Savings Account Reviews

Varo Bank Review: The FinTech With a National Bank Charter

In 2020, Varo Money made history by becoming the first FinTech firm to be awarded a national bank charter — resulting in the new name Varo Bank. Although I hadn’t previously used Varo Money, they always struck me as an intriguing service that put its customers first. So, is that same spirit still present in Varo Bank?

- Up to 5% APR

- In-app check deposits

- Offers Zelle support

- 5% APR is limited to first $5000

- Monthly direct deposit of $1,000+ is required for enhanced APY

Let’s take a look at what Varo Bank has to offer, including the pros and cons of their savings and checking accounts.

What is Varo Bank and What Does it Offer?

Opening Your Account

To get started with Varo Bank, you’ll need to provide some personal information. This includes your name, address, Social Security number, and more. You’ll also need to verify your identity using a form of ID.

Since Varo Bank is indeed a bank, your deposits with them are FDIC insured up to $250,000 per depositor. I should also note that Varo has no monthly fees nor any minimum balance requirements.

For the purposes of this review, we’ll be looking at both of Varo’s main banking accounts: their Savings Accounts and their checking account, which they just call Bank Account.

Varo Savings

APY

By default, funds in your Varo Savings account will currently earn 3.00% (as of July 2023). That’s decent by today’s standards and far better than most big banks — although there are now a number of online accounts offering 4% APY or higher, so it’s not stellar. However, there is the opportunity for customers to earn a much more impressive 5% APY instead.

In order to earn 5% APY for one month, you must meet all of the following requirements:

- You must receive at least $1,000 in qualifying direct deposits

- You must keep your checking and savings account balances in positive territory (equal to $0 or above, not negative)

- The 5% APY will only apply to balances up to $5,000 (and earn the standard rate on any additional balance over $5,000).

To their credit, Varo has revamped their requirements for earning this higher rate and made it a lot better in my opinion. First, they dropped the debit card transaction minimum they had at launch from the equation.

Even more impactfully, however, is that you are no longer penalized for having a balance over $5,000. Under the previous system, if you crossed that threshold during the month, you’d lose out on the higher APY for that month. To me, this was ridiculous — so this newer approach where you simply earn the regular rate on funds over $5,000 makes a lot more sense.

With these adjustments, the requirements for earning the 5% APY are pretty reasonable. In fact, since the change, I’ve regularly been able to qualify myself and I could see it being fairly easy for others who plan on making Varo their main account. Therefore, I think this opportunity is a win overall.

