Money Management Product Reviews

Lemonade Renters Insurance Overview (2024)

For as long as I’ve written this column, I’ve been a big advocate of renters insurance. Unfortunately, despite my best efforts, it seems the majority of apartment dwellers and the like still don’t carry policies to protect their belongings. Luckily, Lemonade is changing that by flipping the script on the insurance model and making it easier to get a policy.

Let’s take a look at what Lemonade is, how their policies work, and how you can apply for coverage.

- Easy application process

- Provides “replacement cost” policies

- Spouses are covered for free

- Not available in all states

- Exceptions to coverage

How Lemonade Renters Insurance Works and What Makes Them Different

About Lemonade

Lemonade uses technology to make insurance easier (and faster) than you may think of it today. They also offer diverse products including renters, homeowners, car, pet, and term life insurance. The company has a unique business model, with social good built into its core, so they’re quick to point out the inherent conflict of interest that exists in the insurance industry. The way traditional insurance companies profit is by collecting your premiums and hopefully not having to pay out any claims. Obviously this isn’t a simple problem to fix, but Lemonade does have a few ideas.

First of all, instead of holding onto unclaimed funds as profit, Lemonade instead takes a flat fee from premiums paid, uses the rest of the money to pay out claims, and donates any leftover funds to charity via their Giveback program.

In 2017 that leftover cash amounted to $53,174 going to charity while that figure rose to $162,135 in 2018. Amazingly, in 2023, $2,008,847 went to supporting a variety of causes. Additionally, Lemonade is a registered Public Benefit Corporation and a Certified B-Corp.

Although Lemonade once described its business model as peer to peer insurance, it seems they’ve phased out that phrasing. While you can still hear it mentioned in the 2016 “Science Behind Lemonade” video linked on their homepage, it doesn’t show up in many other places. However, in their FAQ, they do still reference peer groups in terms of their Giveback program.

Lemonade insurance policies: what’s covered and what isn’t

As we’ll discuss later, Lemonade does a commendable job of disclosing what its policies cover.

Losses due to the following are covered under Lemonade’s renters insurance policies:

- Fire and smoke

- Wind, lightning, and hail

- Crime and vandalism

- Water/burst pipe

It also covers medical payments to others as well as liability.

However, losses due to the following are not covered:

- Floods

- Earthquakes (although additional coverage is available in California)

- Dog bites from “high-risk breeds”

Additionally, Lemonade notes that their policies do not cover items you lose nor does it apply to the belongings of your roommates — although you can include your spouse in your policy for free or add a “significant other” for an additional fee.

It should also be noted that Lemonade offers replacement cost coverage as opposed to actual cash value. This means that your payout will be equal to the current as-new market value of the items you’re claiming. For example, if you file a claim for an iPhone 14 Plus, your payment will allow you to purchase a new one — but keep in mind that, if you paid $899 for the phone originally but it now sells for $799, your payout will only be for $799 (minus your deductible).

