Money Management Product Reviews

Money at 30: Robinhood Retirement Review

During a recent earnings conference call, Robinhood’s CEO Vlad Tenev revealed that the investment app would soon be introducing a retirement account platform for users. Soon after that, the platform announced more details about the offering while opening a waitlist. Now, a mere few weeks later, Robinhood Retirement is here.

So what does this new IRA option have to offer? Let’s look at the details of Robinhood Retirement and my experience with the platform so far.

- Earn a 1% bonus on contributions

- Create your own portfolio or get recommendations

- Must hold funds for 5 years to retain bonus

- Only stocks and ETFs offered on Robinhood can be held in your IRA

What is Robinhood Retirement and How Does it Work?

About Robinhood Retirement

Robinhood Retirement is the latest expansion of the popular (but often controversial) investment app Robinhood. With this feature, users can open Traditional IRA or Roth IRA accounts, make contributions, and invest their funds within these retirement vehicles. Additionally, customers can earn a bonus on contributions — which we’ll discuss more in a moment.

As of this writing in December 2022, the new feature is rolling out to guests on the waitlist but full availability is expected in January 2023.

Opening your IRA

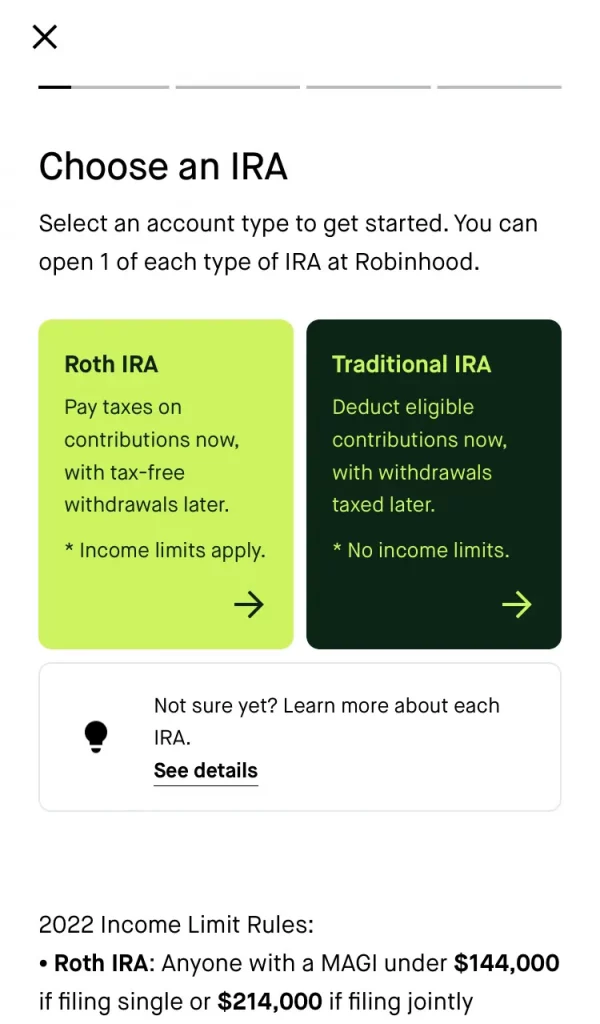

If you’re already a Robinhood user — and the waitlist is no longer a thing — tapping the new Robinhood Retirement tab in the app will give you the option to open an account. First, you’ll have the choice between a Traditional IRA and a Roth IRA. As a reminder, with a Traditional IRA, contributions are tax-deductible but income tax will be assessed when distributions are taken in retirement. However, while contributions made to Roth IRA are still subject to income taxation in the year of the contribution, distributions in retirement can be taken tax-free.

Also notable is that both accounts have yearly contribution limits. For 2022, this limit is $6,000 while the 2023 tax year will see the limit rise to $6,500. There are additional limits to who can contribute to Roth IRAs. Luckily, all of these requirements are noted on Robinhood as you go to make an account. Plus, the app makes it easy to keep track of how much more you can contribute before you reach your annual limit.

