FinTech News

Pocketnest Raises Fresh $2.6 Million Funding Round

A platform that seeks to educate users about financial topics has closed its second funding round in 2022. This week, Pocketnest announced that it had raised $2.6 million. The latest seed round was led by Reseda Group and follows a $2 million round the company raised earlier this year. To date, Pocketnest has now raised nearly $5 million. According to the FinTech, these funds will support a 24-month runway and will be used to help drive product development as well as sales and marketing initiatives.

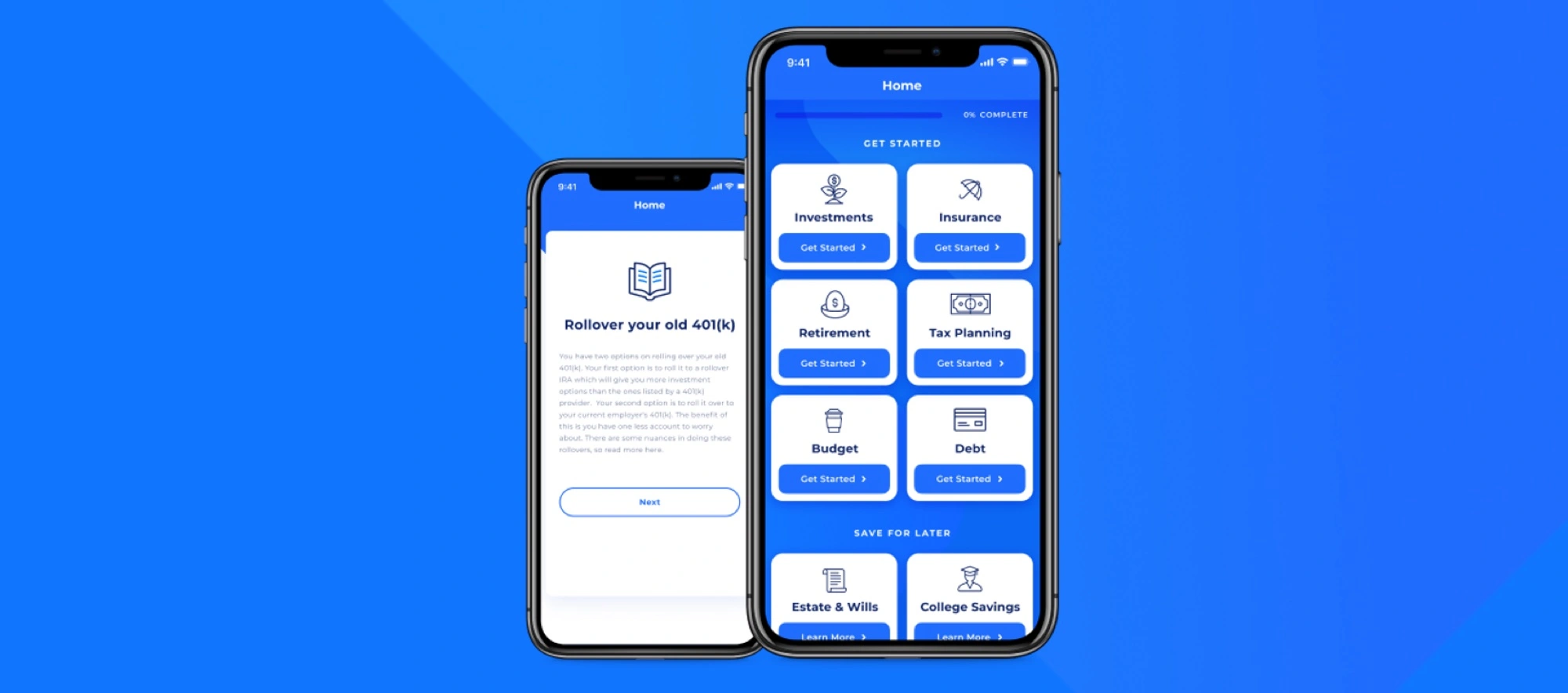

Launched in 2019, Pocketnest is a financial wellness app that helps individuals learn about such topics as investing, insurance, tax planning, and much more. Rather than marketing directly to consumers, the FinTech licenses its platform to financial institutions. As the company notes, since December 2021, the service has seen a 250% increase in new users, 100% growth in annual recurring revenue, and a 75% rise in new clients. Additionally, the startup has doubled its development team headcount to 20 total employees. Pocketnest also says it plans to expand its sales and marketing team in the new year.

Announcing the funding raise, Pocketnest founder and CEO Jessica Willis said in a statement, “Even in this volatile market, we were able to secure $2.6 million of capital in 10 days—a true testament to the value of our platform and the potential it represents for our clients, investors, and most of all, end users.” Willis went on to note, “Our scrappy, elbow-grease approach drives our consistent ‘hockey-stick’ growth while sustaining a very generous runway.”

Additionally, Reseda Group’s chief technology officer Ben Maxim said of the firm’s investment, “We see massive growth and opportunity in Pocketnest and wholly align with their mission of spreading more inclusive access to financial wellness. Pocketnest has a foothold in fintech and can help financial institutions completely reinvigorate their brand, their tech, and their millennial engagement—all while bringing financial wellness to their communities.”

Pocketnest’s latest seed round speaks to at least a couple of funding trends seen throughout 2022. First, while there have been plenty of “megarounds,” early round FinTech funding has also proven robust. On top of that, although previous FinTechs of this nature may have focused on a customer-facing app, more recent developments have seen companies looking to license their services much the way that Pocketnest does. With this year coming to a close, perhaps this funding will signal a happy new year for Pocketnest and the rest of the FinTech sector.