Money Management Product Reviews

Guac App Review: The Pros and Cons of the Automated Savings Tool

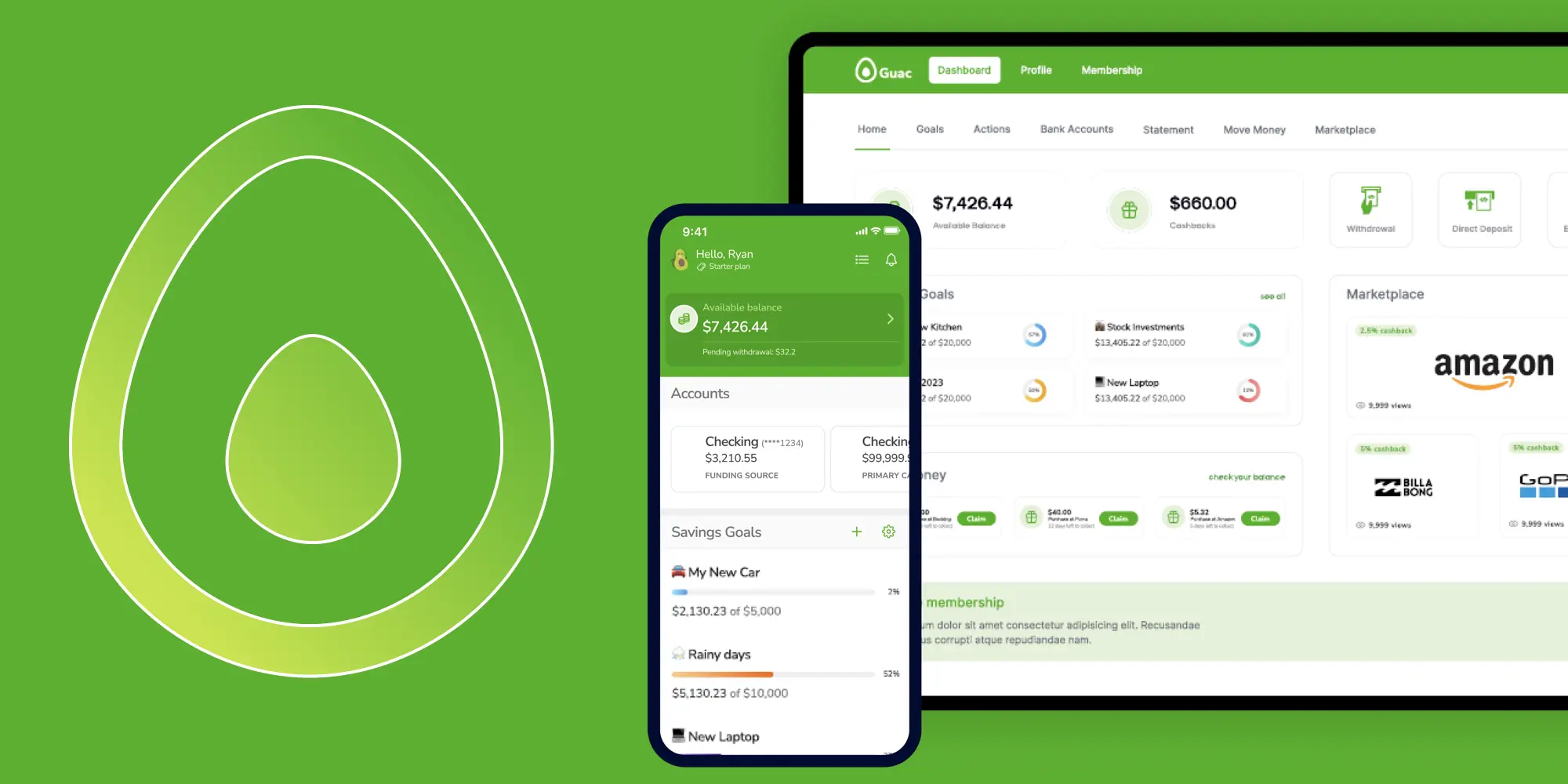

When it comes to managing your finances and making better money moves, automation has been a gamechanger. That’s why we’ve seen a number of apps emerge, each putting their twist on auto-savings and the like. Among these options is Guac — an app that aims to help consumers contribute money toward their savings goals as painlessly as possible.

So, how does Guac work and does it succeed in its mission? Let’s take a closer look at the app.

- Free version available

- Users can create multiple savings goals and painlessly built up funds toward reaching them

- Customization options allow customers to control how much their setting aside with each purchase

- Starter version users can only link one account and cannot make additional deposits toward goals

- Even with the Pro version, customers are limited to linking one funding source and one additional card

- I’ve personally had issues redeeming cashback offers

Guac App Review: The Features, The Cost, and What to Know

Signing up

Getting started with Guac is a pretty simple process. First, you’ll need to enter your name as well as create a username and password for the app. You’ll also need to provide and confirm a phone number, as Guac will utilize SMS for two-factor authentication. With that out of the way, you’ll be able to start creating goals (which we’ll get to in a moment).

