Economic News

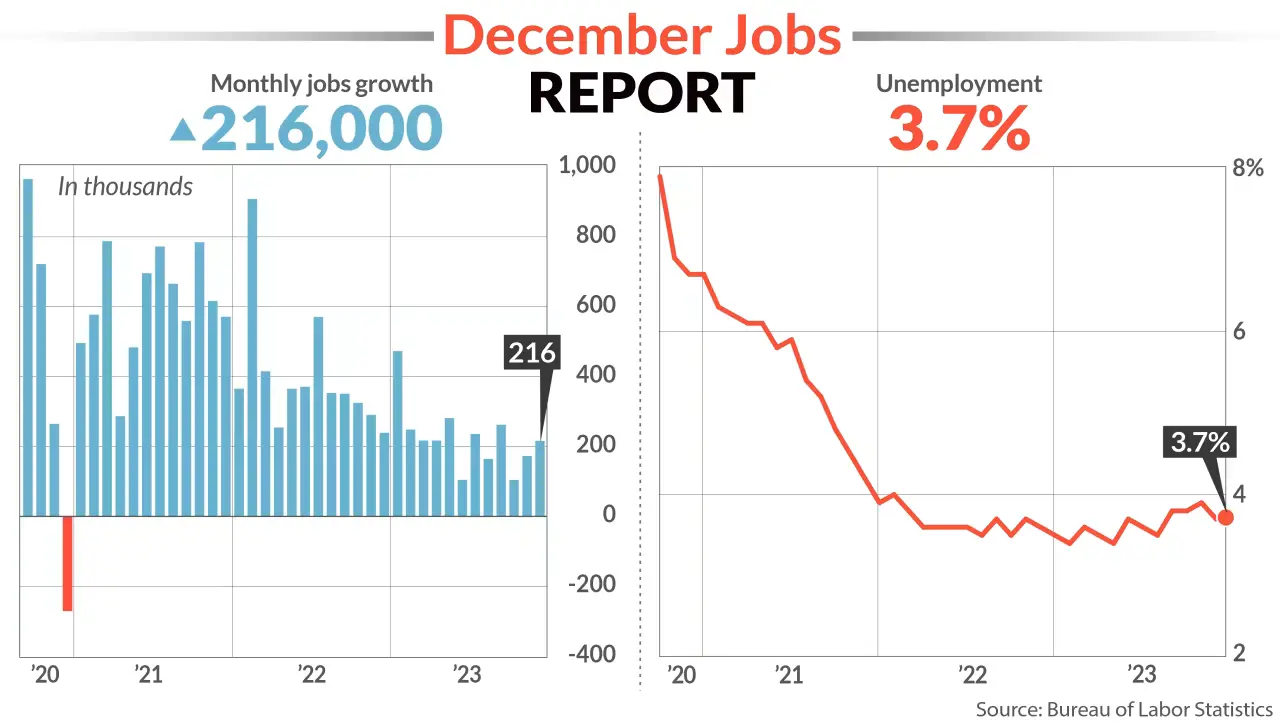

United States Economy Added an Estimated 216,000 in December

The United States economy closed out 2023 with yet another impressive jobs report.

About the report:

According to the latest Bureau of Labor Statistics report, the U.S. economy gained 216,000 jobs in the last month of 2023. That easily beat the 175,00 jobs expected by economists surveyed by Bloomberg. Meanwhile, the unemployment rate was flat month-over-month, sticking at 3.7% (economists had anticipated it to tick up).

While December’s figures were higher than expected, the Labor Department revised figures for the two previous months downward. For November, it is now believed that the economy added 173,000 jobs instead of the originally reported 199,000. Similarly, October’s jobs numbers were revised to 105,000 (down 45,000 from the previous figure).

The report also found that wages increased in December. Average hourly earnings reached $34.27 in the month, marking a 15¢ or 0.4% increase. With that, average wages increased 4.1% over the past 12 months.

What they’re saying

As for what the latest numbers means for investors and the economy at large, BlackRock’s Rick Rieder told Marketwatch that the new info may serve as a “dose of reality” for those who had hoped the Federal Reserve would quickly slash interest rates. Rieder said, “Today’s job report was illustrative of a very gently cooling economy that still displays a solid demand for workers. The headline payroll number of 216K jobs gained made it very clear that the labor market is not at all close to falling off a cliff.”

Despite the feeling that rate cuts may not be as aggressive as some hoped, the Fed is still expected to lower interest rates this year. As Oxford Economics’ lead US economist Nancy Vanden Houten told Yahoo Finance, “There is a lot of noise in the data, but we continue to expect that there will be enough evidence of a further loosening in labor market conditions and a decline in inflation more broadly to allow the Fed to begin cutting rates in May.”

My thoughts:

The “Soft Landing Saga has continued for months now — yet it seems that each passing month only brings more confusion and mixed signals. That’s once again the case here as economists seems split on what exactly this report means and how strong it is. On top of that, as we’ve seen time and time again, revisions in future months could serve to paint a different picture than the one on display right now. Therefore, while investors and consumers are likely anxious for the Fed to lower rates, further patience is definitely required.