FinTech News

Till Launches Family Financial Platform with $5 Million in Funding

Another FinTech that seeks to help parents teach children about money is ready to welcome new users. This week, the family-centric banking platform Till announced that the platform was now available to all, while also revealing that they’d raised more than $5 million for the launch. Those who have contributed to Till’s funding include Elysian Park Ventures, Pivotal Ventures, Afore Capital, Luge Capital, Alpine Meridian Ventures, The Gramercy Fund, SM Ventures, and Lightspeed Venture Partners. Additionally, several angel investors have also contributed.

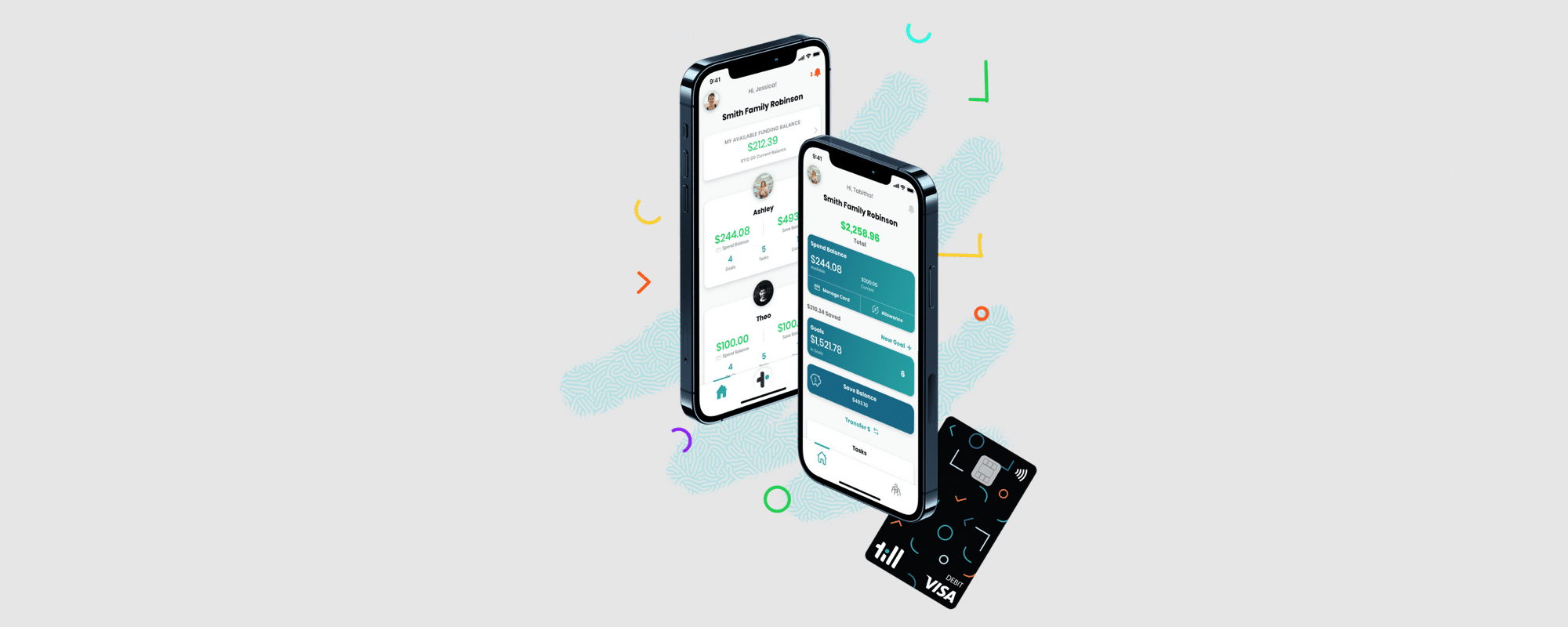

Billing itself as the “first collaborative family financial tool that empowers kids to become smarter spenders,” Till Financial aims to not only teach children about money but also help kids and parents talk openly and honestly about financial matters. With Till, children will have access to both a digital and a physical debit card while participating in goal-based savings.

According to the company, the market for Till is the 50 million “pre-banked” young people aged eight to 18 — who happen to hold a combined buying power of $400 billion. Since Till Financial is not a bank, the FinTech has partnered with Coastal Community Bank to support its platform and card issuance.

Commenting on the launch of Till and the service’s mission, the company’s co-founder Taylor Burton said, “Parents and the current banking options miss the point when they just focus on savings. We need to first prepare kids to be smarter spenders, supported by savings and investing. With Till, kids learn to spend with intention and purpose, while parents gain confidence and trust based on transparency and accountability.” Burton added, “We offer this platform with no fee to all families—irrespective of socioeconomic status—because a kid’s first banking experience should not come with their first banking fee.”

Meanwhile, PayPal Ventures Operating Partner Peggy Mangot also shared enthusiasm about the platform, explaining, “What I love about Till is that they’ve incorporated proven functions and features to help families understand money together. It’s always a hassle to travel to a legacy bank’s branch to set up a teen bank account. Now, it’s convenient and modernized through Till’s platform. Till encourages families of all sizes to work together to create impactful financial wellness habits that will last long after the child leaves the household.”

Till is one of a growing number of FinTech firms with a focus on family or children’s finance. In fact, in recent months, GoHenry announced a $40 million funding round while Step closed a $50 million Series B late last year. Elsewhere, the London-based Revolut offers its Revolut Junior platform in multiple markets.

Financial literacy among young people has long been seen as an area where improvements were needed. Now, several FinTechs — including Till — are offering potential solutions to that problem. As investors continue to flock to these companies, we can expect Till and others to flourish, hopefully improving the family financial dynamic in the process.