FinTech News

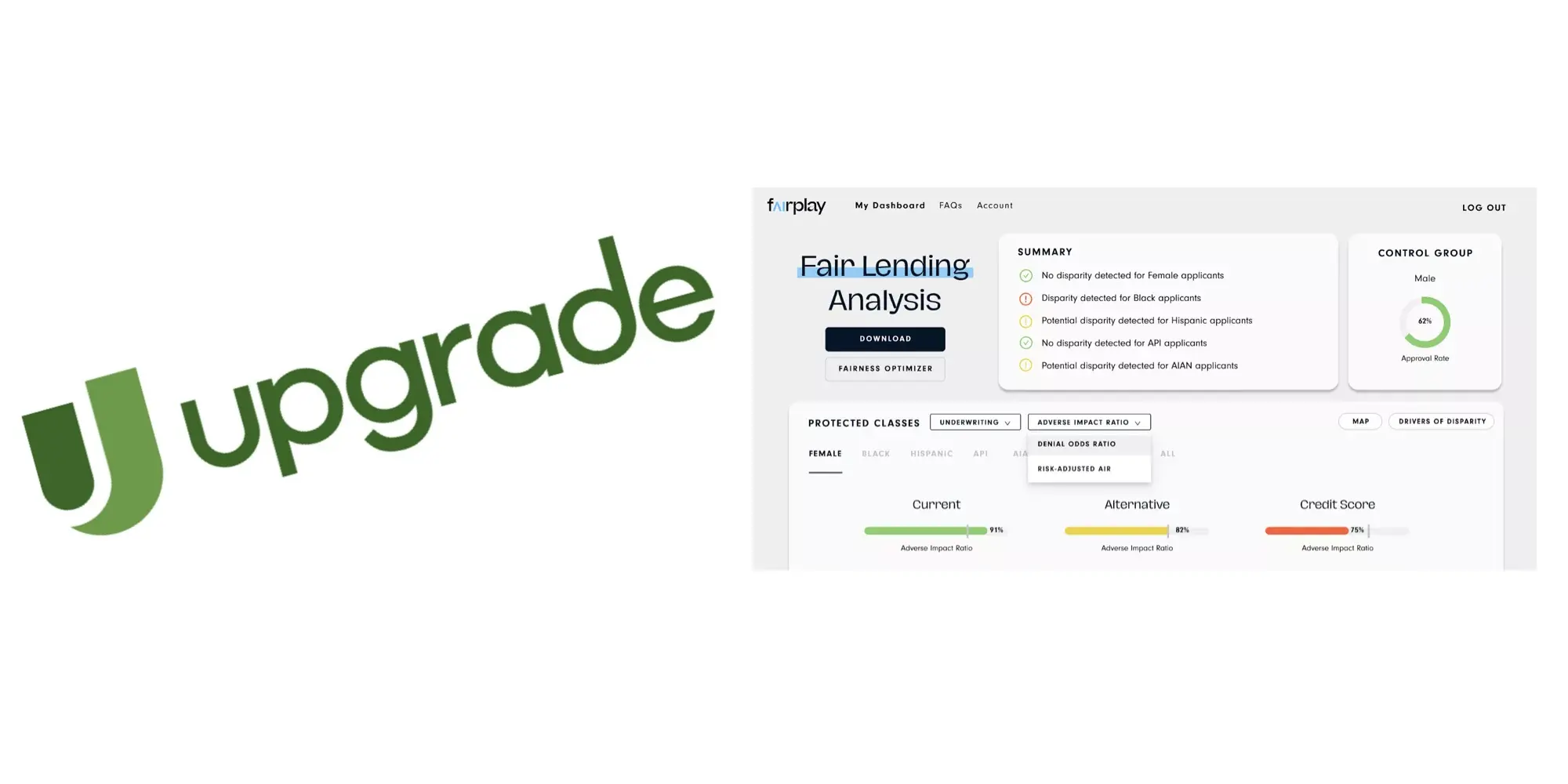

FairPlay Announces Partnership with Upgrade

The FinTech Upgrade will be working with another startup in a bid to make its lending practices more fair.

About the partnership and about FairPlay:

This week, FairPlay and Upgrade announced a new partnership. As a result, Upgrade will implement FairPlay solutions. In doing so, the company is looking to monitor and improve the fairness of the site’s underwriting — which is also expected to result in more “positive outcomes” for customers.

Billing itself as a “Fairness-as-a-Service” company, FairPlay offers real-time fairness testing solutions that are customizable to the needs of lenders. This also includes tools for helping companies keep up to date with regulatory requirements and reduce risk. To do this, the platform leverages AI (which is highlighted in the company’s logo). Currently, the company has partnerships with other FinTechs such as Happy Money, Figure, Octane, and Splash.

Since its founding in 2020, FairPlay has raised a total of $14.5 million in investments. This includes a seed round in 2021 and a Series A in 2022.

What they’re saying:

Commenting on the company’s embrace of the FairPlay platform, Upgrade’s Chief Risk and Compliance Officer Thomas Curran stated, “In an environment where rapid adjustments in credit strategy are necessary, we’re eager to bolster our ability to assess the fairness of data sources and models in real-time and perspectively. FairPlay provides compliance efficiency as a competitive advantage—and we are thrilled to embed its Fairness-as-as-Service solutions at Upgrade.”

Meanwhile, FairPlay founder and CEO Kareem Saleh said of working with Upgrade, “Lenders are most effective when their fairness compliance is rigorous and fast. Upgrade has consistently captured opportunities presented by machine learning, and automation and is consequently diligent about their fair lending compliance.” Saleh added, “FairPlay is thrilled to work with Upgrade to continue to improve its lending practices.”

My thoughts:

While I can’t pretend to understand all of the algorithms and elements that go into underwriting decisions, I think that adding “fairness” as a consideration makes sense for several reasons. In fact, improving fairness is one of the top possibilities that the “FinTech revolution” promised. Therefore, it’s great to see major players like Upgrade putting even more of an emphasis on it.

Of course, as I alluded to, it’s difficult to know exactly what types of changes this partnership will bring or what differences customers might notice. On that note, I’m hoping we get some follow-up reports from both companies that highlight what’s being done and how the partnership has benefitted borrowers.