FinTech News

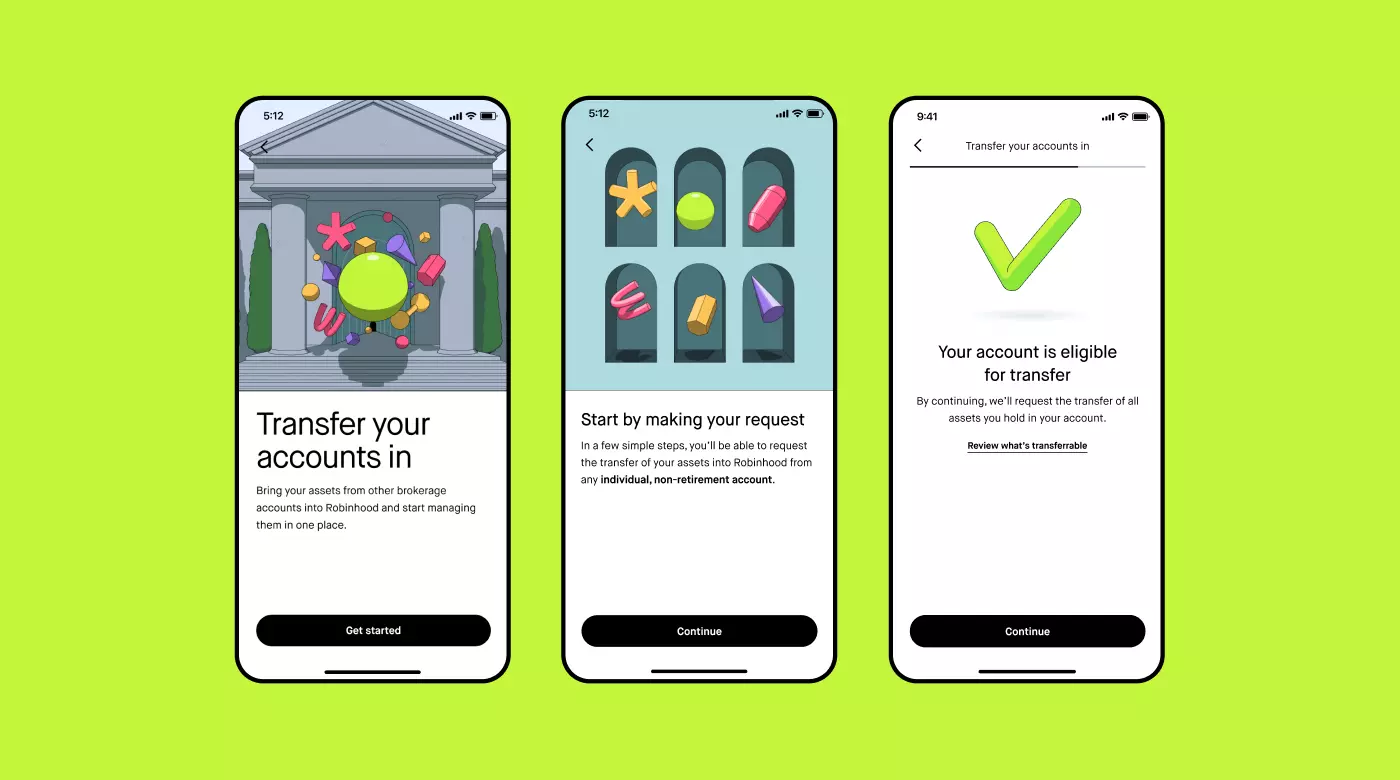

Robinhood Announces Incoming Investment Transfer Tool

Robinhood is closing out 2021 by unveiling yet another new feature. Today, the trading app announced a new service that will make it easier for customers to transfer over assets from other brokerages. According to a blog post on the company’s site, eligible assets include stocks, ETFs, and certain options contracts along with cash balances. Margin balances will also be transferable if the customer has a margin-enabled Robinhood account. Additionally, in order to qualify, these assets must be held in an individual non-retirement brokerage account.

While the initial roll-out will seemingly only allow transfers of entire portfolios, Robinhood does note that support partial transfers — enabling customers to select what specific holdings they want to transfer — is set to debut in early 2022. To further encourage users to move their assets to the platform, the app says it will reimburse customers up to $75 for any transfer fees they may incur.

Looking more closely at Robinhood’s terms, it notes that fractional shares are not eligible for transfer. Thus, when transferring a portfolio with such shares, they will be liquidated at fair market value and the cash value will be transferred. Meanwhile, if a customer has any non-transferable assets other than fractional shares, their transfer application may be rejected. However, this issue may be resolved once Robinhood introduces partial transfers next year. Alternatively, customers can liquidate their non-transferable assets themselves and submit their transfer request again.

Previously, Robinhood allowed customers to transfer their investments out to other brokerages upon request but charged $75 for the service. However, this fee was occasionally waived. Additionally, some rival FinTechs such as Public have offered investors the opportunity to transfer their Robinhood (or other brokerages) accounts over while covering any associated fees for them. However, similar to Robinhood’s feature, if a customer had fractional stock shares in their account, those may have needed to be liquidated depending on which clearinghouse they were held with. Similarly, with Public only recently offering cryptocurrency trading, it was not possible to transfer these investments over.

Incidentally, the introduction of this Robinhood feature comes as the company continues to roll out cryptocurrency wallets that will allow users to receive crypto from external sources (as well as send holdings to other wallets). The clear hope is that customers will use this function to put more of their money on the platform. Thus, it only makes sense that the app would also want to give users a better way to move their money to Robinhood — especially after (anecdotally) many transfers have gone the other way. On that note, with $HOOD stock reaching a 52-week low today, it remains to be seen whether announcements like this can help the FinTech rebound and become the financial giant it aspires to be.

Not a Robinhood user? If you haven’t signed up yet just click the button to create an account and get a free share of stock just for opening an account with this Fioney link.