Small Business News

SoFi Launches Marketplace for Small Business Loans

SoFi is bringing a small business loan hub to its core user experience.

About the marketplace:

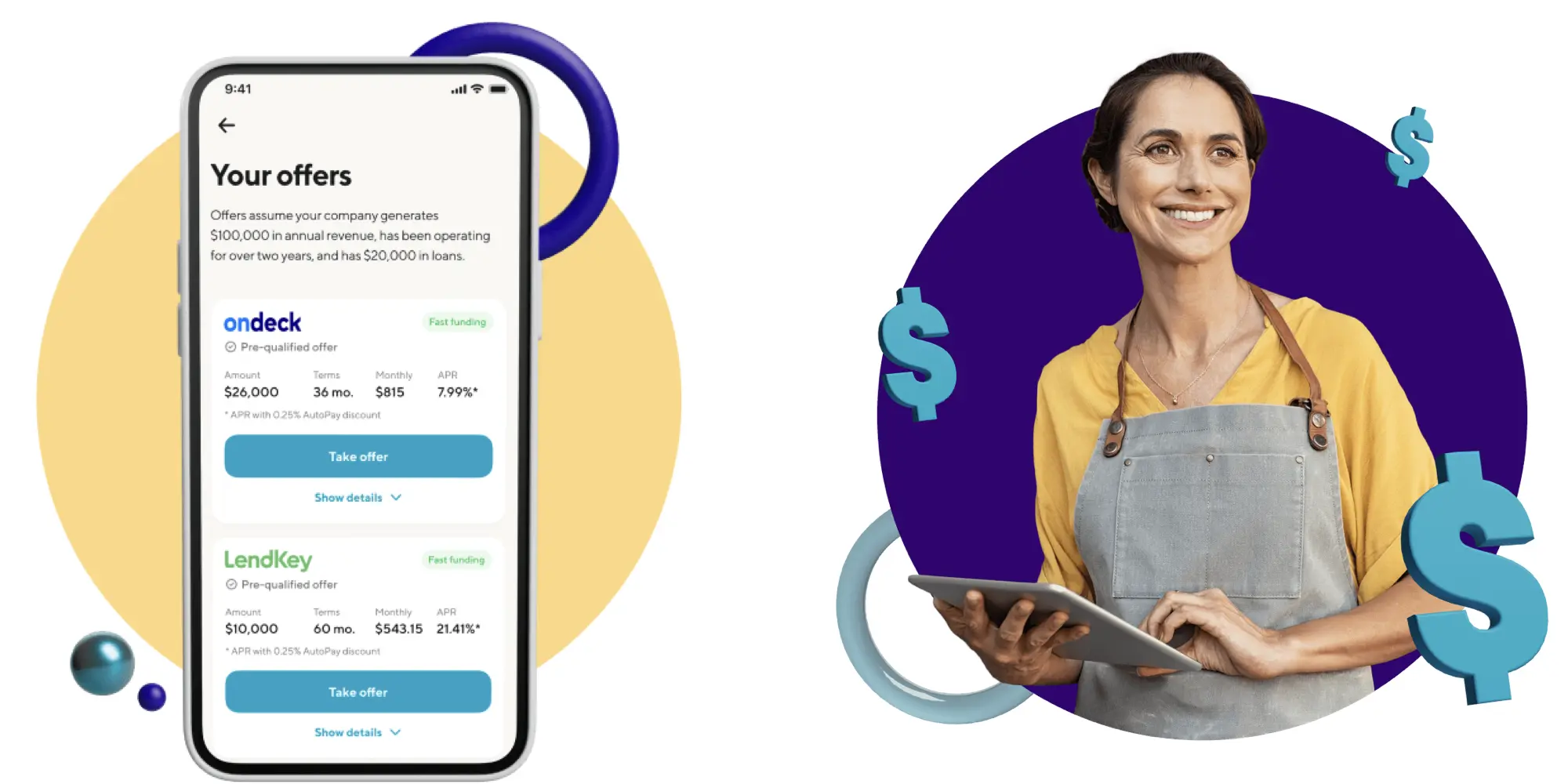

SoFi has announced an expansion of its small business marketplace. Now, small businesses can connect to the bank’s network of providers and view funding options within the SoFi ecosystem. The loan marketplace can be found at SoFi.com/Small-Business-Loans.

Among the loan types/users currently supported by SoFi’s marketplace are expansion loans, equipment loans, working capital, payroll financing, and startup financing. Additionally, the service says it will support more financial solutions for small businesses going forward.

From the SoFi Business Funding Marketplace landing page, borrowers can click the “View your rate” button and log into their SoFi account. Then, they can enter how much they’re looking to borrow, some basic details about their business (name, length of time in business, industry types, etc.), business revenue what they intend to use the funds for, and more. Once completed, business owners can review multiple offers without any impact on their credit. Of course, accepting an offer will likely result in a hard credit inquiry.

The marketplace appears to be similar to the one offered under the Lantern by SoFi banner. According to the Lantern site, participating lenders include the likes of Funding Circle, OnDeck, Lendio, Seek Business Capital, Biz2Credit, and Fundera. However, SoFi’s press release states that it will continue to add more providers.

What they’re saying:

Announcing the expansion, SoFi CEO Anthony Noto said, “SoFi is on a mission to help its members achieve financial independence to realize their ambitions. For many of our members – that’s embracing the entrepreneurial spirit and running their own businesses. But business owners are busy managing multiple facets, with many discovering financial needs as they go.” Noto added, “SoFi’s SMB marketplace can support owners with tangible value and solutions to make fast, but informed financial decisions that are right for their business.”

My thoughts:

Although SoFi essentially already offered a similar service in Lantern, bringing this loan marketplace under the core SoFi brand is notable. It also happens to follow a recent trend where FinTechs seem to be consolidating their various features into a single experience (see: Intuit and their integrations of TurboTax and Mint into Credit Karma).

As for small business owners, this marketplace could be a great resource for discovering loan options. Furthermore, assuming SoFi does follow its plan to add support for more financial solutions, it could prove to be a valuable starting point for those seeking capital.