Money Management Product Reviews

Money at 30: SaverLife Review

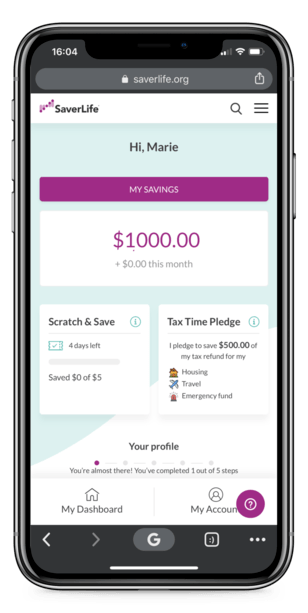

Saving money is rarely easy. Even if there is technically room in your budget, many of us need a little extra push in order to actually start setting money aside. Because of this, several FinTechs have rolled out unique solutions aimed at getting people to better their finances. Unfortunately, some of these apps and tools charge a monthly fee that might compromise your progress. That’s why I was interested to hear about SaverLife: a service that rewards users for meeting certain savings goals. Best of all, it’s completely free to use.

Let’s take a closer look at SaverLife and how you can win money on the platform.

What is SaverLife and How Does it Work?

About SaverLife

First things first: when looking for SaverLife, you’ll want to be sure to put a “.org” instead of the traditional “.com.” That’s because SaverLife is actually part of a 501(c)3 non-profit organization. In order to offer cash incentives and help people better their finances, the company works with a number of sponsors, including JP Morgan Chase, Intuit, MetLife Foundation, and more. They’ve also recently been partnering with Humanity Forward — the organization founded by former Democratic presidential nominee and universal basic income supporter Andrew Yang.

All this adds up to the fact that SaverLife is legit as well as 100% free.

Signing-up for SaverLife

To join SaverLife, you’ll just need to provide some basic info such as your name and email address. You’ll also need to create a password and provide a phone number, which you’ll use to receive a confirmation code. Also, before moving onto the next step, SaverLife will invite you to set a short-term savings goal.

By the way, while anyone is able to join SaverLife, there are requirements for who can win money. For one, winners will need to be residents of the United States and must be over 18 years old. Furthermore, that age requirement rises to 19 for those in Alabama and Nebraska while those in Mississippi must be 21.

Link a savings account

In order to participate in SaverLife’s challenges (which we’ll get to in a moment), you’ll need to link a savings account. This is accomplished via the widely-used service Plaid. If you’re not familiar, Plaid allows you to log into your bank account and securely provide the app in question — in this case, SaverLife — with “read-only” data. It’s also worth noting that Plaid was recently acquired by Visa, so it’s definitely trustworthy.

Unlike some of the other apps and services I’ve reviewed such as Long Game, SaverLife doesn’t hold your money nor do you transfer it to them. Instead, this connection will allow the platform to confirm that you’re growing your savings. In my opinion, this is a pretty smart way to do this and takes one step out of the whole process.

In the event you need to update the account you want SaverLife to monitor, just select My Account and scroll to “Change bank account.” Just be aware that doing this will reset your savings progress. Also, you can always unlink an account if you’d like.

Surveys

After setting up your SaverLife account, you’ll be asked to participate in two surveys: a financial health questionnaire and a Financial Personality Quiz. For the former, you’ll be asked a series of questions about your current money habits, such as your spending, emergency cost preparedness, etc. As for the personality quiz, this will help SaverLife recommend custom saving strategies, reading material, and more.

Each of these should only take a few minutes (less than 5). However, if you’d rather just skip them, that’s okay too. By the way, you can revisit your Financial Personality Quiz results by visiting Your Account, but there doesn’t seem to be a way to alter your answers after the fact.

How to Win Money with SaverLife

Scratch & Save

The main feature of SaverLife is their weekly Scratch & Save game. If you save at least $5 during the week, you’ll be awarded a digital scratcher card that could win you $5. That’s right — saving $5 could earn you $5.

These scratchers are sent out on Mondays to all who’ve met the previous week’s saving goal. Currently each week sees 200 winners. In my first go-round, I was not among these winners, but that’s just my luck.

For those who do win, you’ll be prompted to enter the email address associated with your PayPal account. Then, your prize should be delivered within two weeks. Also, according to the SaverLife site, you are allowed to win multiple times — assuming you meet the weekly saving requirement of course. What’s more, they suggest that the average player wins at least once for every five times they play.

To be clear, your eligibility is determined by whether or not your balance at the end of the week increased by $5 or more versus the previous week. Therefore it’s not an issue if you move money in between. So, for example, you can spend $25 during the week as long as you deposit at least $30 by the end of the week.

Other challenges

In addition to the weekly Scratch & Save game, SaverLife also boasts other challenges that give users the chance to win some extra cash. For example, the promotion for June 2020 when I’m writing this is called Race to $100. As part of this challenge, users will be invited to try to increase their savings by $100. SaverLife users who accomplish this goal by June 30th will have the chance to win $10 or $100, with the site giving out a total of $2,000 in prizes. Like with the Save & Scratch game, your balance on that last day of June is what really matters, so feel free to move and spend money in between as long as you grow your balance by $100 or more at the month’s end.

Resources

While the games and challenges may be the main star of the show, it’s important to remember that the mission of SaverLife is to help people improve their finances. Thus, on their website, you’ll find resources on a number of money topics. Under the “Money 101” tab, you’ll find articles covering debt, budgeting, credit, investing, and more. True to the time, there’s even a COVID-19 section. To that point, there’s also currently a COVID-19 Support button at the bottom of the site where you can enter your zip code and be taken to a site compiling various programs and services that can help you through these tough times.

Beyond “Money 101,” there’s also a a Community section of SaverLife. Here you’ll find a Forum section, personal finance stories, research data, and more. Again, these features provide some great insight and opportunities to learn. Therefore, while you may just want to win money with SaverLife, it’s worth taking a look around as well.

Should You Feel Guilty Using SaverLife if You Don’t “Need” It?

SaverLife aims to teach people how to save in order to help them lead better financial lives. To do this, the organization is funded by private donors, which allows SaverLife to offer the incentives that they do. Because of this, should you feel guilty about using SaverLife if you’re already in good financial standing?

Personally, this is something I asked myself when signing up. What I decided was that I would try the platform once just for the purpose of this review and then forgo attempting to earn future prizes. That said, this is a decision you’ll need to make for yourself and determine when it’s time to walk away (if at all).

Donating to Saverlife

If you are in a position to give instead of get, I should note that you can also donate to SaverLife and help support their efforts. By visiting their donation site, you can elect to give a one-time gift or set up monthly recurring donations.

Since EARN (SaverLife’s parent company and former name) is a non-profit, donations made are tax-deductible. Additionally, you may be able to have your employer match your contribution. To see if your company participants in such matching plans, you can check the pull-down menu on SaverLife or talk to your human resources department.

Final Thoughts on SaverLife

Of all of the services I’ve reviewed, SaverLife really stands out for a few reasons. First, as a non-profit, the questions about monetization that often plague FinTech apps and others are moot. Second, as I mentioned, using SaverLife doesn’t require you to open any sort of financial account or transfer money, making it even easier to trust. On top of that, SaverLife’s platform is incredibly simple to use and is quite straightforward.

For all of those reasons, if you struggle with saving money and are looking for a little incentive to get you started, it’s definitely worth giving SaverLife a shot. Meanwhile, if you are in a financially strong place, the organization is also worthy of your donation. Either way, be sure to check them out at SaverLife.org.