Small Business News

Paychex Small Business Jobs Index Ticks Down in June 2023

The latest report from Paychex shows that the rate of small business hiring decelerated in June of this year.

About the report:

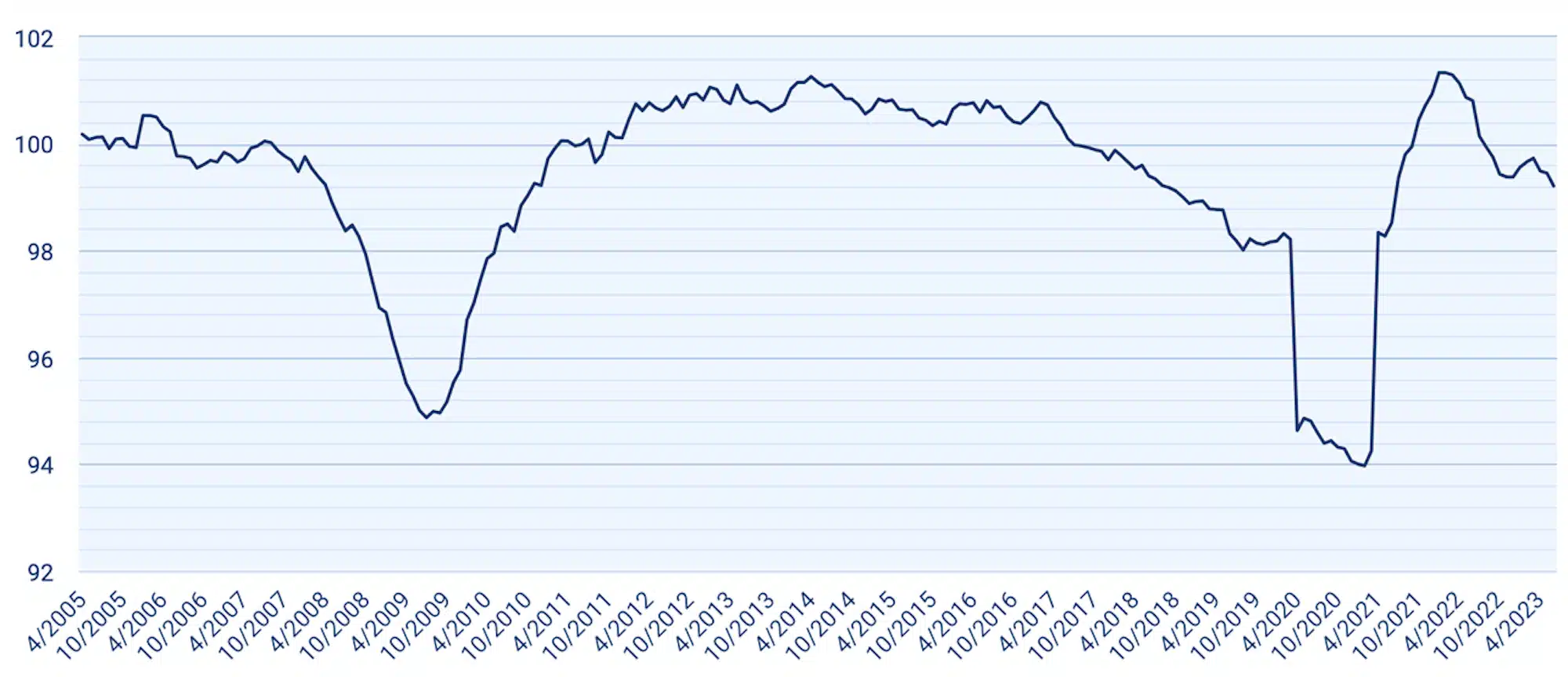

This week, Paychex updated its monthly Small Business Jobs Index, which measures the rate of small business job growth. In June the index inched down to 99.21 from 99.45 in May. This also continued a downward trend, falling from 99.73 in March. It’s also well off from a high of 101.33 recorded in January and February of last year. Nevertheless, the index was still a full point higher in June 2023 than it was in March 2020 just before much of the country went into lockdown due to the pandemic.

The June report also found that wage growth has slowed some. Year over year, hourly wages increased 4.02%, which was down from 4.24% in May. However, weekly earnings growth was flat from May, once again coming in at 4%. According to Paychex, the average hourly earnings in June were $31.64, with the 4.02% YOY increase amounting to $1.22. Also notable is that one-month annualized hourly earnings growth fell below 3% for the first time since 2020, reaching 2.99%.

As for where wage growth was the highest in June, the South led the pack with an increase of 4.15% followed closely by the West with 4.14%. State by state, Texas has seen the greatest wage percentage increase in the past year, climbing 4.91% to reach $30.73. Rounding out the top five were Wisconsin (4.77%), Florida (4.48%), Arizona (4.43%), and Washington (4.36%).

What they’re saying:

Commenting on this month’s index, S&P Global Market Intelligence chief regional economist James Diffley noted, “Hourly earnings gains slowed to 4.02%, in line with a gradually slowing rate of inflation.”

Meanwhile, Paycheck president and CEO John Gibson said, “Our June data suggests small business employment trends are following greater economic patterns, with slowing hourly wage gains aligning with continued declining inflation – a positive sign for businesses.” Gibson added, “A moderation in job growth signals that the competitive hiring environment continues. This is especially true in leisure and hospitality, as these employers appear to once again be struggling to find people to fill open positions.”

My thoughts:

Just as recent Labor Department reports have shown, employers — including small businesses — are continuing to hire even as recessionary fears continue. While this is a good thing overall, as Gibson points out, it has led to some challenges in regard to businesses’ ability to find workers. Luckily, this is where small businesses may have a leg up as those seeking jobs may well be more interested in growing with a smaller company rather than joining a bigger operation. That personal touch is not only a reason why consumers enjoy shopping at small businesses but could also be a benefit for employees as well. With that, hopefully businesses looking to hire can indeed leverage their unique aspects to continue growing their teams and their businesses overall.