Small Business News

SBA’s 504 Loan Program Sees Record Lending Month

At a time when thousands of small businesses across the country are struggling to stay afloat, it seems that some entrepreneurs are investing in future projects. As the National Association of Development Companies notes, the Small Business Administration completed a record number of loans under its 504 loan programs in the past month. During that time, the Administration approved a total of 1,462 loans amounting to $1,284,274,000. That more than doubles the previous monthly funding record set back in September of 2012. For context, the SBA issued 6,000 504 loans totaling $4.9 billion during the entirety of the 2019 fiscal year.

The increased volume comes as interest rates for loans are at historic lows. In fact, as of last month, the SBA reduced the rates on the 20-year 504 loans to 2.214% while loans with terms of 25-years now carry a rate of 2.269%. Incidentally, the 25-year option was only introduced in April 2018, joining the 10 and 20 year programs.

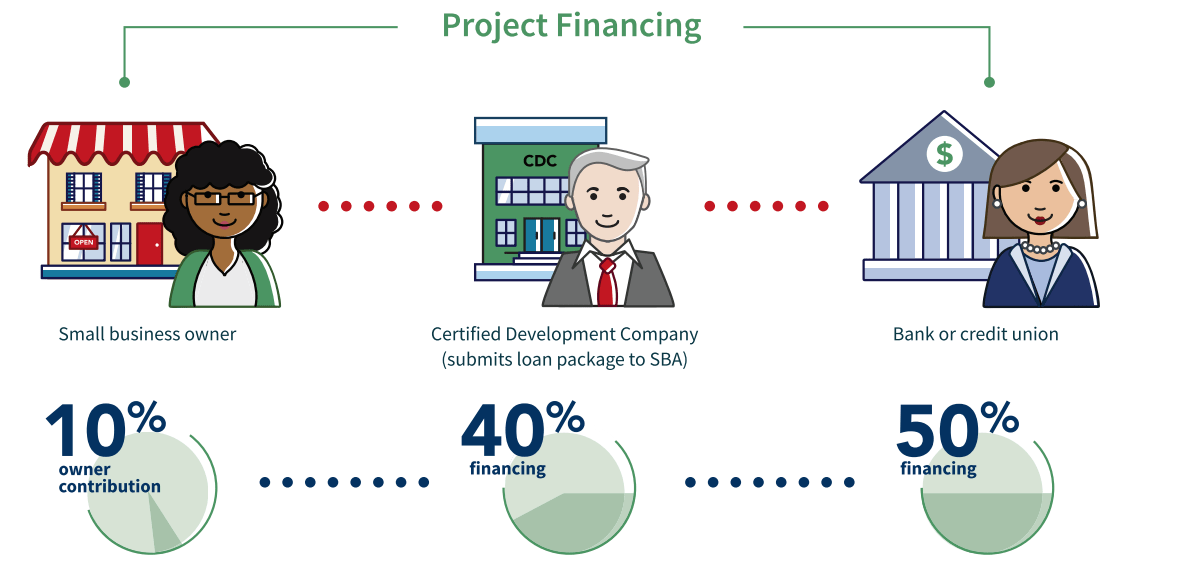

With 504 loans, businesses are able to purchase land, buildings, or other major assets. What makes them attractive to small business owners is that they are typically only required to put 10% down with 40% of funding then coming from Certified Development Companies (CDCs) and the other 50% coming from a bank or credit union.

Reflecting on the milestone months, NADCO President and CEO Rhonda Pointon commented, “America’s small business are vital engines of job opportunities and economic development in local communities across the country. The historic funding in September continues to validate the need and importance for community-based, mission lenders like our CDCs and for important tools like our 504 loan program in providing much needed access to capital to small businesses.” She added, “Our member CDCs continue to work daily to assist small businesses and entrepreneurs as they continue on the road to economic recovery and growth.”

While the increase in 504 loans is impressive, it still pales in comparison to the amount of funds the SBA issued as part of the popular Paycheck Protection Program (PPP) earlier this year. Within two weeks’ time, the Program saw all of its initial $349 billion claimed. The staggering figure amounted to more than the Administration typically loans across 14 years. Following that first round, more funds were later made available.

On the one hand, the timing of this surge in 504 lending makes sense given the low interest rates. However, considering the nature of these loans, it may be surprising to some that so many projects are just getting underway. Regardless, it’s certainly good news for small businesses and the economy at large. Meanwhile, as our nation works toward recovery, perhaps some more SBA records will be broken along the way.