Money Management Tips

Why It Pays to “Discover” Online Banking

For the longest time, banking to me seemed like mostly a practice in making the best of a bad situation. After all, how many people actively discuss what they enjoy about their bank? Instead, it’s mostly complaints about rising fees and buggy apps. Because of this and since I didn’t have any big issues with Wells Fargo and wasn’t paying any maintenance fees for my decades-old account, I assumed I couldn’t really ask for more.

That was until I turned my sights to internet banking. Suddenly I learned that I could be actually earning on my savings while still avoiding fees. Since then, I’ve actually opened a few online bank accounts — but my first and most-used of these accounts come from Discover Bank. So let’s dive into what advantages online institutions offer as well as what I like about Discover Bank specifically.

Editor’s note: this article was updated in June 2021 with the latest info.

What Online-Only Banks Have to Offer

The way I’ve utilized my checking account over the past few years isn’t exactly normal or smart. Aside from receiving my direct deposit and being used to pay rent, it basically acts as a slush fund for my wife and me that just sits there until we need it. That’s not a terrible idea but, then again, it doesn’t earn us anything either. That’s why I decided it would be better to open a real savings account that would at least get us some interest.

Brick and Mortar Rates

Way back when the notion that I should be setting up a real savings account occurred to me, my first thought was to just open a new savings account with Wells Fargo or perhaps a local bank in my area. However I was shocked to learn that unless you have some serious bucks — we’re talking five figures here — you would only get a .01% interest rate on your account. Really?

I knew savings account rates were low but I didn’t know they were that low. Luckily internet banks offer much better rates.

Internet Bank Rates

At the time that I was first looking at online banking options, savings account interest rates were already 100 times better than most big institutions, with APYs north of 1%. Unfortunately, while things even improved from there, the past year has seen rates fall tremendously due to Fed interest rate cuts and other economic factors. Currently (as of June 2nd, 2021), Discover Bank’s savings accounts earn 0.40% APY — which is still better than most.

Why I Went with Discover

Considering that the goal was to earn as much interest as possible, you may be wondering why I didn’t go with the likes of Synchrony, which tends to offer slightly higher rates than Discover. Truth be told, my main reason was that I already had a Discover It credit card and have been pretty impressed with my experience. I figured that having my credit card and other bank accounts under one roof made things easier and I seem to have been right about that. In fact, since the time that I first joined Discover Bank, they’ve upgraded their system so that you can access both credit and banking products with a single login where you previously needed separate usernames and passwords.

The Benefits and Drawbacks of Internet Banks

First a big plus: unlike many too-big-to-fail banks, Discover Bank and many of their ilk don’t charge a maintenance fee or mandate a minimum daily balance. Moreover various online institutions have different policies regarding overdraft fees, with some waiving such penalties in all situations and others like Discover reimbursing your first fine each year. Plus, just like regular bank accounts, online bank accounts are FDIC insured (or at least they should be — make sure to do your due diligence on an institution before joining).

As for the downsides, there’s no question that some will be concerned about the lack of a physical branch to go to. Personally, I rely so much on banking apps that I hardly remember the last time I visited a brick and mortar location. That said, the inability to deposit cash or a check in an ATM does mean that it can take longer to get your money into your account. In the case of cash, you may even have to rely on your “big bank” account to deposit the cash before transferring it to your online account. Such delays mean you’ll need to think ahead if you’re actively using these accounts to pay bills — but hopefully you’ll be able to work out the kinks with some practice.

My Experience With Discover Bank

It’s now been a few years since I joined Discover Bank and, overall, it’s been a great experience. As I mentioned, during this time, my APY had continued to rise before the more recent fall (which is not really their fault). However I’ve also noticed a few changes to my accounts over time that have been both good and, well, less than great. Let’s take a closer look at not only my Discover Bank savings account but also my checking account.

Cash Back Checking Exists

Funny enough, when I first joined Discover, I didn’t just open a savings account — I actually opened a checking account as well. That’s because Discover Bank offers cash back checking, which I thought would be a nice addition to my banking line-up. At the time the deal was that users would earn $.10 back for each debit transaction, check written, and more. I managed to maximize these dime bonuses by only using my debit card for transactions that were under a $1 and then transferring my acquired earnings to my Discover It card’s cashback stockpile.

Unfortunately Discover has since changed the structure of their cashback checking program, now offering 1% back on all debit card purchases. Admittedly this doesn’t do much for me as my Discover It card offers the same and other credit cards I have do even better. That said, this is probably the better program overall and could be perfect for those who either cannot qualify for a rewards credit card or wouldn’t trust themselves with one.

Despite the structural change, my Discover Bank has practically become my primary checking account at times. In fact, it was where I’d write my rent checks from prior to moving to a place that offered online rent payment. To that point, a while back, I also got to see how Discover’s “First Fee Forgiveness” program worked as a mixup with my landlord resulted in an overdraft fee (that’s when I learned that postdated checks aren’t a thing). Although a $30 fee did briefly post to my account, a $30 credit was quickly issued since this was my first — and hopefully last — infraction. This was such a relief and made what turned out to be a frustrating situation at least a little bit better.

As generous as that “First Fee Forgiveness” program was, in 2019, Discover actually did away with fees all together. Now, there are no overdraft fees, excessive withdrawal fees, stop payment fees, etc. Obviously this is good news for customers… but hopefully you won’t need to overdraft your account anyway.

No Branch? No Problem

To be honest, the initial reason I decided to sign up for the checking account was because Discover debit cards offer access to more than 60,000 ATMs without a fee. This comes as the bank has partnered with both the Allpoint and MoneyPass ATM networks, giving them tremendous coverage. Since there’s not a Wells Fargo within a few hundred miles of my home I thought it would be wise for me to have a backup plan. Sure this whole plan only saves me a couple of dollars per withdrawal but everything adds up.

