Economic News

U.S. Trade Deficit Rises to New Record in 2018

Over the past year one of the biggest financial and economic stories has been President Trump’s use of tariffs on goods from China and other countries. Even before becoming President, then-candidate Trump frequently railed against the trade deficits we hold with various nations. However, despite efforts to curtail these deficits, new figures show that they actually reached a record high in 2018.

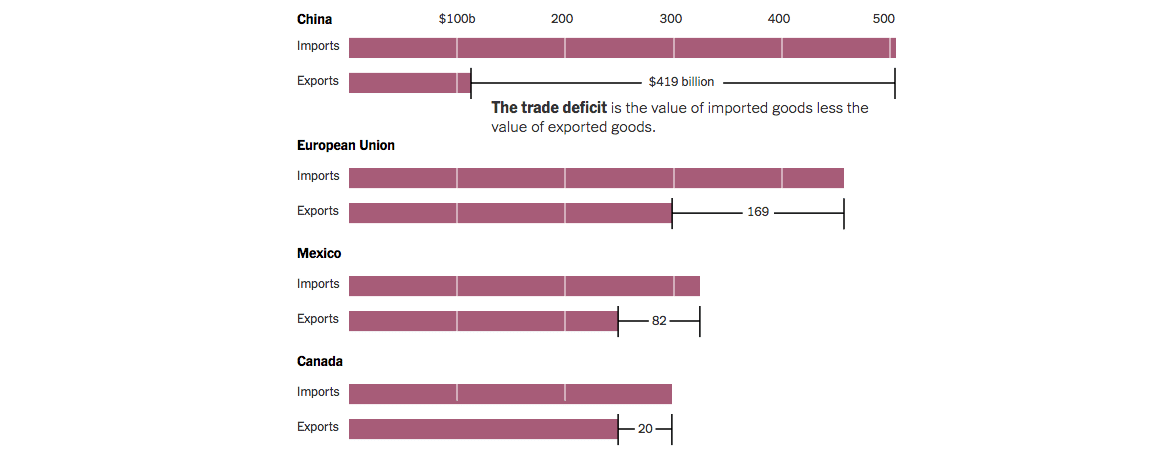

As the New York Times reports, new data from the U.S. Bureau of Economic Analysis shows America’s total trade deficit amounted to $891.3 billion last year. Moreover the deficit with China accounted for $419 billion of that figure. Meanwhile the U.S. also saw a $169 billion deficit with the European Union, $82 billion with Mexico, and $20 billion with Canada.

To be clear, a trade deficit simply means that a country imported more from a certain nation than exported to said nation. For example, while the United States brought in more than $500 billion in Chinese goods during the year, we shipped out just over $100 billion to the country. This has led some economists to suggest that the President’s concern over these figures is unwarranted. Among them, former National Economic Council director Lawrence H. Summers explained to the times, “The stronger trade deficit in the short run is telling you we’re importing more, so it’s not a particularly alarming development.”He added, “The reason we have a trade deficit is people are investing in America.”

On the contrary side, Trump trade negotiator Robert Lighthizer has argued the deficit with China and their other trade policies are “major threats to our economy.” As a result what President Trump has done is use tariffs as a way to bring Chinese leader Xi Jinping to the negotiating table in order to reach a deal that would see China importing more U.S. goods. Recently Trump has touted progress in that pursuit and has postponed additional tariff hikes that were set to impact $200 billion in Chinese imports.

The Times notes that part of what’s helped drive these trade deficits up is the continued strengthening of the U.S. dollar. However the trade wars that have come from the administration’s policy also likely played a factor. As mentioned some of these wars have deescalated as of late, although deals such as the United States-Mexico-Canada Agreement have yet to be officially ratified.

Surely the President can’t be thrilled with the news that trade deficits are rising instead of falling. That said he can still make the case that he’s working toward that goal by continuing to negotiate with China and other countries on the topic of trade. With his reelection campaign getting underway, developments in this area may get more attention as Trump attempts to make good on some of his 2016 campaign promises.