Money Management Product Reviews

Greenlight Level Up Review: A Free Financial Literacy Game

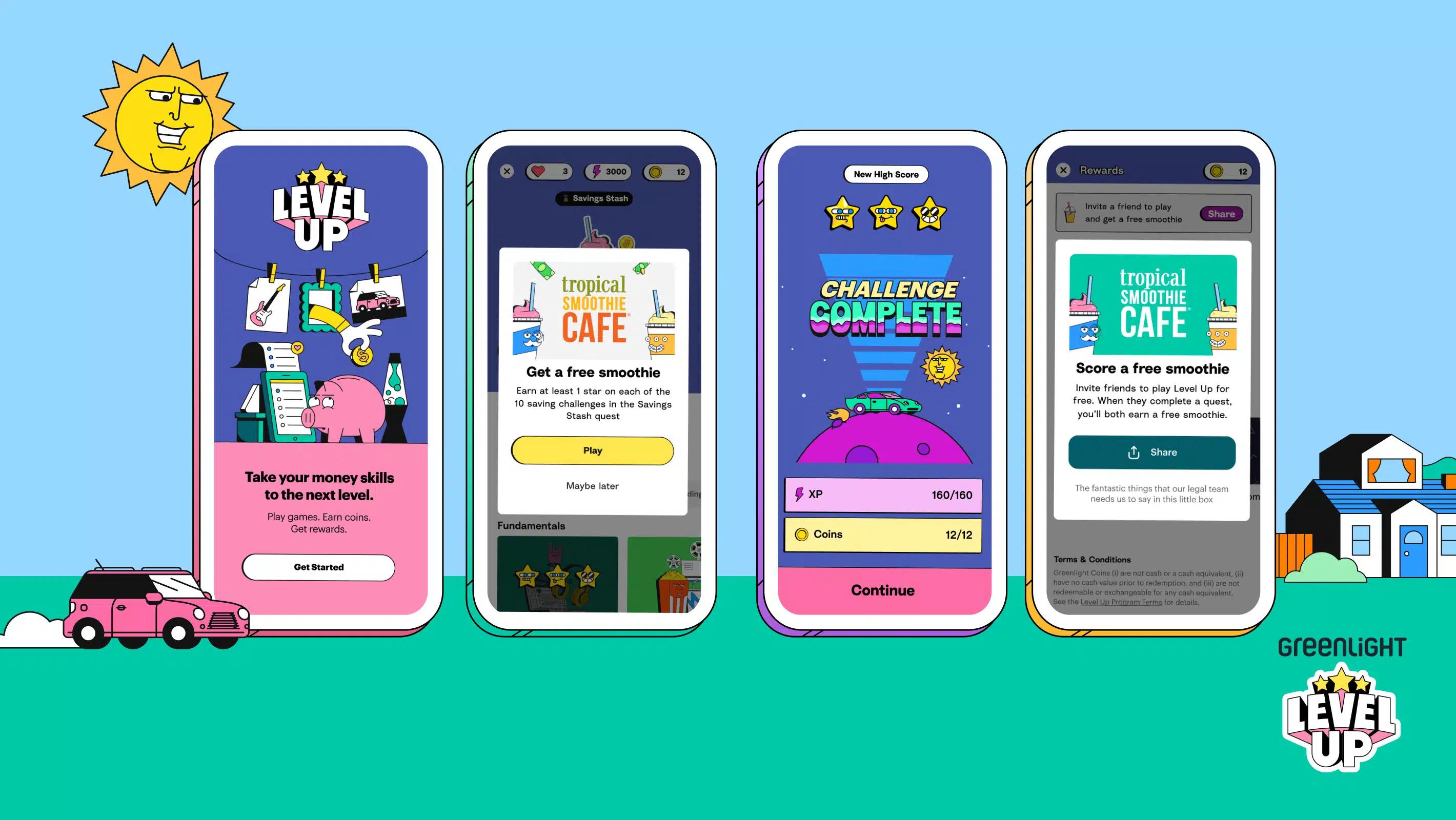

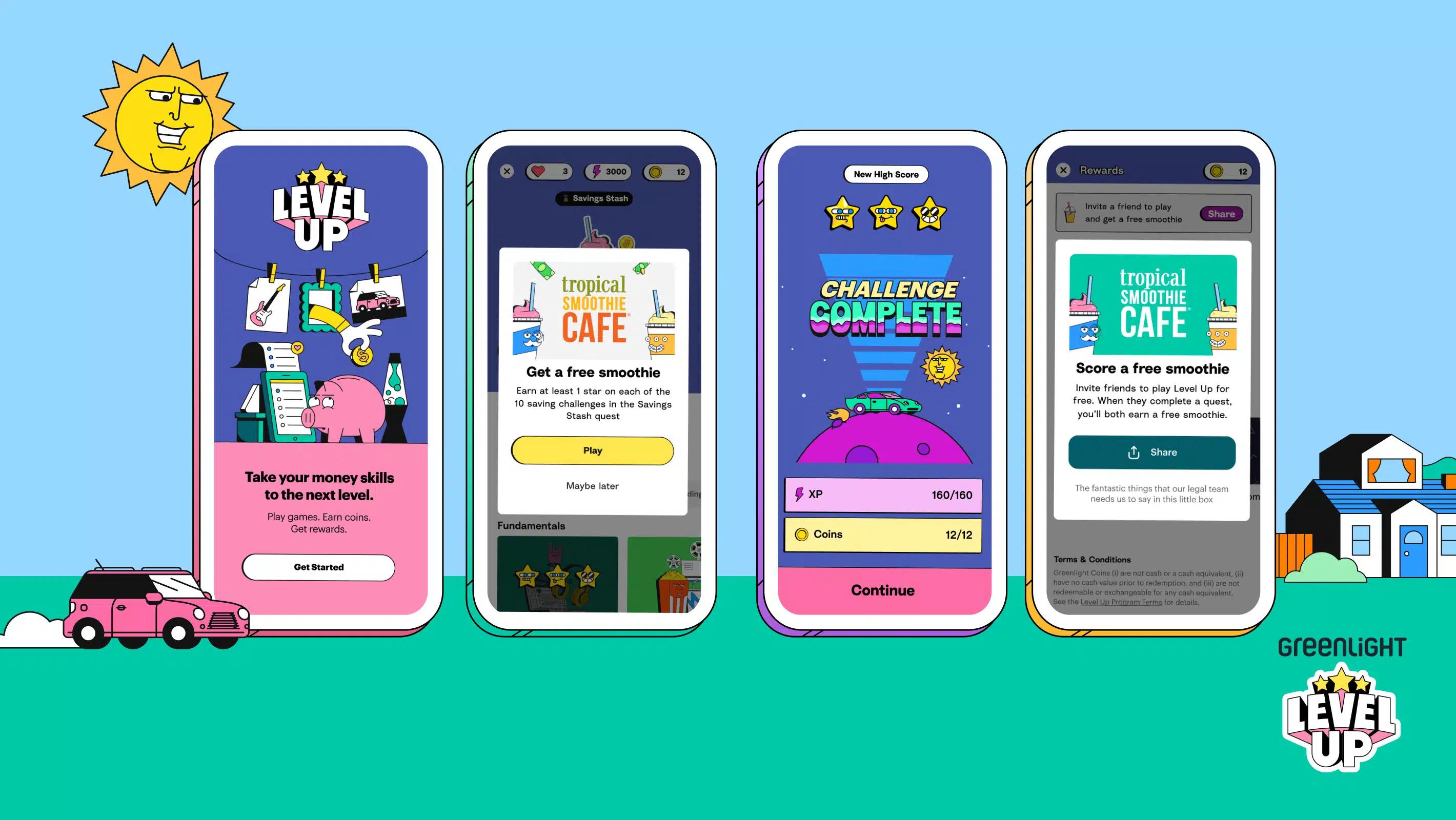

Despite personal finance being an important topic for those of all ages, few schools make it a part of their curriculum. In this absesnse, several companies and institutions have offered their own ways for children, teens, and adults to gain financial literacy. Among those looking to lend some assistance is Greenlight, which now offers a free financial learning game called Level Up. Even better, the company recently announced a partnership with Tropical Smoothie Cafe that will further reward players (in fact, this promotion is what brought the app to my attention).

