Economic News

U.S. Unemployment Rate Retreats to 11.1% in June

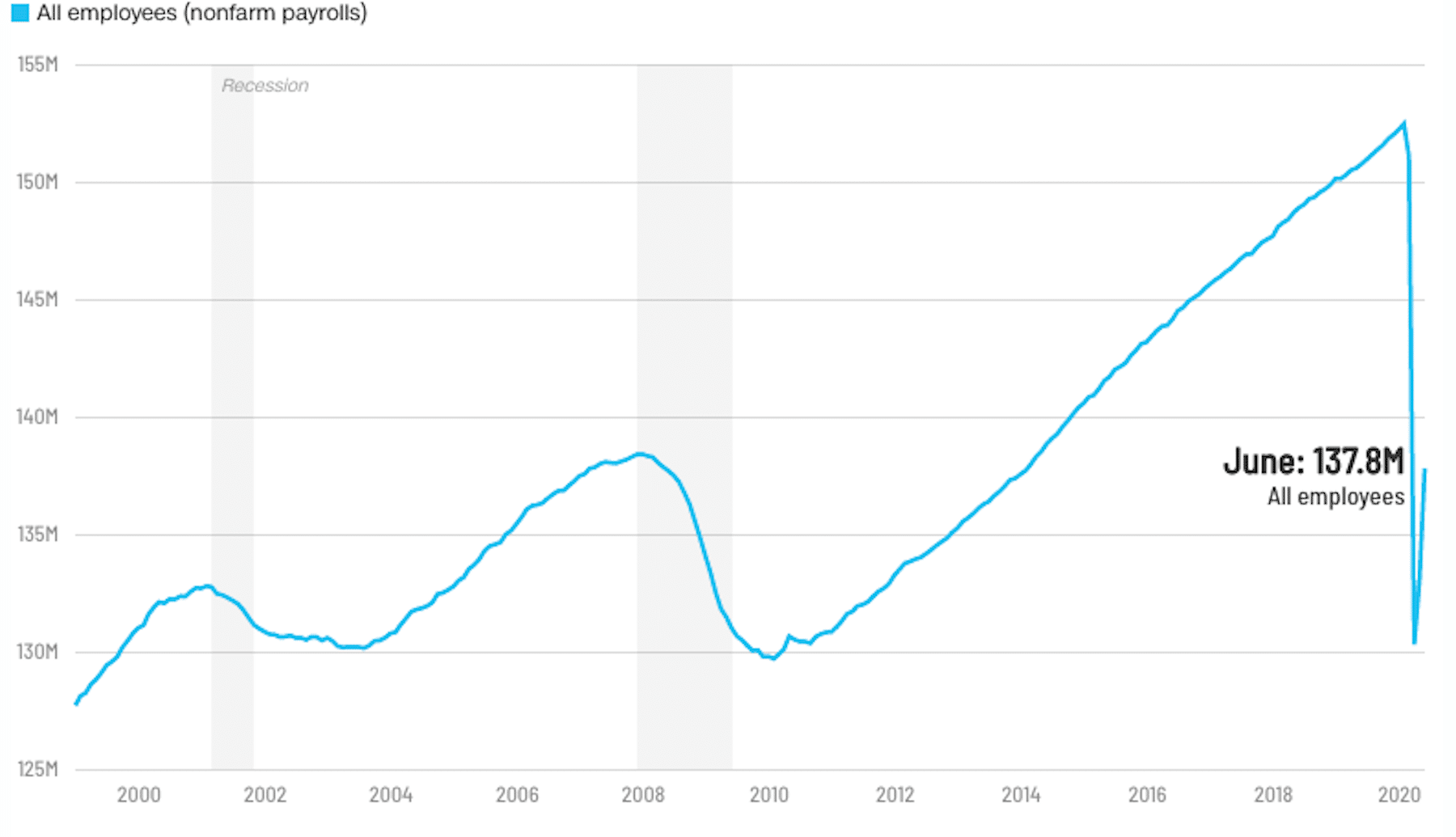

Last month saw more Americans returning to work, even as the COVID-19 pandemic rolls on. According to the latest Bureau of Labor Statistics report, the United States economy reclaimed 4.8 million jobs in June. That’s a notable increase from the 2.7 million added in May (adjusted from the original 2.5 million reported) and, as Axios notes, well exceeds the 3 million jobs that economists had anticipated to see from this report. As a result, the unemployment rate fell to 11.1% from 13.3% the month prior. This data suggests that more businesses are resuming operations following mandated shutdowns during much of March and April.

While unemployment trending in the right direction and millions of jobs coming online are both good news, there is still a lot to be considered — including some looming threats. For one, it’s important to remember that more than 20 million jobs were lost before numbers began rebounding in May.

Additionally, with infection rates spiking in some cities and states, several jurisdictions have either paused or begun reversing their reopening plans. Beyond the virus leading to potential reclosures, some reopening businesses are still being forced to release workers, with demand softening since pre-pandemic times. For example, Universal Orlando Resort, which reopened its theme parks last month, announced that it will now lay off an undisclosed number of employees.

Bureau of Labor Statistics commissioner William Beach stated that, despite providing instructions that those furloughed due to coronavirus closures should be labeled as “unemployed on temporary layoff” instead of “employed not at work,” Beach admits that some workers were still miscategorized. However, he noted that instances of this error were down from previous months. Nevertheless, CNN Business estimates that the unemployment rate could have been as high as 12.3% if not for these discrepancies.

Speaking of layoffs, Beach went on to cite some specific changes to the jobing market last month, noting, “June’s unemployment decline occurred primarily among people on temporary layoff. There were 10.6 million people on temporary layoff in June, down by 4.8 million. The number of permanent job losers rose by 588,000 to 2.9 million. The number of unemployed reentrants to the labor force increased by 711,000 to 2.4 million.”

Despite these reopening numbers suggesting that Americans are getting back to work, it’s unclear if this trend will be able to continue for much longer. With COVID-19 still spreading across the country, a quick economic recovery is looking less and less likely. Additionally, while Congress has continued to mull some additional stimulus measures, there’s currently no consensus on next steps. Therefore, even with somewhat encouraging report, the U.S. could still be in for a some rough months ahead.