could come to fruition as well.

Stock Bits (fractional shares)

One feature that SoFi Invest has added since I first joined and quickly became a star in my eyes is Stock Bits. This allows users to purchase fractional shares of stock, investing as little as $5. It’s true that such a feature is pretty commonplace now, but SoFi was pretty early to the trend. At the same time, I am surprised to see that the minimum is now $5 as it was previously $1. Also, it seems that they’ve largely dropped the Stock Bits name, so I’ll stick with fractional shares from here on out.

If a stock is supported for fractional trading, when you click “Buy,” you’ll be given the option to base your purchase on the number of shares or the amount of dollars. Something else to note is that SoFi only places orders for fractional shares once per day. As a result the purchase price (and in turn the amount you own) might not match exactly what was shown when you first viewed the listing. Still, for those who want to start investing in companies but can’t afford full shares, this could be a great option.

Options trading

As you continue your investment journey, you might be interested in options trading. Luckily, this is something that SoFi Invest now supports. In order to get started, however, you will need to answer a few questions about your trading experience, knowledge, net worth, etc.. If your application is approved, you’ll then get a quick crash course on the basics of options trading before making your first transaction.

While I haven’t actually purchased any options contracts for myself, SoFi’s interface looks clean and easy to use (if you know what you’re doing). On that note, this is not a feature you’ll want to use until you’re ready.

Margin trading

Speaking of features you may not be ready for, SoFi now also offers margin trading. In layman’s terms, this basically means borrowing money in order to make trades. Like with the options trading feature, in order to be eligible for this, you’ll also need to submit an application — although this one’s a bit more in-depth. Additionally, your account must have a balance of at least $2,000 in order to participate.

Crypto

Another feature SoFi recently added is the ability to trade cryptocurrency. Currently supported assets include Bitcoin, Ethereum, Litecoin, and many many more these days. For each of the available tokens, you can choose how much to buy in coins or in dollars.

Honestly, I’ve largely lost interest in crypto so I haven’t visited this part of my portfolio in a while. Doing so now, it does look as though SoFi has done away with the previous $10 minimum for purchases. However, there’s also now a 1.25% transaction fee on crypto transactions. So, selling $6.75 of my Bitcoin (don’t ask), I’d only actually net $6.67. To me, this only further hurts the appeal of trading cryptocurrencies.

