Economic News

WalletHub Highlights Most Financially Distressed Cities Amid Pandemic

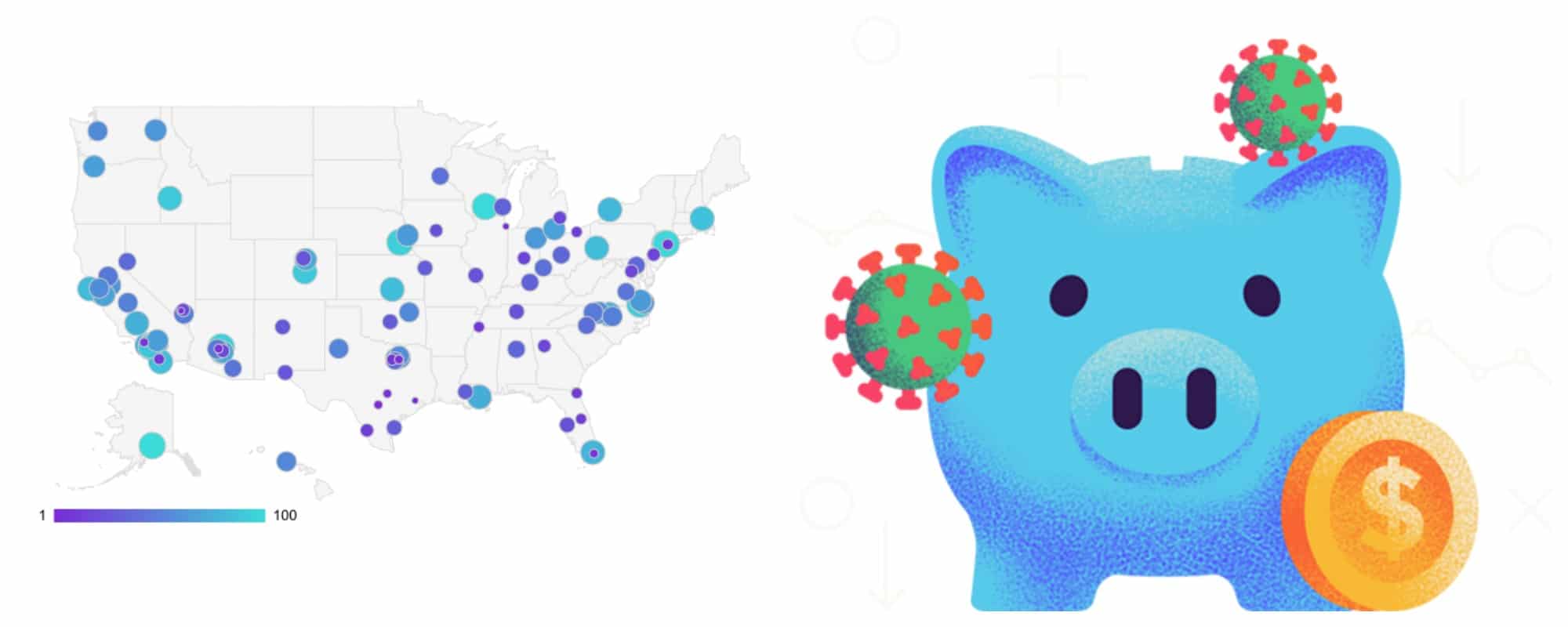

There’s no doubt that the COVID-19 pandemic has affected every American and billions of other people around the world. That said, the economic impacts that have been a side effect of the outbreak have been felt more in certain American cities. That’s why the personal finance site WalletHub recently compiled a list of the most financially distressed locations amid the pandemic.

To arrange the list WalletHub looked at the 100 largest cities in the United States (with the exclusion of Lexington-Fayette, Kentucky; St. Paul, Minnesota; and St. Petersburg, Florida due to data restrictions) and assessed their overall financial distress across six categories. These included impacts to credit scores, people with accounts in distress, the average number of accounts in forbearance or with deferred payments, and change in the number of bankruptcy filings year over year as well as search interest indices for the terms “debt” and “loans.” For many of these categories, the site compared metrics from January of this year to September — however, for the number of bankruptcy filings, they compared figures from June 2020 to June 2019.

Topping the list is a city that relies heavily on tourism, conventions, events, and other large gatherings: Las Vegas, Nevada. Sin City had a total score of 72.39 (out of 100) despite avoiding a “first place” finish in any particular category. Nevertheless, Vegas ranked second in terms of average number of people in distress and seventh for loan search interest. The city was followed by Chicago’s total score of 70.58. The Windy City tied several other metropolia for the most interest in loan and debt search terms. Meanwhile, three Texas cities — Houston (66.74), San Antonio (65.75), and Dallas (65.50) — finished out the top five.

As for the individual categories, citizens of Indianapolis saw the largest impact on their credit scores during the pandemic followed by those in Oklahoma City and Corpus Christi. In the “People in Distress” category, Austin, Texas topped the list alongside Baton Rouge and Laredo, Texas while Northern Las Vegas joined Las Vegas proper and Reno, Nevada atop the list of “Average Number of Accounts in Distress.” Finally, Des Moines, Iowa was found to have seen the largest year-over-year increase in bankruptcy filings. Other cities to see a spike in filings included Honolulu, Hawaii; Richmond, Virginia; Plano, Texas; and Denver, Colorado.

While there are many economic factors that have contributed to the financial distress that many Americans are experiencing, the pandemic has also brought upon some unique challenges. For example, the closure of many schools has further contributed to these fiscal hardships. As WalletHub analyst Jill Gonzalez explains, “Closing schools increases the number of people in financial distress because it removes the normal supervision of children during the day and places that burden on parents. Parents, especially those with younger children, may have to stay home from work or hire childcare as a result. Households where both parents work may see a sudden drop in income, but the hardest-hit households will be those with single parents.”

Although many parts of the country are continuing to reopen, fears that a surge in COVID-19 cases could lead to subsequent shut down are still very real. Additionally, it could be some time before a vaccine for the virus is released, meaning that true normalcy could be months if not years away. With that, hopefully Congress can resolve their current issues and pass additional stimulus measures that may offer some financial relief to these hard hit cities and many others across the country.