So what is Level Up and can it help improve financial literacy? Let’s take a closer look at the game and my experience with it.

- The app is free

- Lessons range from basic to intermediate

- Offers customization by redeeming digital (earned) tokens

- Free version has limited levels

- A Greenlight pop up may appear during gameplay (but only once)

Level Up: What the Financial Literacy Game Has to Offer

Signing up and finding the game

Level Up is a game that can be found in the Greenlight app. Although Greenlight itself is a paid account, access to Level Up is free. By the way, this is apparently a basic version of the game Greenlight offers via partnerships with various banks and credit unions. For the purposes of this review, I’ll be focusing just on the app version of Level Up.

As for how to sign up for the game, well, you don’t really have to! Instead, once you tap the game, you’ll be ready to go. Luckily, though, the app should save your progress so you can return to the game and pick up where you left off.

Once you download the Greenlight app, look below the Get Started and Sign In buttons — there should be a Level Up icon just above the app version number.

Topics

The lessons of Level Up are divided into three main categories: Spending, Saving, and Investing.

Some of the lessons in the first 10 challenges include:

- Where to save your money

- Emergency funds

- Setting S.M.A.R.T. money goals

- Savings attitudes

Meanwhile, some later lessons cover wants versus needs, financial assets (CDs, stocks, bonds, real estate, etc.), capital gains, and more. Heck, there’s even a lesson on the role of regulators!

Overall, I thought these lessons were well laid out, touching on certain topics multiple times without being redundant. The videos are also well made and varied enough that they don’t get boring. Sure, there are a few instances where it’s clear that they’re trying to use hip lingo (that likely won’t be cool anymore in the near future, if not already), but the core content itself doesn’t speak down to its audience, which I think is great.

The format of challenges

Each lesson begins with a short, animated video that explains the topic (as I alluded to above). Then, players will answer a series of questions related to the matter at hand. In some cases, these will be quiz-style questions that emphasize the topic. But, in other cases, they may be more akin to poll questions, basically just asking for your opinion on something.

I will say that more than once, I was surprised by how difficult some of the questions could be. For example, while one video briefly mentioned the FDIC limit, I’d be impressed if kids managed to remember it off-hand when the quiz question arrived. Moreover, some of the questions require some decent math — and some were intentionally tricky. I’m not too proud to admit that this did mean that I missed half a dozen or so questions while playing.

That said, overall, I thought the questions asked were relevant to the topic and did a good job of engaging players. If you’re paying attention, you’ll probably get three stars on most challenges. But, I’ll warn you not to get too comfortable as the game can throw a curveball every once in a while.

Customization (redeeming coins)

As you make your way through Level Up, you may wish to customize it by choosing a new theme. To do this, you’ll need to cash in the Coins you earn from completing challenges.

By tapping the Coins icon, I could look through different Game Modes and use coins to “buy” them. That’s how I managed to turn on “Matix” mode. I chose this one because it reminded me a bit of TRON — or, in an even more esoteric reference, the original look for Robinhood crypto.

The Tropical Smoothie Cafe offer

Finally, let’s talk about the deal that brought Level Up to my attention in the first place. Now, players who complete 10 Level Up challenges with at least 1 Star can earn a coupon for a free kids-sized (12 ounces) smoothie at Tropical Smoothie Cafe. The current offer is valid through March 31st, 2024.

Once I completed my 10 lessons, the coupon popped up right away. From there, I was invited to save a photo with the code. You can also access your coupon by tapping the Coin icon and then going to My Rewards.

