Money Management Product Reviews

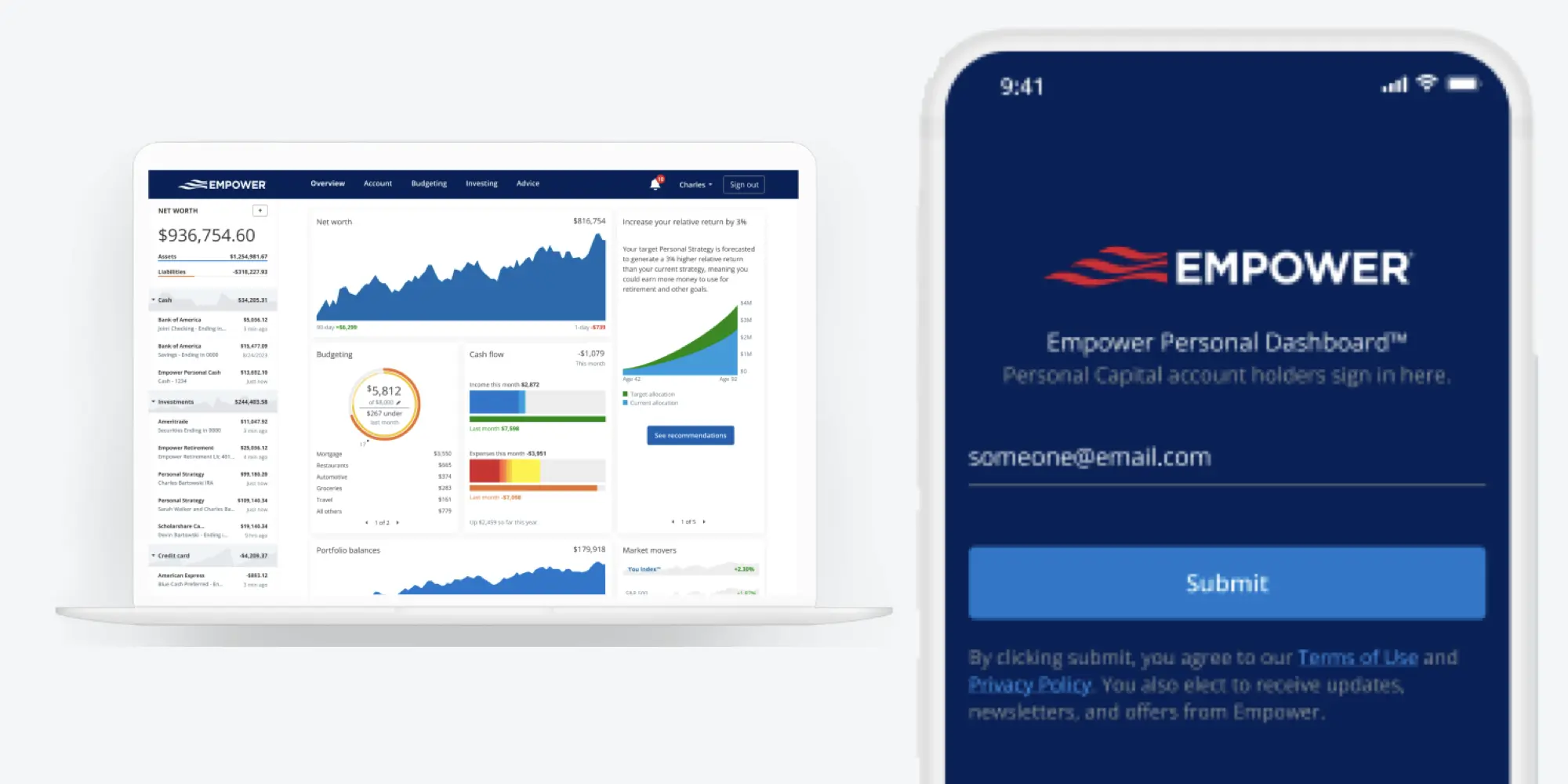

Empower Personal Dashboard Review

A few years ago, my wife and I opened a new chapter in our financial journey as we resolved to make 2019 the year we learned more about investing. Whether I was reading books on the subject or exploring other blogs for advice, there was one recommendation I came across again and again: Personal Capital — which is now part of Empower and is known as the Empower Personal Dashboard. Finally, in conjunction with me opening my first “real” brokerage account, I also set up an Empower Personal Dashboard account for myself. In doing so, I finally understand why so many of my fellow bloggers utilize this tool to track their financial lives.

So what makes Empower’s free tools so great? And is it still something I’d recommend following its rebrand? Let’s take a look at what the platform has to offer.

Setting Up Your Empower Personal Dashboard Account

About Empower Personal Dashboard [Personal Capital]

I should probably mention that, unlike many personal finance apps, Personal Capital is actually a wealth management and investment services firm that just so happens to offer some free tools. Because of this, you may see mentions of their other services as you explore the site. But have no fear as everything I’ll be covering today really is free to use regardless of whether or not you use their other services (I don’t).

In 2020, Personal Capital was acquired by Empower Retirement for $1 billion. Then, in 2023, it was announced that the Personal Capital name would be phased out and the platform would be known as the Empower Personal Dashboard. As a result, customers can now find and sign up for the service on Empower.com.

Creating an account

Signing up for Empower Personal Dashboard is a relatively painless process. To create an account, you’ll provide an email address, create a password, and offer a phone number, which they say will be used to “verify new devices for security purposes.” After that you’ll also be asked for some basic info such as your name and age. With that complete, you’ll be ready to start linking your accounts and using Empower’s free tools.

