Personal Loan Tips

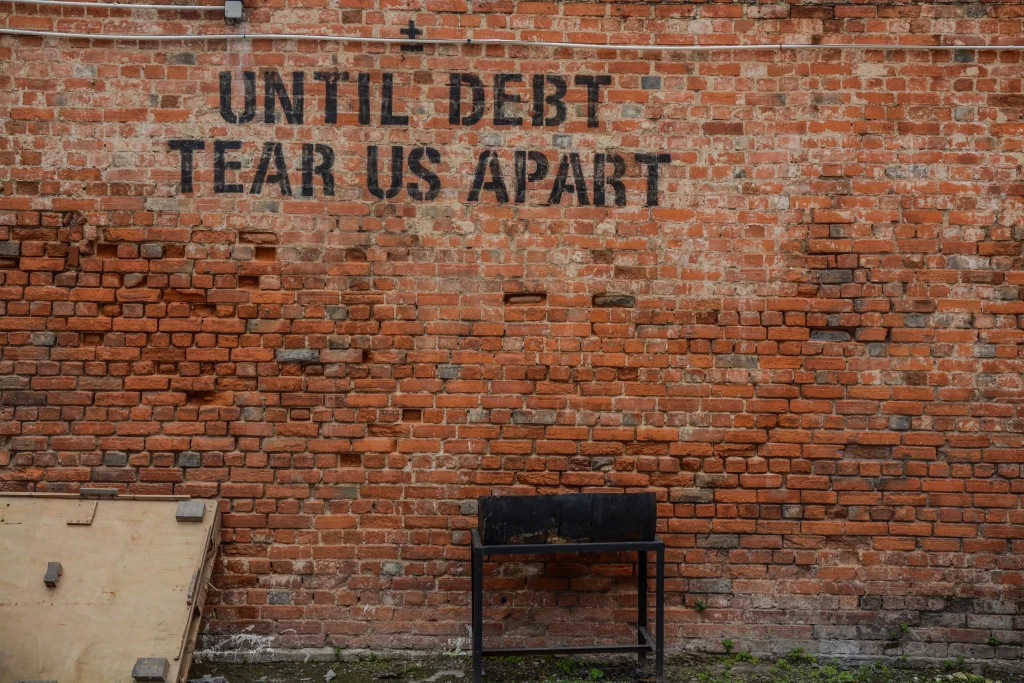

Debt Consolidation: Is it a Good Deal?

Is your credit card debt continuing to haunt you? Ready to pay it off once and for all? Consolidating your debt could be the first big step toward achieving that goal.

According to the Federal Reserve Bank of New York, U.S. consumer credit card debt totaled $800 billion in 2021 — and that was before the current crisis that has hit many Americans financially. Add in the fact that credit cards often carry notoriously high interest rates and it’s easy to see why so many Americans might be considering consolidation.

Let’s take a look at the pros and cons of consolidation as well as at some popular debt consolidation options to determine whether or not they’re ultimately a good deal.

The Benefits of Consolidating Your Debt

Before we get into what kind of debt consolidation options are available it’s worth looking at what some of the benefits of consolidating are:

Save money

The best part about consolidating your debt is that you’re often able to secure a loan that carries a lower interest rate than your credit cards. According to WalletHub, the average credit card interest rate in 2021 was 18.26%. Meanwhile, the site found that the average personal loan interest rate was 12.42% (as of Q1 2021). So, if you had $10,000 in credit card debt to pay off over three year’s time, you’d save approximately $1,000 in interest with the lower rate.

While there are several factors that will dictate what type of interest rate you’re able to obtain on a personal loan, generally speaking, they can be a better deal and save you money in the long run.

Discipline

Another great thing about debt consolidation loans is that they force you to be more disciplined in paying off your debt. The temptation to only make the small minimum credit card payment is erased forcing you to make better financial choices. Additionally knowing the terms of your loan will allow you to see the light at the end of the tunnel and observe real progress being made each month.

Convenience

Usually when people mention the savings associated with consolidation loans they’re referring to money. However an overlooked aspect of these loans is the time it saves. Instead of having to keep track of different due dates and making payments on multiple credit cards throughout the month, you’ll be able to make one quick, easy payment a month that can even be taken out of your checking automatically. This will also help you avoid missed or late payments that can sometimes occur when you have multiple bills to juggle.