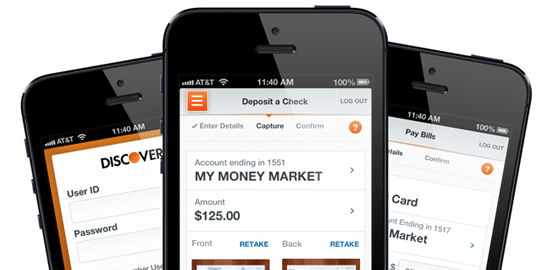

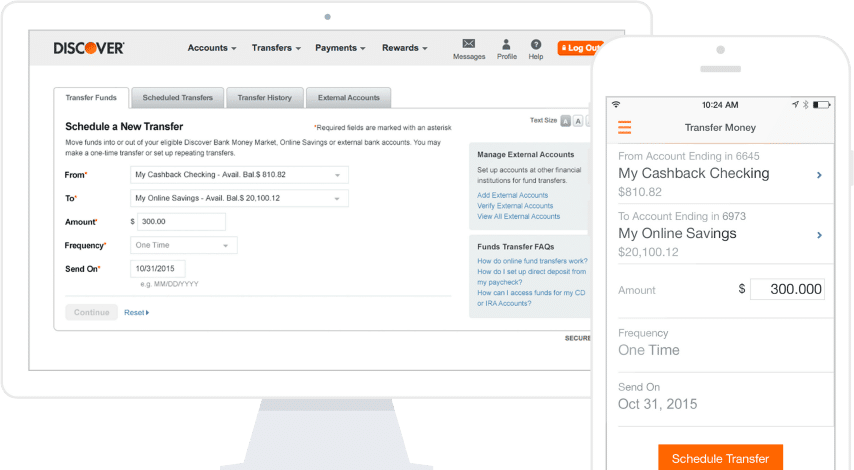

Like many banks, Discover’s app also allows you to deposit checks into your savings or checking account just by taking a photo of it. You can also sign up for various bill pay options, although I have yet to explore those despite the length of time I’ve had my accounts (so I really can’t speak to how that works.) Lastly, you can easily transfer money between your external and internal accounts using the app or website, so there really is no need for a branch.

App update

In May 2021, Discover’s app — which supports credit card accounts as well as banking accounts — received a pretty notable update. Now, users can access common banking features right from the home screen. For example, by swiping left on your checking or savings account balance, you can initial a transfer or deposit a check. Meanwhile, swiping right will display such info as your interest year-to-date or total Cashback Bonus. If you have a Discover credit card as well, this will also display on your dashboard and give you quick access to making a payment, viewing activity, seeing when your next billing due date is, and more.

This latest update only continued the trend of Discover’s app getting better with time. Personally, I’m a big fan of the aesthetic and functional changes made recently — and it’s also what reminded me to update this post! Therefore, even in a world of FinTechs, I think Discover’s technology still holds its own.

A Few Initial Issues

While I’m pretty satisfied with my account experience overall, there were a couple of problems I had when setting up my accounts forever ago. First, when signing up on the website, I was shown my account numbers and then presented with the option to register my accounts for online access. There was just one problem: clicking the button took me away from the page with my account numbers and there was no way back to them.

I assumed this wouldn’t be a big deal as surely they must have sent me an email confirmation, right? Sadly, no — aside from that initial confirmation page I had no other way of knowing if my accounts were actually even opened until several hours later when I was notified that my funding transfers had gone through. This should have been relieving but, since none of these emails contained my full account numbers, I was now sending money to accounts I couldn’t access. To be fair, I could have called their helpline to retrieve the info I needed, but I instead opted just to wait until my paperwork arrived in the mail.

Obviously this wasn’t exactly a deal breaker but I could see others being much more frustrated by such a situation than I was. I can also see some being upset that, in order to transfer between an external account and your Discover Bank account on the app, you must first add the external account information on the website. Again, not a huge deal but it is a little less elegant than you might want.

With all that said, this was several years ago now and was prior to a round of upgrades on Discover’s part. Therefore I can only hope that whatever issues plagued me so many months ago have now been resolved. Considering I haven’t run into any issues since, I’m thinking they just might be.

Final Thoughts on Discover Bank

There’s no doubt about it: bringing my savings to internet banking accounts was among the smartest money moves I’ve made. No longer am I letting my cash just sit in a checking account doing nothing. Instead I’m earning interest, which also encouraged me to save even more. In fact, while I now retain several online accounts with varying amounts of money in them, my Discover accounts remain core among my line-up.

On the whole, I’d also say Discover Bank has improved even since my initially positive review. The merging of credit and banking accounts, sleeker debit card, and Apple Pay support have all been welcomed additions — even if my little $.10 trick no longer works. Furthermore, having found myself fallible and accidentally bouncing a check, it was great to see the bank’s First Fee Forgiveness save the day and have the bank since update their terms to drop fees altogether.

For all of those reasons, I’ve found the Discover Bank account to be the perfect place to house my emergency fund and other extra cash. So, if you’re looking for a better bank account to supplement what you currently have or want to get away from the big banks, I think Discover Bank could be a good option.

Discover Bank offers a variety of products, including online savings accounts, checking accounts with cashback debit, CDs, money market accounts, and more. Checking and Savings accounts have no balance requirement, maintenance fees, or other fees.

Funds can be deposited in Discover Bank accounts via ACH bank transfer, mobile check deposit, or wire transfer. Additionally, Discover supports payments through Zelle.

Discover Bank is best for customers who want to earn cashback on their debit card purchases or earn interest on their savings and who don’t require a physical branch location. Additionally, those who prefer to deal directly with a bank instead of an intermediary may appreciate Discover Bank over other digital banking options.