Money Management Product Reviews

Digit Saving App Review (2022)

Everyone knows that they should strive to save money and break the cycle of living paycheck to paycheck… but that’s always far easier said than done. Most of the reason for this is strictly financial but a part of it can actually be mental as well. Sometimes looking at your checking balance might lead you to believe that you simply can’t afford to be setting aside anything.

Enter Digit and their automated savings tools that strive to assess your spending and find ways to help you sock away funds. While it’s far from the only automated savings solution in the market, the app does make a name for itself with some unique and clever features that have evolved greatly over the years. With that in mind, let’s take a closer look at the current state of Digit, including some of the pros and cons.

What is Digit and How Does it Work?

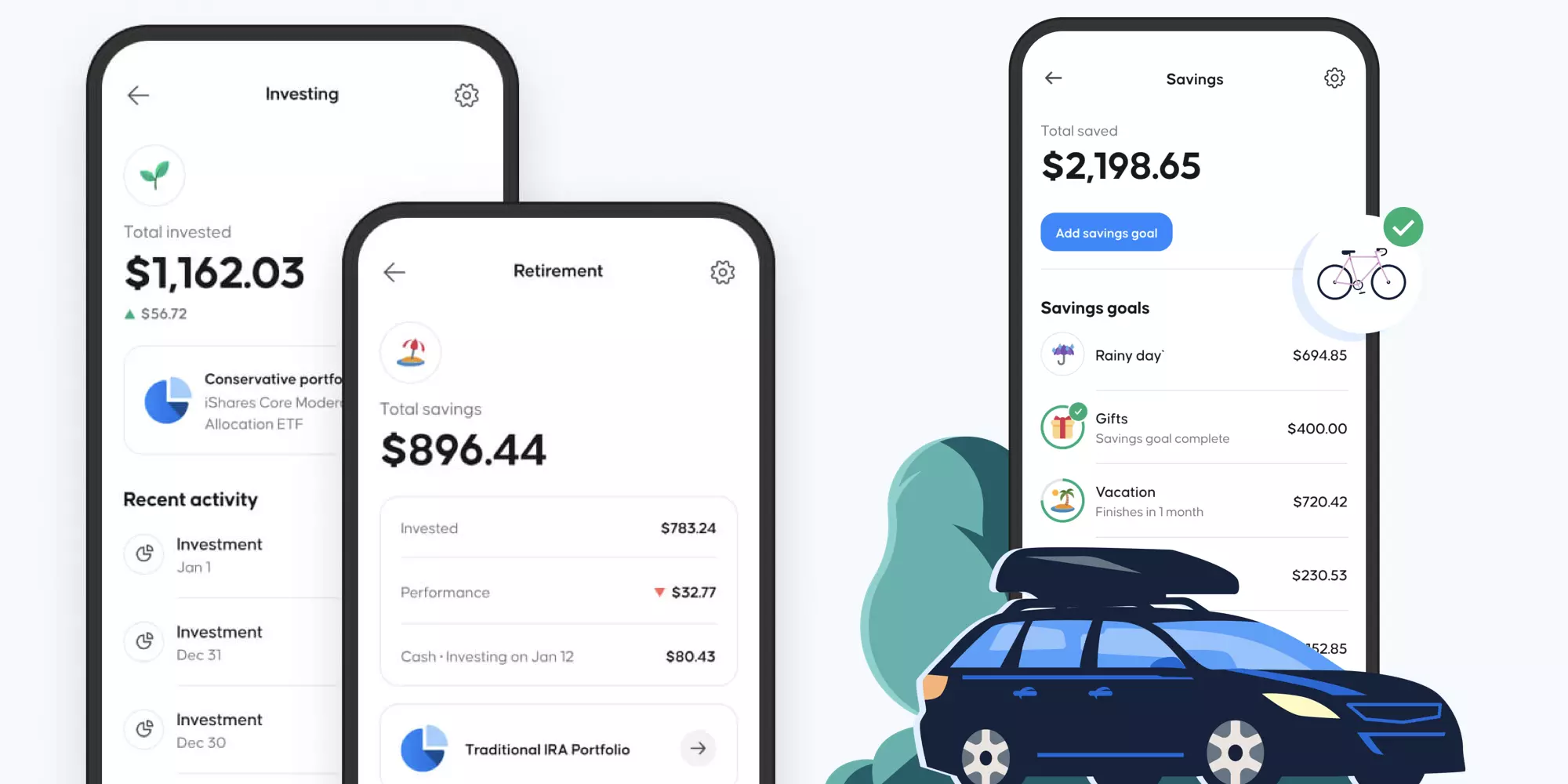

Digit is an automated savings app that uses algorithms and spending insights to determine how much money you should be setting aside for various bills. Moreover, you can tell the app what financial goals you’re saving for (building an emergency fund, paying off debt, taking a vacation, etc.) and it will help keep you on track to succeed. And while the service has changed the way it operates, these core features remain intact.

