Personal Finance

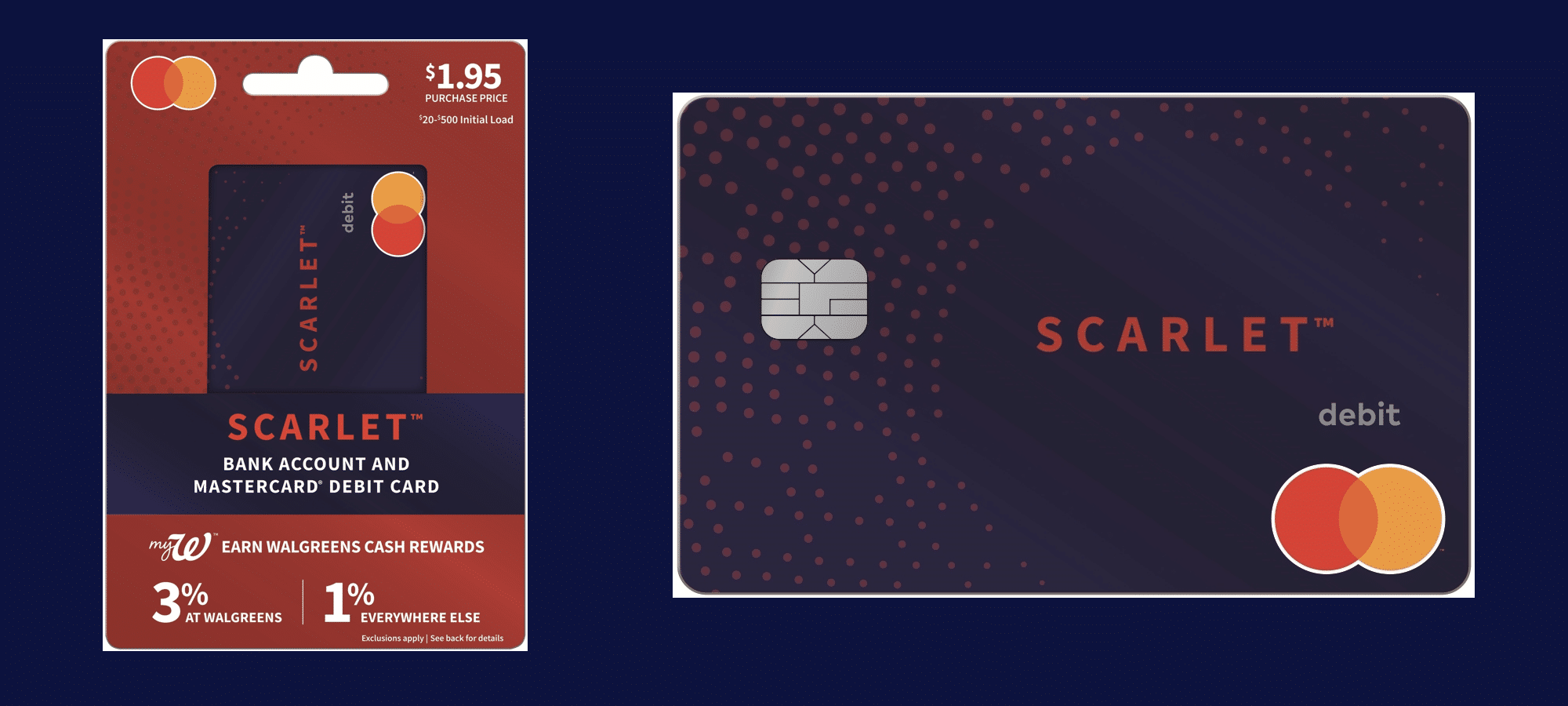

Walgreens Introduces ‘Scarlet’ Account and Debit Card

For years, pharmacies have proven to be convenient financial service locations as various FinTech accounts have allowed customers to make deposits at CVS, Walgreen, and other locations. Now one of those brands is taking on a larger role in the experience by introducing an account of its own. Last week, Walgreens announced that it’s partnering with MetaBank to roll out the new Scarlet bank account and debit card.

With the Scarlet debit card, customers will be able to earn 3% Walgreens Cash rewards on eligible purchases at Walgreens and Duane Reade locations. Meanwhile, cardholders will also earn 1% Walgreen Cash rewards on all other eligible purchases. Plus, until September 30th, new account holders will receive a $10 statement credit after they spend their first $10 on the card. In addition to being accepted wherever Mastercard is, Scarlet customers will also be able to access more than 55,000 fee-free ATMs that are part of the Allpoint network. As for deposits, cardholders will be able to add cash to their accounts for free, provided that they use the Barcode Reload scan option (a $1.95 fee will apply if the swipe method is used instead).

While the debit card can be purchased for $1.95 at Walgreens locations and registered online, customers can also sign-up online and avoid this charge. According to the fee schedule, Scarlet charges $7.95 per month — although this fee is waived for customers who have more than $500 in direct deposits each month or have at least $500 in cumulative POS signature spend transactions during the month. Elsewhere, the card also has a 3% foreign transaction fee and charges a $3 out-of-network ATM fee.

The debit of Scarlet arrives just a month after Walgreens officially introduced the myWalgreens Credit Card and the myWalgreens Mastercard. Issued by Synchrony, each of these credit cards offers customers 10% back in Walgreens cash rewards on Walgreens branded purchases as well as 5% rewards on all other Walgreens purchases. Additionally, those with the Mastercard version of the card can earn 3% Walgreen Cash rewards on grocery and health & wellness purchases made outside of Walgreens and 1% rewards on all other purchases. Neither card charges an annual fee and, currently, new cardholders can earn a $25 Walgreens Cash bonus when they make their first purchase with the card within 45 days of opening their account.

On the surface, Scarlet seems like it could be a great deal — especially for those who frequent Walgreens. Unfortunately, the $7.95 monthly fee could prove to be a deal-breaker for some. Then again, the $500 direct deposit needed to waive this fee (or $500 in monthly spend) is lower than what some other accounts require. It’s also notable that Scarlet has an option for free cash deposits, making this a unique offering outside of traditional banking. Therefore, this could well prove popular among unbanked individuals who may find Walgreens more than 9,000 locations convenient for their banking needs.