FinTech News

Upgrade Inc. Introduces Upgrade Card Credit Card

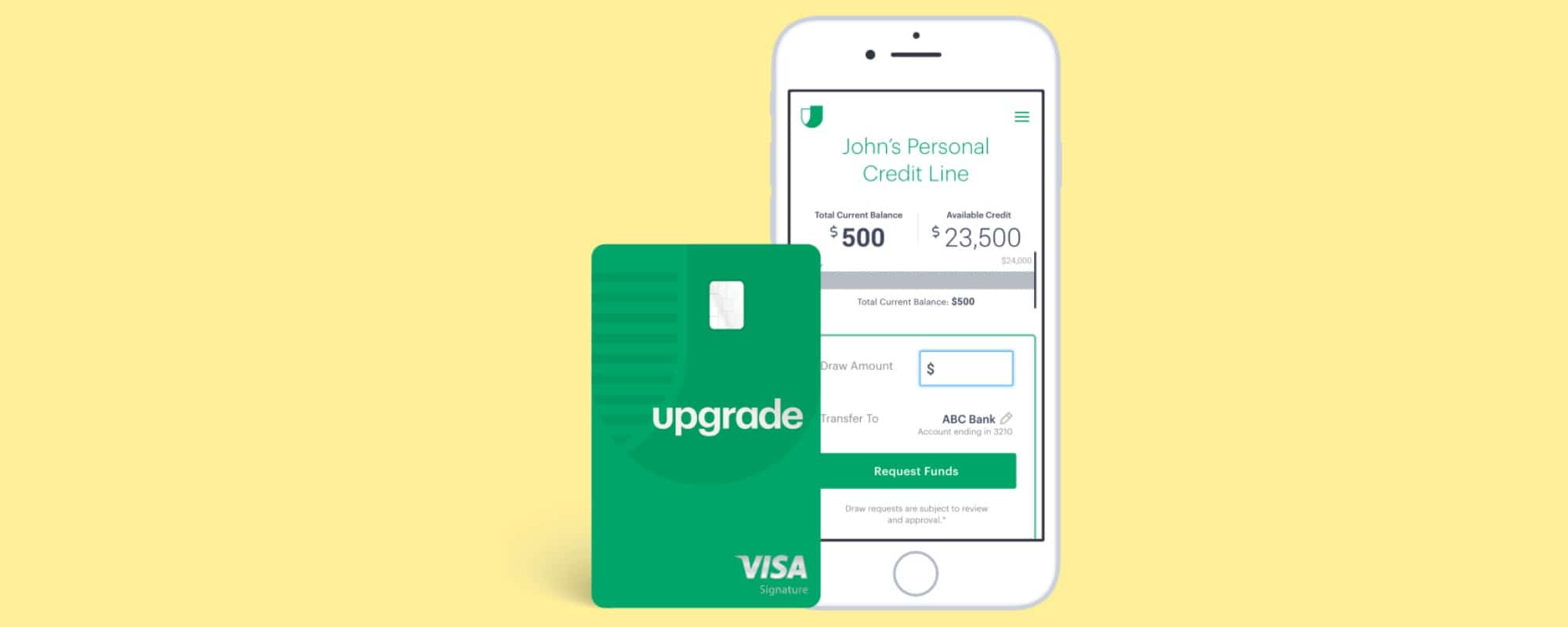

Last year the FinTech lender Upgrade announced it was launching a new personal line of credit option for its customers. At the time the company’s co-founder and CEO (and former Lending Club head) Renaud Laplanche declared, “We’re going to replace credit cards.” Now, 18 months later, Upgrade is actually introducing a credit card of their own — although the Upgrade Card bears some important distinctions from typical credit card products.

The Upgrade Card comes via a partnership New Jersey-based Cross River Bank and utilizes the Visa network. As a result the card is accepted wherever Visa is and will come with credit lines ranging between $500 and $50,000. What makes the card different is that purchases made are combined into installment plans with terms of 12 to 60 months, although there’s also no prepayment penalty. This allows users to pay off their balances via equal monthly payments and at a fixed rate. Speaking of interest rates, the Upgrade Card starts at a lower-than-average 6.49% APR. However the card tops out at a 29.99% APR.

Upgrade also says it plans to roll out a rewards program for the Upgrade Card later this year. Interestingly, instead of offering rewards on what users purchase (like most credit cards do), the company states that rewards will be earned as users pay down their outstanding balances. According to TechCrunch, this reward system will allow cardholders to earn 1% cash back when they make their monthly payments.

In a press release, Laplanche said of the new product, “Consumers are now able to enjoy the convenience of a credit card without running the risk of getting into a cycle of revolving debt that could literally take decades to pay off. Upgrade customers are paying almost seven times less interest on an Upgrade Card balance paid down over two years than they would by making the monthly minimum payment on a traditional credit card.” That figure Laplanche cites is detailed in a table showing that a traditional credit card user would spend approximately $14,423 in interest over the course of 28 years on a $10,000 balance (making only the minimum payment). Meanwhile Upgrade says its customers would be able to pay off that amount in just two years and spend only $2,102 in interest. Laplache also further explained the hybrid product to TechCrunch, noting, “It’s like a mortgage or a car loan with a clear payment schedule. You can budget for it and it sort of forces you to pay down the balance over a reasonable period.”

Overall the Upgrade Card sounds like an intriguing product that has the potential to change the current credit card model. Specifically the idea of tying rewards to payments instead of spending is interesting (although products such as the Citi Double Cash card do already incorporate that to some degree). While it’s unlikely that this new structure is going to replace traditional credit cards any time soon, it is another example of how FinTech lenders continue to disrupt the market.