A brief look at the “old” Digit

When I originally reviewed Digit several years ago, the platform worked quite differently. Back then, one of the main ways you could interact with Digit was via SMS, messaging them to perform certain tasks, manage your account, and more. I was actually really impressed with how functional and fun this aspect of Digit was, inducing the ability to set up a new savings goal just by answering a few prompts via text or even assigning an emoji for that goal.

Now, Digit has switched to a new format, largely taking on the look of a regular banking account. Nevertheless, there are still plenty of clever features that users can employ to help them manage their money. Still, if you tried Digit in the past, be aware that the current version is significantly different.

The cost of Digit

Another aspect of Digit that’s changed over time is the price. When I first tried the service, it was $2.99 a month. Now, the service comes at a cost of $5 a month. However, Digit does offer a 6-month free trial.

I should note that, for a time, one of the versions of Digit costs $9.99 a month, while the “classic” version remained at $5. But, as of April 2022, it seems that all modes are $5.

Signing up and setting up your Digit account

Literally the first aspect of Digit you’re likely to encounter is their simple sign-up process. To get started, you’ll enter a phone number and create a password. The phone number will not only come into play as you’ll need to enter the verification code they text you, but it will also be a major factor we’ll talk about later.

Once you’ve verified your number, the next step is to link a bank account. Like oh so many other FinTech apps, Digit utilizes Plaid to securely access your balance information and make transfers. To allow this, you’ll log into your account using your online banking username and password. If you have two-factor authentication turned on, you’ll likely also need to enter a confirmation code either e-mailed or texted to your contact info on file.

With that out of the way, you’re ready to start exploring Digit.

Using Digit

Automated Savings

After you set up Digit, there’s really nothing else you need to do to start saving money. After all, the main pitch of the app is that it sets money aside for you automatically. However there are a few customizations you can make.

For example, as I mentioned, you can create multiple savings goals for Digit to help you achieve. When setting these up, you can tell the app how much you need to have saved and by what date, which it will take into account when building your savings. If you really want to prioritize a certain goal, you can also Boost it by tapping the goal in the app and going to Settings.

Also in Settings, you can set a maximum daily amount to save, set up scheduled withdrawals, and pause saving if needed. On that, in addition to pausing individual goals, you can go to your profile, scroll down to Manage Account, and select Pause Saving in order to turn off all auto-saving to Digit for a set number of days.

Another pair of features you might want to employ is their Safe Saving Level. This function will prevent Digit from automatically transferring money from your checking account if your bank balance is below a certain threshold.

To find this option, first, select your linked checking account and then head to Settings. The other option — which is closely related — is Overdraft Protection. With this one, not only will Digit pause transfers if your bank account dips below a certain balance but will also transfer money back to your account to help you avoid overdrafts. Hopefully this is a feature you don’t need but it’s nice to know it’s there.

Investments

One of the areas in which Digit has expanded since I last checked in on them is with Investments. Now, you can open a taxable or retirement account, select a portfolio, and have the app automatically invest for you.

To get started with Investments in Digit, you’ll need to choose whether you want a Growth or Retirement Account. In either case, you’ll need to provide additional info to verify your identity. This includes your address, occupation, Social Security number, and more. Annoyingly, it seems you’ll actually need to enter this info twice should you choose to open one of each account type.

When you open your investment account, Digit will ask you a few questions to help determine your risk tolerance and, in turn, recommend a portfolio. In my case, it decided on a Moderate Risk Portfolio, consisting of 64.2% stocks, 35.5% bonds & CDs, and 0.3% cash. Specifically, it notes that this is the iShares Core Growth Allocation ETF.

Just like with savings goals, you can choose to Boost your investment goals, set max daily savings, and pause saving. However, one thing I have yet to find is a way to change your portfolio if you so choose. It’s possible I’m missing it

Alerts

Another helpful function of Digit is that it will give you regular updates on your bank balance via push notifications. On top of the checking balance notifications, you’ll also receive regular updates on your various goals and savings balances. Of course you can always find these on the main screen of the app as well.

