Money Management Product Reviews

Money at 30: Qube Money Concept Review

Overall there aren’t really a ton of personal finance-related memories I have from being a kid, but there is definitely one that comes to mind. I don’t recall exactly how old I was at the time but I do distinctly remember my parents utilizing the cash envelope method to budget. As a result, the far-left drawer of our kitchen island contained half a dozen or so legal-sized envelopes, each stuffed with a certain amount of cash and each bearing a category such as “Groceries” or “Entertainment” on it. At the time, I thought my parents were pretty clever but, as I’ve grown up, I’ve discovered this is a fairly common practice — and one that’s retained fans even as most Americans have moved onto exclusively plastic payments. I have often wondered when a digital version of this concept, that stays true to what makes it effective, would come to be. Well, from what I’ve seen so far, I think Qube Money could very well be it.

When I attended FinCon earlier this year, I had the chance to hear a bit about Qube and what it intended to offer. Now, nearly three months later, the platform is getting one step closer to making its grand debut and has shared some additional details with affiliate partners like myself. Therefore, I thought I’d take a closer look at what I know about Qube Money so far and whether or not I think it will be a viable option for envelope method budgeters.

What is Qube Money and How Will it Work?

In the interest of full disclosure…

I wanted to mention up top that, as an affiliate of Qube, I will receive compensation if you sign-up using the links in this post. Originally I was hoping I’d have the chance to try the app out for myself before posting about the company as I do with my other reviews. Unfortunately the launch is currently slated for Spring 2020. However, in the meantime, Qube Money is looking to get their name out there this holiday season by putting lifetime subscriptions on sale for a limited time. So, while this arrangement may have complicated my plans, I still thought it was worth sharing what I know so far and then letting you decide if you want to jump on board now or wait to see more.

About Qube Money

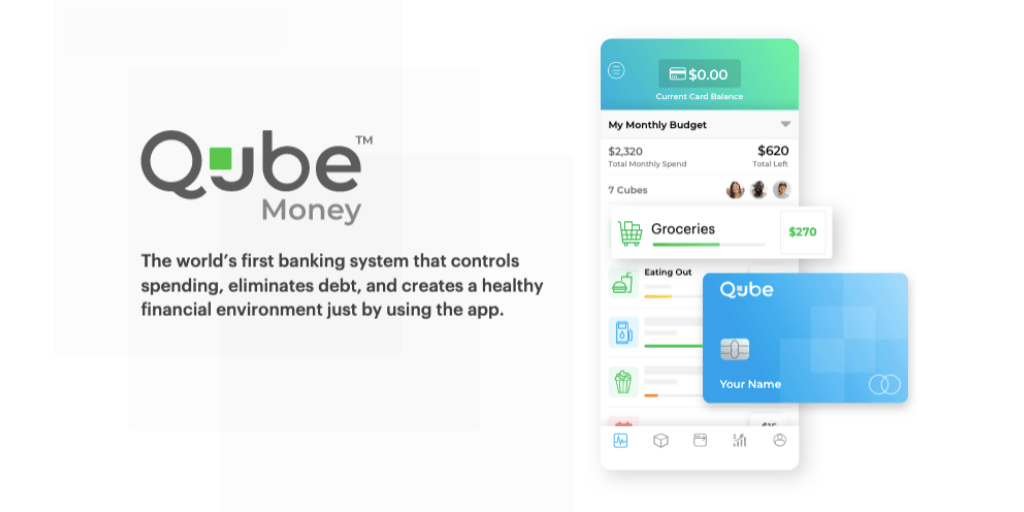

Simply put, Qube Money is an upcoming platform meant to help people practice the envelopes method of budgeting along with the benefits of a digital, cash-less banking experience. Formerly known as ProActive Budget, the company is now getting ready to relaunch with a new app and system. By the way, the company says that the lifetime memberships ProActive previously sold will be honored, allowing those customers to continue their service with Qube Money once it’s available.

