FinTech News

FinTech Financial Planner Savology Closes Oversubscribed Seed Round

Once again it seems that the current pandemic hasn’t stopped some FinTechs from seeking investments and growing their reach. This week the Utah-based Savology announced that it had raised $750,000 in seed funding. The oversubscribed round included participation from MassMutual Intermountain West CEO Brady Murray, RevRoad CEO Derrin Hill, Ascend Finance co-founder/CEO Ben Tejes, and PROFi founder/CEO Bruce Miller. With the funds, Savology hopes to expand their free financial planning platform and hopes to bring its userbase up from 10,000 to 100,000 this year.

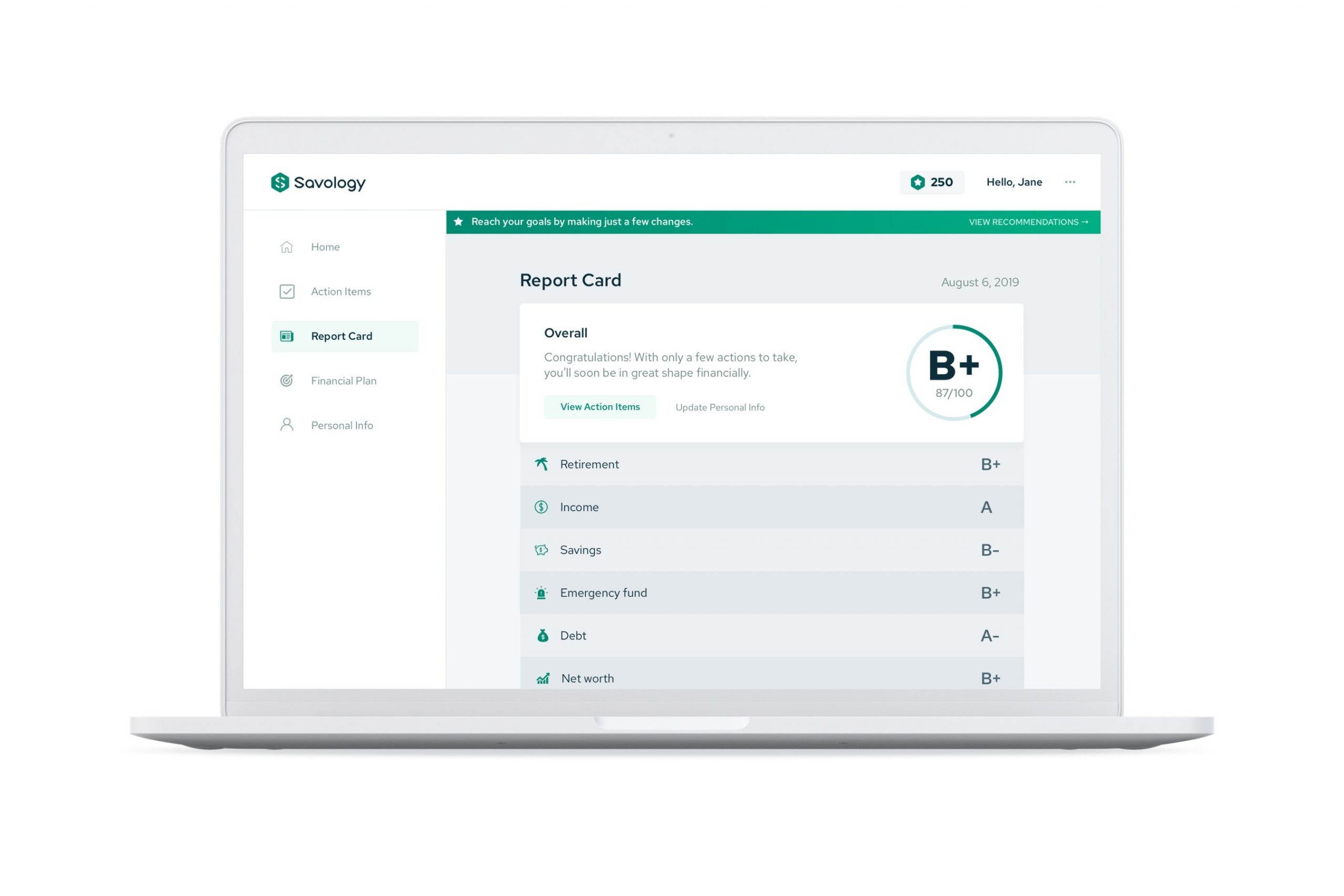

With Savology, individuals and couples can see where their finances stand in comparison to their peers and receive a list of next steps they can take. To do this, users will answer a series of questions about their income, savings, assets, insurances, etc. Then the service will compile this data to offer feedback on what goals individuals might consider setting.

As part of the financial plans it presents, the Savology platform might also suggest services from their various partners. Currently the company notes that these partners include insurance outlets like MassMutual and The Zebra; lending marketplaces such as Credible; and investment/robo-advisors like Acorns, M1 Finance, and Betterment. Additionally other brands listed under their “Providers” tab include Ally, Credit Karma, Self, YNAB, and more.

In a press release about the seed round funding, Savology founder and CEO Spencer Barclay expressed excitement for the investments, stating, “We are grateful to the early investors and partners who believe in our mission and make it possible for us to elevate Savology to new levels.” He added, “We know that we have an incredible amount of work ahead of us, but we are up for the challenge to help millions of households achieve financial security.” Brady Murray who led the round also remarked on Savology’s hopeful impact, noting, “Savology has the potential to fundamentally change the direction of personal finances in America. I look forward to seeing the positive impact that Savology will have on both households and the broader industry as they improve access to financial planning and other financial services.”

From an outside perspective, Savology’s funding comes at both the best and worst possible time. On the one hand, while finances are certainly on the mind of many Americans, it’s unclear if most will be ready to focus on the long-term strategies that Savolgy offers just yet. That said, once the current crisis is over, it stands to reason that some might be seeking advice on how to prepare for future emergencies. With that, whenever individuals and families want to take a closer look at their finances and set better plans for tomorrow, Savology will be there.