Savings Account Reviews

Money at 30: Credit Karma Savings vs. Credit Sesame Cash

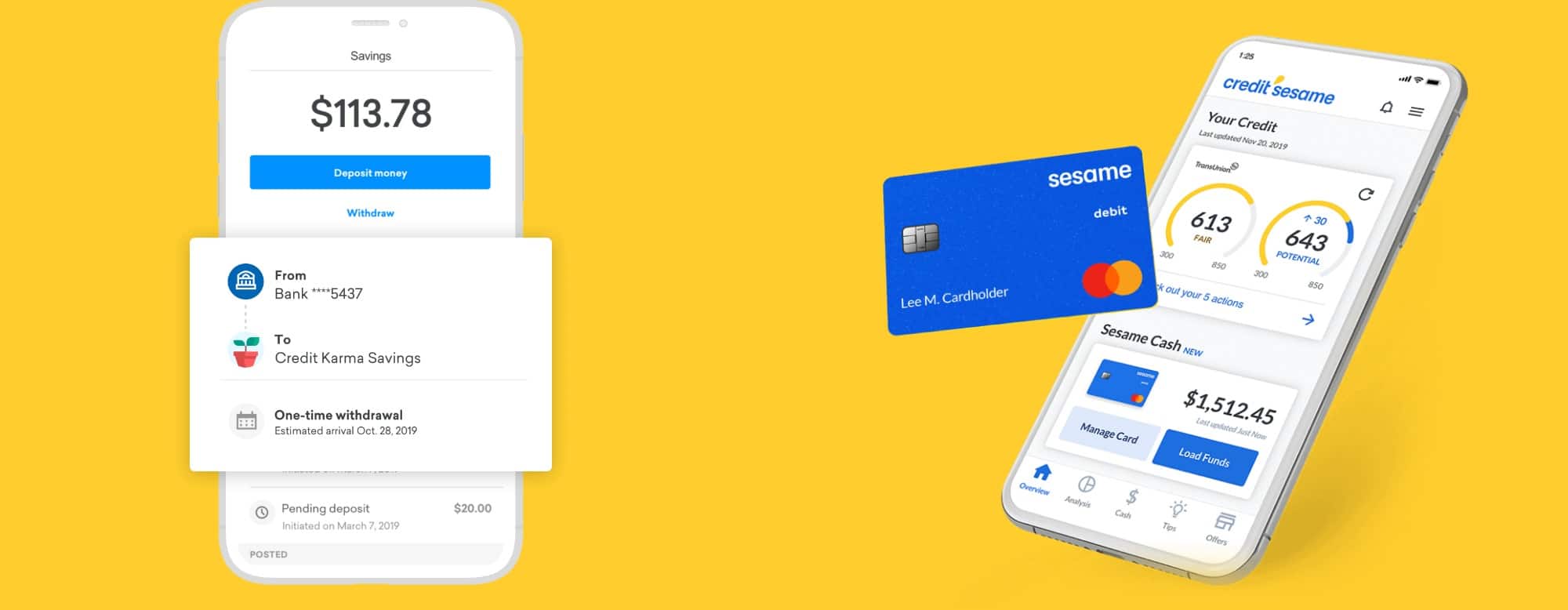

In a fairly short amount of time, two free credit score sites have each introduced their own digital banking offerings. For Credit Karma, that’s Credit Karma Savings. As for Credit Sesame, they recently unveiled Sesame Cash. This of course begs the question: how do these two seemingly similar options compare?

To answer that query, let’s take a look at what each of these platforms have to offer — starting with features geared toward savings and then checking — and whether Credit Karma Savings or Sesame Cash is the better option for you.

Credit Karma Savings and Sesame Cash: How Do They Compare?

Savings Features

Transfers

When it comes to moving money to your account, both Credit Karma Savings and Sesame Cash operate much the same way. In fact, they both employ the API Plaid to securely connect your external account and schedule transfers. Incidentally, both offerings are also a tad annoying when it comes to transfers as neither allows you to keep more than one account connected at any given time. Still, the linking process is fairly simple and very comparable between the two.

Automated deposits

If you’re looking to make regular contributions to your digital account, Credit Karma Savings has you covered. Users can set up recurring transfers for a given amount that triggers weekly, every other week, or monthly. Plus, to give you an idea of what your efforts will add up to, Credit Karma will show you how much you’ll have after two years’ time if you stick to your schedule.

