Small Business News

Sales of Small Businesses Dip 5% in 2019

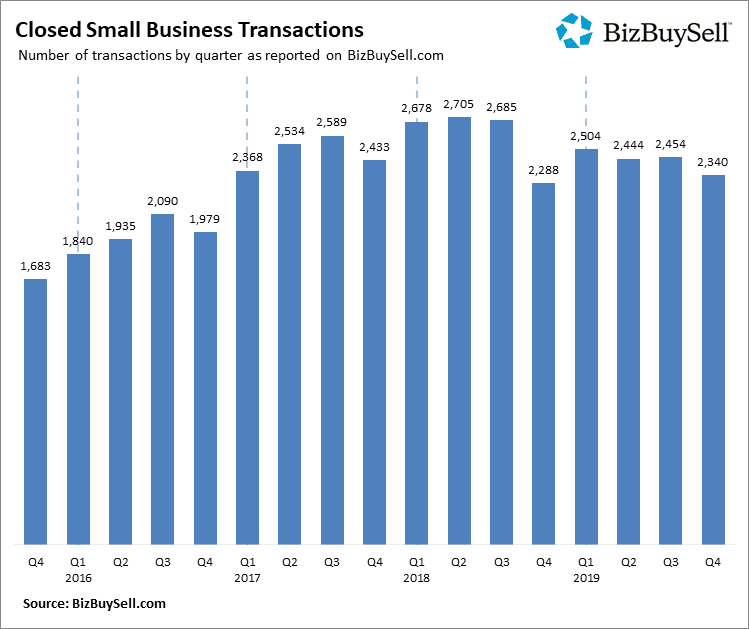

It seems that fewer small businesses changed hands last year than in 2018. According to data from brokers reporting to the business listing site BizBuySell, 9,746 businesses were bought and sold in 2019 compared to 10,312 the year prior. That marks a year over year decrease of 5.5%, snapping a three-year streak of rising numbers. However it’s worth remembering that 2018 saw a record number of transactions, leaving 2019 at a still-historic high.

Quarter by quarter, 2019 saw the most transactions in Q1 with a total of 2,504. This is partially thanks to a relatively weak fourth quarter in 2018 that brought 2,288 transactions. In fact, each quarter in 2019 managed to top that Q4 2018 figure.

Much of the reason for the dip in business sales is being attributed to uncertainty. More specifically, it’s believed that concerns of tariffs, the big changes that could come with the 2020 presidential election, and the unknown future of the U.S. economy are giving some would-be small business owners pause. Speaking to the tariff issue, Franklin Transmission and Auto Care owner Richard Williams told BizBuySell, “The steel tariffs with China have increased my parts cost an average of 35%. This is reflective in my bottom line and it’s not like I can raise prices by 35%. It would cause me to go out of business.”

Meanwhile, with the United States enjoying the longest period of economic expansion ever, some may be wondering whether we’re nearing a peak. This may be motivating current owners to look for sellers, with Evolution Advisors co-founder Randy Hendershot explaining, “The topic of a potential economic downturn is coming up more and more in my conversations with sellers. Many of them have weathered the 2008 recession and are looking to sell before the next down cycle.”

Another potential factor is minimum wages. This year minimums are set to increase in 24 states, including 48 cities and counties across the country. Like with tariffs, some small business owners have seen these laws impact their expenses, leaving them to decide whether it’s worth raising their prices accordingly.

Commenting on the overall results, BizBuySell and BizQuest president Bob House said, “While there is definitely some uncertainty in the market, it’s good to see that 2019 transactions remained strong overall.” He continued, “Buyers and sellers are obviously still seeing value in today’s business-for-sale market and that momentum will likely continue well into 2020, even if levels plateau a bit due to economic and political concerns.”

Even with all of the uncertainties at play, 2019 was yet another great year for many small businesses. Additionally, with the economy off to a good start for 2020, there’s still plenty of optimism for the months ahead. Will that translate to more business changing hands? It may not make for another new record but, as House notes, it does seem to be set up for another historic high.