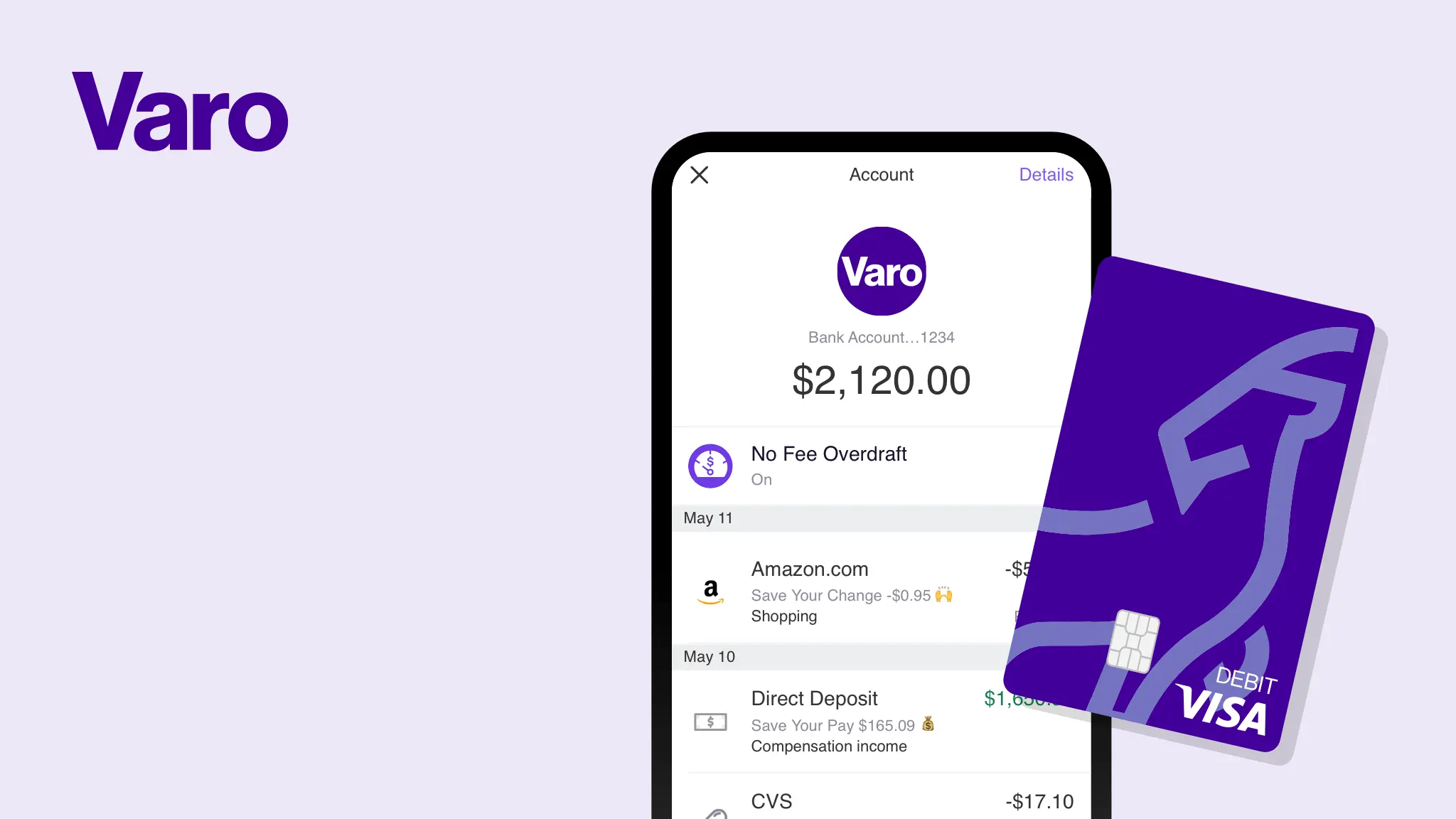

Save Your Change

If you’re looking to boost your savings as painlessly as possible, Varo offers two automated options. The first of these is called Save Your Change. With this feature enabled, Varo will effectively round up your debit card purchases to the nearest dollar and deposit the change into your savings accounts.

This Save Your Change feature is obviously similar to the main feature of the app Acorns (although they weren’t exactly the first to employ it either). Since then, several other apps and accounts have integrated similar functionality — and that’s for a good reason: it works! In my view, the round-ups structure is an easy way to start saving and, thus, I’m glad to see Varo offers this feature.

Save Your Pay

The other half of Varo’s Automatic Savings duo is Save Your Pay. This option allows you to set aside a certain percentage of your deposits. Actually, when you tap on this feature for more details, you’ll notice that this automation only applies to each direct deposit.

With that, I’d like to see this feature expanded so that it can apply to all incoming transfers. In any case, this simple feature is another easy-to-use solution that could definitely come in handy for someone using Varo as their primary account.

Perks

Last year, Varo expanded its Perks program to include a cashback shopping portal. Now, when you select the Perks tab, you’ll see a number of in-store and online offers.

For example, as I write this, there’s a deal where you can earn 4.4% cashback on Allbirds shoes by using your Varo debit card. In other cases, though, you may need to use the Shop Now link and pay with your card in order to get the cashback. Additionally, the platform notes it could take up to two weeks before your rewards arrive in your account.

Scrolling through Perks, there are a few decent offers — but I suspect most of them are also available elsewhere. Because of this, if you do see an online deal you’re considering, try checking Cashback Monitor (a site just reviewed) to see if you can find a better offer elsewhere. Still, this is a nice addition to Varo that could be useful for some customers.

Long Game (no more)

One more thing I wanted to mention about Varo is the reason I initially signed up. Following the death of Long Game, Varo was one of two banks that helped bring it back in a new form. In fact, I found this version to be even better than the original and loved using my Varo account with Long Game. Sadly, the app has since been acquired by Truist — which makes it a non-starter for me, as you can read about in my updated Long Game review. But, while it didn’t ultimately work out with Long Game, I do give Varo credit for trying.

Checking (Bank Account)

ATM access

Even though Varo is now a full-fledged bank, it still doesn’t operate its own branches or have its own ATMs. Because of this, like many online accounts, it offers access to fee-free machines via an ATM network. In this case, Varo partners with the Allpoint network, giving account holders access to more than 55,000 free ATMs. You can also find these machines easily using the “Find ATM” button in the app.