Lemonade premiums

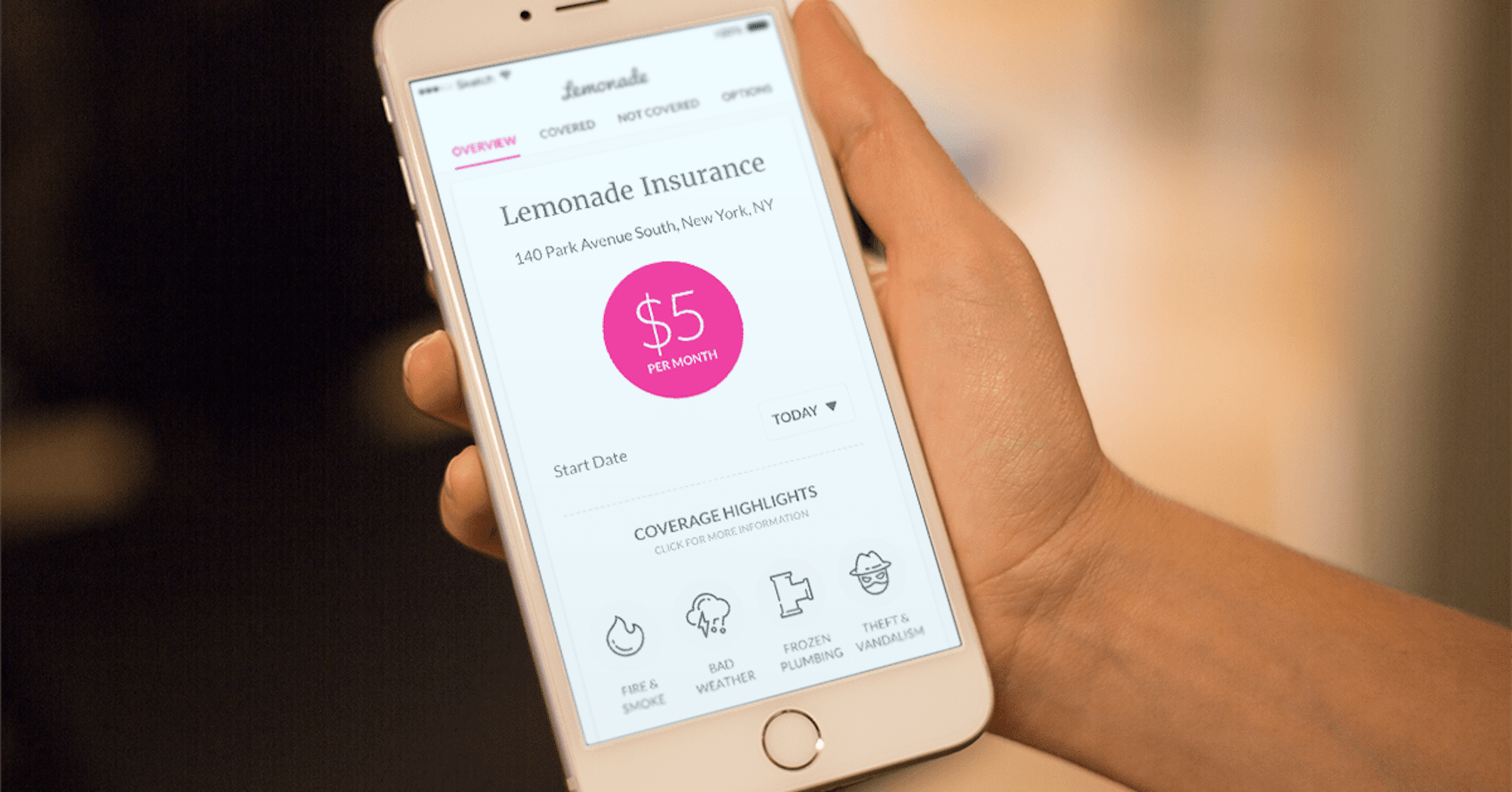

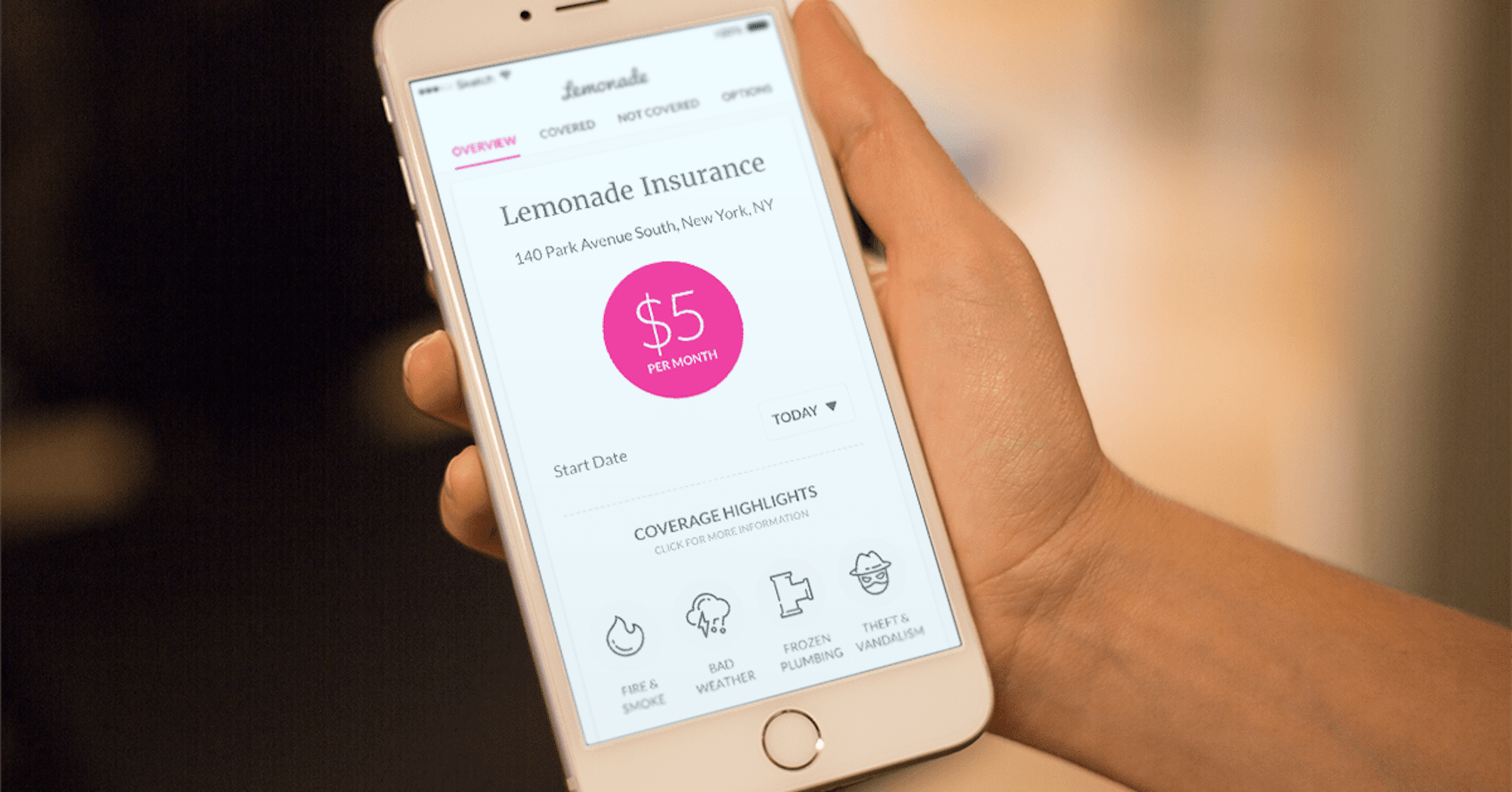

Like any insurance product, your monthly premium with Lemonade will depend on a number of factors, including your location, the amount of coverage you need, and more. However the company notes that renters insurance policies start as low as $5 a month. Meanwhile the company also offers homeowners insurance, with policies starting at $25 a month.

Switching to Lemonade

If you’re already insured and want to switch to Lemonade, the company says they’ll take care of the hassle for you. In their FAQ they write, “If you’re a renter, we’ll simply ask for your current policy number and insurer, and email your provider notifying them of your change in policy. If you’re a homeowner, we’ll notify your lender and handle your escrow payments (if relevant) to switch you over seamlessly to Lemonade.”

Applying for Coverage on Lemonade

Where Lemonade offers coverage

Before we dive into Lemonade’s application process, I should note that their renters insurance coverage is not yet available in all states. However, the company is making its way across the country and has its sights set on being nationwide. If you learn that Lemonade is not yet available in your state, you can enter your e-mail address to get updates from the company.

As of January 2024, the list of states where Lemonade renters insurance is available is: Arizona, Arkansas, California, Colorado, Connecticut, District of Columbia, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Virginia, Washington, and Wisconsin.

The application process

When I initially wrote this article, Lemonade had yet to launch in Missouri. Luckily, that’s no longer the case — so I was able to go through the application process for myself. What I found was a super simple process including an easily customizable quote.

To obtain a quote on Lemonade, all I needed to do was answer a few basic questions, such as where I lived, if I had any roommates, if I had any expensive electronics, etc. Lemonade then used this data to provide me with a basic monthly quote. However, what’s nice is that they clearly label each element of your proposed policy and allow you to make changes. Plus, almost immediately after you edit an element of your policy–like adding more coverage for your personal property– your quote will update to reflect the new price — it’s pretty nifty.

For what it’s worth, Lemonade ended up recommending a plan that cost $18.92 a month (or $215 for a year if paid upfront). This rose to $22 a month if I lowered the deductible from $1,000 to $250. Of course, there were many other options to customize my policy, but that was the starting point.

Coverage options

There are five main Coverage Amounts you can adjust when applying on Lemonade:

- Personal Property

- Portable Electronics

- Personal Liability

- Loss of Use

- Medical Payments to Others

