FinTech News

Oxygen Ending Banking Services, Pivoting to Health Solutions

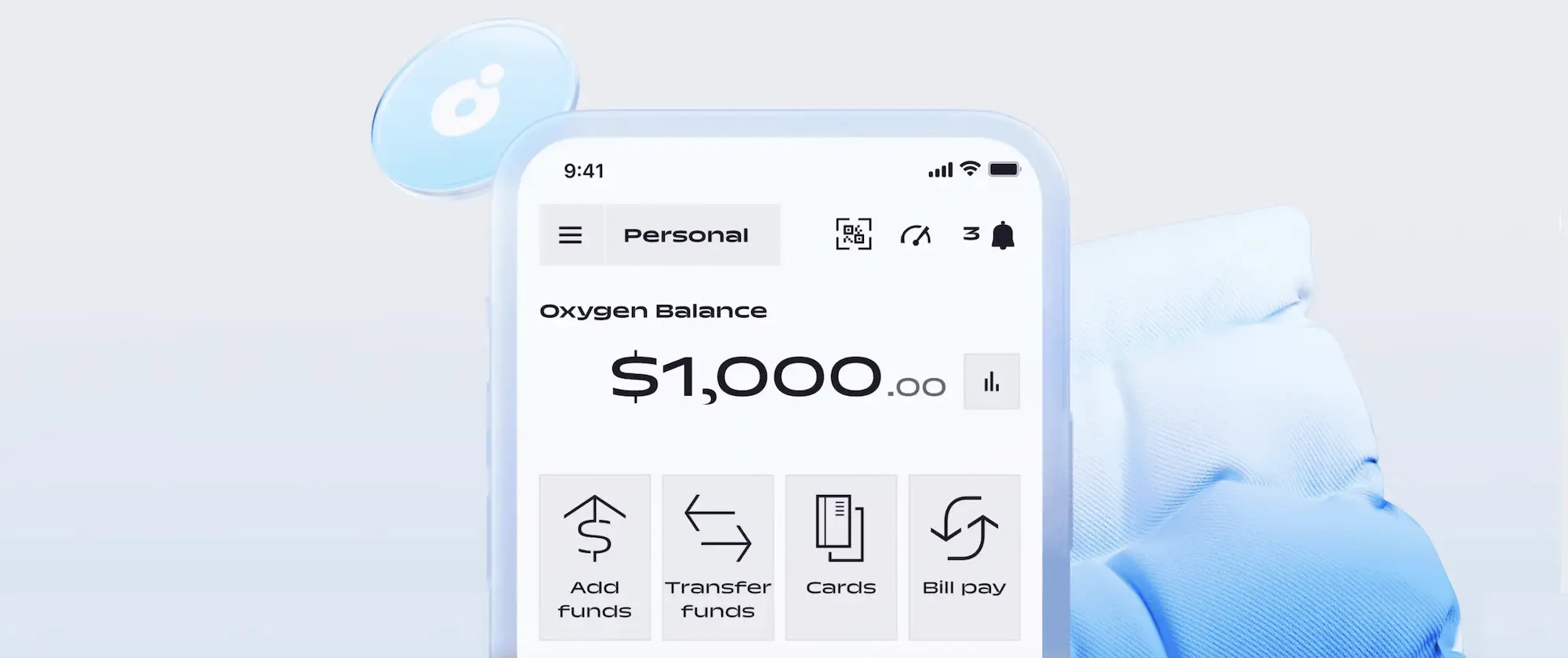

The business and consumer neobank Oxygen has announced a “temporary” exit from banking services.

About the closure:

Oxygen has announced that it will be “pausing banking” and will shut down its current accounts. First, as of today, the Total Rewards Program will be discontinued. Effective March 16th, users will no longer be able to deposit money into their Oxygen account. Then, on March 21st, services such as Round Up Spare Change and Save When You Get Money savings features will be discontinued. Finally, on March 29th, all Oxygen accounts will be closed. Any untouched balances remaining after this day will be refunded via check issued by The Bancorp Bank.

What’s next:

The move to “temporarily” halt its banking services comes as Oxygen will apparently pivot toward health solutions. According to a press release, Oxygen Health is set to launch at the end of this month. This platform will seek to “disrupt the intersection of finance and healthcare” with a direct-to-consumer model. As Oxygen explains, the company will partner with alternative and supplemental health plan providers to bring consumers flexible coverage options and transparent pricing. Oxygen Health will be found on the subdomain of the GetOxygen.com site, although the site doesn’t seem to be live just yet.

What they’re saying:

Commenting on the news, Oxygen CEO David Rafalovsky commented, “At Oxygen, we’ve always believed in empowering our community to achieve their financial goals. As the financial landscape undergoes rapid changes, we see an opportunity to redefine our role and deliver even greater value to our customers.”

Elaborating on the ideas for Oxygen Health, Rafalovsky said,”We understand the challenges individuals and businesses face when balancing financial stability with personal well-being, adding, “We want to give our community the freedom to prioritize their financial goals without compromising their health. With Oxygen Health, you’ll have the tools to invest in your future health and fiscal well-being all in one platform.”

My thoughts:

Funny enough, when Point Card sunsetted its Neon debit card, they had a special offer for Oxygen — but, for some reason, the site never allowed me to open an account. I suppose that’s moot now.

As for the news itself, it’s definitely not something I saw coming. Then again, I suppose the name of the company does lend itself well to this apparent pivot. In any case, I definitely look forward to checking out the Oxygen Health site once it’s up and running.

Finally, in terms of whether this is really a “temporary” move as the company’s press release states, I highly doubt we see a return of anything resembling the accounts they currently offer. If anything, I feel like they are employing this language as a means of keeping current customers interested in what they’re doing next. Perhaps I’m wrong but, either way, I’ll be keeping an eye on Oxygen.