FinTech News

FinTech Deals Decline Amid COVID-19 Outbreak

With the COVID-19 pandemic not only delivering a public health emergency but also crippling the global economy, it should come as no surprise that new investments from venture capital are down as well. According to the latest report from CB Insights, the number of FinTech deals globally year over year was nearly cut in half. Moreover the number of deals in March fell to just 142 compared to 196 in February and 218 in January. Although the latest figures can likely be at least partially attributed to the COVID-19 pandemic and its economic impacts, it’s worth noting that the number of deals has now seen an eight-month downward trend. Meanwhile, in the past 15 months, the high was set in January 2019 when 295 deals were completed.

In terms of dollars, deals made in the first quarter of 2020 are likely to total around $6 billion. Although that might sound like a lot, that would actually account for the worst quarter since 2017. For comparison Q4 2019 saw $11 billion in deals, adding to what turned out to be a near-record year — “near-record” in that it would have been a new high if the $14 billion raised by Ant Financial alone in 2018 were excluded from that year’s total.

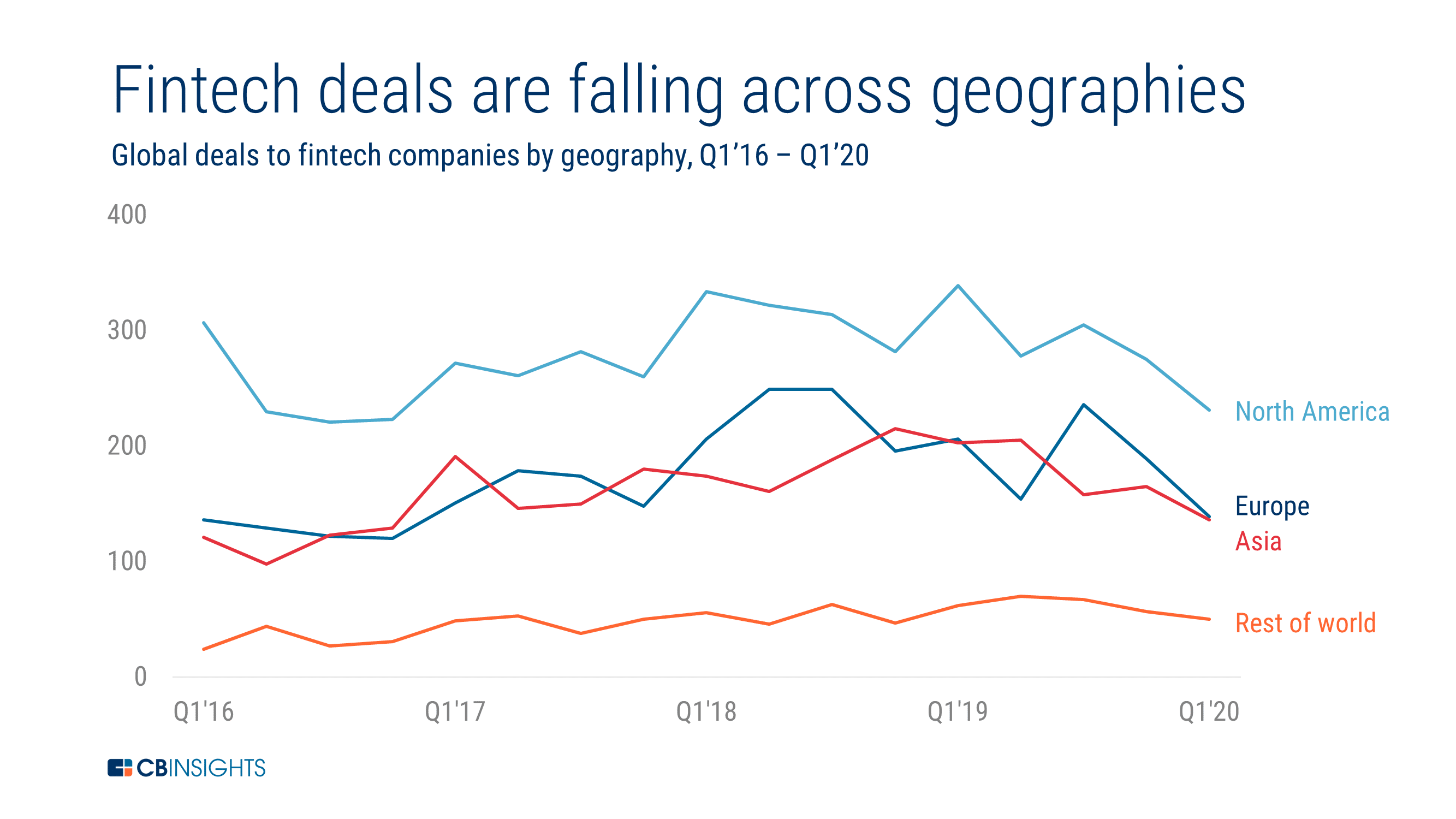

Also notable is that the recent decline has been global. North America, Asia, and Europe all saw their number of deals fall to multi-year lows. This would further support the case that these drops are likely tied to the coronavirus outbreak, which has impacted several regions and countries around the world.

Even though the frequency of deals is on a downswing, that doesn’t mean that they’ve stopped entirely. In fact, just last week the Utah-based free financial planning site Savology announced that it had raised $750,000 in seed funding. Additionally the service Plastiq, which allows individuals and small businesses to use credit cards in atypical ways, closed an impressive Series C in which they raised $27 million. Also notable are the $20 million Series A mobile banking app Empower saw last month as well as the Lendio’s $55 million Series E closed in February.

Obviously the pullback on FinTech investment is far from the most pressing issue facing the world as we work to control the current pandemic. That said it will be interesting to see how firms operate and innovate under the current conditions. It should also be mentioned that FinTechs are also playing a role in helping people manage their finances during these turbulent times. Moreover leaders like Square’s Jack Dorsey have pressed the government on letting them leverage their services to assist with the distribution of stimulus funds. Therefore, while the industry may be hurting just like the rest of us at this time, there’s plenty of reasons to think that it will come back stronger than ever once we reach the other side of this crisis.