Digit Direct

As I alluded to, there’s a new version of Digit they’re calling Direct. While the core Digit product can help you save for various goals, Direct takes things a step further by being a full-fledged digital bank account complete with a debit card. Naturally, this version of the account comes with some unique features not found in regular Digit.

First, in addition to your regular savings goals, you can also have Digit set money aside for specific bills. In fact, you can link certain bills such as credit cards to Digit so it can ensure you have enough money to pay off your balance. You can even set it up to have it make payment for you, ensuring that you are never late.

Another feature of Direct is the ability to set up direct deposit. If you’re unfamiliar, this allows you to receive your payroll checks in your account as soon as funds are available. In fact, like with some other digital banking accounts, Direct advertises that you may be able to access your money up to two days early — although this will depend on your employer’s payroll process and other factors.

Personally, while I like the idea of Direct overall, I do feel like there’s something missing. With regular Digit, the appeal to me is that it automatically pulls money from your linked account. Meanwhile, with Direct, you’ll need to add funds to your account before Digit starts divvying the funds to your goals, bills, etc. I understand why this is, but I can’t help but wish there was a way to make it do both.

My other issue with Direct involves confusion. For one, as I mentioned early, this product was once advertised at a $10 a month price point but now seems to be back down to $5. Also, it’s not clear to me how you can go from Direct back down to regular Digit if you wanted (I actually have two different accounts — a regular Digit and a Direct — to test both out). I’d hope you could contact Digit if you did want to switch back but, again, I’m honestly not sure.

The Good and Bad of Digit

The monthly fee

The biggest negative to Digit is easily its monthly fee. Following a free 6-month trial, you’ll be charged $5 a month to use the app. Your monthly fee will automatically be deducted from your linked checking account so, if you’re not looking, you might miss it.

Should you tire of this fee, you’ll need to close your account in order to prevent future payments. This doesn’t just mean transferring your savings back to your checking account but formally closing it by going into your settings, hitting Manage Account, and finally “Close Digit Account.” By the way, even if you don’t plan on canceling just yet, this is also where you can view when your next payment will be made.

Savings Bonus

Digit pays you a 0.1% Savings Bonus every 90 days… which is well below the former 1%. Well, although it’s billed as a .1% bonus, the app explains that it’s actually .1% annually, paid quarterly — meaning that you’ll only receive a .025% bonus each time. Also this bonus is based on the average daily balance in your Digit account over the prior three months.

Makes it easy to save

To its credit, there’s no doubt in my mind that Digit can help make it easier for people to get into the habit of saving. While I’ve seen some criticism that automated savings can actually be a bad thing as you’re not learning the lessons and making the effort yourself, it’s worth noting that Digit is far from covert when it comes to pulling your funds. Sure it’s automatic but it definitely informs you early and often. In my opinion, this brings more motivation to the affair, while also showing you that setting aside money to reach your goals is possible.

Only one checking account

In my eyes, another drawback of Digit is that it only allows you to link a single checking account. This probably makes sense for the majority of users but caused a bit of a conundrum for me as I couldn’t decide which of my checking accounts it made the most sense to connect. Moreover, since I use multiple accounts, I do wonder if I inadvertently made it harder for Digit to determine how much to set aside for me. Honestly I’m not sure that supporting a multiple-account option would work but, for me, neither does the single account setup.

Final Thoughts on Digit

In my opinion, Digit is a clever, helpful, and occasionally fun app. That’s why it breaks my heart that the $5 a month fee makes it so hard to recommend. Moreover, while I admire what the service is going for, it doesn’t really make sense for where I am in my financial journey. Although I’m a fan of automated savings and continue to use such services, I feel like the way Digit’s algorithm is meant to work doesn’t lend itself to the way I spend and save. Meanwhile, I also have mixed feelings about their Direct digital banking account — but, if that retains the $5 monthly fee, then perhaps it is a better deal overall.

With all that said, if you find yourself having trouble saving and want some help, Digit could very well be worth it. After all, if you can painlessly build an emergency fund that will protect you from taking on credit card debt or worse, $5 a month might seem like a drop in the bucket. Still, at a certain point, it may be best to wean yourself off of the service, take what you’ve learned, and start saving for yourself.

Digit is a service that helps users automatically set aside money and build up their savings. Additionally, the app now offers automated investing and even a digital banking account.

Yes. After a 6-month free trial, Digit costs $5 a month.

Yes. Deposits are insured up to $250,000.

Digit users can elect to withdraw funds using Standard Transfer for free or choose an Instant Transfer for a fee of $.99. When choosing to withdraw funds, an estimated delivery date will display, allowing customers to make an informed decision.