Mobile check deposit

For those like me who still occasionally need to deposit checks, I’m happy to report that Varo Bank does include a mobile check deposit feature in its app. And, unlike some other accounts I’ve reviewed lately, there doesn’t seem to be any need to “unlock” this function.

Instead, you can simply select the account you want to make the deposit to, capture images of your paper check, submit them, and the funds arrive in your account within a few business days. I don’t suspect this is a feature most customers will use terribly often, but it’s certainly nice to know it’s there.

Direct deposit

When my Varo Bank debit card was delivered, I noticed that the cardstock also included a voided check complete with the account and routing numbers. If you’re among those wondering “why a voided check?” the answer is that the form is intended to be used to set up direct deposit. As someone whose former employer regularly required a voided check in addition to whatever form the institution gave employees, I have to say this is a smart inclusion on Varo’s part.

Like some other online banking accounts have begun doing, Varo also allows customers to access their paycheck up to two days early (although the availability of this feature will depend on your employer’s payroll company).

Other than that, I don’t really have a lot to say about direct deposit with Varo aside from what I’ve already noted regarding its role in earning the higher APY and utilizing automated savings options. Hopefully, if you do plan on using your account for direct deposit, the voided check provided may just come in handy.

Depositing cash

Another option for moving money into your Varo Bank account is to deposit cash. Again, since Varo doesn’t have any physical branches, depositing cash will mean paying a visit to a participating location — including select CVSs, Rite Aids, 7-Elevens, Walgreens, and Wal-Marts to name a few. This service is in partnership with the Green Dot Network.

One downside is that there may be a fee for adding cash to your Varo card, with the bank warning that merchants may charge up to $5.95 for the transaction. Also, you can only deposit a maximum of $1,000 in cash per day and up to $5,000 in cash per month. Still, despite the fees and limits, this option could prove useful in a jam.

Zelle

I’ll admit that I was pretty surprised to learn just how passionate people are about Zelle. With that newly-acquired information, it then gives me great pleasure to inform you that Varo now supports the Zelle platform. In turn, you can send and receive funds using your Varo account and Zelle.

If you’ve previously used another account with Zelle, adding Varo will require you to remove your other account. However, as I learned when I went through it, this was a pretty simple process overall. The bottom line is that, if you’re a fan of Zelle, then this could be a big selling point for Varo.

Varo Advance

Finally, one relatively new feature is Varo Advance. Presented as an alternative to payday lending, this option allows customers to borrow up to $100. However, there are some stipulations and requirements for customers.

First, in order to qualify for Varo Advance, your account must be at least 30 days old and be in good standing. Additionally, you’ll need to have received at least $1,000 in direct deposits in the last 31 days. Assuming you meet that criteria, you’ll be able to select how much you need to borrow and set a date for when the loan will be automatically paid back. Notably, a fee of $5 or less per use may apply. It should also be noted that using Varo Advance won’t impact your credit score in any way.

Features like Varo Advance are ones you hope to not have to use. Of course, if needed, this option could easily be better than some pricier alternatives. On that note, I do think I prefer this pricing model to something like FloatMe, which charges a monthly fee instead.

Final Thoughts on Varo Bank

For those who enjoy the benefits of FinTech but prefer to deal directly with a licensed bank, Varo is now a great option. As an FDIC-insured bank, there’s definitely an enhanced peace of mind that comes from dealing with them. Plus, they’ve still retained some perks — such as the ability to earn up to 5% APY — even though they are a “real bank” now. I also give them props for their sleek and easy-to-navigate mobile app, as well as their continued updates to their products.

Since adding “Bank” to its name, Varo has continued to roll out new features (including support for Zelle) and options while expanding its product lineup. In other words, they’re staying true to what their vision was when they chose to pursue the banking charter route several years ago. Personally, I think their efforts have paid off as the new Varo Bank has a lot to like now and even more to look forward to. Therefore, if you’re looking for a truly usable online bank, I think Varo is a solid choice.

Yes. In 2020, Varo was granted a national banking charter and accounts are fully FDIC insured.

Varo Bank is a digital-first bank that has been awarded a national charter. The institution offers checking, savings, and credit products.

Varo Bank was founded in San Francisco and has Utah-based consumer service. However, it is a digital bank without physical branch locations at this time.

Yes. As of 2022, Varo Bank customers can now opt-in to send and receive money through Zelle using their Varo accounts.

Varo Bank does not charge any monthly fees for its core checking or savings accounts.