By the way, Guac notes that funds on the platform are FDIC-insured up to $250,000 per depositor. Looking at Guac’s page, it states that their partner bank is NBKC. Personally, I’d love for this to be confirmed by the app by displaying an account or at least a routing number in the app.

Plans, pricing, and trial

While Guac has a free option, the functionality of this Starter version is fairly limited. Thus, users may want to consider an upgrade to Guac Pro. This paid version comes at a cost of $1.99 a month. But, luckily, there is a 30-day free trial.

When you activate your free trial, you’ll instantly have access to Guac Pro features. I also appreciate that the app provides a countdown showing how much longer you have left on your free trial and makes the “Cancel Subscription” button super easy to find.

While writing this review, I did find a discrepancy in my free trial, though. In the app, it states that my trial will end on November 29th and adds “After that, your account will revert to the Starter Plan.” Yet, on desktop, I can see the same expiration date, but this time it says “Next payment will automatically occur on 29 Nov 2023.” That’s confusing as I’m unsure whether I will be charged the monthly fee upon expiration or simply be downgraded…

Anyway — we’ll talk more about which features are included with the Starter and Pro versions of Guac as we go through them.

App and desktop

Before we get into the features of Guac, I do want to mention that the platform can be accessed either via mobile app or desktop site. Personally, this is something I love as I enjoy being able to access my account from whatever device I’m currently using. At the same time, anecdotally, I seem to encounter more errors when using the desktop version than the app. Still, I find myself using both — even if the app is probably the preferred option overall.

Goals and autosaving

The premise of Guac is that users can automatically contribute toward various financial goals simply by setting aside a bit of cash every time they spend. To execute this, Guac users will first want to set a savings goal. Some common examples include:

- Rainy day fund

- Down payment on a house

- Travel fund

- New car (or other large purchase)

- Paying down debt

- Etc.

When setting up a goal, users can also state a target amount — although this is optional. Next, they can also select a target date for when they’d like to reach their goal.

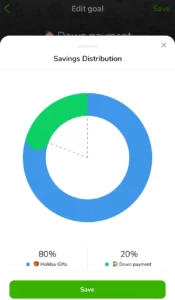

For those who have multiple active goals, you can dictate how you’d like Guac to split the money it pulls into your account. So, for example, if you wanted to prioritize saving for the holiday shopping season but also wanted to continue setting money aside for a down payment on a home, you could potentially have Guac set 80% of your savings aside for your short-term goal and put the remaining 20% toward the long-term one. Users do have the option to toggle various goals on and off or even delete them as well.

Next, once your goals are created, you’ll want to adjust your savings settings. This starts with choosing a Savings Percentage. Guac recommends that customers do at least 10%, but any percentage is possible. This Savings Percentage will dictate how much Guac will transfer based on your purchases. For example, if you have a 10% Savings Percentage and make a $150 purchase, Guac would transfer $15 to your account and split it among your Savings Goals.

On that note, Guac does offer some other options to prevent users from “oversaving.” The first of these options is a Spending Limit. For this, if you set your limit at $300, Guac will basically ignore purchases over this amount and exclude them from triggering savings.

The other failsafe tool is a Daily Savings Limit. Here, you can tell Guac to cap your savings at a certain dollar amount. In this case, if you set your limit at $10 per day, then the $150 purchase referenced earlier would still only result in a $10 transfer to Guac (rather than the $15 your 10% Savings Percentage would otherwise trigger).

Lastly, Guac does note that it won’t pull money from a funding source if the balance is under $70. I’m not exactly sure how this figure was determined, but I’d personally like to see an option where this threshold could be increased. That said, I think the other options Guac has in place should help users avoid issues.

All things considered, I think this basic aspect of Guac works pretty well. And while it’d be nice to see additional customization options for Savings Rules, I honestly can’t think of any specific suggestions at the moment. Thus, this core aspect of Guac gets a thumbs up from me.

Account linking and transfer

Something important that I purposely excluded from the above section is how Guac monitors transactions and where it pulls savings from — so let’s answer that now.

First, like many apps, Guac utilizes Plaid to securely connect external accounts. To get started, customers will need to link a funding source, such as a checking account. Notably, you can only connect one funding source at a time. Furthermore, you’ll seemingly need to contact support if you want to change it out.

To be clear, your funding source is not only where the money Guac automatically sets aside will be pulled from but is also the account that the app will monitor for purchases. So, what happens if you typically use a different credit or debit card for purchases? Well, then you’ll need to upgrade to Guac Pro in order to link one of these cards.

With Guac Pro, you’ll then be able to link a credit or debit card and monitor that account for transactions. Again, this linking is done via Plaid. Unfortunately, even with a Pro subscription, users are limited to one funding source and one additional card. For someone like me who has half a dozen credit cards, this is obviously a drawback. On the bright side, swapping out your primary card does appear to be an easier process than changing your funding source.

By the way, when you do link a card, although Guac will use the purchase data to determine how much to set aside, the fund will actually come from your funding source (not charged to your card). That may seem obvious, but it’s important to point out nonetheless.