By the way, eligible customers are welcome to open both a Roth and Traditional IRA. However, the yearly contribution limit applies to the combined total between these accounts and any others you may hold.

After making a selection, opening a Robinhood Retirement account only takes a few taps. In fact, you’ll basically just need to review and sign off on the terms. Then, you’ll be ready to get started.

Not a Robinhood user? If you haven’t signed up yet just click the button to create an account and get a free share of stock just for opening an account with this Fioney link.

Funding your account/making contributions

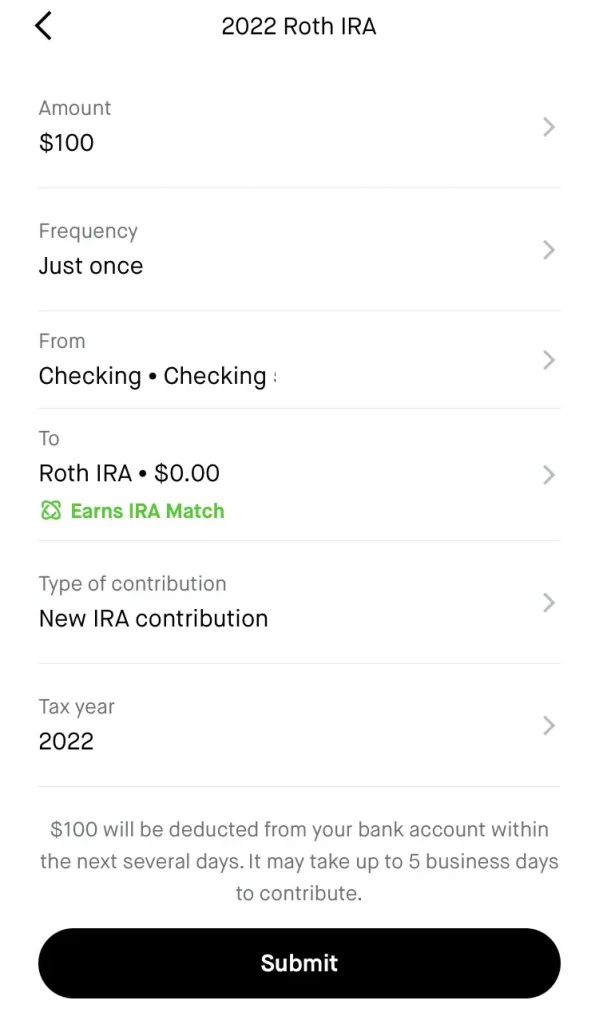

Making a contribution to your Robinhood Retirement IRA is simple. Users can choose how much they’d like to deposit and can select a linked account to pull from. Like with regular transfers to Robinhood, contributions to Robinhood Retirement IRAs that are for less than $1,000 can be credited instantly, allowing customers to make trades right away.

Notably, customers can choose to move funds from an existing Brokerage or Spending account to their IRA. However, these funds won’t be eligible for IRA Match.

For those who want to set a goal of contributing more to their IRA, Robinhood Retirement also supports recurring investments. Users can choose to set the frequency of these deposits to Weekly, Twice a month, Monthly, or Quarterly. Of course, this is optional and the one-time contribution is the default.

Lastly, since individuals can make IRA contributions toward the prior tax year up until Tax Day of the following year (so 2022 contributions can be made until April 18, 2023), Robinhood allows you to select what tax year you want to apply your deposit to. To change this, just tap the Tax Year option at the bottom of the Contribute interface. Currently, seeing as it’s not yet 2023, only the 2022 option shows. But, this will undoubtedly change starting next month.