Consolidation Pitfalls and How to Avoid Them

Despite the apparent benefits there are some consumers and financial advisers that warn against debt consolidation loans. However many of the concerns that they have about such loans can be addressed by avoiding some common mistakes.

Calculate the terms of your loan

The top mistake that consumers might make is accepting a debt consolidation loan because the payment is lower than what they’re currently paying. That may sound like a good thing but remember that the entire idea is to get out of debt as soon as possible. In some cases the terms of your loan will only draw out your debt and perhaps even cost you more money in the long run (even if the interest rate is lower).

To avoid this issue be sure to find a lender who will let you choose the length of your loan and be sure to run the numbers. You’ll want to calculate how much you can afford to pay each month, how long it would take you to pay off your credit card with that payment, and how much you’d end up paying including the interest. Be sure to compare that to the terms of the consolidation loan you’re applying for to see if you’re really getting a good deal.

Change your habits

Suppose you do pull the trigger on a consolidation loan and are able to pay off your credit cards: what do you do next? Unfortunately far too many people leave their accounts open and go back to the same spending ways that got them into trouble in the first place. A debt consolidation loan will only help you if you’re serious about changing your spending habits and getting out of debt. Otherwise you’re just causing more trouble for yourself.

Pay more when you can

The one good thing about credit cards is that you can pay off as much of your debt as you’d like. Of course the problem is that many can only afford to or only wish to pay the minimum each month, which not only prolongs the debt but also accumulates interest charges. That’s why when looking for a consolidation loan you’ll want one that won’t charge you a penalty for paying off your debt early. This way you’ll be able to put holiday bonuses, tax returns, and other “found money” towards paying off your debt faster and saving on interest costs.

Debt Consolidation Options

Now that you have a basic overview of debt consolidation pros and cons, let’s look at some specific options — along with the benefits and drawbacks of each.

Option #1: A Credit Card Balance Transfer

What is it?

One of the most common “tricks” that consumers will use to consolidate their debt is called a balance transfer. Simply put, this means that they will pay off one card by moving the amount they owe to another card that carries a lower interest rate. In most cases, this is made possible via a credit card offering a promotional rate to entice new users.

The pros

As mentioned, oftentimes credit card companies will offer low — even 0% — interest rates when you first sign up for a card. This is what’s known as an introductory rate. Make sure to check how long the rate lasts as most offers expire in less than a year, although some can be substantially longer. If you can pay off your debt during the introductory period it could end up saving you a bundle in interest charges compared to a regular credit card.

The cons

The first pitfall of balance transfers is that they require you to be approved for a new credit card that has a low interest rate offer. If you have a lot of outstanding debt you are unlikely to get a low interest rate on the balance transfer offer, which makes it a bad deal right from the start.

It’s also worth noting that all of this reshuffling of your revolving credit could negatively impact your credit score, at least temporarily. Worst of all, if you don’t pay off your debt in the allotted amount of time, the regular interest rate will take effect — which may in fact be higher than the rate you were paying on your original card. When that happens your debt balance is likely to shoot right back up.

On top of that most cards will charge a balance transfer fee, up to 5% of the total balance transfer amount. Suddenly that low introductory interest rate can turn expensive.

Is it a good deal?

When done right, taking advantage of introductory rates with a balance transfer can be a great deal. However, in order for the plan to work, consumers need to remain committed to paying off their debt by the deadline of the introductory offer.

Additionally, balance transfer fees could end up cancelling out some of your interest savings if you’re not careful. To help you better decide, Bankrate offers a balance transfer calculator so you can crunch the numbers and see if it makes sense for you.

Credit Cards That Offer Balance Transfer Introductory Rates

If a credit card balance transfer sounds appealing to you, there are several cards that will not only benefit you by offering a 0% interest rate for a limited time but will also provide you with other rewards going forward. Here are a few popular picks:

Chase Freedom Unlimited

Currently, this card offers a 15-month 0% introductory APR on balance transfers. However, there is a fee of $5 or 3% (whichever is greater) based on the amount of each transfer made within 60 days of account opening — climbing to $5 or $5 after that period.

As far as rewards, the Freedom Unlimited earns 1.5% back on all purchases plus 5% on travel purchased through Chase, 3% on dining at restaurants, and 3% at drugstores.

Chase Freedom Flex

The Chase Freedom Flex features the same balance transfer offer and fee. The rewards are also similar except that, instead of earning 1.5% back on all purchases, it earns 1%. However, the Flex does add 5% rotating quarterly bonus categories good on up to $1,500 in purchases each quarter.

