Economic News

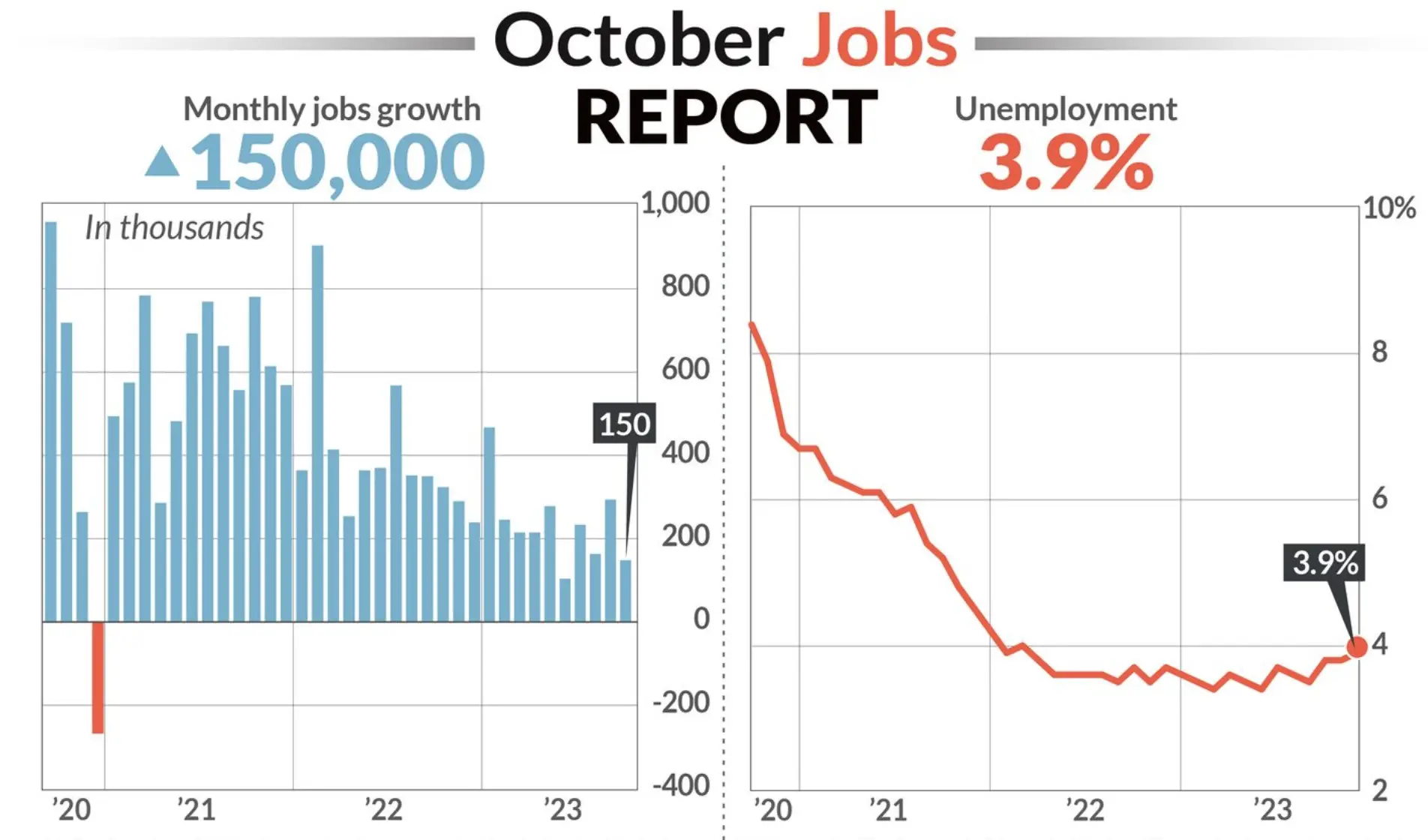

U.S. Economy Adds 150k Jobs in October, Unemployment Ticks Up

This morning, the United States Bureau of Labor Statistics released its initial jobs report for October 2023.

About the report:

Headlining today’s report, the U.S. economy added an estimated 150,000 jobs last month. That’s below the 170,000 jobs that economists surveyed by Wall Street Journal forecasted. But, it’s expected that the figures would have been closer to 180,000 jobs if not for the auto workers strike in October.

Despite that added payroll, the unemployment rate did tick up. The rate now sits at 3.9% versus 3.8% in September. October’s rate is the highest seen since early 2022.

In addition to the latest month’s figures coming in below expectations, the jobs numbers for some previous months were revised downward. September’s estimate was changed to 297,000, which is off 39,000 from the originally reported 336,000. Similarly, August’s numbers were slashed to 165,000 — a negative revision of 62,000 jobs. However, this downward adjustment follows a positive one last month. When August 2023’s report was initially released, it showed 187,000 jobs. Thus, this latest revision isn’t quite as dramatic as it may seem.

Notably, this report arrives on the heels of the Federal Reserve electing to leave interest rates untouched for the time being. Currently, these rates are the highest they’ve been in more than two decades.

Lastly, October saw a slight increase in the average hourly earnings of private nonfarm employees. That average rose by 7¢ or 0.2% last month and now sits at $34. Year over year, the average hourly wage has climbed 4.1%. Interestingly, that bests the 3.7% increase the Consumer Price Index has seen over the past 12 months (as of September 2023).

What they’re saying:

In a statement obtained by Marketwatch, Morning Consult senior economist Jesse Wheeler said of the report, “This is the first time in awhile that all the various indicators the jobs report tries to measure went in the same direction: cooling.”

Meanwhile, Principal Asset Management chief global strategist Seema Shah noted, “Today’s report suggests that the job market is, in fact, slowing. September seems to have been just a momentary upward blip in the jobs numbers.” Shah added, “This jobs report further increases the chances of no [Fed] move in December.”

My thoughts:

Obviously the biggest story with this month’s report is what it likely means in terms of interest rates. On that front, it does look as though the rate hikes we’ve been seeing over the past several months are likely done for at least a bit. At the same time, though, we’ve seen just how big these monthly revisions have been. Therefore, in my opinion, we may not actually have a solid snapshot of the economy for at least a couple more months.