IRA Match

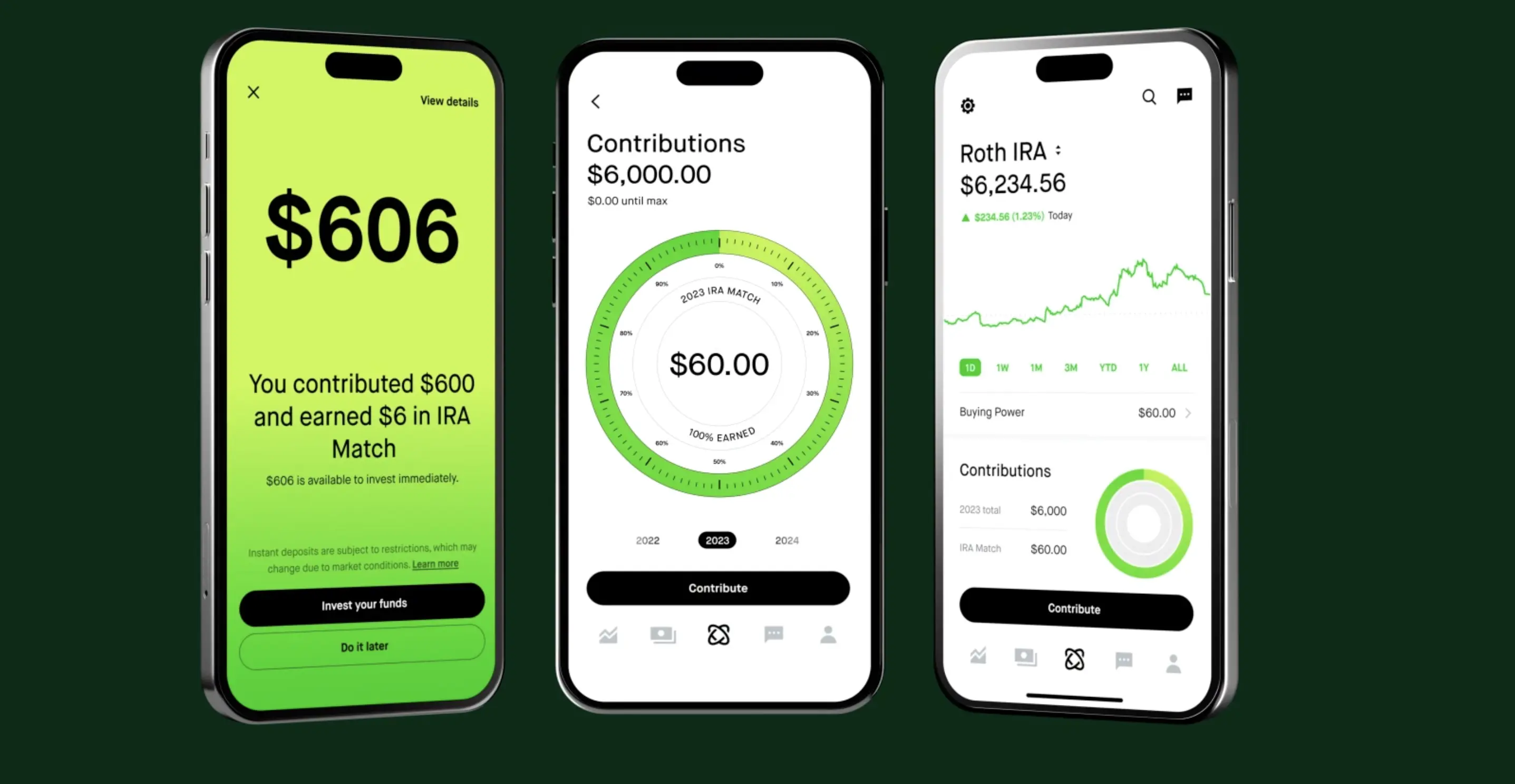

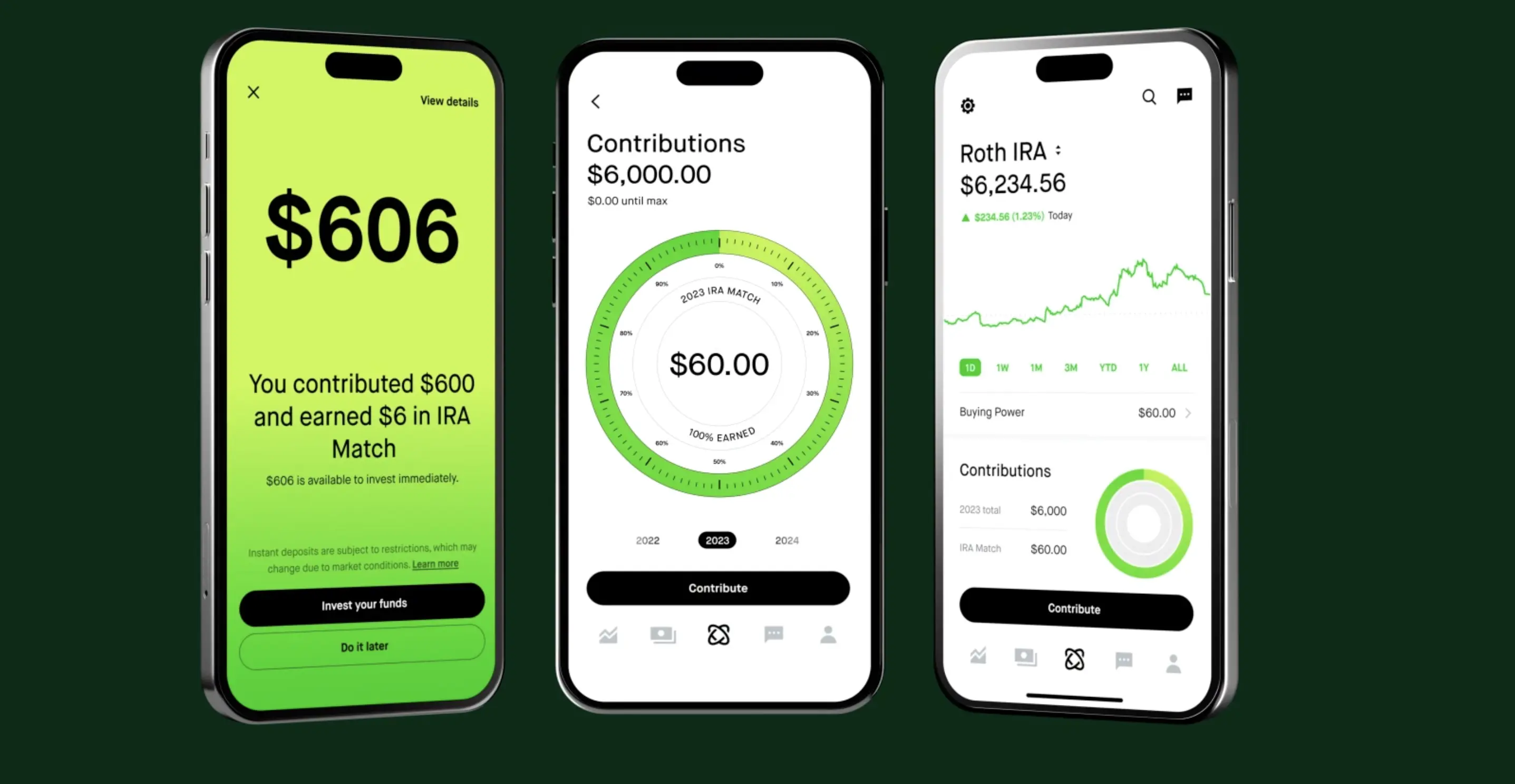

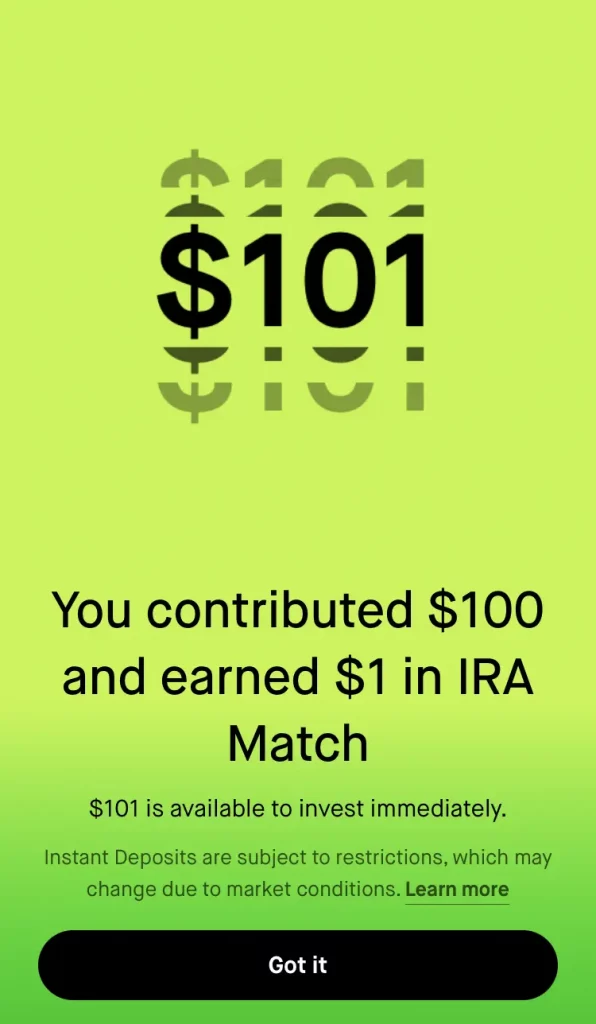

One of the headlining features of Robinhood Retirement is their IRA Match offer. When users contribute to their Robinhood IRAs, the platform will provide them with a bonus equal to 1% of their contribution. So, if you deposit $1,000, Robinhood will boost your account with a $10 bonus.

Looking at Robinhood’s FAQ, there are some things to note about this offer. First, there’s good news which is that these bonus funds will be classified as interest and won’t count toward your IRA contribution limit As for the bad news, Robinhood will require customers to hold the funds that earned IRA Match bonuses in their account for at least five years. Otherwise, they may be assessed a penalty up to and including fully forfeiting their bonus funds. Granted, you should probably not be moving money out of your IRA anyway, but these terms are worth reviewing regardless.

The other minor catch (as noted in the previous section) is that IRA Match is only available on contributions made using funds that are new to Robinhood. In other words, they’ll need to come from an external account rather than from a Robinhood Brokerage or Spending account. To me, this rule seems kind of silly — but, to their credit, Robinhood does make this distinction obvious by putting “Earns IRA Match” under eligible funding sources.