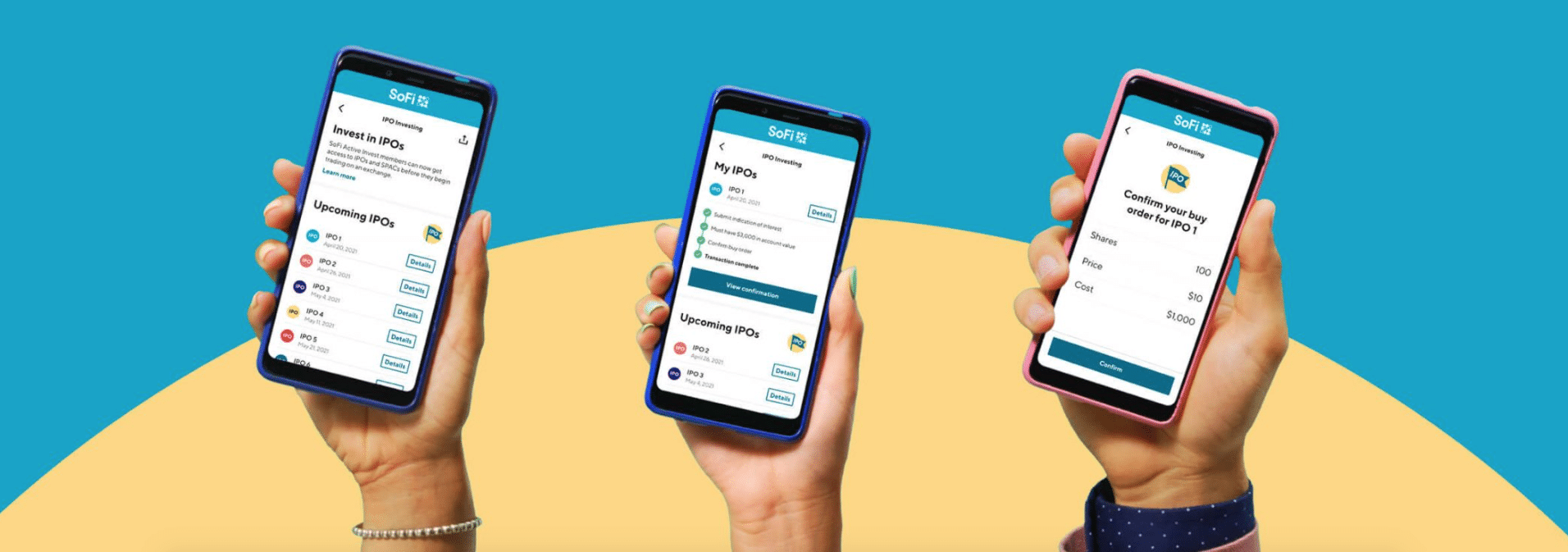

IPO Investing

Similar to Robinhood, SoFi now allows members to request IPO shares of select companies. What does this mean? Well, it basically means that customers have a shot to buy shares of companies going public right as they hit the market — and before they (hopefully) rise in price.

As cool as this feature is in theory, there are a few flaws. First, SoFi is only able to offer shares for a few companies. Thus, for a long time, this feature has been largely dormant. On top of that, since shares are limited, not every customer who requests IPO shares will be able to buy them. Nevertheless, it is a good idea and hopefully this feature grows more robust down the road.

Social sharing

Fun fact: “SoFi” stands for “Social Finance.” Living up to that name, the platform added what they call “Social sharing” to their Invest product. Now, you can opt in to share what stocks you’re buying (although the dollar amounts are hidden). Similarly, you can also see what popular traders have in their SoFi investment portfolios. Incidentally, this gimmick is reminiscent of the app Public — although that startup takes the concept to another level.

Revisiting this feature now, I see that there’s a leaderboard that reflects brokerage performance of members with at least $500 in their accounts. So basically the whole thing is gamification. Overall, while it’s not a big part of the platform, this is a feature I really don’t care much more about.

Final Thoughts on SoFi Active Investing

Given how much I enjoyed my SoFi Money account back in the day, I was excited to give SoFi Invest a try as well. Thankfully the experience has been similarly positive. Yet, as SoFi Money’s appeal faded and the account later went away, I found myself ignoring Sofi Invest too. Coming back to the account, I’ve found that it’s truly blossomed over the past few years, adding some key features that were missing and adding some more innovative ones.

That said, I do still think that Robinhood offers the better app experience. With a dedicated application, more intuitive navigation, and honestly more appealing aesthetics, I can see why they’re still the leader. Of course, given Robinhood’s past controversies, this might not matter to some users. For them, I think SoFi’s platform serves as a nice alternative.

Overall I appreciate what SoFi has built with their Active investing platform. On top of that, with the company consistently adding new features and functionality, it will certainly continue to rival Robinhood. In fact, the two companies have already shown a knack for one-upping each other, with both rolling out features such as IPO Investing and IRA matching bonuses one after the other.

Final word: considering it only takes a $1 to get started, I say it’s worth giving SoFi Invest a shot for yourself.

Yes. SoFi Invest does not charge any trade commission fees, monthly fees, or other expenses. However, certain ETFs may have expense ratios associated with them.

SoFi Invest allows users to buy and sell individual stocks as well as ETFs and select cryptocurrencies. Additionally, the platform’s Stock Bits enables customers to purchase fractional shares of top companies, investing as little as $5.

Yes. SoFi Invest comes from the well-respected FinTech company SoFi, which was founded in 2011. To date they have raised $2.5 billion in venture capital funding.

Current SoFi Invest users may earn rewards for referring friends and family to the platform. Typically successful referrals will result in both parties earning free money to invest in the stocks or ETFs of their choice.

Per FTC guidelines, this website may be compensated by companies mentioned through advertising, affiliate programs or otherwise. (Note: advertising relationships do not have any influence on editorial content. Advertising compensation allows Fioney to provide quality content for free. All editorial opinions are those of the individual author and/or Fioney.)