Linking accounts

To get the full benefits of what the Empower Personal Dashboard offers, you’ll want to connect as many of your bank accounts, brokerage accounts, and other financial accounts as you can. To do this, you’ll be asked to log into each of the accounts you’d like to link. In most cases, you’ll likely also be required to enter a registered email address or phone number and enter a code sent to you so that your account provider can confirm it’s really you requesting to login.

Anyone who’s ever tried to link multiple bank accounts to apps knows that going through all of the steps one at a time can be time-consuming. That’s why I really appreciated that Personal Capital allowed me to add an account by logging into it but then moving the account to the sidebar for you to complete the two-factor authentication.

Unfortunately, Empower seems to have changed its system since I first linked my accounts. Now, for many of the accounts I needed to link, it opened a new page with that account provider’s website. This process also seemed far slower than I remember, but hopefully that was just bad timing.Like other apps that utilize account linking, there will undoubtedly be times when you need to reconnect these accounts. Moreover, there are some institutions that seem to be needier than others, such as my Aspiration account requiring me to enter a text code pretty much anytime I log into Empower. Once again, thanks to Empower Personal Dashboard’s layout, these reauthorizations are far less annoying than they are in some other apps and in my experience don’t present too large a problem.

Empower Personal Dashboard Features

Net worth tracking

One of the most visible and prominent tools that Empower Personal Dashboard offers is net worth tracking. When you link your various accounts, you’ll see this number posted at the top of the left column along with your total assets and liabilities. For me, tracking this figure has been motivating and helps give me a better idea of where I stand financially, beyond any single account or type.

A fun sub-feature is one I hadn’t used until now: the ability to track your home value. By entering your home address, you can choose to have Zillow’s “Zestimate” of your house’s value applied to your net worth. As a new homeowner, I don’t exactly feel the need to keep that close of an eye on this figure (lest it dip below what we just paid), but it is still a neat option to have.

Budgeting and savings

On your main Empower dashboard, you’ll see several widgets you can customize to monitor a budget, track your cash flow, and more. There’s also a tool that will show how large your emergency fund should be (you may also get a nice message congratulating you on your savings should you surpass that amount — or even a suggestion of how much more you could be investing).

Clicking on “Budgeting” will show you a chart of how your spending in the current month compares to the prior month (or whatever timeframe you select). It will also display a breakdown of what categories make up the largest chunks of your spending. Furthermore, tapping a specific category will then show you your top spending spots. For example, it’s no surprise that Starbucks was my largest expense under “Restaurants.”

Below that you can view recent transactions, re-label purchase categories if need be, and hide duplicates. There are also tags you can add to transactions including “business,” “reimbursable,” “medical,” and “tax related.” You can sort tagged transactions by tapping the “Tags” column.

For those seeking the ability to create a customized budget and set spending caps for each category, Empower Personal Dashboard might not be the best option. That said, for my needs and my non-budget budget, these features are perfect.

Portfolio

While apps like Mint (RIP) also provide net worth and budgeting tools, to me, what makes Empower Personal Dashboard stand out is its emphasis on investment tools. This starts with the Portfolio section where you can monitor movement in your accounts. What’s more, instead of merely viewing account balances, you can also look at the individual stocks or funds that make up a given account to see how each of them is performing. Naturally there are plenty of charts you can peruse as well, giving you visual representations of your portfolio’s performance.

Retirement planner

Perhaps the coolest feature here is the fee assessment tool. As it would imply, this allows you to easily view how much you’re paying in fees among your retirement accounts and, furthermore, how much of your returns you could be sacrificing. This can be truly eye-opening and encourage you to find less expensive options. In fact, after taking a closer look, I decided to move my IRA to another fund.

Beyond this fee assessment, you can also see how your investment allocation stacks up against recommendations, track how much you’ve set aside for retirement so far this year, and view projections of how much you’ll have for your retirement years based on your current trends. Again, each of these insights can be helpful, although it’s important to remember that they can’t predict the future. Meanwhile, I should also point out that, while it would be easy for these tools to plug paid services, none of them do — at least not that I’ve seen.

“And more”

There’s even more to Empower’s free tools to discover. There are so many rabbit holes you can go down when exploring all of the different charts, comparisons, and customizable planners they pack in. Therefore, while these are a few of my favorite features, you can surely find more tools for your needs as well.

Empower Personal Cash [Personal Capital Cash]

I’d be remiss if I didn’t mention that Empower also offers its own high-yield savings account. Currently, the account boasts 4.7% APY (as of February 16, 2024).

Last year, I finally decided to open one of these savings accounts for myself. One thing that’s kind of nice is that, if you already have your various banking accounts linked to Empower, it’s easy to simply select one you want to use to fund your Empower Personal Cash account — via either a one-time transfer or recurring deposits.

Once you open an Empower Personal Cash account, it will show alongside your other accounts on your dashboard. From there, you can also arrange transfers, view account information, and more.

All in all, given its current APY, Empower Personal Cash is fairly competitive. Plus, having the account automatically integrated into your Empower Personal Dashboard is pretty convenient. Therefore, if you do become a regular Empower user, it might be worth adding a banking account as well.

Final Thoughts on Empower Personal Dashboard [Personal Capital]

As a newbie investor (even with a few years of experience now under my belt), Personal Capital has been an incredible asset to me. In my mind, I see it as a “Mint 201” for those who have graduated from needing more budget-specific help to requiring investment-focused tools. Luckily, that legacy continues under the Empower Personal Dashboard moniker, with no major changes to speak of so far.

Plus, while Empower’s dashboard makes it easy for me to access the tools that are most important to me right now, I can also see that there are plenty more features that will likely suit more seasoned investors.

For all of those reasons, I’m glad I finally looked into what all the hype was about and made Empower Personal Dashboard a part of my financial toolbox.