Choosing investments

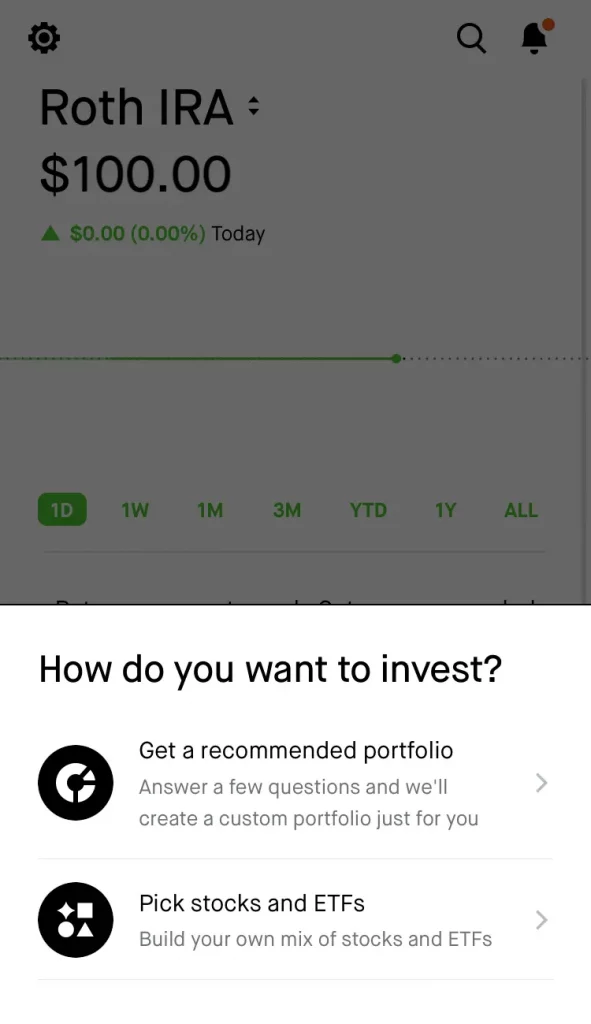

A common mistake among consumers is thinking that just having and IRA or 401(k) means they’re investing. Alas, that’s not the case. So, once your contribution has been made, you’ll want to select what investments you want to make.

With Robinhood Retirement, you choose to purchase individual stocks and ETFs just as you would with a regular Brokerage account. Alternatively, you can have the app suggest a portfolio for you, made up of a variety of ETFs. For the latter option, you can start with as little as $20 and can get started by answering some risk tolerance, income, retirement date, and financial objective questions. The results will be a mix of ETFs, diversified between stocks and bonds. Although these portfolios are fixed, once your purchases have been made, it does look as though you can buy or sell individual assets.

My Experience with Robinhood Retirement So Far

Getting the invite

When I happened to look at Robinhood in the morning, I was still on the waitlist, sitting at about 90k. Yet, later that afternoon, I got an email and push notification that I could now open an account. Seeing as I wanted to be a timely reviewer, I jumped on that opportunity. While it’s unclear how many more people are still on the waitlist, I suspect that Robinhood Retirement will likely be available to everyone very soon — making it the fastest Robinhood feature rollout I’ve ever experienced by far.

Earning my match

To test the account. I decided to contribute $100 to my new Roth IRA. As promised these funds were immediately made available. Plus, I earned a $1 IRA Match bonus. However, I was a bit surprised that the app didn’t show me how much of a Match I’d earn from my contribution ahead of time. Yes, I could easily do the math myself — but it seems like something the app would want to highlight, right?

My portfolio suggestion

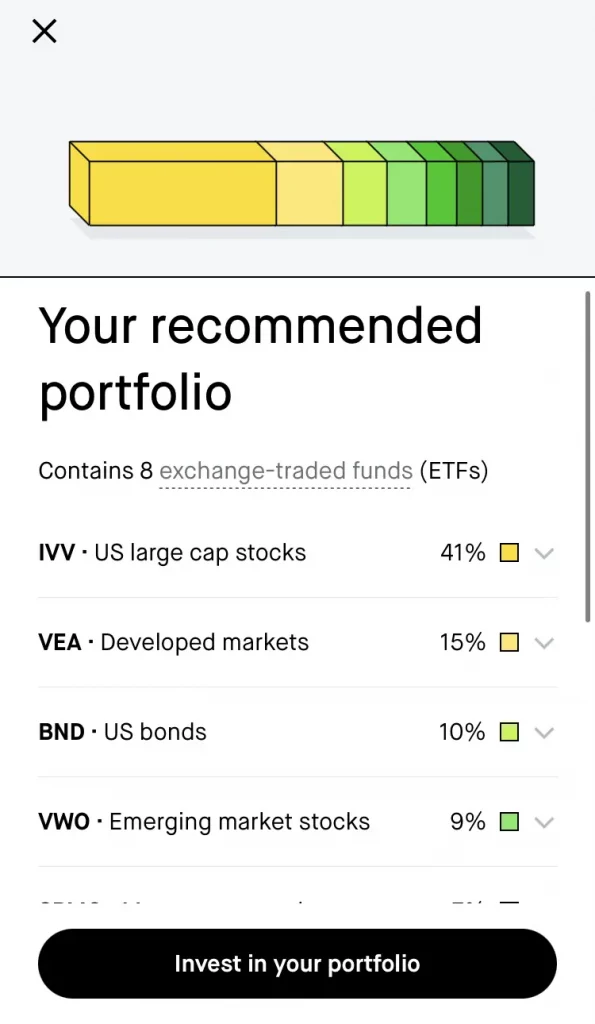

Rather than purchase specific stocks within my new Roth IRA, I decided to see what Robinhood’s suggestions were. To get this process started, I took a short quiz that asked me about my investment preferences, time horizon (AKA how long I had until I planned to retire), etc. Based on my answers, the app suggested a portfolio made up of 90% stocks and 10% bonds — which would be on the aggressive side.