One thing I have noticed is that transfers to Guac do seem to be fairly slow. This is actually born out in the details, where I can see that the processing date for a transaction is 11/15, yet the funds won’t be available until 11/20. To be fair, that’s actually a pretty typical timeline, but does feel sluggish here. The good news is that it shouldn’t make too much of a difference since you’ll likely want to be “saving in the background” anyway.

“Direct deposit”

Another feature exclusive to Pro is “direct deposit.” I put that in quotes because, in most cases, direct deposits refer to having payroll checks automatically deposited into your banking account. In this case, however, it simply means the ability to add extra funds to your Goal. Yes, with the free account, the only way to grow your goal savings is by triggering autosavings via purchases in your linked account. If you want to throw some “found money” in there to help boost your balance — well, you’ll need Pro for that.

As you can probably sense from my tone, I think that it’s a bit ridiculous to keep this feature behind a paywall. But, hey, it ain’t up to me.

Withdrawals

In the event that you need to withdraw money and send it back to your funding source, Guac does make it fairly easy to do so. By going to the Move Money tab and then selecting “Goal to Bank,” customers can select how much they’d like to transfer. From there, they can opt for a Standard transfer that will take three business days (“bussines day” as the app calls them). Alternatively, they can select Rapid transfer, which cuts that down to 1 “bussines day.” For Rapid, the minimum withdrawal amount is $5. There’s also a 1.5% fee, with a maximum fee of $15. Something that is nice is that, as a Pro user, there’s no fee for rapid withdrawals.

Cashback marketplace

If you’re looking to boost your savings goals by earning some easy money, then Guac’s Cashback Marketplace is meant to help you do that. Here, you’ll find cashback offers from a number of popular online retailers — including select Amazon categories. There are also some key travel companies, including Southwest, Alaska Airlines, Marriott Bonvoy, and more. Heck, even Carvana is on there — which, if you really can earn 2.5% back on the purchase of a car, could amount to quite a significant amount of cashback.

Although the line-up of cashback offers has some winners, unfortunately, I’ve had a hard time in my attempts to earn cashback through the platform. First, I noticed Walmart was an option, so I decided to try to purchase a Starbucks gift card via Walmart.com. Granted, I figured this would be ineligible — but the Guac app doesn’t have any list of restrictions or other notes. What’s more, oddly, I can see the $15 purchase under Cashback & Rewards > Transaction History in the app but don’t see any mention of it on desktop. Alas, there’s no other information beyond this and no cashback from the transaction.

After this, I then tried to make a purchase from Maud’s (a coffee pods company I’ve tried during stays at Hotel Vandivort). For this purchase, I used the link on the desktop site and completed my transaction. I even used the credit card that’s attached to Guac just in case. Despite this, cashback again alludes me — and, this time, my Maud’s purchase doesn’t even show under Transaction History.

I’m not exactly sure what I’m doing wrong but, even if it is my fault, I feel there are some things Guac could do to improve this experience. For example, Rakuten lists additional information and restrictions for its merchant offers, which is helpful to know before trying to make a purchase. Additionally, it’d be great if there was some way to know whether you’d properly activated an offer and were then able to track the status. Instead, I’m left sans reward while wondering what happened.

Something I haven’t yet tried is earning cashback via the Amazon categories featured. However, looking at Guac’s FAQ, it seems as though requesting this cashback requires users to snap a screenshot of their order and submit it to Guac. I imagine that this is because the app is manually paying out cashback they earn from being an Amazon affiliate — but that’s just a guess. Either way, it seems a little more complicated than the other offers (or at least to how the other offers should work).

Final Thoughts on Guac

Overall, the concept of Guac is solid as it makes it easy for consumers to set money aside as well as boost those savings by earning cashback. Unfortunately, this concept is held back by some key limitations imposed by the platform. First and foremost, as a free user, customers can only use their checking account to trigger autosavings. I suppose this is fine enough for those who use a debit card for most purchases but those who prefer credit cards will need to upgrade to the Pro plan. Even then, the app only allows for one funding source plus one card. While there is technically a workaround in which users could have their credit card payments pull from checking account and (assuming their spending limit is set high enough) have those transactions trigger autosaving, that kind of defeats the trickle-saving nature of the app.

On top of that, I feel as though the app could use a bit of a polish. While the app mostly looks good, I’ve found that the navigation and steps required to perform certain tasks can be a bit clunky. Speaking of clunky, the need to submit screenshots of your Amazon order to claim cashback is a bit strange — and I won’t even rehash my issues with trying to earn cashback.

All of this might make it sound as though I don’t like Guac, which isn’t really the case. Instead, I see it as an app that could benefit greatly from a few tweaks and upgrades. With some app improvements, support for more transaction sources, and perhaps some expanded savings options, Guac could be worth the $1.99 monthly fee for Pro. In the meantime, the free version may be worth it if you can fit into the app’s constraints.

Per FTC guidelines, this website may be compensated by companies mentioned through advertising, affiliate programs or otherwise. (Note: advertising relationships do not have any influence on editorial content. Advertising compensation allows Fioney to provide quality content for free. All editorial opinions are those of the individual author and/or Fioney.)