What is it? Digital envelopes via debit card

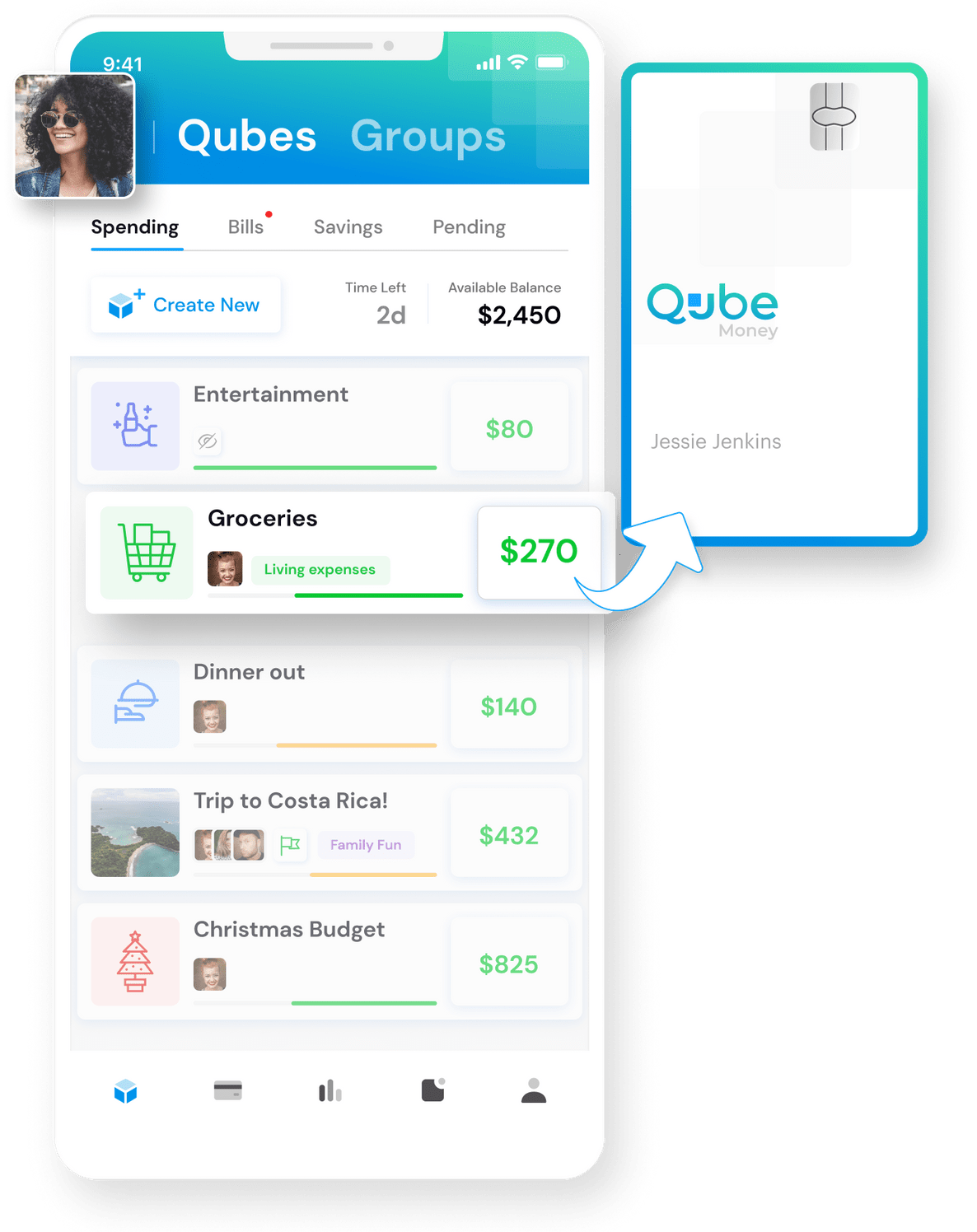

To those who swear by the cash envelopes method, the biggest benefit of this setup is that it requires you to plan ahead, think about your purchases, and spend with intention. So how do you replicate this without cash? Well, Qube’s idea is to marry a mobile app with a debit card that can only be used once you’ve selected which envelope you’d like to pull from.

That’s right — with Qube Money, you’ll first need to load the app and select the applicable spending category in order to load funds onto the debit card. To be clear, failing to do this will lead your card to be declined. Additionally, while all available money in an envelope (or qube, as they’re calling them) will be sent to your card, leftover funds will be transferred back shortly after.

Of course, there are still some workarounds to this plan. For example, you could transfer money from one envelope to another if you bust your budget in one area. Moreover, since merchant codes are too fickle to rely on, Qube won’t actually ensure that you’re using your money at a retailer in the “correct” category. That said, these same “loopholes” are true of the actual cash envelopes method as well. What’s ultimately important is that you are taking the time to consider each of your purchases — even if you eventually decide to cheat on your budget.

Other features

While the qubes and debit card features are the highlights of Qube Money, there are some other upcoming features worth mentioning. For example, users will apparently be able to share qubes with friends or family, essentially functioning like a peer to peer payment option. On that note, the company will also offer kids cards so that you can begin teaching your children about money and budgeting. Of note, this functionality will require you to sign-up for a family subscription, which is a higher price point. Speaking of price…

Pricing and more

As I mentioned at the start of this post, Qube Money is currently offering lifetime subscriptions. However, these will 1) only be available for a limited time and 2) rise in price over the coming weeks. Then, prior to the app’s official debut next year, Qube will move to a monthly subscription model.

From what Qube has told me so far, the lowest paid tier for the service will be $8 a month. When I first heard this at FinCon, my immediate reaction was that it was a bit high. After all, I haven’t paid for a bank account… well, ever (technically). But, to be fair, I did a bit of research and found that $8 a month is far from the highest fee some basic checking accounts charge. Therefore, perhaps this price point won’t be as hard to swallow for some as it initially was for me.

Final Thoughts on Qube Money

Ever since the concept of Qube Money was first explained to me, I thought it was a pretty ingenious way to recreate the cash envelopes system but bring it into the 21st century. As more information comes out about the app and I’ve had the chance to talk to the Qube team about the offering, that opinion hasn’t changed.

Given the fact that Qube will likely go for $8 a month when it debuts, the lifetime subscription (currently priced at $134 as of December 3rd) does seem like a pretty good deal. At the same time, it’s certainly not easy to spend that kind of money for a product you have yet to see — especially when the company has already had to pull the plug once. To their credit, the folks at Qube do acknowledge that this can be a bit of a hard sell, although they compare this pre-launch offer to a Kickstarter campaign. I suppose that’s fair enough, but I’ll leave it up to you to decide if it’s worth whatever risk there is.

Personally, based on what I’ve learned so far, I’m really excited to give Qube Money a try and see if it lives up to its clever concept. Once that happens, I’ll definitely be sure to post a full review with my honest opinions on the product. In the meantime, you can keep tabs on the app’s progress by visiting their site.