To redeem, parents will apparently need to create a Tropical Rewards account and then use the code to claim the free kids smoothie. According to the terms, this reward must be used within 14 days (presumably, this means 14 days from when the code is redeemed via Tropical Rewards.

As I noted, it seems as though this current offer is set to expire later this month — but I hope it (or something like it) continues on afterward.

My Experience Trying Greenlight’s Level Up

The material and challenges

Like I said earlier, I think that the lessons in Level Up are pretty solid. Not only does the app cover the basics in a way that still makes them engaging but also goes way more into the world of investing than I might have expected from a youth-centric game like this. As a result, all I really have are nitpicks.

For one, I did notice that, in some lessons, terms would be used without much explanation. For example, one investing lesson casually mentioned “expense ratio.” However, a couple of challenges later, there was actually a whole lesson dedicated to the topic, which I was happy to see. The only other example I can think of was the use of “time horizon,” although I trust that there’s enough context that players will be able to pick up on what this means even if they might not have heard the term specifically.

Other than that, I thought Level Up’s lessons were well arranged, with the basics and “intermediate” lessons flowing nicely into each other.

Music and sound

Since each Level Up lesson does start with a video, I often decided to play the game with the sound on (sidenote: the videos are captioned so you can play quietly if you prefer). That’s how I know that, while you complete the quiz parts of the game, there’s a music soundtrack, that I think would be described as Lo-Fi. Although the music itself wasn’t too distracting, what was a bit odd was how, after answering a couple of questions, the music would seemingly get louder. I’d say that maybe I’m crazy… but this happened every single time!

The good news is that, as I mentioned, you can play with the sound off and still be fine, but I do wonder what glitch is causing this audio error.

Pop-up

One thing I encountered while playing Level Up that I thought was a bit weird was when I was served a pop-up advertising Greenlight’s debit card account. This even ended with the line, “Text your parents to let them know” and included an “Ask them now” button.

I get that Greenlight wants a way to monetize this program and turn free Level Up players into paid customers, but I’m not sure this is the best way to do that. Then again, I vividly remember an ad campaign for Nickelodeon Magazine that revolved around kids trying to get their parents to buy them a subscription — so I suppose this tactic isn’t exactly unique.

Kill screen?

In retro video games, there’s a concept known as a “kill screen.” Perhaps you’ve heard this phrase if you’ve even seen the documentary The King of Kong. Anyway, the idea is that, at a certain point, the game forces players to stop by forcing a random death or basically just freezing up.

That may or may not be what happened to me while playing Level Up. After completing several lessons, I seemingly reached the end. But, rather than being greeted with a congratulatory screen, there was just a circle and two lines hanging out in the upper left corner of the screen. While this is there, I can still access the Coins interface and even select past lessons below — yet, there doesn’t seem to be a way to continue with new challenges.

I don’t know if this is really the end of the current batch of content, but it wasn’t exactly the conclusion I expected.

Final Thoughts on Greenlight Level Up Game

Overall, I think Greenlight’s Level Up does a great job of laying a financial literacy foundation while making the material engaging. I was also impressed that the quiz sections weren’t just a cake walk but, instead, included some challenging questions to keep players on their toes. On top of that, while I’m not sure how long this smoothie promotion will last, I think it’s awesome to give users further incentive to explore the game.

As for what age I think Level Up would be right for, my initial thought is tweens. While there’s nothing overtly inappropriate for younger kids, I’d probably stick to the first few lessons for them as the more specific lessons and those on investing may be a bit more challenging for them. Meanwhile, for older teens, I might skip ahead a few rounds.

I do wish that Greenlight would make Level Up its own app rather than burying it in its banking app. While I appreciate that it’s free, it doesn’t really get as much shine as it deserves when it’s shoved down in the bottom of the screen. Of course, in truth, it’s more likely that this version of the game is just a proof of concept so that Greenlight can continue selling it to institutions that might then supply it to their customers.

Setting all of that aside, if your kid, tween, or teen is looking for a fun personal finance resource, I think Greenlight Level Up could be a great place to start.