Capital One SavorOne

Another option for both balance transfers and rewards is the Capital One SavorOne. It currently offers a 0% intro APR for 15 months but does have a 3% fee on the amounts transferred within that time. Turning to rewards, SavorOne offers 3% cashback on dining, 3% on entertainment and select streaming services purchase, 3% on grocery stores purchases (excluding Walmart and Target), as well as 1% on all other purchases.

Option #2: A Personal Loan

What is it?

A personal loan allows you to borrow a lump sum of money that is then paid back in installments over time. Typically loan payments are due monthly but that will depend on the lender. In addition to paying off your credit cards, personal loans can also be used for other debts or expenses you may have.

The pros

While you’d be extremely hard-pressed to find a 0% interest personal loan, as we covered earlier, the rates on these loans are typically lower than that of credit cards (depending on the quality of your credit). Additionally, personal loans combine your principal with the interest you owe to provide you with a standardized monthly payment amount. This can be encouraging and motivating for consumers, as it gives them a clear plan and end date for becoming debt free.

Something else to note is that select lenders may also offer ways to lower your interest rate. For example, SoFi provides a .25% interest rate reduction to borrowers who sign up for their AutoPay program. That may not sound like much but it could make a significant monetary difference over the life of your loan.

The cons

As mentioned, personal loans rarely if ever offer 0% interest or introductory rates. Another downside is that many lenders will charge what’s known as an origination fee — typically between 1 to 6% — which will be deducted from the amount you receive. For example, if you borrowed $10,000 with a 3% origination fee, you would actually receive $9,700. Speaking of fees, you should also be cautious of loans that charge a prepayment penalty.

Is it a good deal?

Many people prefer personal loans to balance transfers because it gives you a clear plan for paying off your debt. Plus, as long as you avoid loans that charge prepayment penalties, you may be able to save even more money by paying off your loan early. To help you figure out what your monthly payment would be and how much you could save versus a credit card, SuperMoney offers a personal loan comparison tool that can come in handy when weighing your options.

Option #3: A Home Equity Loan or Line of Credit

What is it?

If you own your home and have been making payments on it for a while you will earn what’s called equity. Basically equity is a measurement of not only what you’ve paid on your mortgage but also what your home is worth. If you’ve paid a significant amount or your home’s value has increased, you may be able to borrow against this equity in order to pay off your credit card debt.

The pros

Home equity loans (HELs)— also referred to as second mortgages — often carry very low interest rates and have long terms, allowing you to pay it back with smaller payments (although this could also just needlessly extend the amount of time you’re in debt). On top of that there are also home equity lines of credit (HELOCs). These allow you to not only pay off your credit card debt now but also tap into your home’s equity for future home improvement projects.

The cons

First, the obvious: you need to own a home in order to take advantage of a home equity loan or line of credit. Additionally not every homeowner will qualify —especially those who only purchased recently or whose houses may be “under water” (meaning you owe more than your home is worth). Another big downside is that, by taking out a home equity loan, you are putting up your home as collateral. This means that failure to repay your loan could result in you losing your home. Lastly HELs and HELOCs may also come with conditions that not every owner will be happy about, including stipulations about not renting out your home.

Is it a good deal?

For homeowners with a good amount of equity that want to pay off their credit cards, both HELs and HELOCs can be great options. Just be sure to research and read all the fine print so you understand what you’re getting yourself into. You will also want to compare a fixed-rate option to a variable rate one, both of which have their own sets of pros and cons.

Option #4: 401(k) loan

What is it?

If you have a 401(k) through your employer, you may be allowed to borrow money from your account to pay off debt. In most cases, you’ll select the terms of the loan (e.g. how long of a period you want to pay it back over), with payments being deducted from your paychecks just as your 401(k) contributions are.

The pros

With a 401(k) loan, not only will you often be able to borrow money at a lower interest rate than you would via a personal loan but that rate will also not be dependent on your credit (most loans of this type won’t require a credit check). That could make them attractive for those with less-than-stellar credit. Plus, while they may not be as speedy as some FinTech lender options, 401(k) loans are typically pretty straightforward and pay out quickly.