My specific portfolio was made up of eight ETFs:

- IVV

- VEA

- BND

- VWO

- SPMO

- IJR

- SPYG

- SPHQ

However, the percentages of these ETFs varied, ranging from 41% for IVV to 6% for SPHQ and others. These percentages were also fixed.

From there, I could elect to select this portfolio. But, before the deal was sealed, I needed to review my order — including seeing the dollar amounts I’d be investing in each ETF. Then, with a swipe up, my orders were placed and my holdings were displayed in my account.

Navigating the account

Although it’s only been a short time since I opened my Robinhood Retirement account, I have discovered a few interesting things about it. For one, it seems that IRA funds are not included in the total shown on the Investing tab. Similarly, you won’t see your retirement portfolio on this main tab either. Instead, you’ll need to tap the center icon to view and manage your Retirement account.

Something else I found is that your IRA account has its own set of settings. For example, even if you have DRIP (dividend reinvestment) turned on in your main Robinhood account, you’ll need to opt into it again under these specific settings if you want to utilize it. Elsewhere, in IRA Settings, you can find options for starting a Roth conversion, transferring in from an external IRA, or opening another IRA (you can have one Roth and one Traditional in the app).

Final Thoughts on Robinhood Retirement

In line with past Robinhood features, Robinhood Retirement is another sleek and easy-to-use option for investors. Plus, while the IRA Match feature may be pretty gimmicky and does come with plenty of strings attached, free money is, indeed, free money. Between these two factors, I do think that the account option is a win overall.

As for downsides, with your account balance updating in real-time and being just a tab tap away in the Robinhood app, I worry that some users may spend too much time obsessing over how their retirement investments are performing on a day-to-day basis when these should be long-term plays. Furthermore, it seems you can buy and sell these investments at will, which could get dicey.

Meanwhile, the other potential negative involves the future of Robinhood itself. Although the company is certainly big, it’s also had its fair share of troubles, which could lead some to wonder how long into the future the app will even be around. Of course, should the service close, customers would (hopefully) be able to transfer their holdings to another brokerage,

With those hesitations aside, I think Robinhood Retirement is a good addition to the app. While this expansion itself is unlikely to win back fans who were turned off the Robinhood’s past missteps, those who do still enjoy the service will surely appreciate this new option. And, if it helps more young Americans to start saving and investing for retirement, then I see the platform as an overall good thing.

Not a Robinhood user? If you haven’t signed up yet just click the button to create an account and get a free share of stock just for opening an account with this Fioney link.

Robinhood does allow customers to transfer assets from an external IRA to their platform provided that the assets are supported by Robinhood. The process typically takes 5 to 7 business days to complete. To find this option, users can go to Settings, scroll down to Actions, select “Transfer in an external IRA,” and follow the instructions.

Robinhood IRA accounts are SIPC insured. Of course, since customers can select their own investments with the platform, there is inherent risk that some of the assets may lose value.

Yes, it is free to open and invest with a Robinhood IRA. However, some fees, such as an early withdrawal fee, may apply depending on usage.

When users make deposits to their Robinhoood Retirement account from an external account, they’ll earn 1% of that eligible deposit as a bonus or “match.” For example, if you deposit $5,000 from a linked banked account, you will receive a $50 IRA Match.

Robinhood Retirement is free to use and offers a 1% IRA Match. Those who do not already have a 401(k) or other retirement accounts may find Robinhood’s offerings to be easy-to-use and ultimately rewarding.