Small Business News

Survey: 94% of Small Business Merchants Accept Card Payments

A new survey highlights how the vast majority of small businesses are now accepting modern forms of payments — although satisfaction with some popular payment platforms is waning.

About the survey results:

J.D. Power has released its 2024 U.S. Merchant Services Satisfaction Study, which compiled responses from 5,383 small businesses. Conducted between September and November of last year, the survey inquired about provider satisfaction is several areas, including the cost of processing payments, data security and protection, quality of technology, and more.

First off, the survey found that 94% of merchants now accepted credit or debit cards, with 88% also accepting digital wallets, such as Apple Pay, Google Pay, and others. Additionally, more than half (54%) reported accepting “buy now, pay later” (BNPL) payments.

Of those who do accept card payments, 80% process via their provider. However, satisfaction with these payment processors varied. Furthermore, these providers ranked lower on J.D. Power’s merchant services survey.

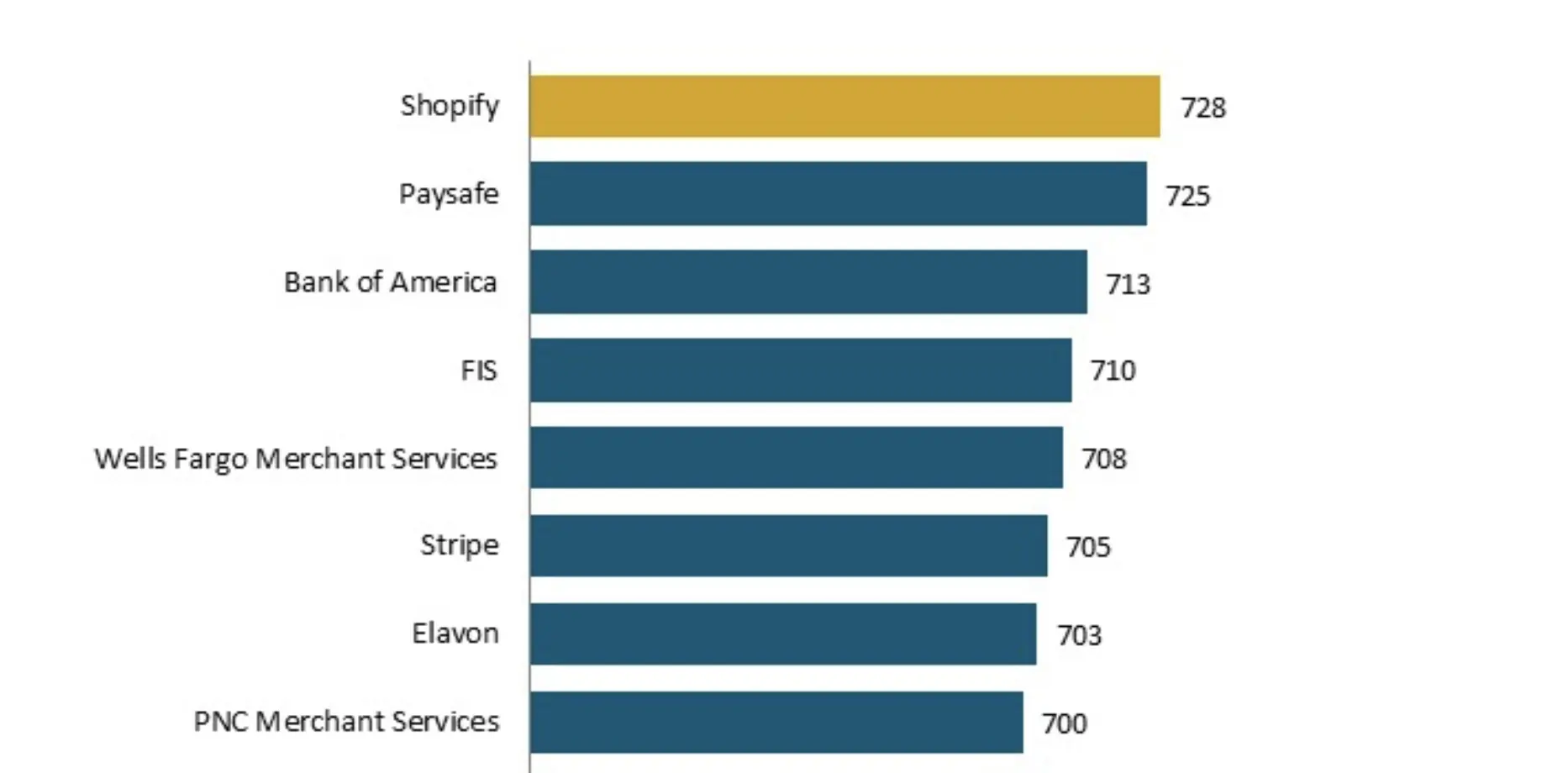

Turning to the list itself, Shopify came out on top with a total of 728 points (out of 1,000). Paysafe, Bank of America, FIS, and Wells Fargo Merchant Services rounded out the top five. Other popular payment services such as Stripe and PayPal also rated above the 688-point average, coming in with 705 and 691 points respectively. Notably, Square — which gained enormous popularity as a small business point-of-sale solution — ranked below average with a total of 681. Lastly, Intuit Quickbooks was the lowest-rated platform on the list with 646 points.

What they’re saying:

Commenting on the survey results, J.D. Power’s managing director of payments intelligence John Cabell stated, “We’re seeing an interesting disconnect in the merchant services marketplace whereby the most frequently processed forms of payment—credit and debit cards—generate the lowest levels of overall satisfaction among small business owners, while less common payment types such as BNPL, pay by bank and gift cards drive higher satisfaction.”

Cabell continued, “Part of that is driven by demographics. Younger, newer business owners are more apt to accept a wide variety of payment types and have higher overall satisfaction with their merchant services providers. However, we’re also seeing some challenges across the board with debit and credit when it comes to delays in account funding, cost and fees and fraud management.”

My thoughts:

Although the rankings of these platforms is notable, to me, the most interesting part of this survey is the acceptance rates of certain payments. Sure, the fact that 94% of merchants accept credit cards is a given, the 88% figure for digital wallets is a bit higher than I might have expected. Plus, even though BNPL fever has seemingly calmed in recent months, it would appear as though this payment option continues to be strong among small business merchants.

As for the satisfaction survey, it’s hard to say whether these providers and banks will take the results to heart or not. But, bottom line: considering how important payments are to small businesses, hopefully these merchants can find platforms that work well for them and their businesses.