FinTech News

Family-Centric Finance App GoHenry Raises $40 Million

It seems as though even more FinTechs are managing to close deals before the year is done. Last week, GoHenry announced that it had raised $40 million in its latest funding round. The round was led by Edison Partners with participation from Gaia Capital Partners, Citi Ventures, and Muse Capital. With the funds, GoHenry plans to further its expansion plans, mainly in the United States but also in the United Kingdom, where it’s already proven successful. According to a press release, the startup currently has more than 1.2 million active users and has been profitable since this past March.

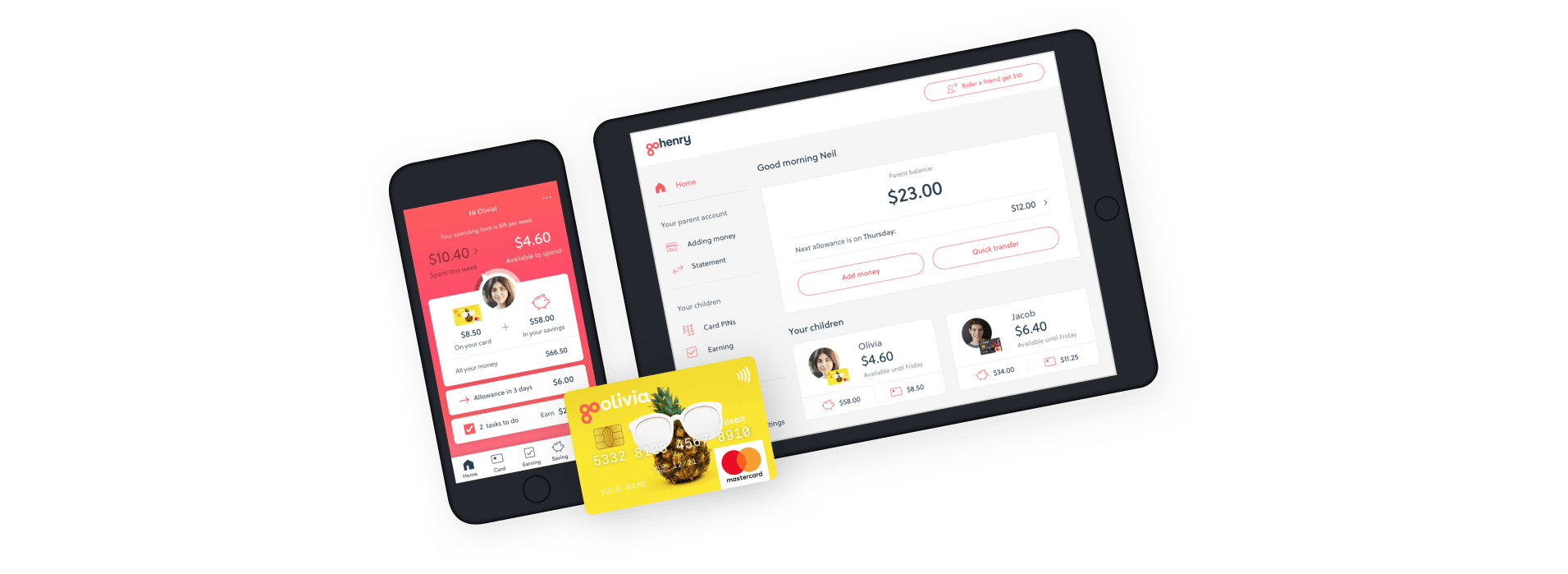

GoHenry offers a financial platform intended for parents with children aged six to 18. In addition to children receiving their own custom debit card (including branding that changes the GoHenry logo on the card to “Go[child’s name]”), they’ll also learn about personal finance and managing their money. Meanwhile, parents can set spending limits, add tasks that children can complete to earn extra funds, set savings goals, and much more.

Speaking to the impact GoHenry has had so far, the company’s CEO Alex Zivoder said in a statement, “For too long, kids have been locked out of the digital economy and parents lacked the tools to help their children gain confidence with money and finances. GoHenry was the first to respond to these needs in 2012 when we launched a groundbreaking financial education app and debit card that truly empowered children.” Zivoder went on to mention more recent successes, remarking, “In 2020, we’ve achieved three key milestones: becoming profitable which many B2C FinTechs seek, raising $40 million during Covid, and partnering with world leading funds. All three will help us fuel our U.S. expansion.”

GoHenry’s $40 million round arrives on the heels of another young-skewing banking app: Step. Earlier this month, the startup announced a $50 million Series B that not only included participation from VCs but also numerous celebrities including Justin Timberlake, Eli Manning, Larry Fitzgerald, and 16-year-old social media star Charli D’Amelio. While GoHenry may be aimed at children, Step’s platform is intended for teens and offers a free banking account, P2P payments, and its credit-building Step Card. According to the company, they’ve already amassed more than half a million users since officially launching two months ago.

Between Step and Revolut‘s off-shoot Revolut Junior, GoHenry does face a growing amount of competition as it looks to expand. Nevertheless, the market for youth-focused FinTechs is also growing tremendously — with the move to contactless payments that the pandemic has accelerated also potentially playing a role in this push. Therefore, it seems that there’s plenty of room for all three players (and more) to compete and hopefully increase the financial literacy of the next generation in the process.