FinTech News

Klarna Officially Closes $800 Million Down Round

The popular “buy now, pay later” app Klarna has confirmed its latest investment round. Following reports last week, the FinTech has now officially announced that it’s raised $800 million in funding. The round builds upon a $639 million venture round the company closed in June 2021. However, while the earlier round valued the company at $45.6 billion, the latest raise cut that valuation to $6.7 billion.

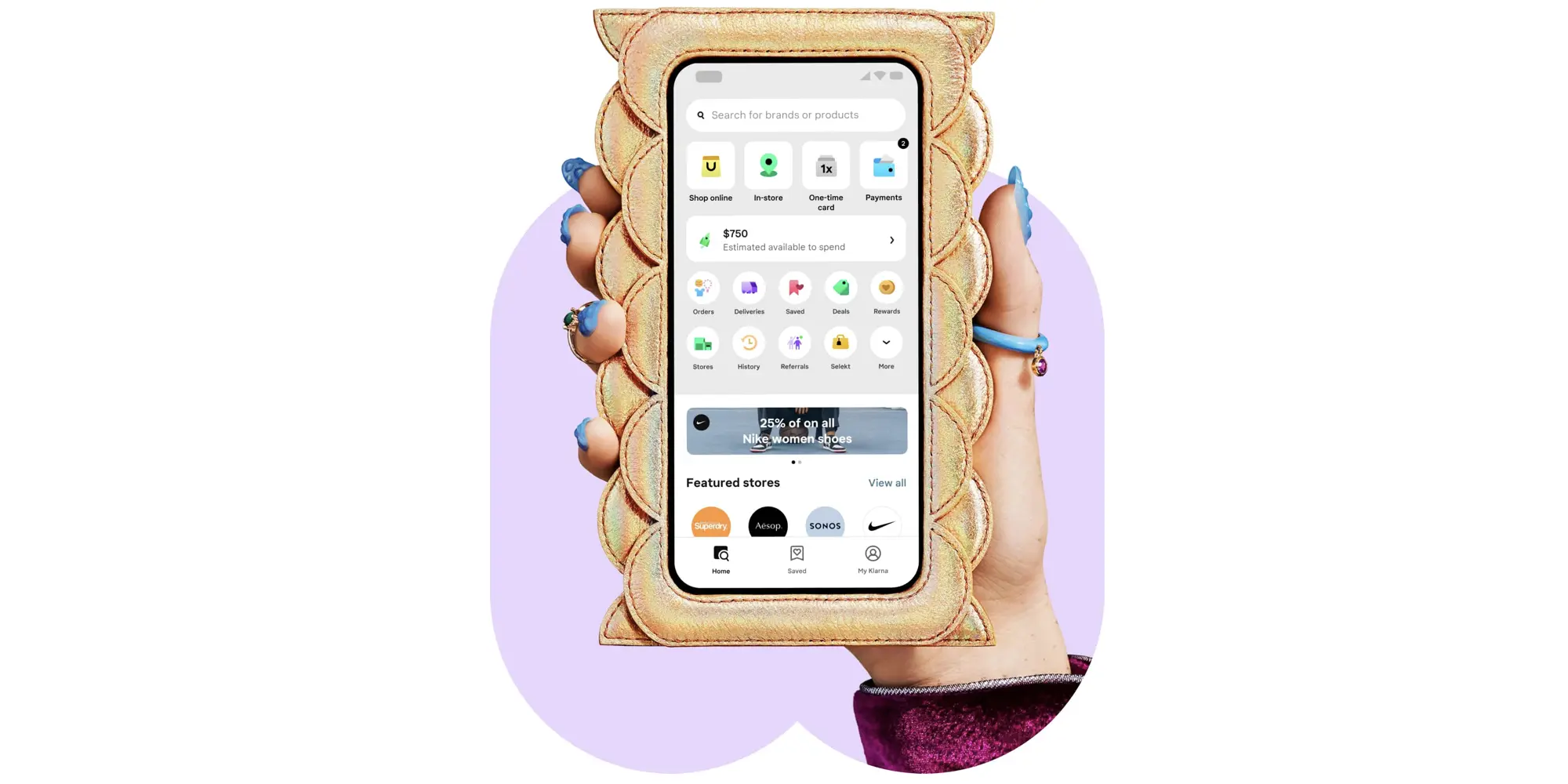

Like many other BNPL platforms, Klarna has helped popularize the “pay-in-4” format where customers pay for a quarter of their purchases upfront with subsequent payments every 2 weeks. This financing option comes with no interest or other fees. Furthermore, Klarna has begun expanding its offerings in various ways. For example, last month, the company rolled out the Klarna Card, giving customers an even easier way to split purchases into four payments, albeit without a down payment in this case. While the card does carry a $3.99 a month fee, that fee is waived for the first 12 months.

Despite the dip in valuation, Klarna states that they continue to be on an upward trajectory. Among the stats they shared was that the platform currently has close to 30 million users in the United States. Additionally, with 150 million users worldwide, the company notes that it is now larger than American Express.

In the press release announcing the funding round, Klarna CEO Sebastian Siemiatkowski defended the down round, noting, “Klarna is the only fintech in the world that has been profitable for its first 14 years of existence… The last few years however we have made significant investments as we took the opportunity to transform Klarna into a global player. With the recent shift in investor sentiment we also now shift our focus and look forward to returning to a modus operandi of growth and profitability. The foundation for a global leader has been set.”

Siemiatkowski added, “It’s a testament to the strength of Klarna’s business that, during the steepest drop in global stock markets in over fifty years, investors recognized our strong position and continued progress in revolutionizing the retail banking industry.”

Elsewhere, Sequoia partner Michael Moritz also commented on the matter, stating, “The shift in Klarna’s valuation is entirely due to investors suddenly voting in the opposite manner to the way they voted for the past few years. The irony is that Klarna’s business, its position in various markets and its popularity with consumers and merchants are all stronger than at any time since Sequoia first invested in 2010. Eventually, after investors emerge from their bunkers, the stocks of Klarna and other first-rate companies will receive the attention they deserve.”

Klarna’s current state is interesting in that, as they point out, the company is doing well overall. However, the fall in valuation was always going to be the headline for this funding round, as evidenced by the heavy pushback Klarna gives in its press release announcing the round. Of course, something not mentioned in the release is Apple, which is planning to launch its own BNPL platform in a matter of weeks. As a result of these factors and others, it will certainly be interesting to see how Klarna leverages its newly-raised $800 million and where the company goes from here.