On top of that, you can purchase additional riders for things like:

- Jewelry

- Fine art

- Bikes

- Cameras

- Musical instruments.

Perhaps the most important option you can select when setting up your policy is your deductible. As a reminder, this is the amount you’ll need to pay out of pocket before your coverage will kick in. So, if you make a claim for a covered loss on a $1,000 laptop and have a $500 deductible, your payout will be $500. For the policy I was looking at, Lemonade allowed me to select a deductible as low as $250 and as high as $2,500. Something to note is that lowering the deductible from the highest to the lowest level only increased the premium by a few dollars a month. Therefore you’ll want to carefully consider which option is right for you.

As I mentioned earlier, Lemonade allows you to add a spouse to your policy for free. Meanwhile, if you wish to include a significant other’s belongings in your policy, your premium will likely increase slightly. On a separate note, you can also add a landlord, property manager, or other “interested party” to your policy for free.

Understanding your policy

Continuing the application process, before you actually purchase your policy, Lemonade does a great job of laying out exactly what’s included and what is not. They also provide definitions and examples for each coverage option so you can better understand them. Moreover, the site has an extensive FAQ section where you can get more insight if you have any issues. I was also impressed by how they plainly explain basics like deductibles, replacement cost, and other insurance terms that not everyone might be as familiar with.

That said, it’s important to remember that while renters insurance can help cover a wide range of losses, it won’t cover flooding from the outside. That requires a separate flood insurance policy.

Activating your policy

Once you’re ready to buy, you can click the button under “Activate Your Insurance” to make it official. All you’ll need to do is select what day you’d like your policy to take effect and enter a credit or debit card number for payment. Note that I didn’t actually complete this step but I would presume that doing so would complete your purchase.

Final Thoughts on Lemonade

Overall, I was impressed by Lemonade’s transparent policy purchasing process. On top of that, their business model sounds like one I’d like to support. Of course, while Lemonade is now in my area, I’m no longer renting! That said, I do personally have pet insurance and term life insurance policies with the company, so they’re a brand I’d recommend overall.

The bottom line is that, if you’re looking for renters insurance (and you should be if you don’t have it already), Lemonade could be a great option. Plus, with the company expanding into other categories of coverage, there’s even more reason to check them out and keep an eye on them going forward.