At this time, Sesame Cash doesn’t offer that kind of a feature. However, they do have a different option for making regular deposits that we’ll discuss in the Checking section below.

Earning interest

One of the benefits of many digital banking accounts is that they pay out interest far greater than you’d find at most brick and mortar banks. Of course, while you could find APYs of 2% or more just a few months ago, that’s changed in a hurry thanks to a series of rate cuts by the Federal Reserve. Nevertheless, what you’ll get from a number of online banking platforms still easily beats the 0.01% you’d get elsewhere.

With that in mind, the 0.52% APY Credit Karma Savings currently offers is not bad. That said, as always, it is subject to change. In any case, the interest you earn from holding funds with Credit Karma savings will be paid out on the last day of the month.

As for Sesame Cash, at this time, they do not pay any interest on savings. To be fair, as you’ll see in a moment, this offering is more a checking account and those are less likely to accrue interest (although some banks like Ally do have interest checking). Still, it’s something to note.

Checking Features

Direct deposit

Earlier I mentioned that, while Sesame Cash doesn’t allow you to set up recurring transfers, they did offer a different option. Enter direct deposit. If you’re not familiar, direct deposit is a feature that allows your employer to send your paycheck funds to your specified account instead of you needing to manually cash a check — in other words, your funds are directly deposited. What’s more, with Sesame Cash, you could have access to direct deposit funds up to two days early (although this feature will depend on your employer’s payroll practices).

Meanwhile, as of this writing, Credit Karma Savings does not have any direct deposit option.

Debit card and ATM access

When you open and fund a Sesame Cash account, you can request a free debit card as well — or opt to use a digital version instead. This card is accepted anywhere Mastercard is, making it easy to access your money. Speaking of accessing your funds, Sesame Cash utilizes the Allpoint ATM network, allowing customers to use more than 55,000 machines for free.

With Credit Karma Savings serving more as a savings account, there is currently no debit card associated with that product. Thus, if you want to access you stashed cash, your only option is to transfer back out to an external account.

Mobile check deposit

Up until this point, we’ve looked at a lot of features that one account has and the other doesn’t. So let’s mix it up and look at something that neither technically has: mobile check deposit. Although you will find such a tab in the Settings of Credit Sesame’s app, depositing checks into your Sesame Cash account actually requires a third-party app called Ingo Money. While that itself might not be a dealbreaker, Ingo does charge for quick deposits while a fee-free transfer can take up to 10 business days. Therefore, it’s hard to recommend this as a legitimate feature. That said, once again, Credit Karma Savings doesn’t even offer that much, with online transfers serving as the only option for deposits.

Bonus Features

Credit Karma Cash Monthly Sweepstakes

To further incentivize users to save, Credit Karma has been offering monthly sweepstakes. For example, in August 2020, those who deposit at least $1 into their Credit Karma Savings account during the month will be eligible to win a grand prize of $20,000. Obviously your chances of scoring this jackpot are slim, but it doesn’t hurt to try.

Sesame Rewards

Last but not least, perhaps the most unique element of Sesame Cash is their Sesame Rewards program. With this feature, customers who manage to improve their credit score by at least 10 points in a month can earn $10 or more. To be eligible, users will need to deposit at least $25. Then, starting from when that deposit is made until 30 days later, those who raise their score by 10 points or more will be awarded $10 while those who manage to raise their score by 100 points will be rewarded with $100. At this time, however, the Sesame Cash Rewards program is only set to last through October 2nd, 2020.

Credit Karma Savings vs. Sesame Cash: Which is Better?

As you can see, while banking offerings from rivals Credit Karma and Credit Sesame may seem similar on the surface, there are some major differences between the two offerings. While Credit Karma Savings stays true to its name, Sesame Cash offers an experience more akin to a checking account. Because of this, few of the features that either platform boasts overlap.

So which is ultimately better? That will depend greatly on your needs and preferences. Personally, while it’s a simple, stripped-down account at the moment, I have more use for Credit Karma Savings thanks to its easily customizable deposit automation and respectable APY. At the same time, those looking for a basic free checking option that also happens to incentivize you for raising your credit score may find a lot to like in Sesame Cash. In that aspect, I have to say that I think Sesame Cash actually makes a bit more sense as an extension of a free credit score site overall — although Credit Karma has certainly expanded to be a general personal finance hub in recent years.

The bottom line is that, with Credit Karma Savings and Sesame Cash each being free, there’s little harm in trying one or both — especially if you’re already a Credit Karma or Credit Sesame user.