FinTech News

Galileo Introduces Post-Purchase BNPL Solution for Banks

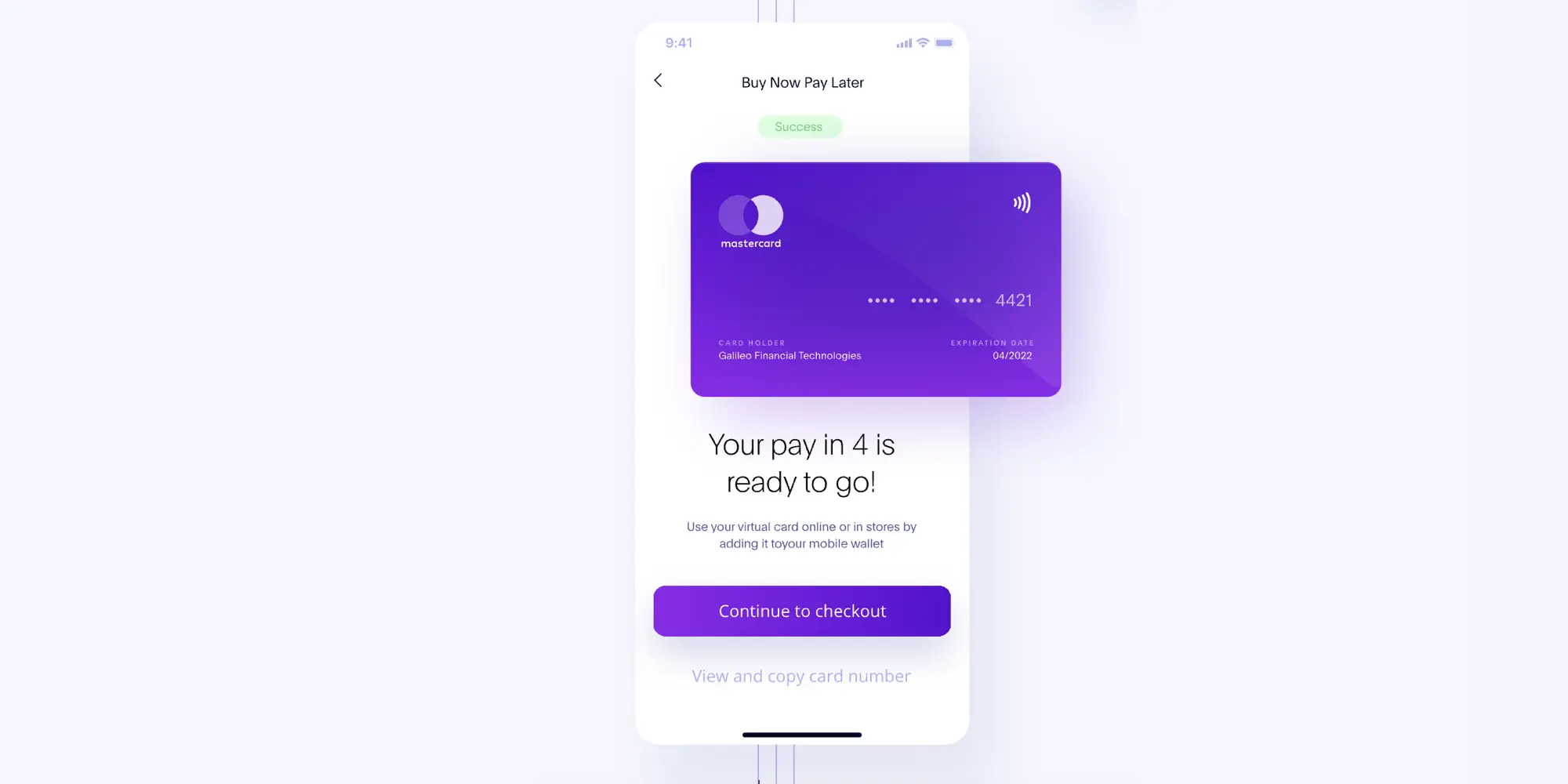

Galileo is bringing new purchase financing options to a variety of card customers.

About the feature:

The FinTech Galileo (which is owned by SoFi) has announced an expansion of its “buy now, pay later” platform. Now, banks and fellow FinTechs can enable a post-purchase installment plan option for debit and credit cardholders. This joins a more traditional pre-purchase BNPL feature. These options are now available via an API.

According to Galileo, this feature will allow institutions to add value to their card products while also increasing revenue via installment fees. They also note that their BNPL solutions include flexible and transparent financing for customers. This type of feature is new to the debit space after previously being exclusive to credit products.

Looking at Galileo’s FAQ, customers wishing to use this new feature will first make a purchase with their eligible credit or debit card. Then, once transactions are settled, they can elect to convert them to a BNPL payment plan. Of note, customers will only be able to select up to five transactions to enroll at a time. As part of the process, Galileo will also confirm that the transactions are not already part of any existing loans.

What they’re saying:

Announcing the new feature, Galileo’s chief product officer David Feuer said, “This new offering bridges the gap between cards and loans and allows banks and fintechs to establish and deepen customer relationships with innovative, flexible financing options for both credit and debit customers. By expanding pay over time opportunities, post-purchase financing is ushering in a new era of responsible lending.” Feuer continued, “Enhancing the accessibility of payment options is a fundamental aspect of our commitment to promoting financial inclusion. With that in mind, one of the major perks of the post-purchase BNPL offering is that it works across all merchants where credit and debit cards are accepted today.”

My thoughts:

Even though I’m not a big fan of the “buy now, pay later” model in general, this post-purchase feature is intriguing. Although some existing credit products do offer options that are slightly similar, as the company points out, this is novel for debit cards. Because of this, I expect to see tech-forward banks and FinTechs integrating this feature in the near future.

As for whether this will actually be a good option for consumers, that will depend on the fees associated with purchases. Therefore, while I remain skeptical overall, I’ll defer judgment until programs powered by this Galileo feature do roll out.