The cons

The biggest risk with 401(k) loans revolves around what happens if you were to lose your job. In such a scenario — whether the termination is voluntary or not — you’ll have to fully repay the balance of your loan right away. If you fail to meet the given deadline, the remaining amount will be considered a distribution, which will mean paying taxes on the money as well as a 10% penalty if you’re under 59 and a half years old.

Outside of that risk, borrowing from your 401(k) could end up costing you more than you think. That’s because, by pulling your money out of your account and thus out of the market, you could be hurting your upside investment potential. Similarly, you’ll also miss out on the benefits of compounding interest.

Is it a good deal?

While 401(k) loans may seem like a smart idea to some, there are plenty of reasons why financial experts often advise against them — including the potential risks associated with job loss and the chance you might hurt your investment growth potential. Of course, calculating these impacts can be difficult. Therefore the best plan of action may be to do your own research and consider all of the elements before deciding for yourself.

Consolidation Alternatives: Options for Paying Down Your Credit Cards Directly

If none of the above consolidation options sound right for you, don’t be discouraged — there are still other ways you can pay off your credit cards. However, before you can do that, you will need a plan. With that, here are a few common schools of thought when it comes to attacking your credit card debt, depending on your situation and goals:

Pay off the smallest debt first

The first idea is to arrange your debts by how much you owe and then start with the smallest balance. While this means that your largest debts remain looming, the small victories you experience from ridding yourself of lesser debts can help you power through. Think of it as a video game where the levels get progressively harder but, by the time you make it to the final round, you’re a pro.

Also known as “The Snowball Method, “ this plan of attack is great if you’re in need of some encouragement along the way. It may seem silly but watching your debts fall one by one can be a tremendous feeling that inspires you to persevere even when it’s time to take down those big balances. However, if you want to really make a dent in your debt, this might not be the best method.

Pay off the largest interest rate first

One of the reasons debt can pile up on so many Americans so quickly is because of high-interest rates. These costs can make it feel like someone keeps dumping dirt on those trying to dig their way out of debt. That’s why it makes sense to take aim at the guy with the biggest shovel first.

Mathematically, this plan will allow you the greatest amount of savings. The problem is that sometimes your debt with the highest interest rate is also your largest balance. Although that’s even more motivation to pay it off as soon as possible it can be an admittedly daunting task. But if you have what it takes to show your debt who’s boss, then this is the way to do so.

Pay off the debt that’s closest to maxing out first

The last method is a little less straightforward than the others and involves arranging your debts by how close your account is to hitting its credit limit. This matters because of the way FICO scores are calculated. In fact the amount of available revolving credit you have on hand accounts for 30% of your score.

Under this plan you would be paying off credit cards before other debts such as loans. Incidentally this likely means you’ll be paying off the debts with the higher interest rates first as well. One you’ve paid your high balance percentage credit cards your other obligations can be arranged in whatever order you choose (including the aforementioned methods).

Overall debt consolidation can be a smart move if you’re seriously looking to dig your way out of debt. There are several different methods and plans for consolidation that each have their own advantages and disadvantages. By considering each option carefully to determine which is best for you, you could save yourself thousands in interest and more importantly, be on your way to being debt free.

Simply put, debt consolidation loans are personal loans that will allow you to pay off your credit cards and other debts to avoid higher interest rates and fees. These loans can be secured or unsecured and have terms typically ranging from 24 to 60 months. Usually consolidation loans are paid back in monthly installments, which are predetermined before you accept the loan.

Balance transfers are a popular way to reduce the interest paid on credit card debt. The idea here is to open a new credit card that offers a low (sometimes even 0%) introductory interest rate and move all of your other credit card balances to that one card. Of course the most common problem with these plans is that you will want to make sure you can pay off the debt before the introductory rate expires and that timeframe can be pretty short. If you miss that window you could find yourself right back where you started as their rates after this period are typically much higher than those on debt consolidation loans.

A secured loan is one that requires assets such as your house or vehicle to be put up as collateral. Since this lowers the level of risk for the bank or other lender you may be able to get a lower rate on the loan and borrow more money. However it’s important to note that, should you default on your loan, you could lose your collateral. An unsecured loan requires no collateral and these types of loans have become more popular thanks to an influx of online lenders such as Lending Club. Instead of being based on your assets, decisions about your loan eligibility, including your APR, are determined by your credit score and other indicators of your credit worthiness. It should be noted that while you won’t lose your home or car as the direct result of defaulting on an unsecured loan, doing so could still badly damage your credit.