Economic News

The United States Economy Grew 3.3% in Q4 2023

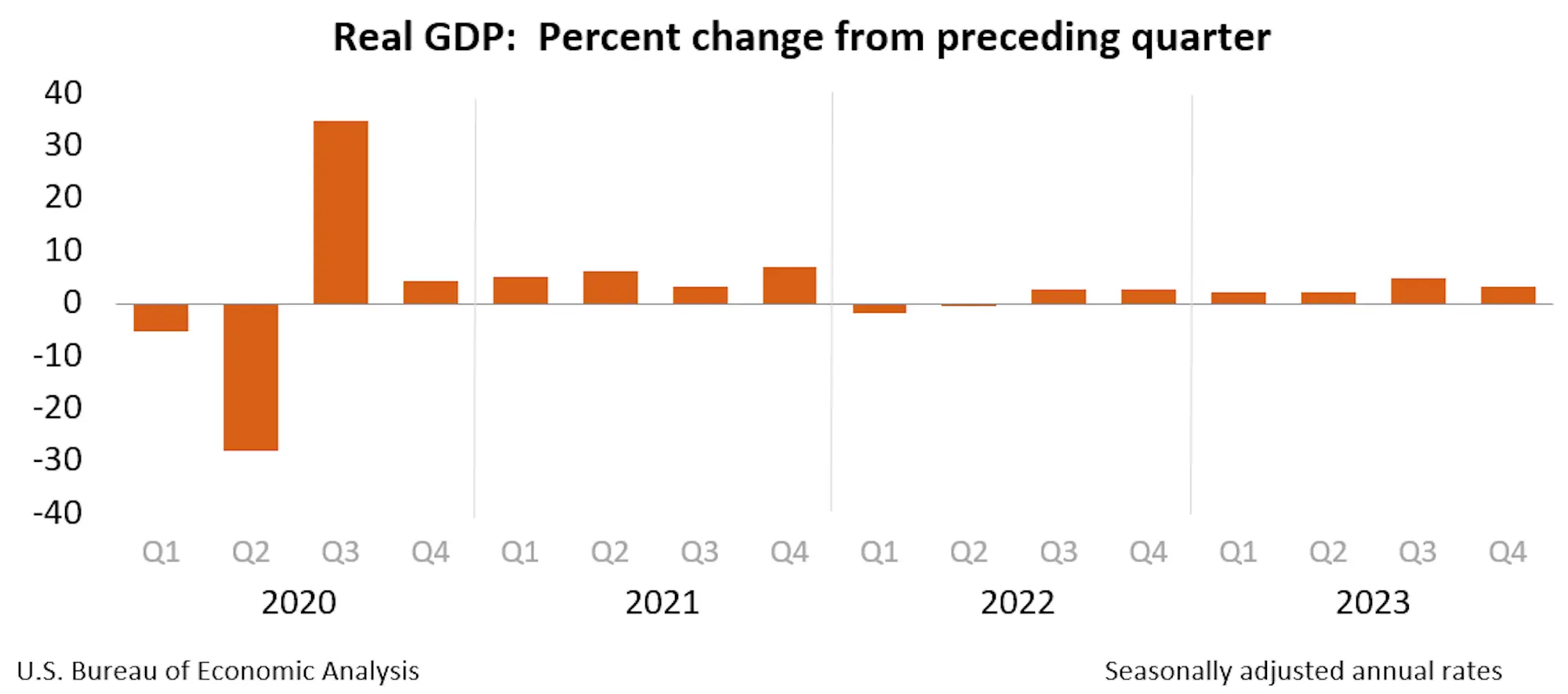

A new report shows that the United States economy continued to expand in the last quarter of 2023.

About the numbers:

According to the Bureau of Economic Analysis, the U.S. gross domestic product (GDP) increased 3.3% in the fourth quarter. As CNN Business notes, although that’s down from the 4.9% growth rate recorded in the third quarter of the year, it’s more than double the 1.5% growth economists expected. For the whole of 2023, the economy grew 2.5% compared to 1.9% in 2022.

Looking more closely at the report, consumer spending grew 2.8% during the quarter, while business spending increased by 1.9%. By comparison, consumer spending was up 3.1% in Q3 2023 although business spending was +1.4% for the quarter. For the year, consumer spending was up 2.2% — which was a bit slower than the 2.5% increase in 2022.

This GDP report comes as the stock market has also reached new highs. On Thursday, the S&P 500 logged its fifth consecutive record close. Meanwhile, the Dow Jones Industrial Average recently closed above 38,000 for the first time ever.

What they’re saying:

As for what this Q4 2023 report means for 2024, Moody’s Analytics senior director Scott Hoyt remarked, “Prospects are good that the economy will continue to perform well this year. Consumers are doing their part and spending just enough to support broader economic growth.”

Also looking forward, EY-Parthenon senior economist Lydia Boussour noted that a recession is less likely, stating, “We continue to see a soft landing as the most likely outcome this year even if a collection of headwinds and risks means that recession odds are around 35%.”

My thoughts:

It seems that every report we get from the Bureau of Economic Analysis or Bureau of Labor Statics these days includes elements that are “unexpected.” That said, I think that more than doubling the expected GDP does indeed count as a surprise. Ironically, though, these unforeseen reports often lead to people trying to guess what will happen next.

On that front, the big question (once again) is what will happen with interest rates? With economic growth still strong, the odds of a rate cut in the short-term seemingly fall. Then again, there are many factors at play that the Federal Reserve will need to consider, including the monthly jobs reports.

Overall, while it’s hard to say what’s ahead, the good news is that the U.S. economy is still going strong.